By the Numbers

Bank view of consumer credit sees student loan, auto pressure

This material is a Marketing Communication and does not constitute Independent Investment Research.

Banks are taking a benign view of their own consumer loans despite concerns kicked up by the bankruptcy of subprime auto lender Tricolor Holdings and other rising consumer delinquencies. Student loans and autos held by banks look a little weaker than they have for the last five years with credit cards and mortgages still strong. The latest bank outlook reflects broader snapshots of consumer health, suggesting consumer credit is running in the same direction both inside and outside the bank market.

The Federal Reserve every quarter asks large or highly complex banks to categorize their consumer loans by 2-year probability of default. The long horizon encourages banks to weigh not just immediate performance but also a longer view of borrowers and their circumstances. The answers provide a good benchmark for banks’ evolving view of credit.

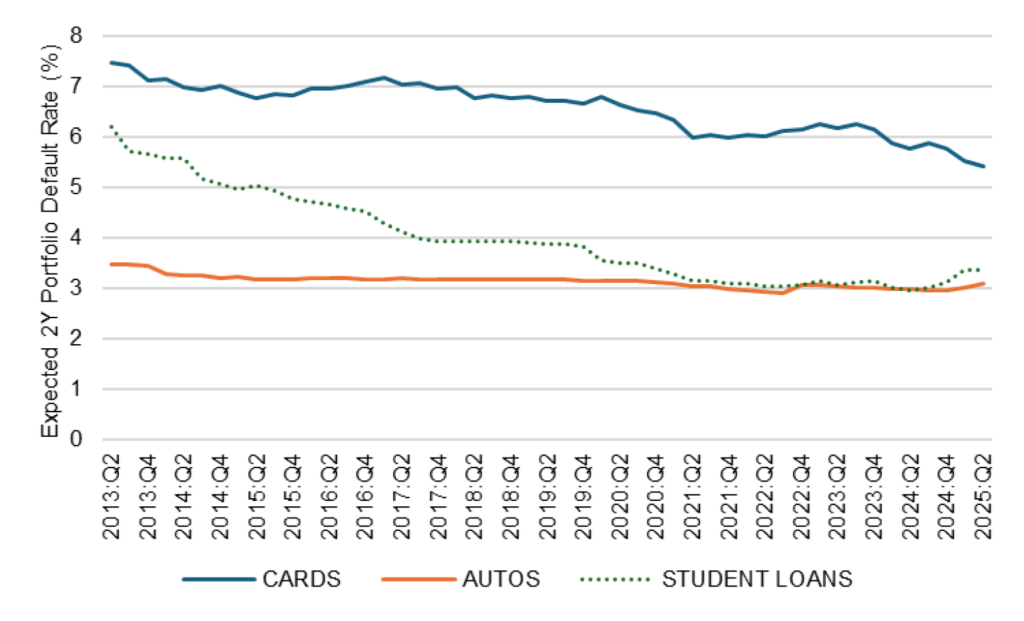

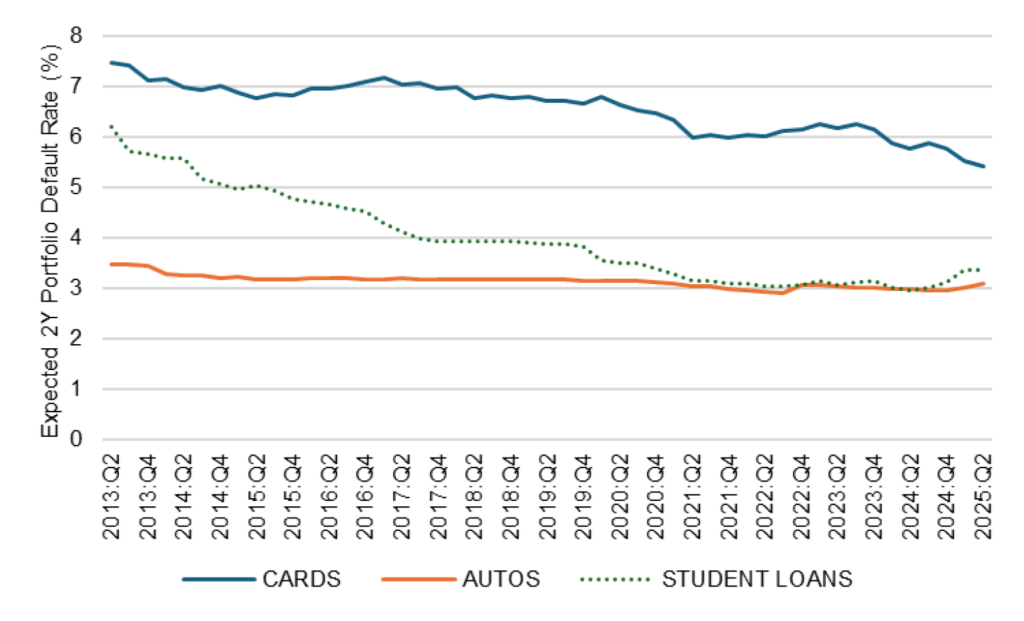

The series of weighted average 2-year default rates on consumer loans going back to 2013 shows cards continue to decline in the latest report with auto and student loans up slightly (Exhibit 1). The amount of change is small. Cards are down 35 bp in the last year through June, autos up 12 bp and student loans up 39 bp.

Exhibit 1: Banks’ default expectations for cards fall, autos and student loans rise

Note: methods for calculating these expectations described in an appendix to this note.

Source: Federal Reserve Enhanced Financial Accounts, Santander US Capital Markets

