By the Numbers

A closer look at office performance

This material is a Marketing Communication and does not constitute Independent Investment Research.

The nearly $3 trillion US office market is on everyone’s radar these days. Potential defaults could have repercussions across commercial real estate and financial markets. Office property prices already have dropped 13% year-over-year, although a 2.3% delinquency rate for US office properties in CMBS and a 4.2% special servicing rate appear moderate. A more detailed dive shows a large maturity wall this year for loans securitized by office properties across both traditional CMBS and CRE CLOs, and up to 15% of those maturing balances are in some category of non-current status.

Rating agencies typically report aggregate delinquency rates across securitizes product types, which may then be broken down by property or asset type. For example, when S&P reports that 4.2% of office loans in US CMBS are in special servicing, that covers office loans in conduit or SASB deals rated by S&P. There are two problems with this:

- That delinquency and special servicing rate does not include office properties in CRE CLOs, so it is already missing some of the higher-risk transitional loans in the market

- Those rates are calculated as the sum of loan balances in special servicing divided by total loan balances outstanding. But commercial real estate loans tend to have the highest default rates at maturity, and loans that have matured can continue performing even as they negotiate modifications, extensions or seek new financing

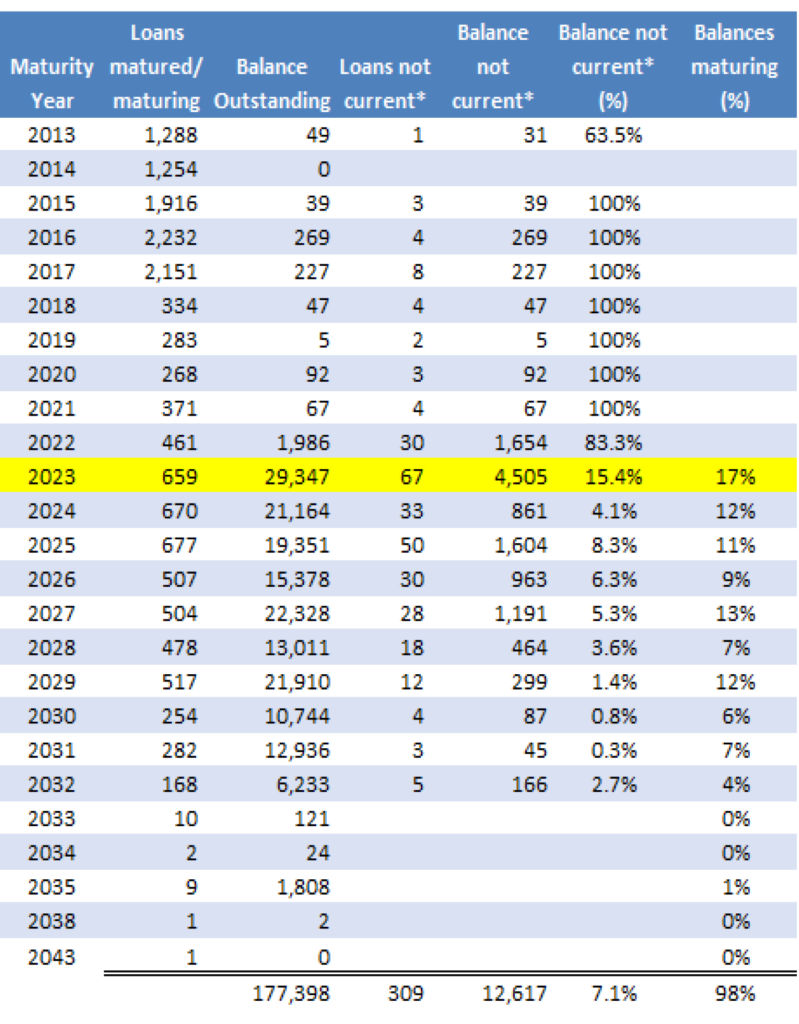

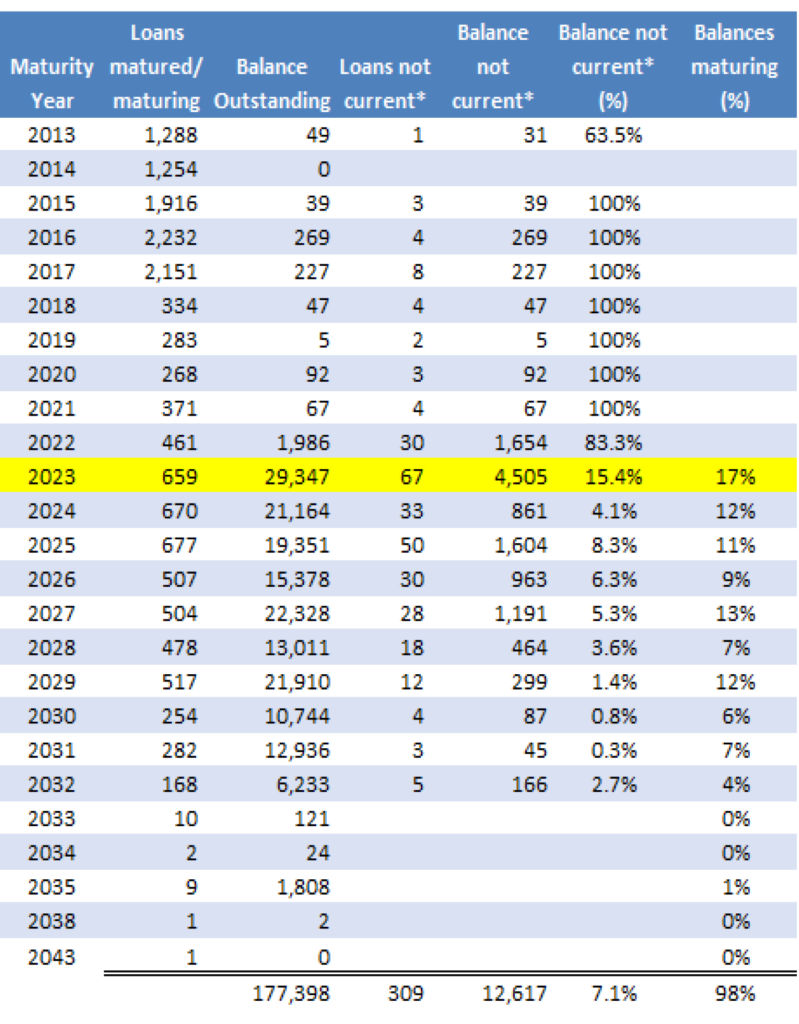

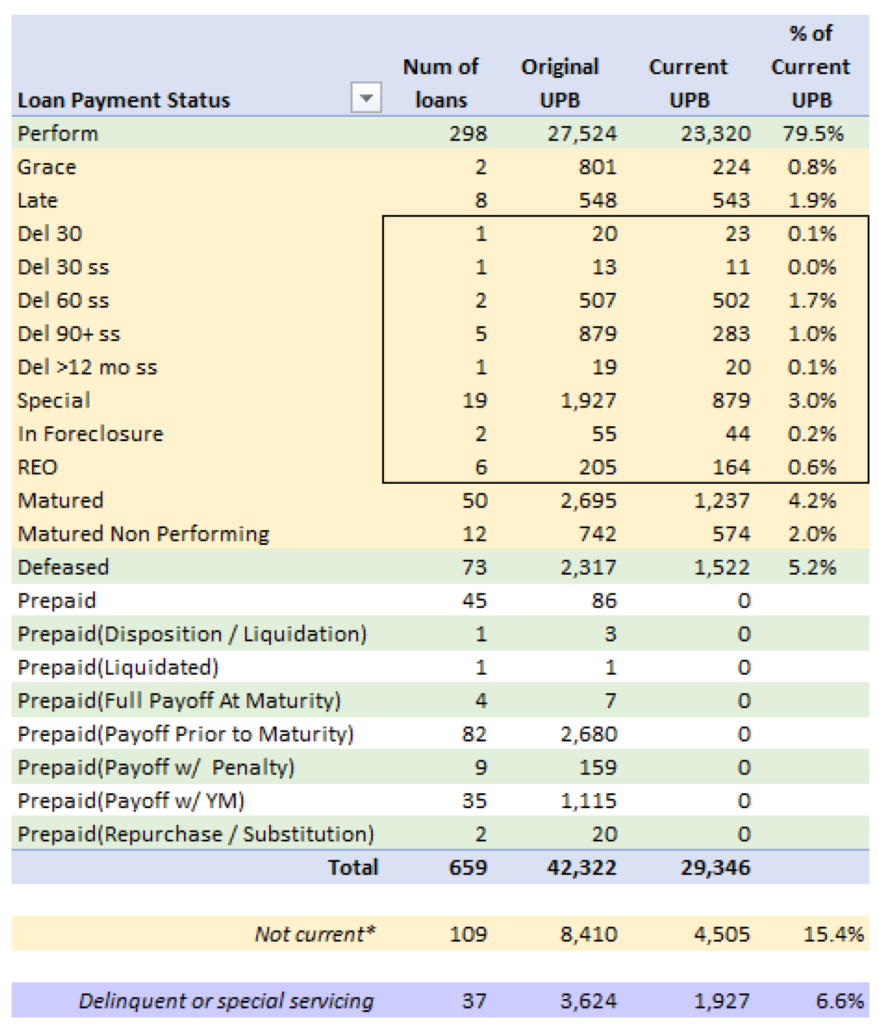

To truly evaluate market conditions requires a broader look at loan performance and a more detailed view of the maturity wall for office properties. There are currently about $177 billion of loans for office properties that are securitized in CMBS or CRE CLOs (Exhibit 1). That’s 6% of the estimated $2.8 trillion asset value of the US office market. The maturity wall shows that $29 billion, or 17% of outstanding balances, have a scheduled maturity date in 2023. This includes loans in CRE CLOs which often have multiple extension options beyond the initial maturity date. Of the $29 billion maturing this year, over 15% of those loans, or $4.5 billion, have a payment status that is considered “not current”.

Exhibit 1: Maturity wall for office properties in US CMBS and CRE CLOs

Note: *Not current includes all outstanding loans whose payment status is not “performing” or “defeased”. Not current* loans may have payment status of: grace / late, in any stage of delinquency, special servicing, in foreclosure, real estate owned (REO), matured or matured non performing. Payment status as of March 23, 2023. Balances in millions.

