By the Numbers

Signs of stress in large loans

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Larger loans in non-QM MBS have always been a source of risk for investors in private-label bonds, mainly because historically they have been far more negatively convex than smaller loans. A curious and somewhat counterintuitive trend has begun to form where larger non-QM loans are exhibiting elevated serious delinquencies compared to smaller loans. A granular analysis suggests that growing strains on household budgets may be the root cause given elevated delinquency rates on second homes in New York and primary residences in Florida.

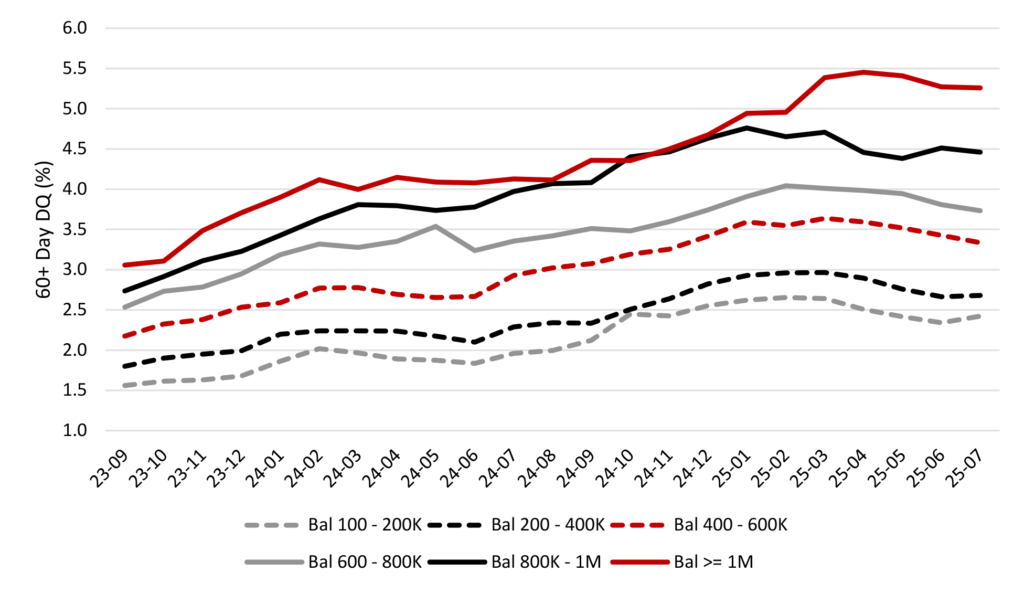

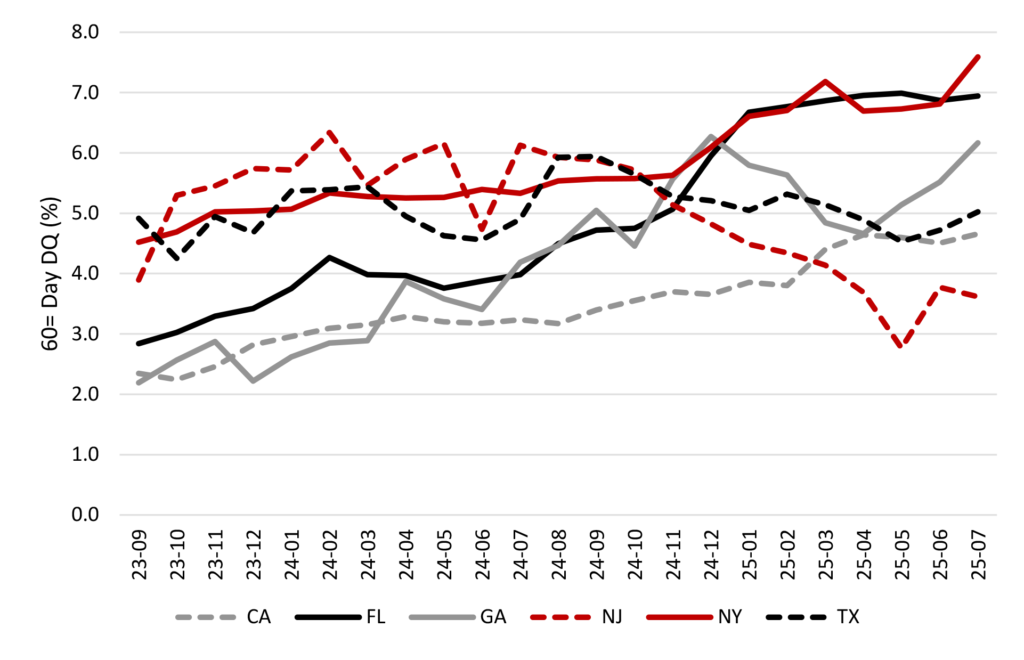

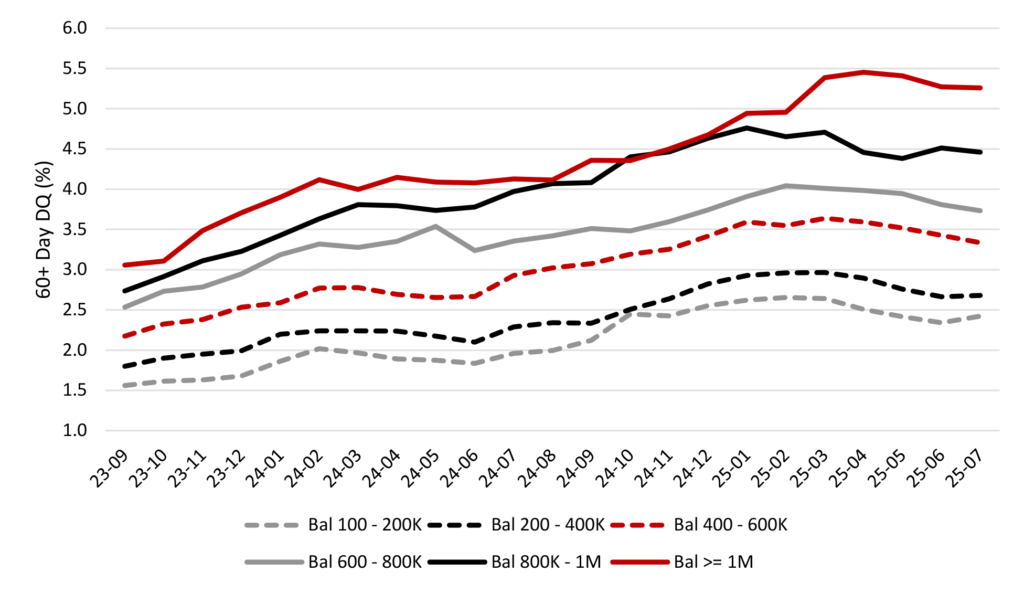

In the run-up to the Global Financial Crisis, conventional wisdom said that large loans bore less credit risk than smaller ones as larger loans generally went to more affluent borrowers who could afford bigger homes and heftier downpayments. Smaller loans were also problematic since fixed costs of foreclosure and liquidation would represent a higher loss severity on default. Fast forward to today and there is a discernible difference between large and small loans with more large loans rolling into serious delinquency (Exhibit 1).

