The Big Idea

Signal and noise about Fannie Mae, Freddie Mac portfolio growth

Steven Abrahams | September 26, 2025

This material is a Marketing Communication and does not constitute Independent Investment Research.

Separating signal from noise about Fannie Mae and Freddie Mac requires fine antennae these days, but a signal of actual or pending activity in their investment portfolios is starting to come through. That does not mean anything is actually going on. But some investors have started looking at MBS partly as an option on that kind of structural change in the market. The agency debt and interest rate derivatives markets may also want to take note.

The latest signal requires connecting a few dots:

- The enterprises already have authority and capacity to buy

- Buying would likely add to profits, lower mortgage rates or both, and

- Some recent hires and reorganizations have improved ability to invest

It only takes a few dots in a noisy world to encourage new theories. But even the possibility of a new Fannie Mae and Freddie Mac bid may have already pulled capital into MBS—capital willing to believe that an enterprise bid at the very least creates a backstop, cuts off the worst risks of wider spreads in MBS and biases the distribution of potential spreads tighter. The implication for agency debt would be more issuance, and, for derivatives, more active hedging of MBS negative convexity and rising volatility as a result.

The dots waiting to get connected

It is true that both enterprises already have authority to use their investment portfolios and have capacity to buy. Each portfolio can invest up to $225 billion under the senior preferred stock purchase agreement with the US Treasury, but each currently is well short. Fannie Mae had only $88 billion invested at the end of July, leaving $137 billion of capacity or the equivalent of 3.32% of its current par balance of guaranteed securities. Freddie Mac had only $106 billion invested, leaving $119 billion of capacity or 2.93% of its guaranteed book. Since going into conservatorship in 2008, both enterprises have used their portfolios mainly to warehouse delinquent loans bought out of mortgage pools. That has left all the extra room.

It is also true that building the portfolio would likely add to profits, tighten mortgage spreads or both. Before conservatorship, the portfolios made extraordinary contributions to combined net income and guarantee fees. In 1998, for example, arguably the heyday of the portfolios, Fannie Mae’s portfolio contributed 73% of net income and guarantee fees, according to its SEC filings. In 2024, the contribution was 19%. Adding a portfolio bid to the current market, where net supply of conventional MBS this year has been close to zero, would also likely have a big impact on spreads.

True, too, is that more profits and tighter spreads line up with some of the administration’s stated interests. The administration’s interest in a public equity offering for Fannie Mae and Freddie Mac does get easier if the enterprises have better earnings. And the administration’s interest in lower interest rates, or at least lower mortgage rates, gets a lift from tighter mortgage spreads.

Other things are a little more subtle. The enterprises have made hires this year and done some reorganization in their portfolios that would help them return to more active portfolio investing, if that’s the plan. Fannie Mae, for example, hired the former global head of JPMorgan’s investment portfolio to become chief investment officer and head of treasury and capital markets, a structure that would help coordinate investing and funding. That does not mean investing and funding actually is the plan. But it could be.

The available evidence

The available evidence does point to signs of portfolio growth. It is most noticeable in the Freddie Mac portfolio. Sometime in May or June, the balance of mortgage loans and the balance of agency MBS began to rise (Exhibit 1). It may be coincidence, but social media posts from the administration first announced interest in a public offering on May 21. The agency’s most recent report shows loans from May through August up $14.3 billion and agency MBS up $5.2 billion.

Exhibit 1: Freddie Mac has added $14.3 billion loans since May, $5.2 billion MBS

Source: Freddie Mac, Santander US Capital Markets

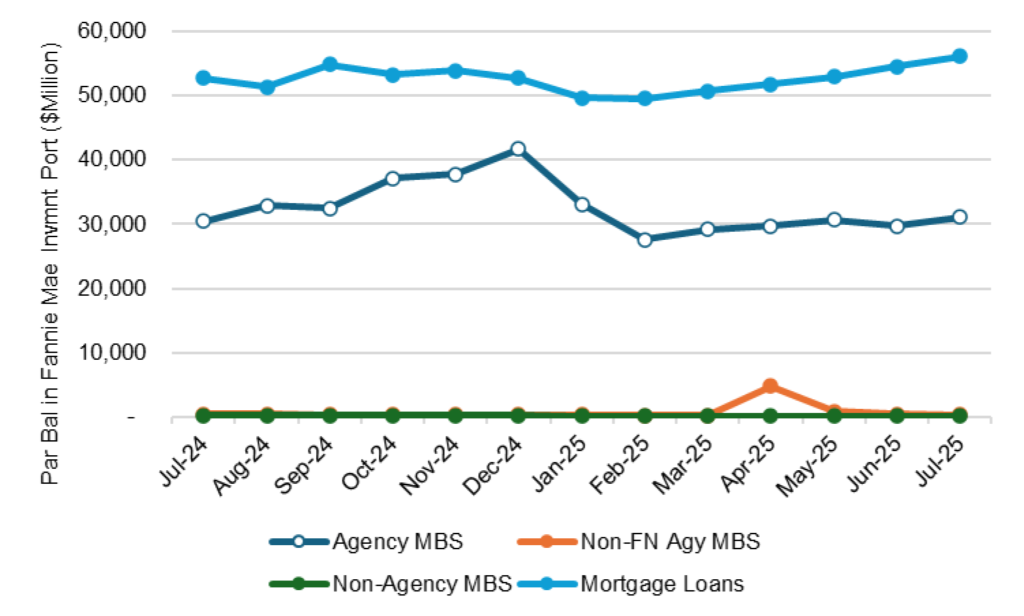

The signs at Fannie Mae are weaker. The agency’s most recent report, which only goes through July, shows loans since May up $3.1 billion and holdings of its own MBS up only $420 million (Exhibit 2). Over a longer horizon, the increases are bigger. Since February, loan balances are up $6.6 billion and its own MBS $3.5 billion. A new report covering August should come out in the next few days.