Source: Bloomberg, Santander US Captial Markets

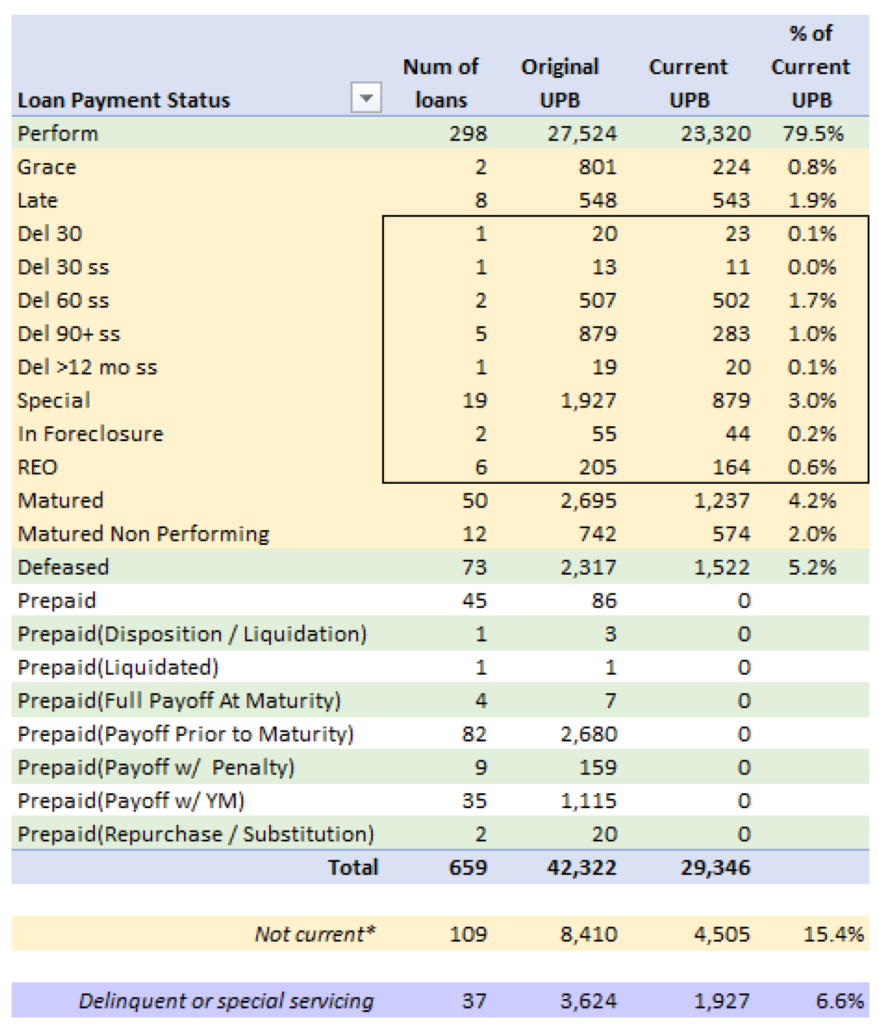

“Not current” is considerably broader than delinquent or even special servicing, with 15.4% falling into this category for loans maturing in 2023. A complete breakdown of the payment status of the office loans maturing in 2023 is shown in Exhibit 2. The maturity wall clearly has a big impact on performance, as fully $1.7 billion of the $4.5 billion of loans that are not current have already matured. The rate of delinquent or specially serviced loans, which are outlined by the box within the not current loans in yellow, is much lower at 6.6%.

Exhibit 2: Office loans maturing in 2023 by loan payment status

Note: Delinquent or special servicing totals includes all non-current loans, less those in grace / late period, matured or matured non-performing. UPB in millions.

