By the Numbers

Estimating the likelihood of a CLO reset or refinancing

Steven Abrahams and Brian Landy, CFA | July 11, 2025

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

CLO investors spend a lot of time thinking about whether a particular piece of debt will likely get reset or refinanced and whether the margin will disappear to only get replaced by something lower. A lot of it is rule-of-thumb, with as many thumbs as investors. A study of resets and refinancings in the 1,403 broadly syndicated loan deals issued since the start of 2020 shows clear patterns in the rate of early redemption depending on spread incentives and time past the non-call period. One implication is that deals with incentives of 50 bp or less stay outstanding longer and are more valuable than many investors expect.

Lots of resets and refinancing

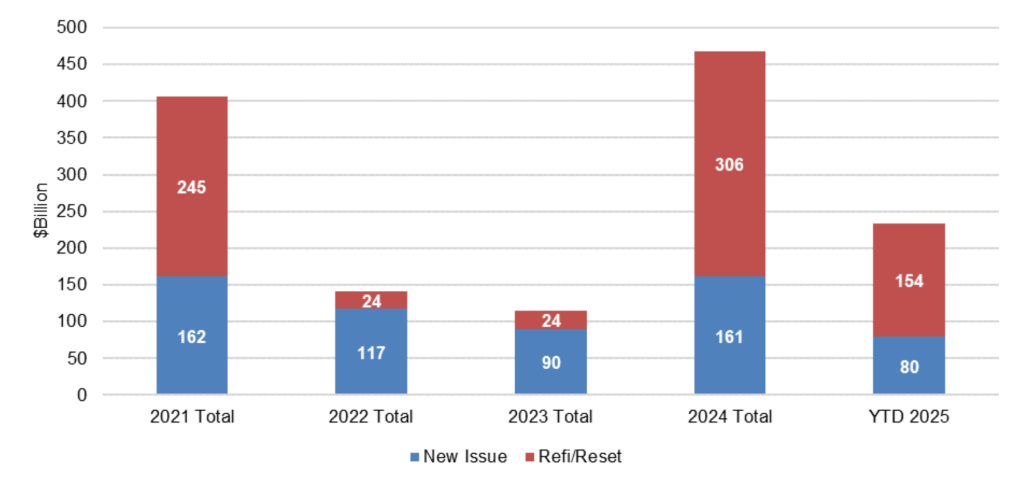

CLO debt investors have spent big parts of the last few years replacing securities that have reset or refinanced. Of the $1.36 trillion in broadly syndicated loan transactions since the start of 2021, 55% have involved the reset or refinance of an existing deal (Exhibit 1).

Exhibit 1: Resets and refis have dominated new BSL deals but vary over time

Note: BSL CLOs only.