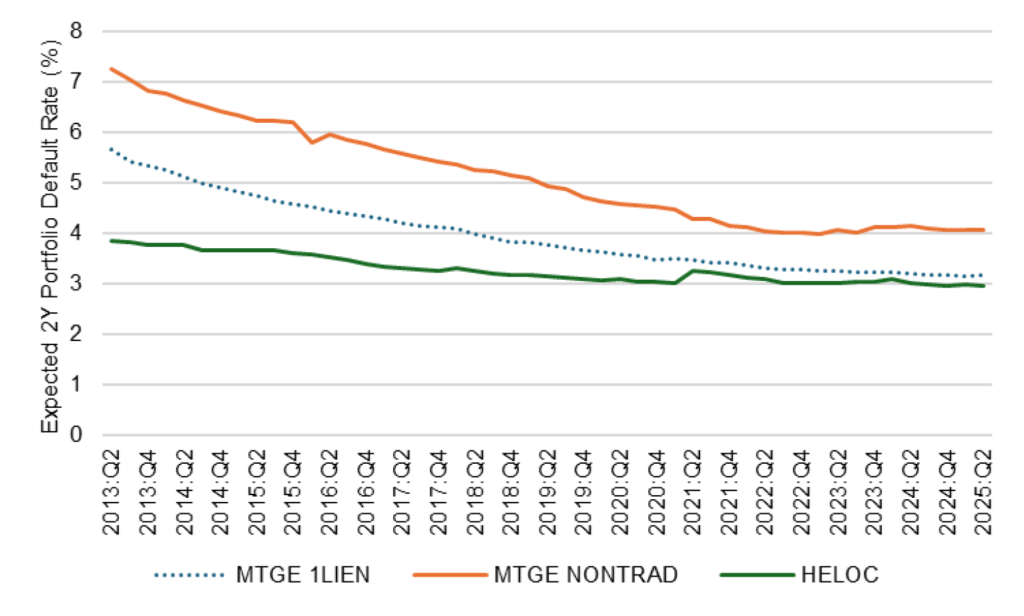

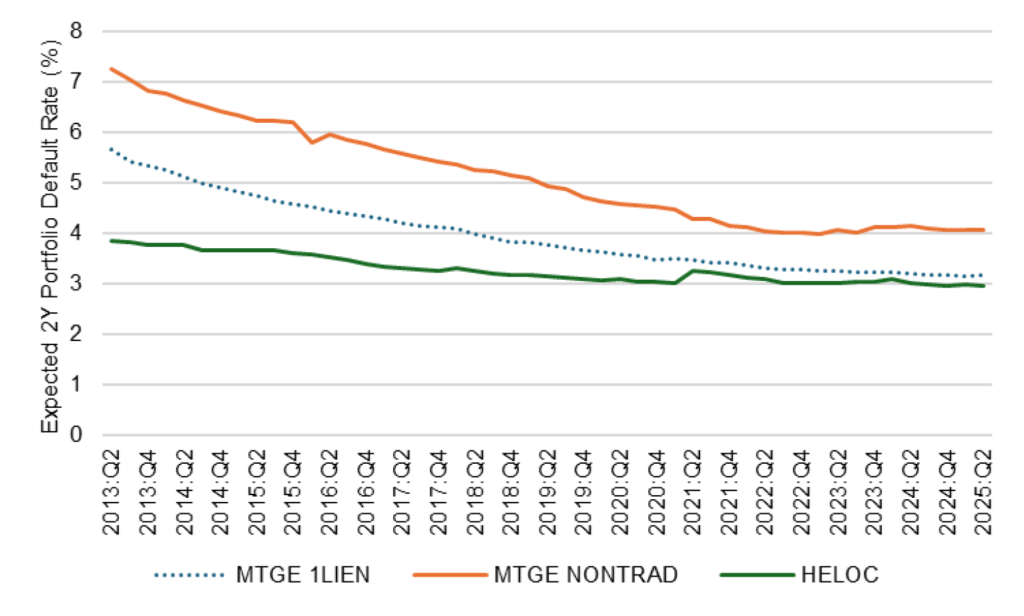

In bank mortgages, expectations of default continue to drift lower. Weighted average 2-year defaults in first liens are down 5 bp in the last year through June, nontraditional mortgages with flexible repayment terms and other features are down 7 bp and home equity lines of credit down 3 bp (Exhibit 2).

Exhibit 2: Banks default expectations for mortgages fall

Note: methods for calculating these expectations described in an appendix to this note.

Source: Federal Reserve Enhanced Financial Accounts, Santander US Capital Markets

