The Big Idea

Treasury debt leads supply, money funds and ETFs lead demand

Steven Abrahams | March 15, 2024

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

If net supply were the only thing dictating pricing in US debt securities, then the bears have come out for Treasury debt and the bulls for most other parts of the market. On the other hand, if demand were the only thing driving pricing, then securities that fit money funds, ETFs, insurers and pensions should draw the bulls and securities held by the Fed and banks should draw the bears. At least, that’s the picture painted by the latest Financial Accounts of the United States showing supply and demand for debt securities. It looks bearish for Treasury debt, challenging for agency debt and MBS and bullish for corporate and structured credit.

Treasury debt leads net supply

The market value of US debt securities—affected by net issuance and repricing— grew last year by $3.3 trillion or 5.9%, according to the latest Financial Accounts, the fastest pace since the start of pandemic. Remember that rate of growth. It’s just about the same as the 5.8% rise in nominal GDP last year. If debt and GDP grow at about the same rate, then leverage across the aggregate economic balance sheet stays the same. In other words, imagine an asset worth $100,000 with $80,000 of debt. If the asset grows by 10% to $110,000 and debt by 10% to $88,000, leverage stays the same. The economy or an asset, it works the same way.

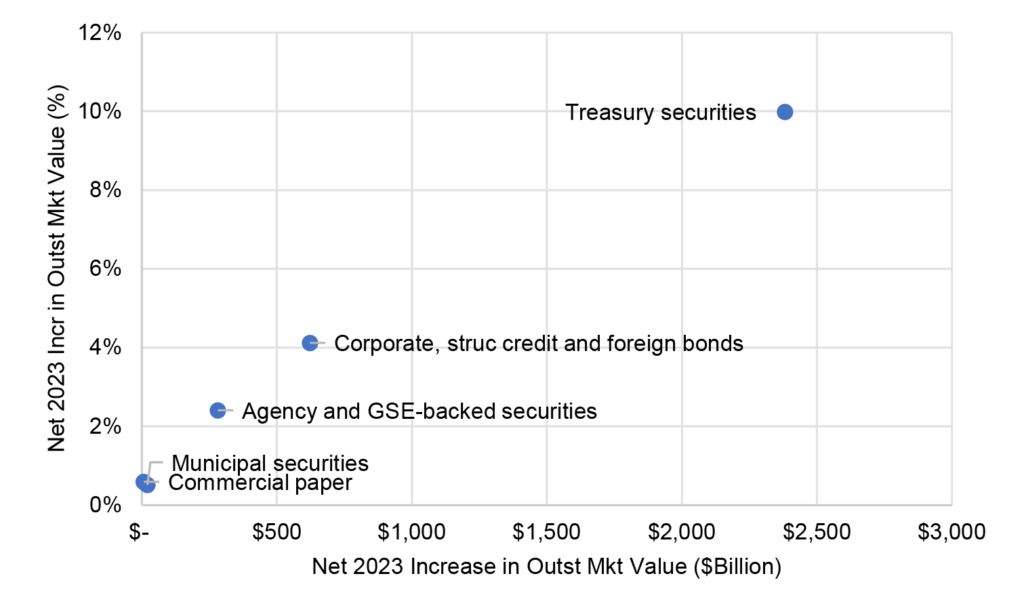

Treasury debt led all debt growth by a long shot, rising last year in outstanding value by $2.4 trillion or 10.0% (Exhibit 1). Corporate, structured credit and foreign debt together grew by a much smaller $622 billion or 4.1%. And agency debt and MBS rose by $281 billion or 2.4%. Muni debt grew by $21 billion or 0.5%. And commercial paper rose by $7 billion or 0.6%.

Exhibit 1: The Treasury market in 2023 grew faster than GDP, others slower

Source: Financial Accounts of the United States, L.208, 7 Mar 2024, Santander US Capital Markets

The faster growth in Treasury debt likely means the government balance sheet is becoming more leveraged while the slower pace in other sectors means they are likely becoming less leveraged. Key word here is “likely.” If the value of the federal balance sheet—whatever that is—is growing as fast as the federal debt and the other balance sheets as slowly as their debt, then leverage in each sector could still be the same. But it’s more likely that there is no structural shift in value across these balance sheets. All else equal, Treasury yields should rise in a market with Treasury debt growing faster than GDP and risk spreads should tighten in a market with risk assets growing slower than GDP.