Exhibit 1: Larger loans exhibit elevated delinquencies in non-QM trusts

Source: Santander US Capital Markets, CoreLogic LP

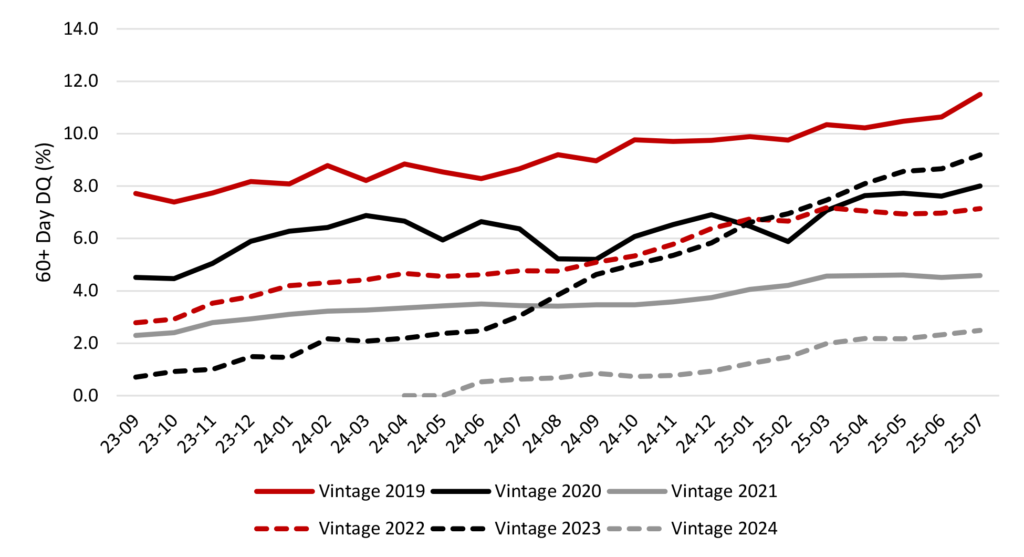

Vintage and occupancy trends

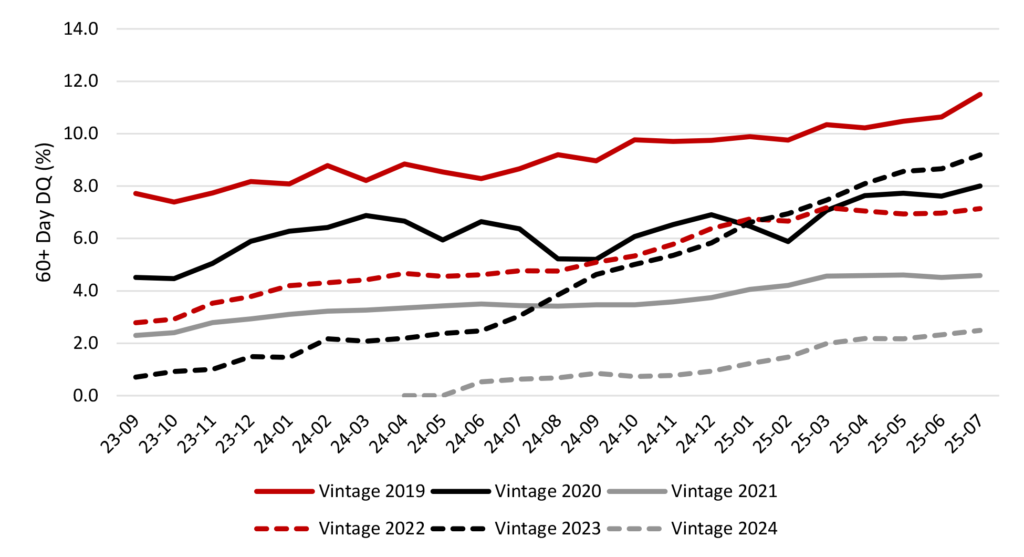

Stratifying the universe of non-QM trusts by loan balance to isolate performance of loans with original balances of $800,000 or more and then further cutting this cohort by vintage and occupancy shows that more seasoned trusts are significant contributors to elevated delinquencies. This is especially notable for 2019 and 2020 vintages and not surprising as these loans are further up the seasoning curve. They should exhibit higher balances of delinquent loans than less seasoned trusts. However, the 2023 vintage appears to be somewhat of an aberration as delinquency rates are ramping with greater velocity than other post-COVID vintages (Exhibit 2).

Exhibit 2: 2023 vintage high balance loans rolling delinquent faster than other cohorts

