The Long and Short

Steeper yield curve, flatter spread curve

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

US Treasury yields have dropped nearly 20 bp over the past several sessions as investors remain focused on the prospect of Fed intervention. Still, rates had remained largely range-bound since May as tariff concerns across capital markets have become more contained. And despite the recent move lower in rates, the yield curve has steepened drastically over the past several weeks. Within investment grade corporates, this has translated to even more investor demand for long-dated paper—a trend dictating market behavior for the past several months. As a result, investment grade spread curves have become extremely flat over recent sessions, potentially giving investors a reason to pause and assess the landscape for value.

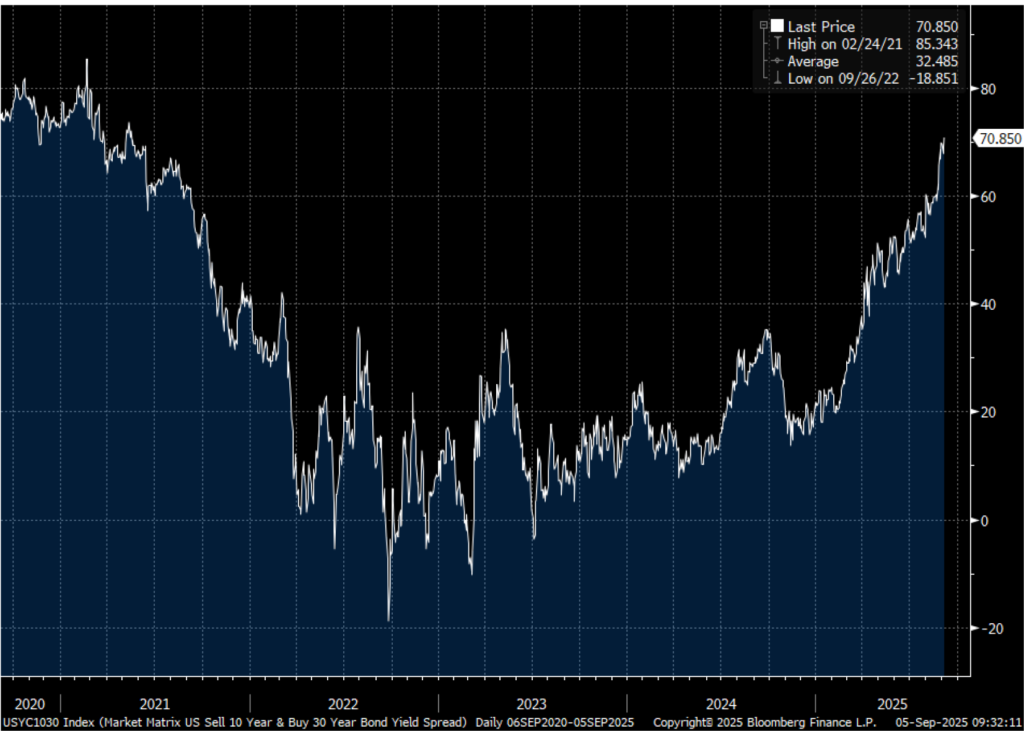

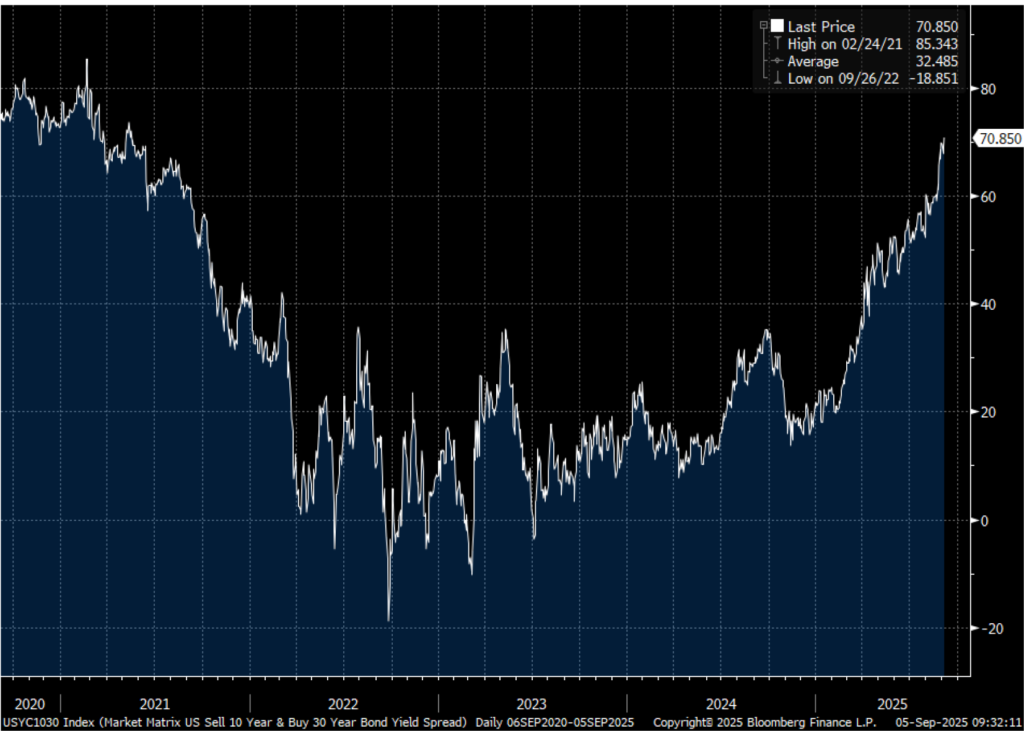

The 10s30s Treasury curve has been steadily steepening since the late months of 2024 (Exhibit 1). The recent spike beginning in late August has pushed the slope to its steepest level since May of 2021, during the tail end of the Covid pandemic. This week’s rate rally has provided little if any relief to these market pressures.

