The Big Idea

Argentina | New attention to BOPREAL bonds

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Argentina’s BOPREAL bonds have drawn new attention with plans to re-open the 2026 Series 3 issue for an additional $1.8 billion. Although maturing in dollars and intended to alleviate US dollar demand, they trade in the secondary market under Euroclear settlement and local law jurisdiction with select inclusion in emerging markets indices. The unique feature of these bonds is that counterparty risk is not to the treasury but to the central bank. This matters for a country prone to default with weak liquidity and solvency ratios. The shorter tenor bonds from 2025 to 2027 also isolate repayment risk through the policy orthodoxy of the Milei term. There has been crossover support for the BOPREAL from international investors that see them as having a first claim to foreign exchange reserves, giving them better dollar access and lower repayment risk.

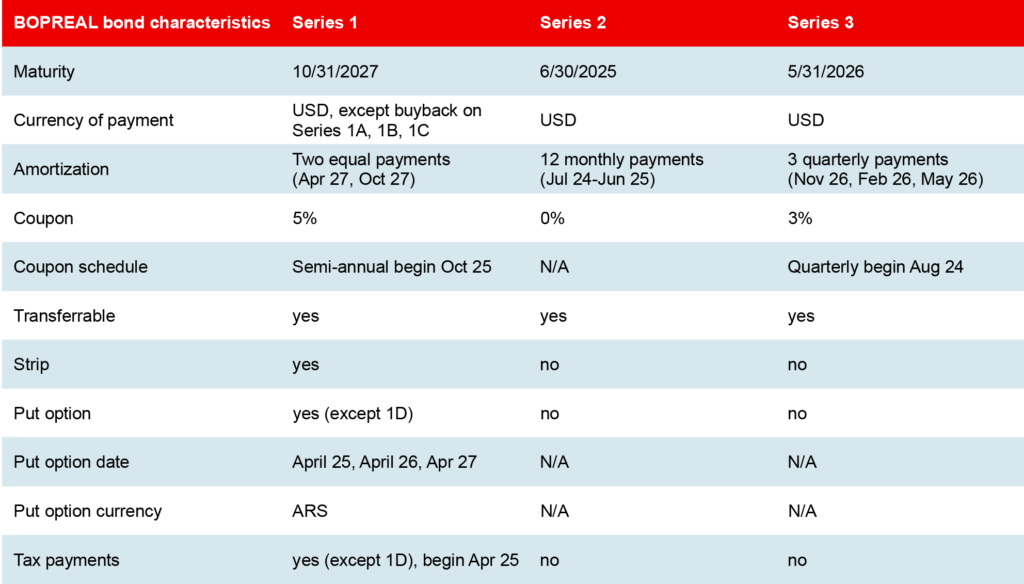

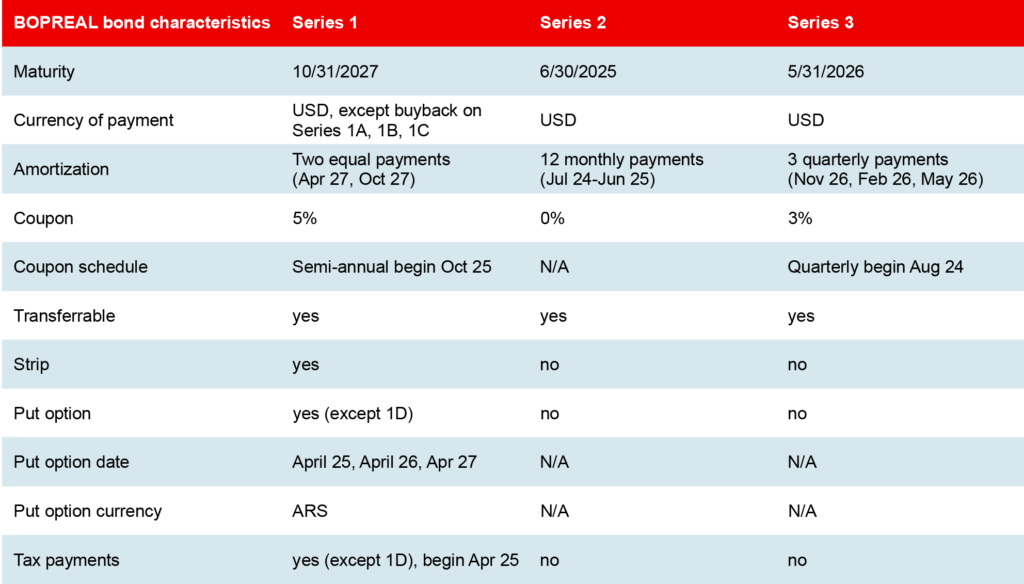

The BOPREAL bonds have emerged as new US dollar bond issuance with unique characteristics that have broadened demand from international investors. They have also and created indirect access through the secondary market. The official guide is available on the central bank website (table below).