Source: Santander US Capital Markets, CoreLogic LP

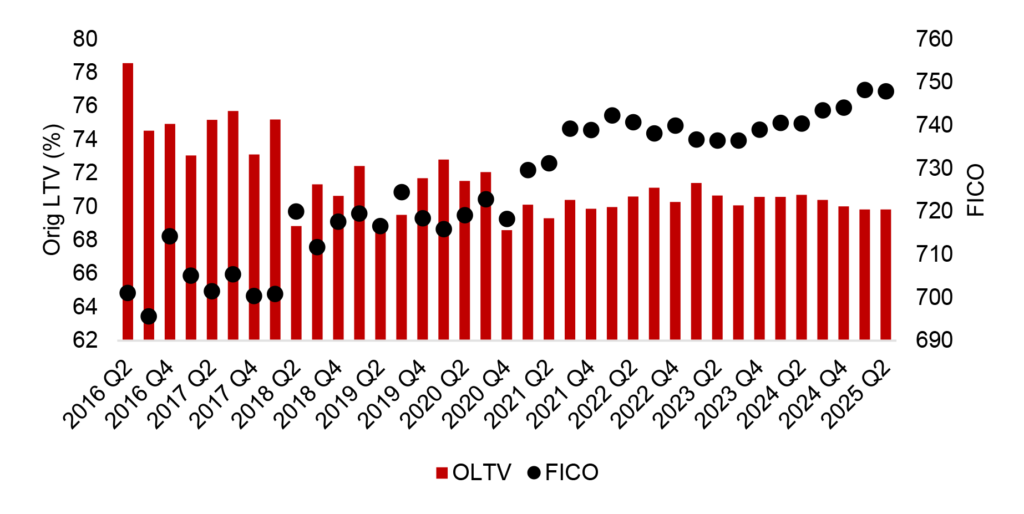

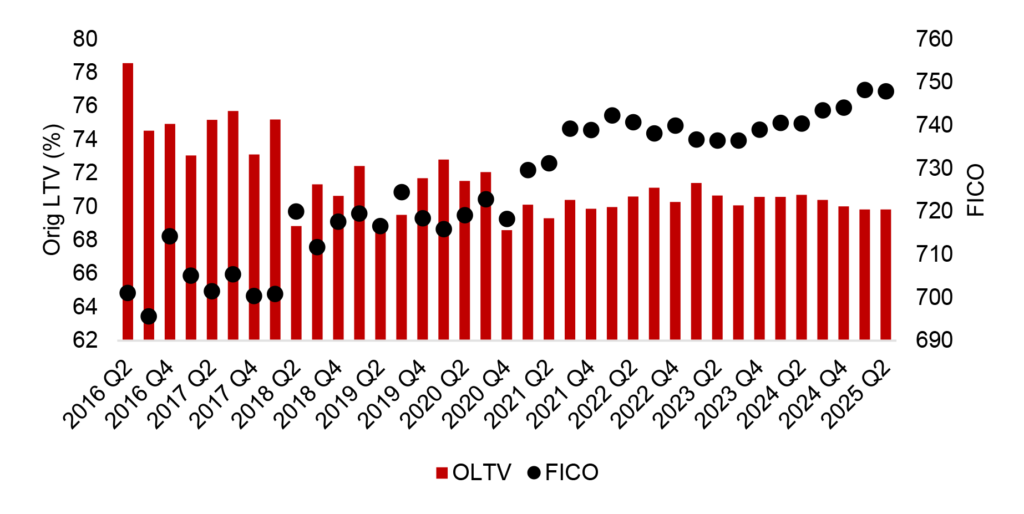

Underperformance in the 2023 vintage does not appear, at least on the surface, to be a function of materially looser underwriting standards. While the credit box did loosen modestly coming out of the pandemic, with average LTV rising by one to two points and average FICOs decreasing by roughly 10 points versus the absolute tights in underwriting, they by no means signal a meaningful deterioration in underwriting. Additionally, while anecdotal, talks with many originators suggested that they began to tighten underwriting standards through 2023, either pricing loans with layered risks such as high LTV loans to lower FICO borrowers more punitively, or removing the offerings from their pricing grids altogether as primary mortgage rates rose.

Exhibit 3: Underwriting remained strong in 2023 vintage despite weaker performance

Source: Santander US Capital Markets, CoreLogic LP

While difficult to know with certainty what might be driving this underperformance it seems plausible that large balance borrowers in the 2023 cohort may have ‘bought the house and not the rate’ with an eye towards being able to refinance that loan at some point in the not-too-distant future, thereby bringing down household debt burdens substantially. Persistently elevated mortgage rates, coupled with rising non-fixed costs such as taxes and insurance seem likely to be putting pressure on a segment of larger balance borrowers.