Exhibit 1: Steady steepening in the US Treasury 10s30s curve

Source: Bloomberg LP

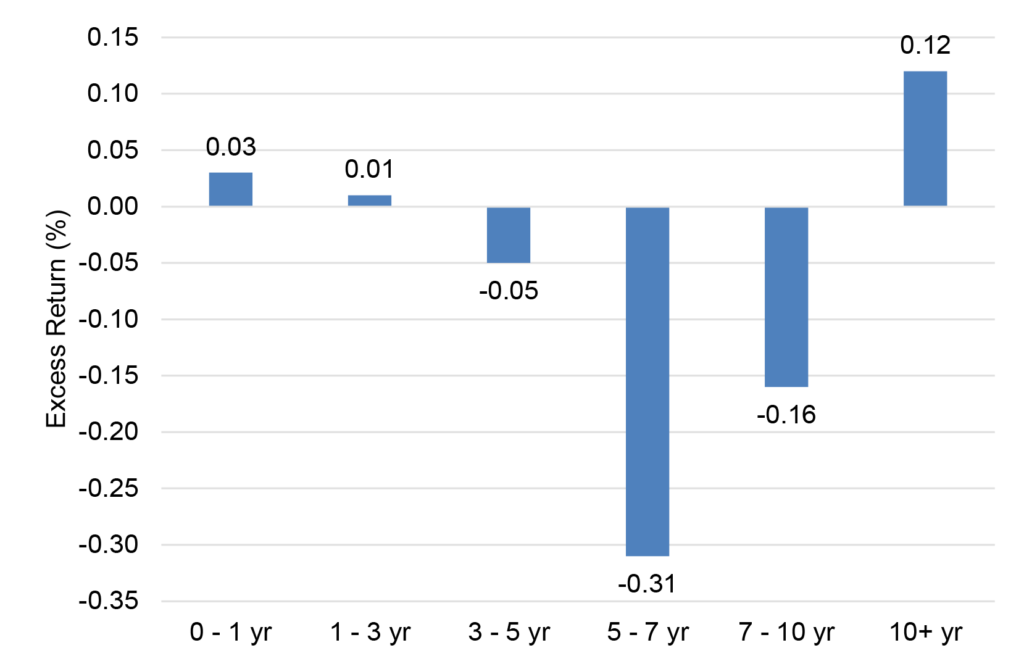

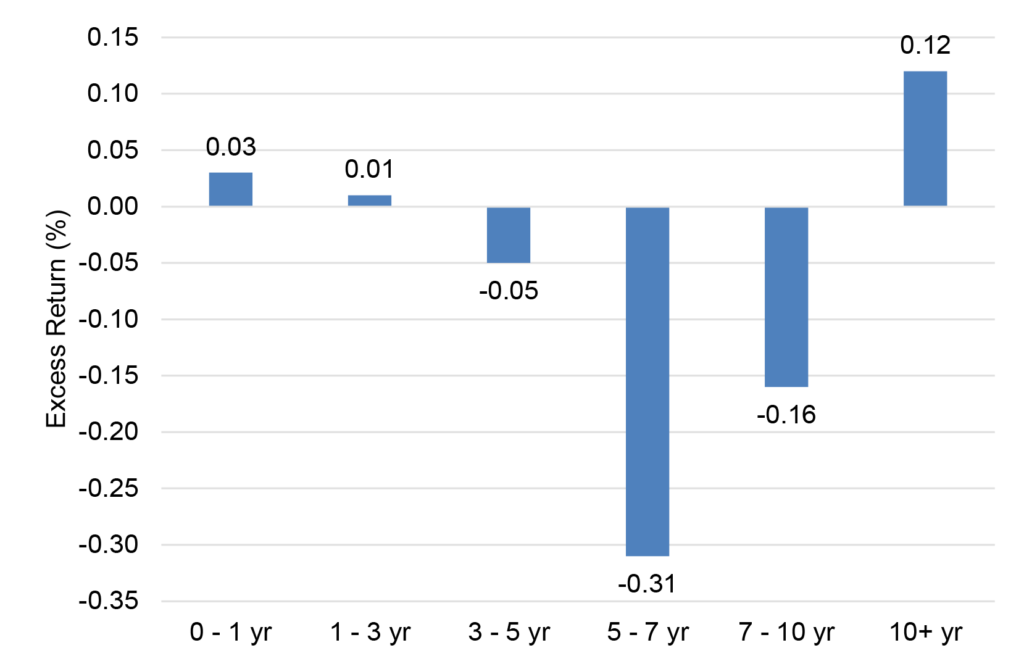

Meanwhile, in both the primary and secondary investment grade corporate bond markets, demand for 30-year paper continues unabated while intermediate maturities have struggled more under the weight of near historic tight levels for the broad market. In August, return attribution for the investment grade index demonstrated a stark contrast in performance between the long-end of the curve and intermediate maturities, as measured by monthly returns after netting out the effect of shifting rates (Exhibit 2). The 5- to 7-year maturity bucket was the single worst performance (-0.31%) in the index by duration for the month of August. Not far behind was the 7- to 10-year maturity bucket at -0.16%. While only a modest positive 0.12% excess return for 10-year and longer paper, it was still a stark contrast to shorter maturities.