Source: Bloomberg, Santander US Captial Markets

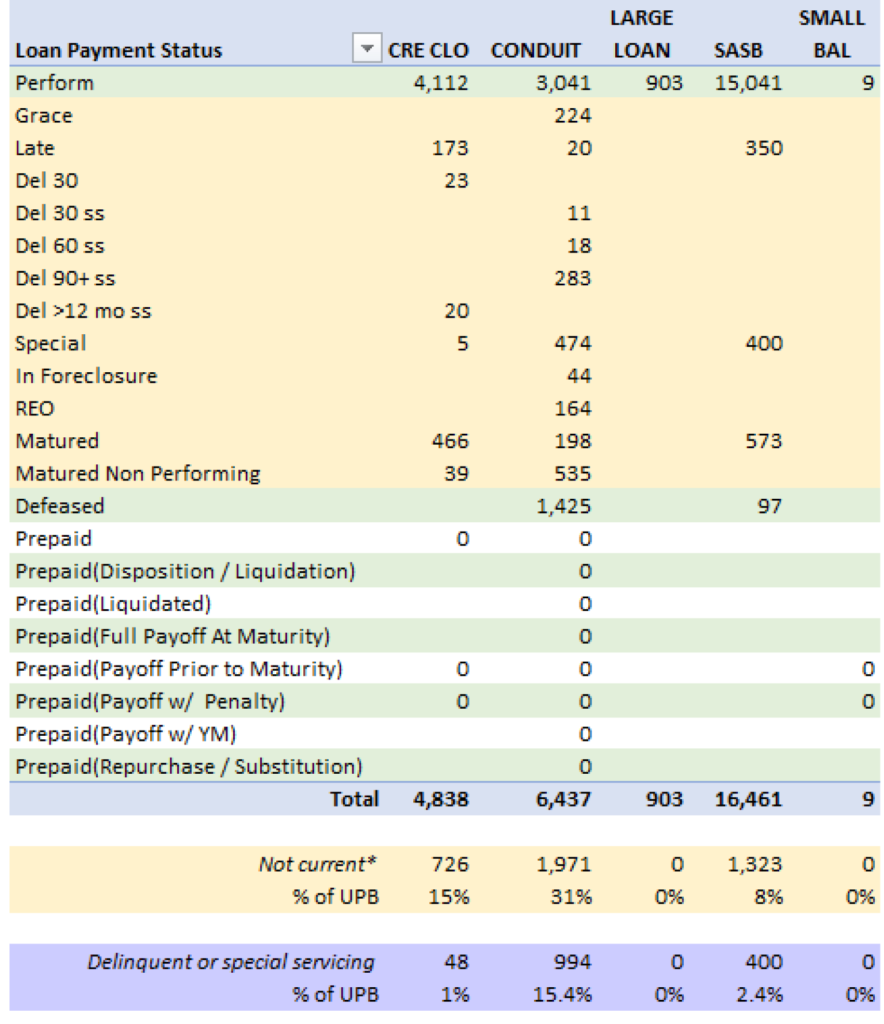

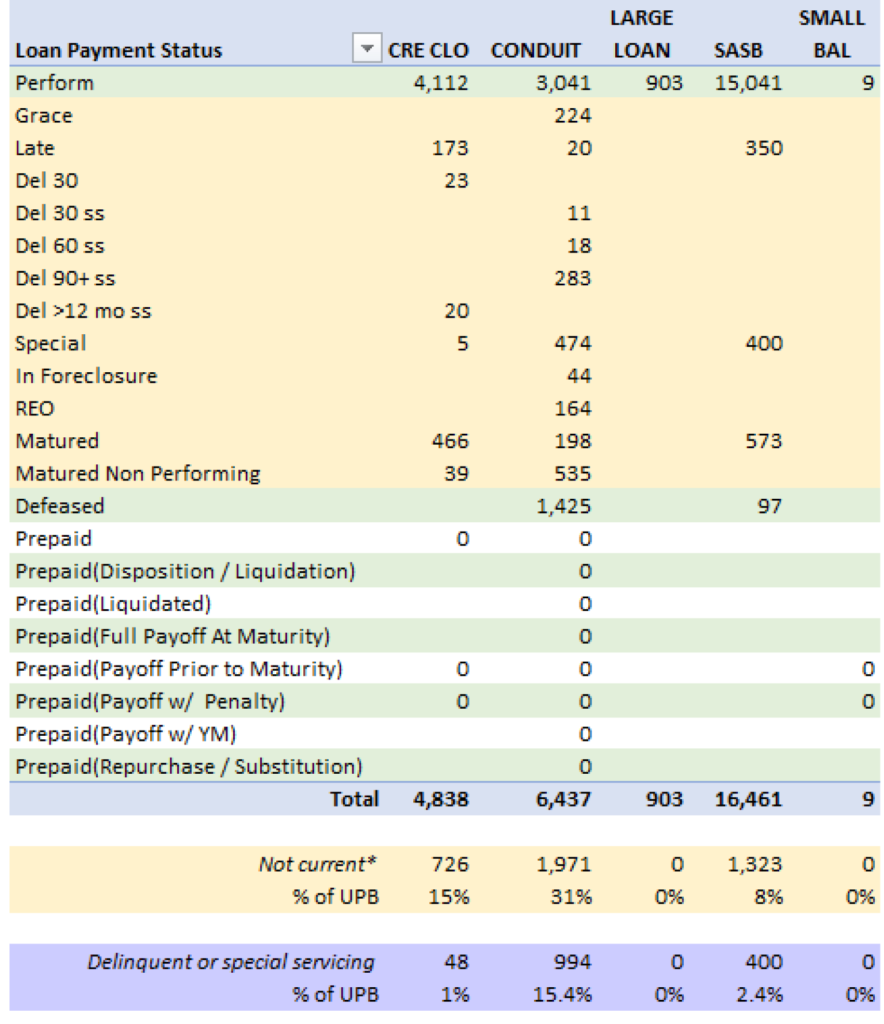

SASB, large and small balance office outperform CRE CLOs and conduit

The highest rates of not current or delinquent or specially serviced office loans across securitized products are in conduit and CRE CLO deals (Exhibit 3). The rolling maturity windows of loans in CRE CLOs does contribute to the high percentage of office loans that have matured and are not current. The $466 million of CRE CLO office loans that have matured and are still performing may be affected by the high cost of interest rates caps. Those caps typically expire at the first maturity date of the loan, then need to be replaced for each extension. The caps have become extremely expensive to replace due to the extraordinary rise in interest rates and increased volatility, and many borrowers have sought alternative arrangements or loan modifications.

SASB office performance continues to be strong, as the loans in those deals are typically for trophy office properties – one of the few office sectors where performance has remained relatively robust. The conduit deals tend to have a lot of office properties in secondary and tertiary markets, and lower cost, often lower quality buildings in primary markets. The delinquency and special servicing rate in conduit alone for loans maturing in 2023 is over 15%, which the not current rate is over 30%.

Exhibit 3: Office performance across product types for 2023 maturity loans

Note: Data through March 2023.

Source: Bloomberg, Santander US Captial Markets

The securitized office loans represent only a fraction of office loans outstanding. The majority of lending is done by banks, life insurance companies and office REITs. There is clearly more stress in the office market that is being captured by CMBS delinquency rate data. Of office loans outstanding in the securitized space, fully 40% hit a maturity date in 2023 to 2025. The pressure on office property is just getting started.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2026 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.