By the Numbers

Out-of-consensus calls on agency MBS in 2026

Brian Landy, CFA | November 21, 2025

This material is a Marketing Communication and does not constitute Independent Investment Research.

Agency investors will need to contend with growing negative convexity in 2026, as the collateral delivered into generic pools continues to weaken. This is particularly true of Ginnie Mae MBS, given the large difference in prepayment behavior between FHA and VA loans. Most investors should prefer conventional to Ginnie Mae MBS; heavy demand for Ginnies should keep spreads tight despite the weak fundamentals. In discounts, however, prepayments of delinquent FHA loans should lift the value of Ginnie Mae MBS, especially specified pools. Net supply should increase a little, mostly to the benefit of Ginnie Mae, but otherwise remain a little light historically.

Less convexity, but at a slower pace

Market participants are understandably concerned about growing refinance risk of agency MBS pools and TBA contracts, underscored by fast prepayment speeds in October. Greater refinance risk manifests as lower convexity of these securities. Higher home prices and larger loans, new specified pool types, and improved lending technology have contributed to faster prepayments. TBA convexity is likely to keep deteriorating as more loans get placed in specified pools. But the underlying loan convexity may be less responsive to lending efficiencies than many expect, and the risk of faster speeds through changes in loan pricing seem small.

In production coupons, TBA convexity is likely to fall more for Ginnie Mae MBS than conventional MBS. Despite this, demand for Ginnie Mae MBS should remain strong from domestic banks and overseas investors. For the rest of the market, this should keep conventional MBS a better relative value than Ginnie Mae MBS in production coupons.

Some of the factors that can alter the convexity of MBS include:

- Pool collateral characteristics

- More efficient lending

- Government policy

Pool collateral characteristics

The trend towards creating new categories of specified pools backed by larger loans should continue. It is in the nature of the TBA market to encourage the creation of specified pools, leaving behind pools of the lowest convexity loans to be delivered into TBA contracts.

In theory, slower home price appreciation and loan size growth should reduce the pressure to create new categories of pools. However, lower HPA since mid-2022 has done little to blunt the creation of new pool types.

The Ginnie Mae TBA is especially at risk of falling convexity due to increased issuance of specified pools, known as custom pools. Strong demand for Ginnie MBS from domestic banks and overseas investors is likely to continue and these investors often look for pools with protection against fast prepayments. Those loans are plentiful—40% of Ginnie Mae loans over the past 12 months were fast prepaying VA loans. That means 60% of Ginnie Mae production, which are predominantly FHA loans, is potentially available to construct custom pools with better convexity than the TBA. The large prepayment difference between FHA and VA loans means there is incentive to make FHA-only pools.

Lending efficiencies

Prepayment speeds over the last year suggest that the timeline from borrower application to rate lock to closing has shortened. Thus, prepayment speeds can pickup more quickly after rates fall. And, because this can pull forward prepayments from the following month into the current month, speeds can be faster.

However, while timelines are shorter, it is less clear that these changes are creating new prepayments and a truly steeper S-curve. For example, refinance activity has fallen sharply in October and November, despite mortgage rates remaining near or below the lowest points in September. This means that faster initial prepayments may be followed by stronger burnout. For a buy and hold investor, the two effects may roughly offset each other, and the long-term effect on convexity and MBS value may be minimal.