Exhibit 2: August investment grade excess return shows demand for long paper

Source: Santander US Capital Markets LLC, Bloomberg Investment Grade Index

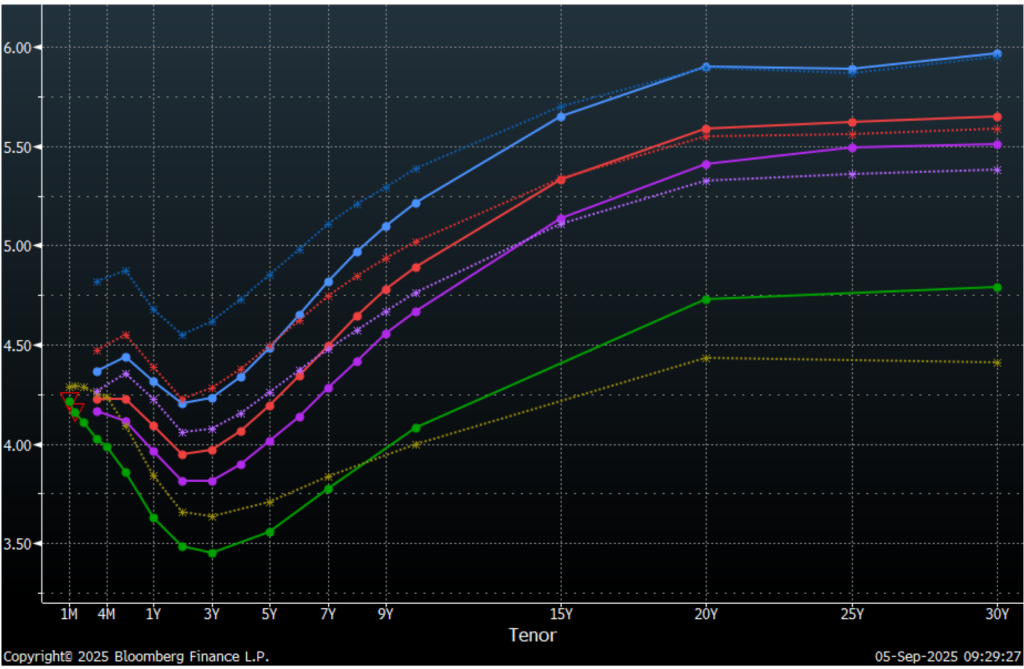

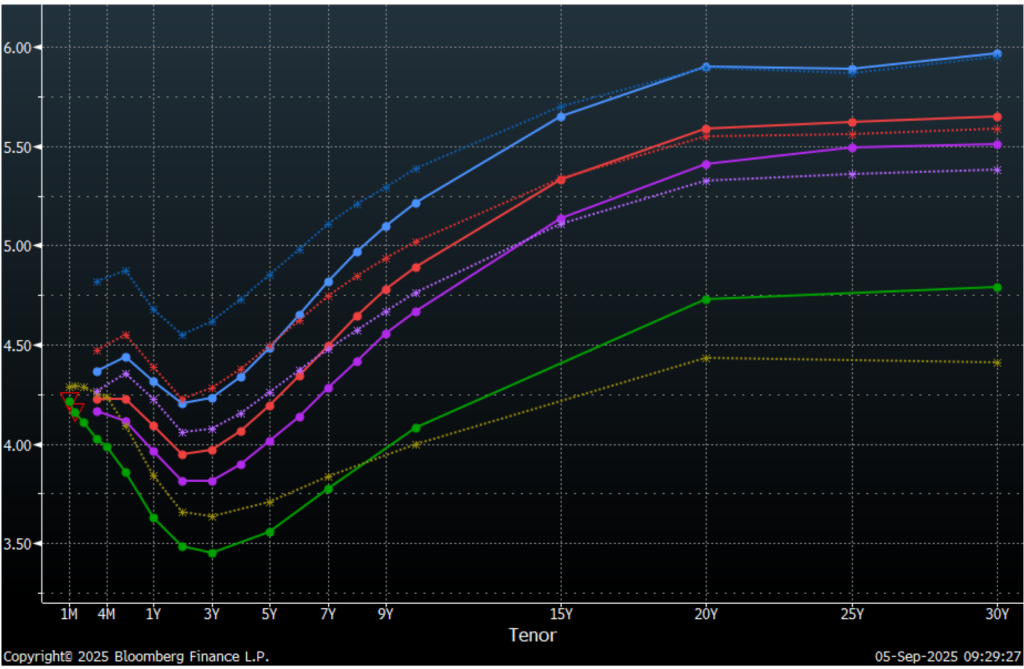

It is worth noting the current relative steepness of yield curves versus the same curves at the year-to-date low for interest rates on April 4, just past Liberation Day (Exhibit 4). The solid green line presents the current yield curve for US Treasuries while the dotted green line represents the curve on April 4. The purple lines demonstrate current and past yields for ‘AA’ corporate credit. The red lines are ‘A’ corporate credit yields and the blue lines are ‘BBB’ corporate credit yields. In all four instances the long end of each curve is notably steeper in the current reading from the year-to-date nadir of US interest rates.