Last year sets the tone for the current market. Treasury debt should grow fast, other sectors slower. The Congressional Budget Office projects an increase in marketable Treasury debt in fiscal 2024 of 6.3%. Corporate debt so far this year is growing faster than last year, with the par balance of the Bloomberg investment grade and high yield indices up 2.11% so far this year, faster than the 1.77% rise over the same period last year, but likely to slow in the second and third quarters. The par balance of the MBS index is up only 0.9% so far this year, slower than the 0.56% rise over the same period last year. Other sectors are relatively small.

The verdict based on net supply: bad for Treasuries, good for risk assets.

Money funds, dealers, ETFs, pensions and insurers lead demand

Of course, not all else is equal, especially demand. Focusing only on holders of at least 1% of outstanding debt security market value—where a change in demand can have the biggest marginal effect—some grew explosively, some are hard to interpret, and some pulled back significantly. The general picture of demand favors corporate and structured credit and not Treasury and agency debt and MBS.

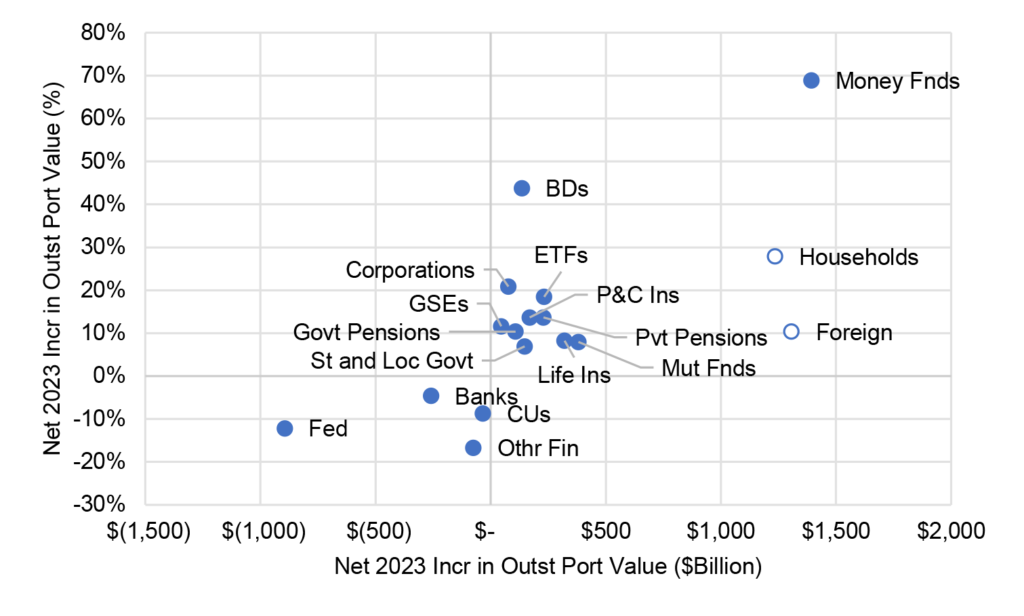

A wide set of portfolios grew faster than the market value of outstanding debt. Balances at money funds grew by an explosive 69% (Exhibit 2). Broker/dealer balance sheets grew by 44%, corporate portfolios by 21%, ETFs by 18%. Private pensions and P&C insurers by 14%. GSEs, government pensions, state and local portfolios, mutual funds and life insurers all grew faster than the market value of outstanding debt.

Exhibit 2: Many portfolios grew quickly while the Fed, banks pulled back

Source: Financial Accounts of the United States, L.208, 7 Mar 2024, Santander US Capital Markets

All of these portfolios grew above the pace of nominal GDP, suggesting they are attracting more than their fair share of investable debt capital. That should favor the assets these portfolios tend to prefer. For example, money funds are the biggest single holder of commercial paper and a substantial buyer of Treasury debt—mainly T-bills. ETFs own healthy exposure to corporate and structured credit. Mutual funds own a significant amount of Treasury debt—mainly notes and bonds—and own a large share of corporate and structured credit. Life and P&C insurers and private pensions also own a significant share of corporate and structured credit.

A few categories of the Financial Accounts are harder to interpret. Households grew by $1.2 trillion or 28%, but that category serves as a catch-all for balances not counted elsewhere. It could include individual households, but hedge funds as well. Households show up as a large holder of Treasury debt, agency debt and MBS and muni debt. Foreign portfolios also grew by $1.3 or 10%. But this category captures an eclectic mix of portfolios ranging from central banks to commercial banks to life and P&C insurers and pensions and beyond. The preferences of a group that diverse have to be all over the place. The safest assumption is that they mirror the preferences of domestic portfolios. Foreign portfolios are the biggest holders of Treasury debt, the biggest holder of corporate and structured credit and a large holder of agency debt and MBS.