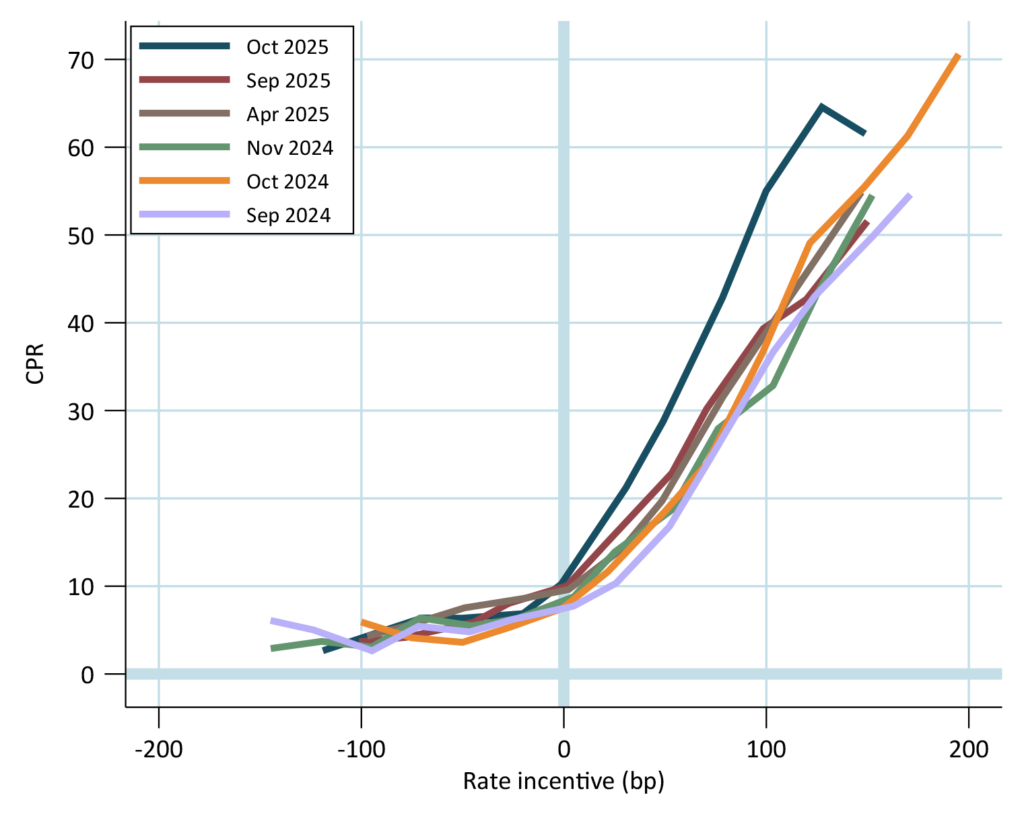

S-curves suggest that October’s speeds are an outlier compared to prepayment environments in late 2024 and early 2025 (Exhibit 1). A simple explanation for the difference is that rates fell in September, stayed low, and October’s prepayments included some loans that historically might have fallen into November. Over the course of a few months the average S-curve may match the other S-curves. It is possible that many investors and models will overreact to the October print and enter the year overestimating the negative convexity of MBS.

Exhibit 1. October’s S-curve is an outlier

Loans are fixed rate 30-year, 6 to 24 months seasoned, owner occupied, orig. FICO≥700, orig. LTV≤80, orig. loan size between $400,000 and $600,000. Rate incentive grouped into 25 bp intervals and must have at least $1 bn UPB to include in the graph.

Source: Fannie Mae, Freddie Mac, Santander US Capital Markets.

These S-curves control for several important attributes that influence prepayments, to make the comparisons comparable. Doing this helps isolate the potential influence on MBS prepayments caused by servicers or other exogenous changes.

Government policy

The Federal Housing Finance Agency is looking at changing its loan level price adjustments. A prime concern for the administration is to improve housing affordability, and lowering LLPAs would help. But lower pricing means lower revenues, and that it more challenging to sell shares of Fannie and Freddie to private investors. Lowering pricing for some borrowers and raising pricing for others could preserve revenue but hurts affordability for borrowers facing increases and risks the wrath of voters next fall.

An IPO faces many challenges besides revenue. And it may be difficult to explain the benefit of an IPO to voters. Lower pricing, on the other hand, can be quickly implemented and used to demonstrate the administrations focus on making homeownership more affordable. The last time pricing was adjusted, in early 2023, it raised fees for most borrowers with high credit scores and lowered fees for most borrowers with low credit scores.

Therefore, it seems probable that the administration will pursue lower loan pricing at the expense of the IPO. The focus would be on purchase loans. Undoing some, or all, of the 2023 price increases for purchase loans while leaving intact the price decreases appears to be a likely solution. This should lift the value of most discount MBS; the value loss from faster turnover in pools priced above par should be small.

Regulators could adjust pricing for purchase loans and leave pricing for refinance loans alone. Keeping refinance fees unchanged would cushion the hit to revenues and be supportive of any IPO attempt. And lowering refinance fees would likely result in lower prices for TBAs and higher mortgage rates, which is bad for affordability. So, with cautious optimism, it seems like lower pricing may not bring worse convexity for agency MBS.

If the administration were to raise pricing for low credit borrowers, then those borrowers could always consider an FHA loan. In a sense there is a cap on the price increase those borrowers would truly face. However, the optics of an increase would look bad and be complicated to explain to voters.

Other changes being floated are 50-year mortgages, assumable mortgages and portable mortgages. The 50-year mortgage, if implemented, is unlikely to be a high-volume product. Assumable mortgages could lower out-of-the-money prepayment speeds for new loans, but typically they are only effective when home price appreciation has been low. Portable mortgages that can move with the borrower would lower prepayment speeds of new MBS in a discount environment but would affect existing securities.

So, paradoxically, while there are plenty of potential changes being floated by the administration and FHFA, it seems unlikely that any will have a large effect on the value of agency MBS next year.