Source: Bloomberg, Santander US Capital Markets

Follow the bouncing margins

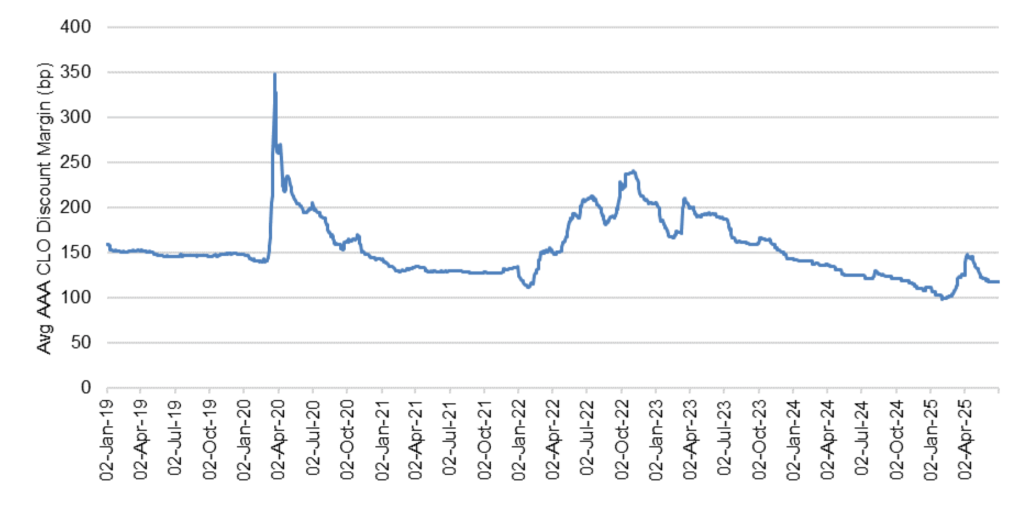

CLO resets and refinancings have clearly reflected debt margins. Margins in 2021 ran at low levels compared to prior years, for example, driving up resets and refinancing to 60% of the total as managers lowered their funding costs (Exhibit 2). Margins rose and stayed high compared to prior years in 2022, cutting debt redemptions to 17% of the total, and again in 2023, keeping redemptions at 21%. And margins have since fallen, driving resets and refinancing up to 65% of the total in both 2024 and so far in 2025.

Exhibit 2: CLO spreads, and opportunities to refi, have varied over time

Source: Bloomberg, Santander US Capital Markets

Predicting early debt redemption

The ebb and flow of resets and refinancings has raised interest in trying to predict when managers will retire existing debt. A deal clearly has to age beyond its non-call period when deal structure finally permits a reset or refi, and then the manager usually has to have clear incentives to lower the cost of funds. There are other influences on the decision, of course, including the quality of the loan portfolio, the need to add equity to the deal, the availability of rating agencies and legal counsel, even the manager’s interesting in extending the fee stream. But exiting non-call and having incentives are the big ones.

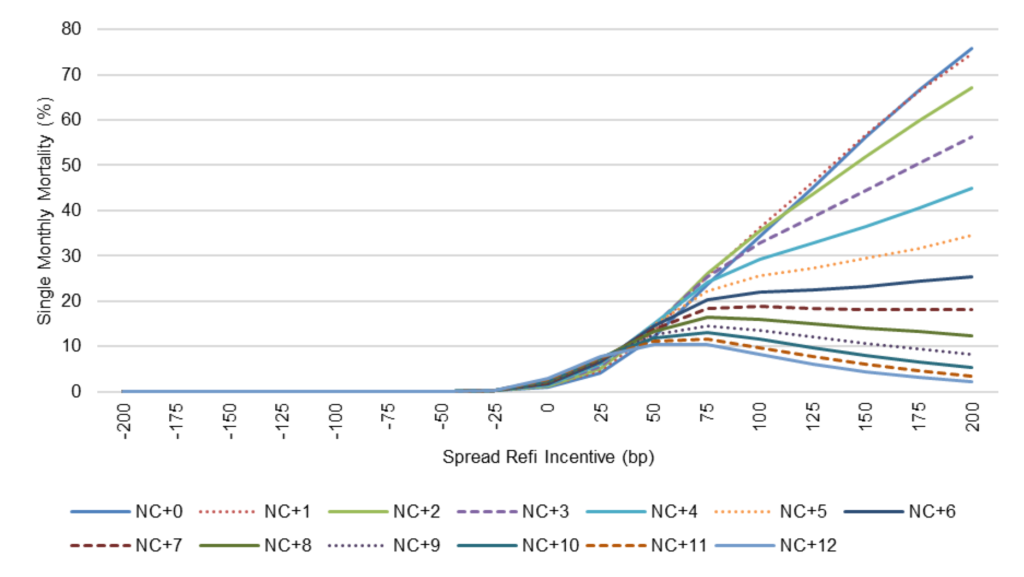

Our statistical study of 1,403 deals done since 2020 shows managers clearly respond to ‘AAA’ refinancing incentive as deals leave the non-call period, but the shape of the response changes as time goes by. Details of the study are in appendix to this note. A few highlights (Exhibit 3):

Exhibit 3: CLO deals refi aggressively after non-call, but quickly burn out

Note: ‘AAA’ refi incentive. See appendix to this note for details.