These bonds offer some defensive attributes for those more cautious investors that value the central bank counterparty risk. The central bank has an untested repayment record but also logically would have first recourse to scarce foreign exchange reserves. There was a notable exclusion of BOPREAL bonds (maturities less than 1Y) on the most narrow calculation of net foreign exchange reserves in a recent central bank presentation along with other senior liabilities including the BIS swap line, treasury deposits, China swap line and private sector bank reserve requirements. Tight liquidity constraints remain relevant with foreign exchange reserves still in negative territory at $4 billion on the narrowest definition, which excludes the central bank and treasury deposit claims. This perceived senior status explains the much lower BOPREAL yield curve that trades well inside the Eurobond curve. However, both curves remains inverted at distressed levels with potential for a downward shift on successful economic stabilization through this year.

Source: https://www.bcra.gob.ar/PublicacionesEstadisticas/Guia-para-importadores.asp

There is also varying attributes across the BOPREAL bonds including liquidity, tax and payment considerations that explain divergent relative valuations. There are several bonds maturing in 2025, 2026 and 2027 with the latter offering several series of stripped A, B, C and D tranches. The zero coupon BOPREAL’25 bonds trade the tightest on the front-loaded sinking fund repayment schedule that begins in July (coincident to the ARGENT’30 bonds) with monthly payments through June 2025. These front-loaded payments are relevant for the still uncertain multi-year economic stabilization trajectory that deeply discounts the backloaded payments. They are also the primary vehicle for local investors to access US dollars with strong demand that explains the highest cash price and near normalized yields. The offshore investors would naturally focus on the higher yielding 2026 and 2027 maturities. The 2026 bonds offer 3% annual coupons on a quarterly basis with three sinking fund payments from November 2025 through May 2026. The 2027 bonds are more complex with the first three A, B and C series subject to a buyback option and partly allowed to cancel tax payments at par USD value (beginning April 2025). The stripped A and B series represent shorter 1Y and 2Y respective maturities.

There are quite a few relative value considerations. The shorter maturity BOPREAL bonds through 2027 all front-load payments uniquely through the policy orthodoxy of the Milei administration. The BOPREAL curve trades 420 bp to 540 bp inside the Eurobond curve for similar duration bonds. There is clear segmentation between a short maturity curve through 2027 with only limited overlap on the 2029 and 2030 sinking fund Eurobonds. The BOPREAL’2025 merits exclusion for its aggressive monthly sinking fund feature that near normalizes valuations and serves primary as US dollar supply for local investors. The primary explanation for the divergent credit risk between BOPREAL and Eurobonds is the counterparty risk between the central bank and the treasury that compensates against the local law status while also inferring stronger access to USD liquidity and stronger repayment risks.

These bonds were primarily a vehicle to satisfy local US dollar demand; however, there is also a unique opportunity for foreign investors to access still high sovereign yields with more defensive counterparty risk. The 2026 trade at a spread discount for their lower cash price relative to the 2027 series bonds. The 2027s offer slightly more defensive characteristics for the ability to partially pay tax obligations. This would provide a floor of support on the downside (implied buyback) as well as potential higher domestic investor demand closer to the April tax payments. The put option offers less value at low cash prices for the 2027 BOPREAL bonds and the still tight US dollar liquidity metrics. There has already been impressive gains year-to-date in sync with broader sovereign credit risk for the BOPREAL bonds. The scenario for economic stabilization over the next 12 months suggests still significant passive 12% to 16% total returns or more ambitious total return profile under bullish curve steepening. The BOPREAL bonds would be vulnerable to mark to market risk on any bearish macro scenarios; however the counterparty risk would ultimately determine the repayment risk on the longer investment trajectory on holding until final maturity. The counterparty risk may also encourage incremental local demand over the next 6-12 months as the shorter maturity bonds increasingly offer a US dollar hedge for local investors (similar to the BOPREAL’2025).

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2025 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.