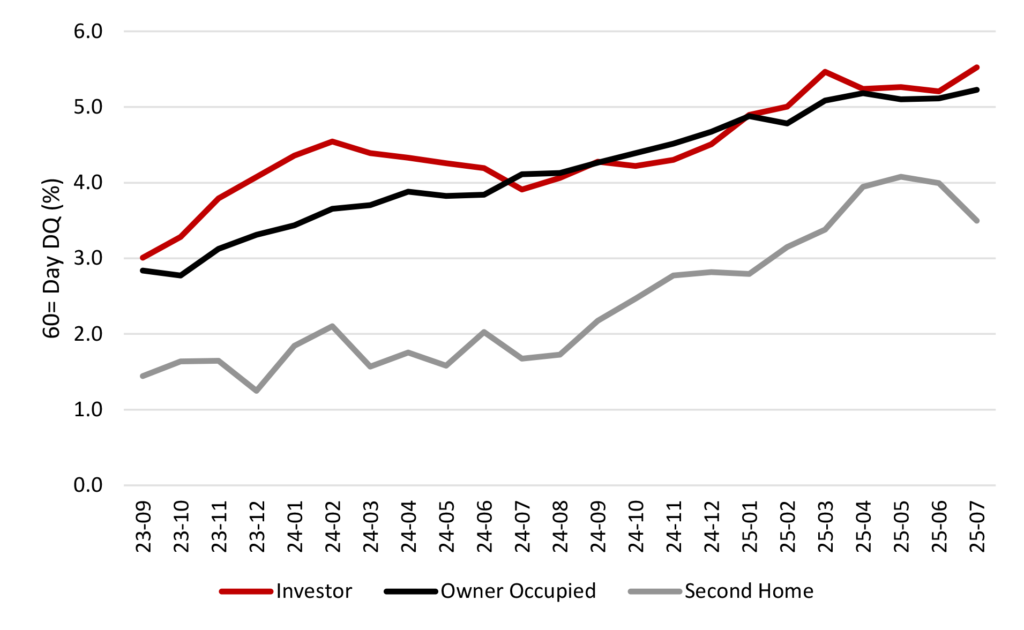

A look at occupancy trends

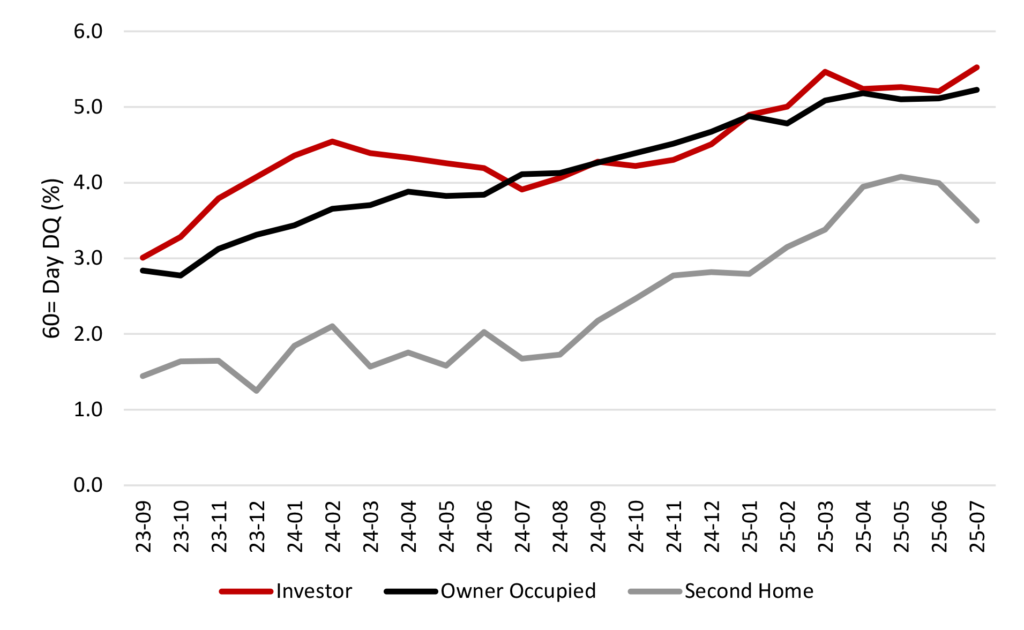

When cutting higher balance loans at the cohort level by occupancy, both owner-occupied and investor loans are showing comparable delinquency levels with second homes performing markedly better than both primary residences and investor loans. Delinquencies on primary residences and investor high balance loans have converged over the past year after delinquency rates on higher balance investor loans surged at the start of last year (Exhibit 4). However, this trend is not uniform across states that are currently flashing elevated delinquency rates.