Exhibit 2: Fannie Mae has added a little since May, more since February

Source: Fannie Mae, Santander US Capital Markets

The rising balances look like intentional decisions to grow the portfolio rather than responses to other things going on across the balance sheet. The rising balances in loans in particular could reflect rising efforts to buy delinquent loans out of pools. Delinquencies have gone up this year at Freddie Mac, but less than 10 bp (Exhibit 3). Delinquencies have dropped at Fannie Mae. And on newly delinquent loans, the enterprises have 24 months to buy them out of pools. It seems that this kind of loss mitigation might explain only a small part of the increasing loan balances in the investment portfolio.

Exhibit 3: A small rise in Freddie Mac delinquencies, a fall in Fannie Mae

Source: Fannie Mae, Freddie Mac, Santander US Capital Markets

It is worth noting that the choice to hold guaranteed loans or securities should have the same effect on MBS spreads. Either form constitutes demand for confirming conventional mortgage risk.

If the plan is to grow, it’s likely to be gradual at first

If the enterprises or the administration do want to grow the portfolios, it is likely to start slowly. The art and science of buying pass-throughs, funding them with bullet and callable debt, hedging out most of the residual interest rate risk with swaps and swaptions and reporting and accounting for all of it are skills that might have eroded from lack of practice.

The pace of growth also could depend on the real objective here and on market conditions. If the goal is profits first and policy later, then tight spreads could leave portfolio growth waiting in the wings. If- the goal is policy first—tight spreads—and profits later, then the portfolios could grow despite market conditions. Only time and spreads will tell.

In the meantime, with noise and signal competing neck-and-neck on this topic, the enterprises’ monthly activity reports are likely to become a regular focus. Continued or accelerated growth should give more investors conviction that the Fannie Mae and Freddie Mac portfolios have become a new source of either ongoing demand or demand that comes in at wider spreads. A stall in growth or a decline would weaken the case.

For now, it seems worth giving at least some credence to the possibility of a new role for the portfolios. It serves private and public purposes, and some evidence backs it up. How much that is worth is hard to tell, and the recent tightening in MBS spreads probably has priced in part of it. But all it takes these days is one more post somewhere in the internet universe, or maybe a few more monthly reports from the enterprises, and theory can quickly become fact.

* * *

The view in rates

The market is starting to moderate its convictions about Fed eases. Fed funds futures for the end of 2025 now roughly match the Fed median dot from the September FOMC and fall only 30 bp below the median dot for the end of 2026. That is less than the 44 bp of extra cuts priced for the end of 2026 a week before. The moderating views presumably reflect inflation still well above target, which makes it hard for the Fed to consider aggressive cuts.

Despite a bit less bullishness about rates in the short end of the curve, which helped flatten the curve this week, bearishness about rates in the long end continues. Steady political pressure on the Fed and the background risk of rising US federal deficits should bias longer rates higher, all else equal. The 2s10s curve should resteepen.

Key market levels:

- Fed RRP balances settled on Friday at $48 billion, up $37 billion from last week

- Setting on 3-month term SOFR closed Friday at 399 bp, down 1 bp in a week

- Further out the curve, the 2-year note traded Friday at 3.64%, up 7 bp in the last week. The 10-year note traded at 4.18%, up 5 bp on the week

- The Treasury yield curve traded Friday with 2s10s at 53 bp, flatter by 3 bp on the week. The 5s30s traded Friday at 98 bp, flatter by 8 bp

- Breakeven 10-year inflation traded Friday at 238 bp, down 1 bp on the week. The 10-year real rate finished the week at 180 bp, up 6 bp on the week

The view in spreads

The case for tight spreads in credit and MBS rests on an easier Fed, solid fundamentals, lower volatility, continuing inflows to credit buyers and relatively heavy Treasury supply. Those tides continue to flow. The Bloomberg US investment grade corporate bond index OAS traded on Friday at 75 bp, wider by 3 bp on the week. Nominal par 30-year MBS spreads to the blend of 5- and 10-year Treasury yields traded Friday at 125 bp, wider by 14 bp on the week. Par 30-year MBS TOAS closed Friday at 24 bp, tighter by 2 bp on the week.

The view in credit

The weakest consumers and companies are showing stress. The news from Tricolor Holdings, in the business of selling used cars to subprime borrowers and financing them, continues to play out. The firm filed bankruptcy on September 9, and investors are now trying to tell if the collapse is due to credit, fraud or both. Serious delinquencies in FHA mortgages and in credit cards held by consumers with the lowest credit scores have been accelerating. Consumers in the lowest tier of income look vulnerable, and renewed student payments and cuts to government programs should keep the pressure on. The balance sheets of smaller companies show signs of rising leverage and lower operating margins. Leveraged loans also are showing signs of stress, with the combination of payment defaults and liability management exercises, or LMEs, often pursued instead of bankruptcy, back to 2020 post-Covid peaks. If persistent inflation keeps the Fed at higher rates, fewer leveraged companies will be able to outrun interest rates, and signs of stress should increase. LMEs are very opaque transactions, so a material increase could make important parts of the leveraged loan market hard to evaluate.