The Big Idea

More Treasury supply, tighter risk spreads

Steven Abrahams | March 22, 2024

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The Treasury market continues to grow faster than nominal GDP while risk assets grow more slowly. If that trend continues and if the US gets a soft landing with falling market volatility, risk spreads in the next few years could reach some of their tightest levels ever. For evidence, just look to swap spreads.

Work by the Treasury Borrowing Advisory Committee, the World Bank and others consistently finds that Treasury supply affects swap spreads. Heavy supply, measured either directly as outstanding debt as a share of GDP or indirectly as the federal deficit as a share of GDP, tends to coincide with tighter spreads. In other words, Treasury yields rise relative to swaps. And light or falling supply coincides with wide spreads as Treasury yields falls relative to swaps. Some of the widest spreads in the history of the swap markets, for example, came in the late 1990s as the US ran a federal surplus and outstanding Treasury supply fell.

Other things matter, too, of course. Credit spreads matter for LIBOR swaps, reflecting the creditworthiness of the banks setting LIBOR rates, but likely not for SOFR swaps collateralized by Treasury debt. The steepness of the yield curve can matter. A steeper curve encourages more demand to receive fixed and tightens swap yields relative to Treasury and a flat or inverted curve encourages more demand to pay fixed and widens spreads. Treasury repo rates and proxies for MBS hedging also influence spreads. But after accounting for these influences, shifting Treasury supply still matters, too.

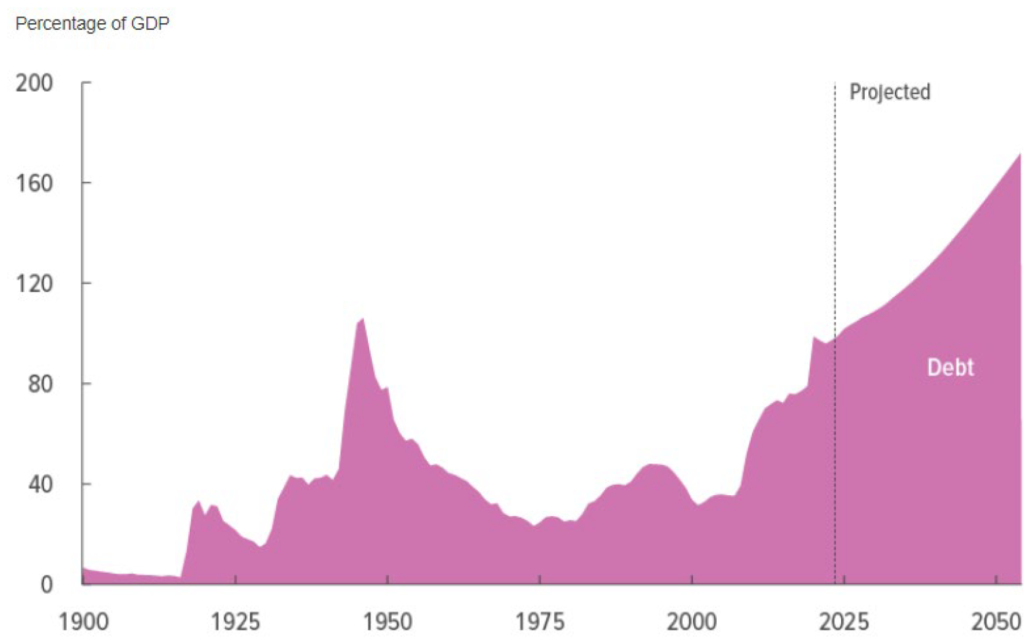

The Congressional Budget Office’s latest federal budget outlook projects outstanding marketable Treasury debt as a share of GDP will climb well above 100% in the next few years and accelerate for decades (Exhibit 1). A decade is a long time, and changes in economic growth, tax rates, spending or a combination of these can have a big impact on federal deficits and Treasury supply. Nevertheless, the trend is toward more debt rather than less and tighter spreads rather than wider.

Exhibit 1: The CBO projects a significant rise in outstanding Treasury supply

Note: Data show projected outstanding marketable Treasury debt as a percentage of GDP.