Exhibit 4: Delinquency rates on high balance primary residence and investor loans converge

Source: Santander US Capital Markets, CoreLogic LP

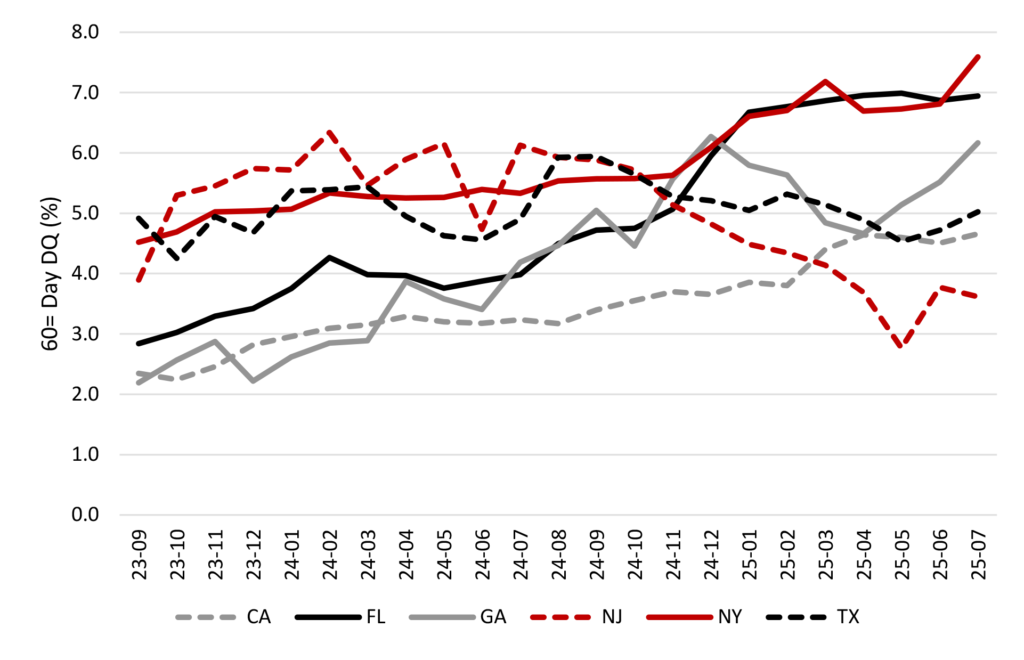

Geography matters

When cut by geography, there are notable differences in the performance of larger balance loans across states. The start of the year marked the beginning of a significant divergence in credit performance across states that make up substantial swaths of non-QM collateral. Delinquencies in Florida and New York surged and currently sit at the highest readings of meaningful non-QM geographies. Delinquency rates in loans in Georgia have surged in recent months as well. Conversely, delinquency rates on large loans in New Jersey have fallen substantially. While readings in California and Texas remain relatively benign (Exhibit 4).

Exhibit 5: Delinquency rates rising in large loans in New York and Florida

Source: Santander US Capital Markets, CoreLogic LP

Signs of stress in New York second homes

Evidence that persistently elevated rates and rising non-fixed costs of homeownership may be putting strains on larger loan borrowers in non-QM trusts can be seen when drilling down into the state with the highest delinquency rate, New York.

In New York, delinquency rates on second homes are significantly higher than those of both primary residences and investment properties, contrary to the broader trend for the non-QM universe where second homes exhibit markedly better credit performance than the other two exposures. Serious delinquency rates on second homes in New York surged to as high as 11% earlier this year, 5.6% higher than primary residences and 4.2% higher than investor loans in the same period. Second homes in New York are by no means a meaningful cohort in the broader non-QM universe. However, the trend may be illustrative of strained household budgets and potentially continued stress on larger primary residence and second home borrowers within the sector.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2025 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.