Exhibit 3: Steeper Treasury and credit curves since April 4

Source: Bloomberg LP

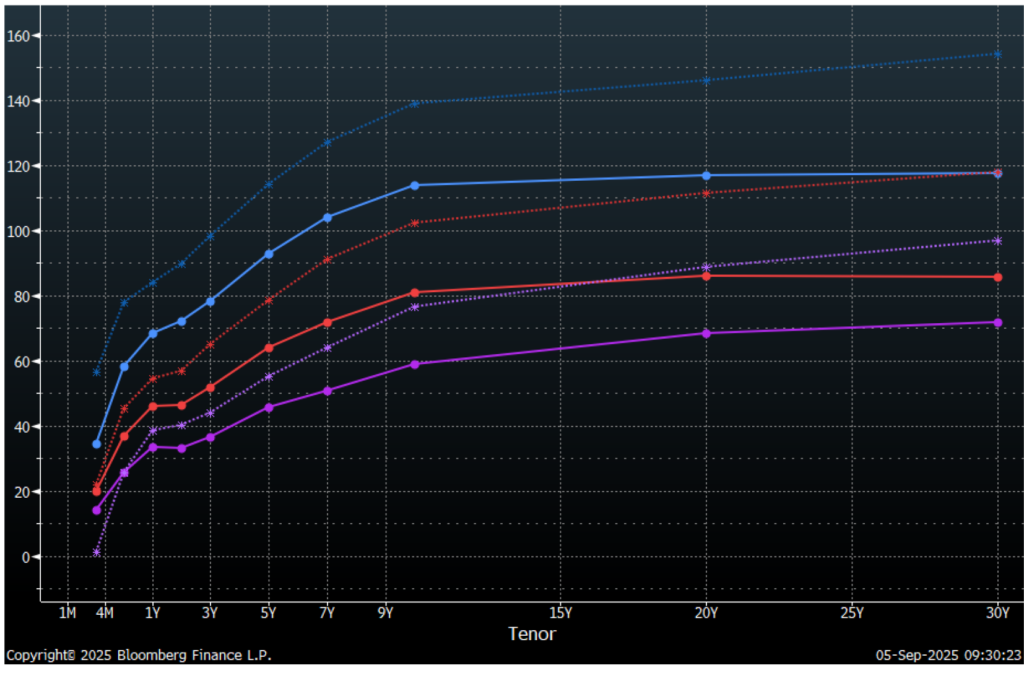

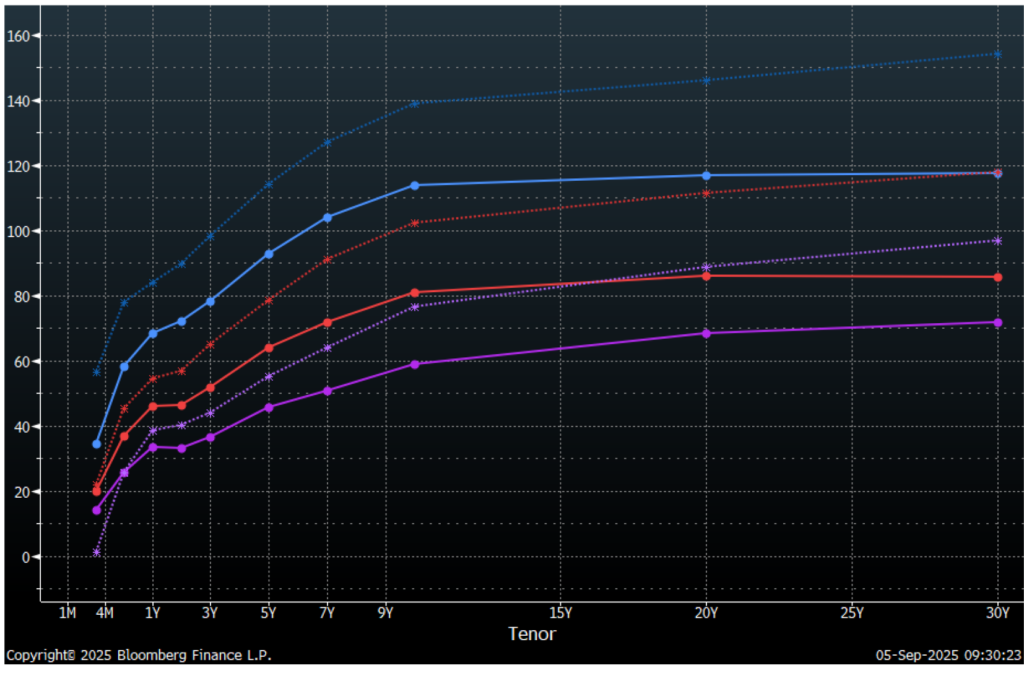

Drilling a further layer down shows flattening credit curves (Exhibit 4). Again, ‘AA’ credit is depicted in purple, ‘A’ credit in red and ‘BBB’ credit in blue. All three spread curves have flattened even further over the past five months, as investor demand for longer duration paper has remained unabated amid broader changes in rates and markets. Despite a steeper yield curve, investors are generating less and less spread compensation for moving out the curve from 10s to 30s. ‘BBB’ credit in particular provides very little spread compensation amongst the riskiest class of investment grade credit. Even the 20-year bucket—traditionally a source of deeper liquidity discounts—appears less and less attractive in the context of a flatter overall spread curve. Investors would be better served from a relative value standpoint to target more allocation to the 10-year and intermediate buckets along the credit curve, with very limited give-up in spread. Alternatively, investors can seek additional duration in other fixed income asset classes.

Exhibit 4: Flattening spread curves since April 4

Source: Bloomberg LP

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2025 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.