Source: Congressional Budget Office 2024, Santander US Capital Markets.

Although most of the work on Treasury supply has focused on LIBOR swap spreads—the history of SOFR swap spreads being too short—the findings should apply to most risk assets, too. As long as Treasury supply is growing faster, spreads on risk assets should tighten.

A steady bias toward tighter spreads could cloud a lot of analysis that screens for value by looking at spreads against historic levels. Showing that spreads look tight to history and calling an asset rich may not be enough. The analysis should adjust for the size of the Treasury market as a share of GDP. Only then might a little lesson in spread history offer a clear picture of relative value.

* * *

The view in rates

Fed funds futures still reflect three cuts by December, with a 50% chance that the first cut come in June. That will not happen if Stephen Stanley is right and the Fed stays on hold through the November US elections. Whether the market or Stanley wins will likely depend on the path of inflation into July. If it is down significantly, which seems unlikely, the Fed could start cutting at that month’s meeting. If not, the Fed likely waits for politics to settle. Implied rate volatility remains elevated, although now at the lowest point of the year.

Other key market levels:

- Fed RRP balances closed Thursday at $461 billion, up $47 billion this week but part of a steady trend down since April 2023. Yields on some short Treasury bills this week have dropped below the RRP’s 5.30% rate, making RRP at least temporarily more attractive. Continuing QT should keep draining cash from the financial system and bringing RRP balances down.

- Setting on 3-month term SOFR traded Friday at 532 bp, unchanged so far this week.

- Further out the curve, the 2-year note closed Friday near 4.64%, down 9 bp this week. The 10-year note closed at 4.27%, down 4 bp this week.

- The Treasury yield curve closed Friday afternoon with 2s10s at -37, steeper by 5 bp this week. The 5s30s closed Friday at 18 bp, steeper by 8 bp over the same period.

- Breakeven 10-year inflation traded Friday at 235 bp, higher by 3 bp this week. The 10-year real rate finished the week at 191 bp, down 8 bp this week.

The view in spreads

Little has changed here in the last week. Credit has momentum and a strong bid from insurers and mutual funds, the former often funded with annuities and the later getting strong inflows. The broad trend to higher Treasury supply also helps in the background. Credit spreads should trade stable to tighter for the foreseeable future. The fact that markets have now priced to the Fed dots also looks bullish for credit spreads.

The Bloomberg US investment grade corporate bond index OAS closed Friday at 88 bp, tighter by 3 bp this week. Nominal par 30-year MBS spreads to the blend of 5- and 10-year Treasury yields traded Friday at 141 bp, tighter by 9 bp this week but volatile lately. Par 30-year MBS TOAS closed Friday at 39 bp, tighter by 6 bp this week. Both nominal and option-adjusted spreads on MBS look rich. Fair value in MBS is likely closer to 70 bp in OAS, so widening toward fair value looks reasonable.

The view in credit

Credit fundamentals also look little changed in the last week. Most investment grade corporate and most consumer sheets look relatively well protected against higher interest rates, and eventual Fed easing—even if easing comes late this year—should relieve pressure from interest rate expense and falling liquidity. Fixed-rate funding has large blunted the impact of higher rates on both those corporate and consumer balance sheets, and healthy stocks of cash and liquid assets allow these balance sheets to absorb a moderate squeeze on income. Consumer balance sheets also benefit from record levels of home equity and steady gains in real income. Consumer delinquencies show no clear signs of stress. Less than 7% of investment grade debt matures in 2024, so those balance sheets have some time. But other parts of the market funded with floating debt continue to look vulnerable. Leveraged and middle market balance sheets are vulnerable. At this point, mainly ‘B-‘ loans show clear signs of cash burn. Commercial office real estate looks weak along with its mortgage debt. Credit backing public securities is showing more stress than comparable credit on bank balance sheets. As for the consumer, subprime auto borrowers and younger households borrowing on credit cards, among others, are starting to show some cracks with delinquencies rising quickly. The resumption of payments on government student loans should add to consumer credit pressure.