Mortgage insurance premiums for FHA loans also seem unlikely to fall. They are already at historical lows and FHA delinquencies keep growing. The FHA’s forthcoming Annual Report to Congress should shed more light on this issue.

Turnover and defaults

Prepayments of delinquent loans is likely to be a large contributor to discount speeds in Ginnie Mae MBS next year. Close to 6% of FHA loans in MBS are at least 60 days delinquent and about 12% of loans have partial claims. The worst performing vintage, 2022, is approaching 10% delinquent and roughly 24% have partial claims. Many FHA borrowers may not be eligible for future loss mitigation due to FHA rules changes that took effect on October 1. Borrowers that redefault and cannot receive another partial claim will eventually be removed from the pool, which is a prepayment. Discount Ginnie Mae MBS, especially custom pools that have high FHA concentrations, should benefit most.

Discount prepayment speeds may also receive a lift in locations that have experienced large increases in hazard insurance or property taxes (or both). Florida is a prime example. Some homeowners may find it too expensive to continue living in their homes and be forced to move.

Net supply edges higher, remains tight in conventional MBS

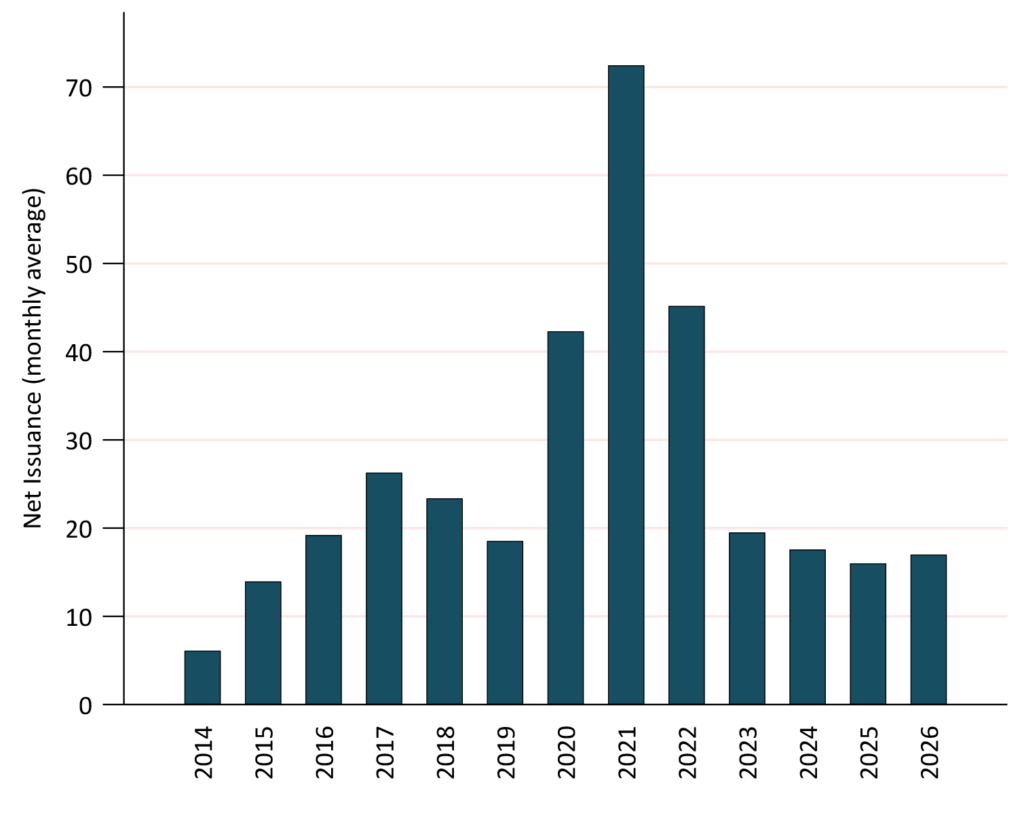

Net supply should increase slightly next year, by about $1 billion per month (Exhibit 2). This is still low in historical context. The increase comes from modest projected increases in existing and new home sales. It is likely that net supply of conventional MBS will be roughly flat, like it has been in 2025; most of this growth should come at Ginnie Mae. There are other factors at play—net supply is effectively lifted by runoff from the Fed’s MBS portfolio, while Fannie Mae and Freddie Mac’s investment portfolio growth reduces net supply. Although Ginnie supply is positive, those bonds will be met by strong demand from domestic banks and overseas investors.

Exhibit 2. Net issuance to increase slightly next year

2025 is a combination of actual issuance through October and projected issuance for November and December. 2026 is projected.

Source: Fannie Mae, Freddie Mac, Ginnie Mae, Santander US Capital Markets.