Source: INTEX, Bloomberg, Santander US Capital Markets

- CLOs in the month they end their non-call period (NC+0) refinance aggressively if they have clear incentives; of deals that emerge with 100 bp of incentive, for example, an average 34.4% reset or refinance in that initial month of callability. Redemptions drops to 12.1% with only 50 bp of incentive, and rises to 75.6% with 200 bp of incentive

- CLOs in the first full month after non-call (NC+1), continue to refinance aggressively; of deals with 100 bp of incentive that month, 36.2% reset or refinance

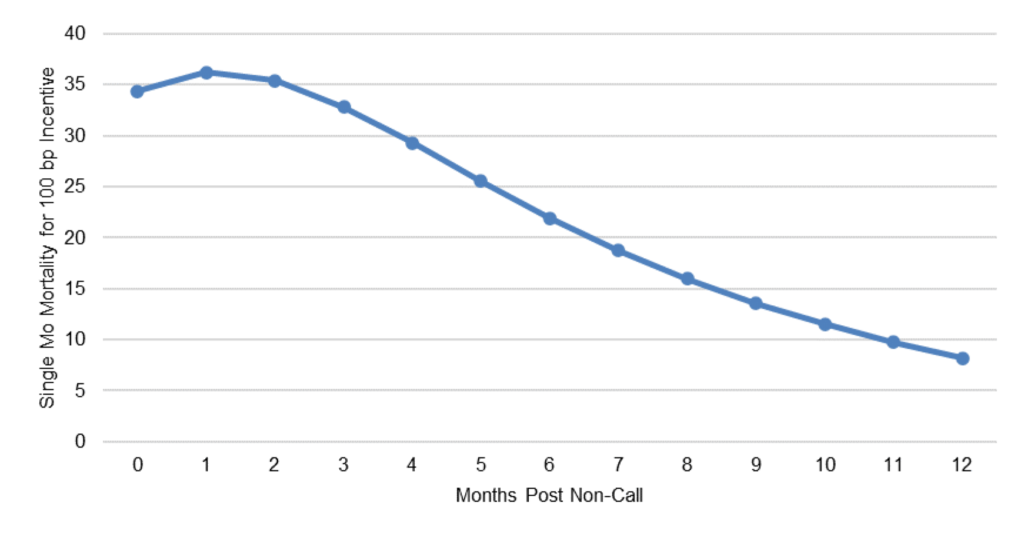

- CLOs with incentives of 50 bp or more continue to show a decreasing response as time goes by, likely because surviving deals face some obstacle to refinancing such as poor loan quality, a need to add equity, or even bottlenecks at rating agencies or law firms; for deals with a constant 100 bp incentive, the monthly rate of reset or refinancing drops from near 35% immediately after non-call to below 10% a year later (Exhibit 4).

Exhibit 4: At a fixed 100 bp incentive, reset and refi volume burns out over time

Source: INTEX, Bloomberg, Santander US Capital Markets

- Finally, the amount of incentive where the rate of reset or refinancing is roughly steady regardless of months after the end of non-call is somewhere between 25 bp and 50 bp. Outstanding deals with this range of incentives likely are on the reset and refinancing cusp, bouncing back and forth between sufficient and insufficient reasons to pull the trigger. These deals reset or refinance somewhere between 7% and 15% as each extra month goes by.

Impact on CLO value

The CLO’s margin and expected time outstanding after the end of non-call should have a clear effect on the fair value of the debt. Take a simple example of a ‘AAA’ CLO with a margin 50 bp higher than the currently available market rate. The CLO might have a margin of 175 bp, for example, in a market where the average ‘AAA’ CLO traded with a discount margin of 125 bp. Putting aside the discounting of cash flows for the moment, the security should be worth $100-16 if the investor knew with certainty the manager would wait a year to reset or refinance the debt. The $0-16 represents the value of the extra 50 bp of margin for a year. If the manager would wait six months, fair value would fall to $100-08.