A small but significant set of portfolios not only grew more slowly than the market value of outstanding debt but actually became smaller. The Fed, banks, credit unions and financial institutions not counted elsewhere showed declines in the value of their debt securities through runoff, sales or repricing. The Fed’s debt securities value, for instance, declined in 2023 by 12% and banks’ by 5%. The Fed is the largest holder of Treasury debt after foreign portfolios and the second largest holder of agency debt and MBS after US banks. Banks hold material amounts of both the Treasury and agency debt and MBS markets.

These performances may not repeat this year, especially the explosive growth in money funds, which benefited from turmoil in US banking last year. But mutual funds, P&C and life insurers and pensions will likely grow this year as fast or faster than nominal GDP while the Fed and bank portfolios will either grow slower than nominal GDP or, in the case of the Fed, get smaller again.

The verdict based on net demand: bad for Treasuries, challenging for agency debt and MBS and good for corporate and structured credit.

Supply and demand

Combining supply and demand paints a bearish picture for Treasury debt, a challenging picture for agency debt and MBS and a bullish picture for corporate and structured credit. For all risk products, a relatively heavy supply of Treasury debt should tighten spreads. All of this is consistent with the relative return performance of these assets last year and into 2024. Everywhere you look, it’s déjà vu all over again.

* * *

The view in rates

Fed funds futures still reflect three cuts by December, with a 50% chance that the first cut come in June. That will not happen if Stephen Stanley is right and the Fed stays on hold through the November US elections. Whether the market or Stanley wins will likely depend on the path of inflation into July. If it is down significantly, which seems unlikely, the Fed could start cutting at that month’s meeting. If not, the Fed likely waits for politics to settle. Implied rate volatility remains elevated, although now at the lowest point of the year.

Other key market levels:

- Fed RRP balances closed Friday at $414 billion, down $30 billion week-over-week but part of a steady trend down since April 2023. Treasury bills and Treasury and MBS repo almost all trade at yields above the RRP’s 5.30% rate, giving money market funds good reason to move cash out of the RRP and into these higher-yielding alternatives.

- Setting on 3-month term SOFR traded Friday at 532 bp, unchanged week-over-week.

- Further out the curve, the 2-year note closed Friday near 4.73%, up 26 bp in the last week. The 10-year note closed at 4.31%, up 24 bp in the last week.

- The Treasury yield curve closed Friday afternoon with 2s10s at -42, flatter by 2 bp In the last week. The 5s30s closed Friday at 10 bp, flatter by 11 bp over the same period.

- Breakeven 10-year inflation traded Friday at 232 bp, higher by 4 bp over the last week. The 10-year real rate finished the week at 199 bp, up by 20 bp in the last two weeks.

The view in spreads

Credit has momentum and a strong bid from insurers and mutual funds, the former often funded with annuities and the later getting strong inflows. Credit spreads should trade stable to tighter for the foreseeable future. The fact that markets have now priced to the Fed dots also looks bullish for credit spreads.

The Bloomberg US investment grade corporate bond index OAS closed Friday at 91 bp, tighter by 5 bp over the last week. Nominal par 30-year MBS spreads to the blend of 5- and 10-year Treasury yields traded Friday at 150 bp, wider by 5 bp in the last week. Par 30-year MBS TOAS closed Friday at 45 bp, wider by 9 bp over the last week. Both nominal and option-adjusted spreads on MBS look rich. Fair value in MBS is likely closer to 70 bp, so a widening toward 70 bp looks reasonable.

The view in credit

Most investment grade corporate and most consumer sheets look relatively well protected against higher interest rates, and eventual Fed easing—even if easing comes late this year—should relieve pressure from interest rate expense and falling liquidity. Fixed-rate funding has large blunted the impact of higher rates on both those corporate and consumer balance sheets, and healthy stocks of cash and liquid assets allow these balance sheets to absorb a moderate squeeze on income. Consumer balance sheets also benefit from record levels of home equity and steady gains in real income. Consumer delinquencies show no clear signs of stress. Less than 7% of investment grade debt matures in 2024, so those balance sheets have some time. But other parts of the market funded with floating debt continue to look vulnerable. Leveraged and middle market balance sheets are vulnerable. At this point, mainly ‘B-‘ loans show clear signs of cash burn. Commercial office real estate looks weak along with its mortgage debt. Credit backing public securities is showing more stress than comparable credit on bank balance sheets. As for the consumer, subprime auto borrowers and younger households borrowing on credit cards, among others, are starting to show some cracks with delinquencies rising quickly. The resumption of payments on government student loans should add to consumer credit pressure.