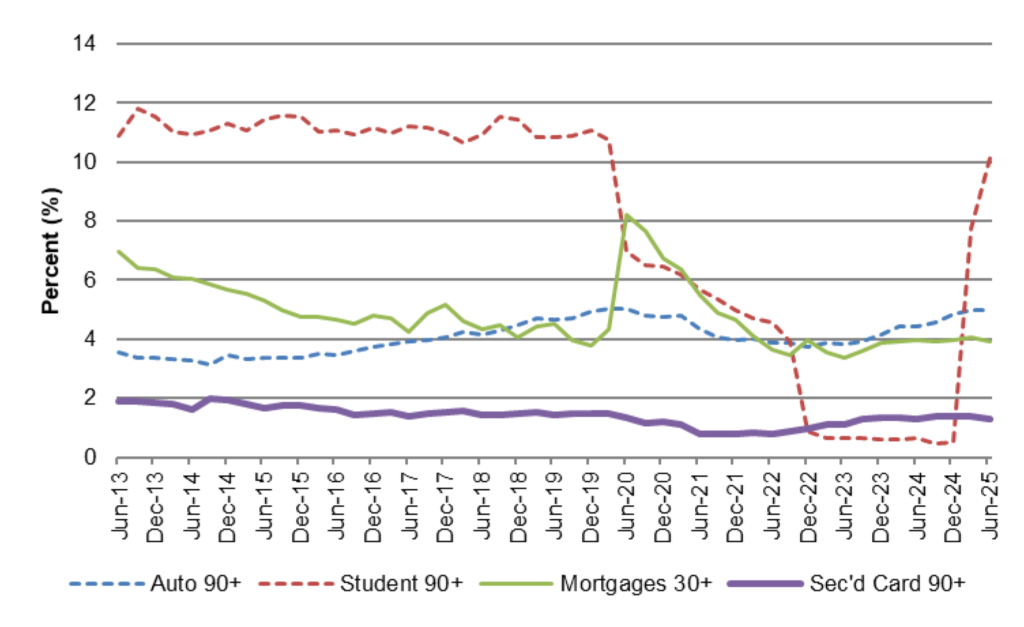

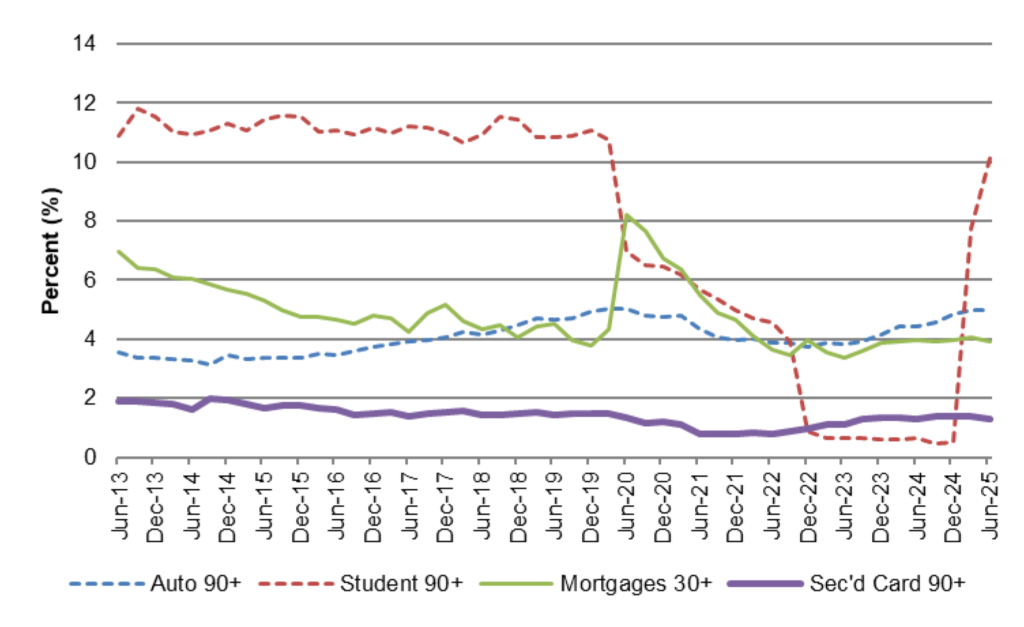

The trends broadly parallel results from credit bureaus that report loans made both inside and outside the banking system. Instead of reporting expected defaults, the Fed reports current delinquencies using a national representative sample of individual and household credit records from Equifax. Those numbers show credit card delinquencies down 1 bp, mortgage delinquencies down 4 bp, auto delinquencies up 56 bp and student loan delinquencies up 951 bp (Exhibit 3). The direction for each type of loan is the same in the credit bureau numbers as in the survey of bank expectations, although the percentage change in the delinquencies are obviously greater.

Exhibit 3: Delinquency for cards and mortgages fall, autos and student loans rise

Source: Bloomberg, Federal Reserve, Santander US Capital Markets

The delinquency series is clearly more volatile than the survey, but that almost certainly reflects bank efforts to partly look through current conditions and consider outcomes over two years.

Despite differences between the bank survey and the delinquency series, both suggest student and auto loans are the biggest sources of stress on consumer balance sheets. Both types of loans have become more leveraged in recent years. Student loans became leveraged by a moratorium on payment that started in 2020 and only completely ended in October 2024. And auto loans became leveraged by a decline in auto prices starting in 2022 and by a steady extension of auto loan maturities, leaving the loans secured by highly depreciated vehicles toward the end of their term. These look like continuing sources of stress.

Both series also agree that mortgage credit looks strong. Mortgage risk has deleveraged as home prices have climbed quickly since 2020. Although home prices have decelerated this year, accumulated home equity should keep most mortgage credit strong.

Both series also agree that credit card performance looks at least stable. But that may only reflect a resilient labor market.

For investors, risk premiums on the associated debt should reflect the strength or weakness in the fundamental credit. Quality consumer credit looks more likely to be found in mortgages and cards, speculative credit in student loans and auto paper.