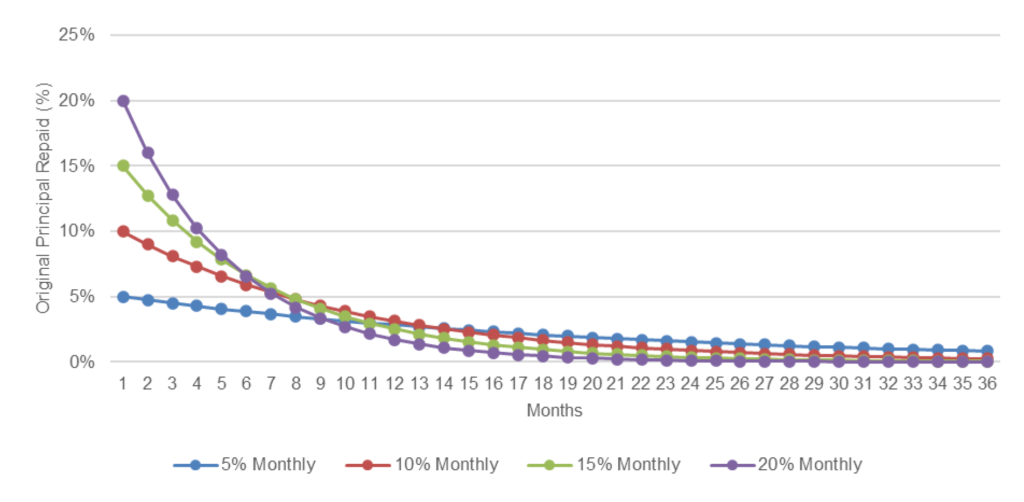

For a diversified set of ‘AAA’ CLOs past their non-call period with margins between 25 bp and 50 bp above the market, our study suggests repayment rates range from an average 5% a month at the low end to 20% a month at the high. Those produce significantly different principal cash flows with different weighted average lives (Exhibit 5):

- At 5% a month, a 13.3-month WAL

- At 10% a month, a 9.2-month WAL

- At 15% a month, a 6.6-month WAL

- At 20% a month, a 5.0-month WAL

Depending on expected repayment rate and excess margin, the price of these securities should vary significantly.

Exhibit 5: Return of principal varies with different constant repayment rates

Source: Santander US Capital Markets

Quantifying common sense

Investors already know that callable CLO debt with a margin above the prevailing market rate should get called, but quantitative estimates of how long it might take to pull the trigger are lacking. Some investors suggest that anything above 25 bp or so should exercise the reset or refi option ruthlessly. But this study suggests that’s not the case. One resulting sweet spot for investors could be deals with margins 25 bp to 50 bp above the market. These securities in aggregate take time to reset or refinance and should trade at a premium to par. Anything below that fair value premium looks like a good addition to most portfolios.

Appendix: Methods

To see how much incentive a manager needs to either reset or refinance a deal, we looked at resets and refinancings on all broadly syndicated loan deals done since the start of 2020. That was 1,403 deals. We calculated a few important measures:

- Initial ‘AAA’ spread premium (Spread Premium): the difference between the deal ‘AAA’ margin and the Palmer Square ‘AAA’ discount margin on the pricing date. If the deal launches with a ‘AAA’ margin of 150 bp while the Palmer Square index is at 125 bp, for example, the spread premium would be 25 bp.

- ‘AAA’ spread refinancing incentive (Refi Incentive): the difference between the deal ‘AAA’ margin and the initial ‘AAA’ spread premium plus the Palmer Square ‘AAA’ discount margin. If the Palmer Square index drops from 125 bp to 100 bp, the refi incentive would be ‘AAA’ Margin – (‘AAA’ Spread Premium + Index) = 150 bp – (25 bp + 100 bp) = 25 bp.

- Time out of non-call (Out of NC): the number of months out of the non-call period

- RefiReset: a variable with the value of 1 in the month when the deal is either reset or refinanced and 0 otherwise

Because new deals often arrange the sale of the ‘AAA’ class well in advance of pricing, we calculated the Refi Incentive using values of the Palmer Square ‘AAA’ discount margin from 45 days earlier. Because deals often show up in Intex at a lag to their pricing date, we also used the Palmer Square ‘AAA’ discount margin from 45 days earlier to calculate the Spread Premium.

We estimated the relationship

RefiReset = f(Refi Incentive, Out of NC)

with RefiReset coded as either 0 or 1. For a binary outcome like that, we used nonparametric logit to calculate the main effects of each variable and their interaction. The statistical results allowed us to plot the curves in this note.