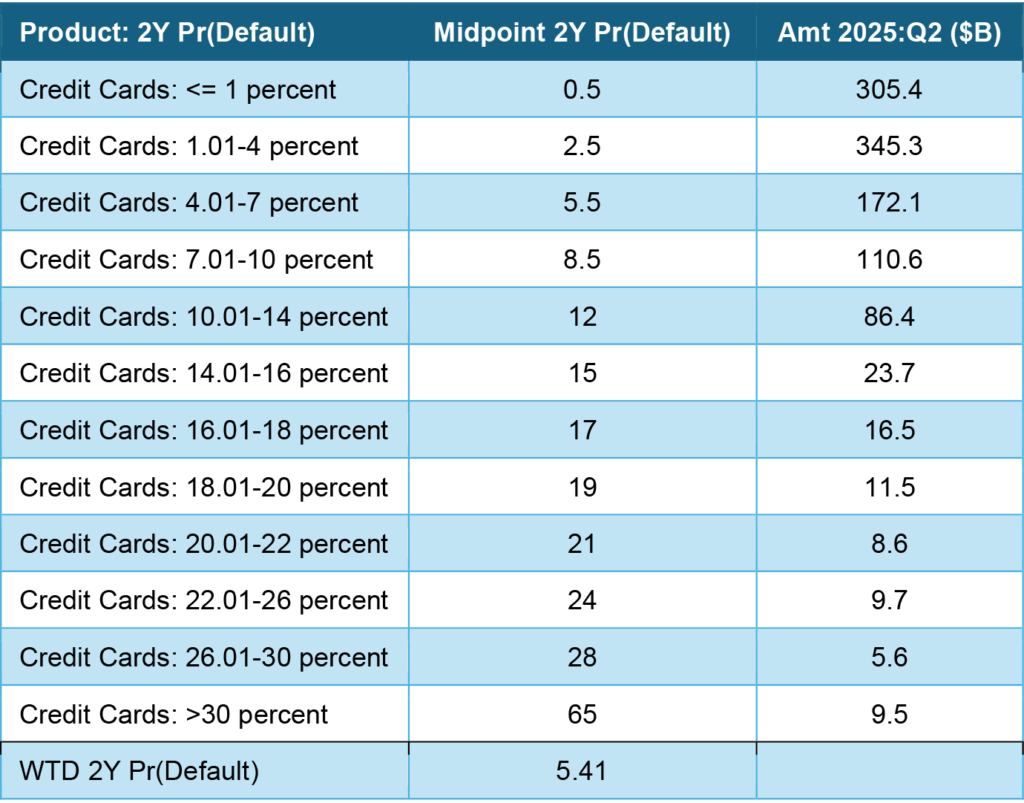

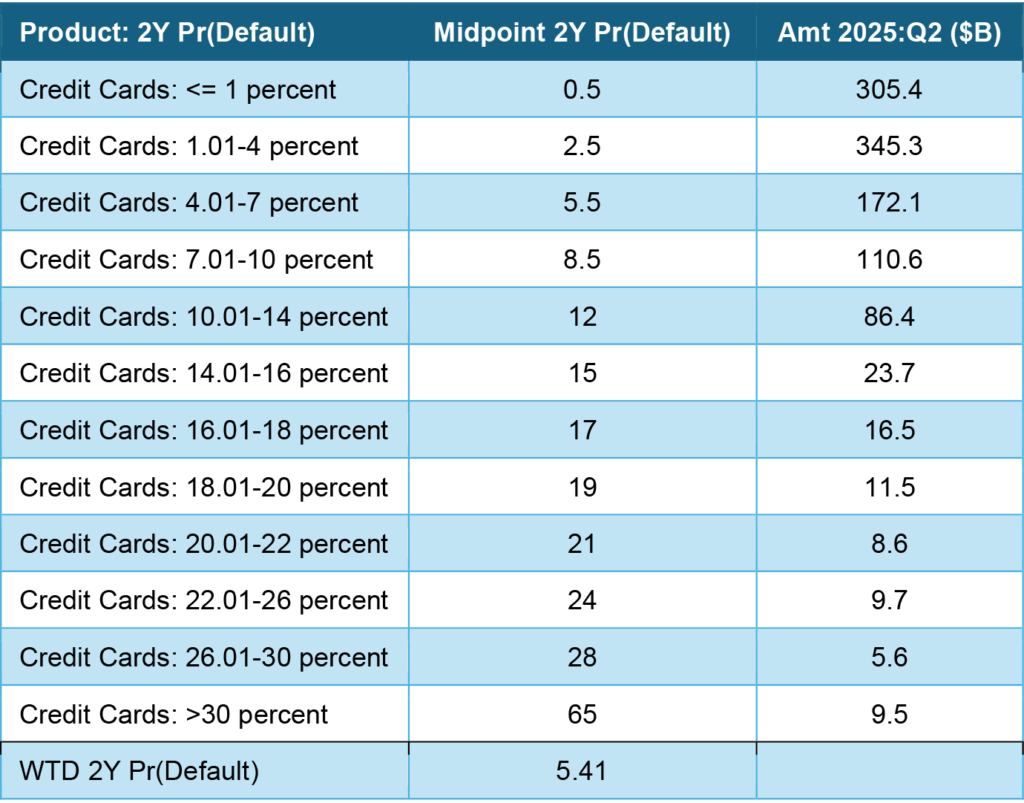

A note on methods to calculate weighted average default rates from bank survey responses:

The banks surveyed by the Fed put their loans into 12 categories from loans with less than 1% probability of default in the next two years to loans with more than 30%. One summary of the results is to take each category and weight it by the amount of loan principle assigned. The most recent credit card numbers from the second quarter, for example, show an expected 2-year default rate of 5.41% (Exhibit 4). These numbers become valuable across loans and over time.

Exhibit 4: Calculation of latest weighted 2-year default rate in credit cards

Source: Federal Reserve Enhanced Financial Accounts, Santander US Capital Markets

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2026 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.