By the Numbers

Freddie Mac to homeowners with untapped equity: “lien on me”

Brian Landy, CFA | April 19, 2024

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Freddie Mac may end up purchasing and securitizing closed-end second lien mortgages, based on a new proposal from the Federal Housing Finance Agency, with ramifications for investors in all types of residential MBS. Housing policymakers would like to expand access to second liens, which allow homeowners to borrow against home equity without prepaying low-rate first lien mortgages. It could bring more originators into the second lien market and lift volumes. The pools also may appeal to the broad group of investors in agency MBS. The prepayment effects on existing agency MBS are complicated—some aspects of the approach pushing speeds faster, others pulling speeds slower. But it could disrupt the businesses of issuers of non-agency second lien deals. And refinancing could pickup in existing non-agency deals from loans that are eligible for Freddie Mac’s program.

The FHFA is taking comments on the proposed second lien program for 30 days. The details and implications of the program fall into a few areas:

- Key details of the program

- An opportunity for mortgage originators

- An opportunity for agency MBS investors

- The push and pull on agency MBS prepayment speeds

- Trouble ahead for non-agency second lien issuers

- Faster refinances for non-agency second lien deals

Key details of the program

Freddie Mac will only buy second liens associated with first liens that Freddie Mac already owns. The loans must be originated by approved Freddie Mac lenders. The property must be owner-occupied. The second liens must be fixed-rate, amortizing, with original term no longer than 20 years. The combined LTV of the two loans must not exceed 80%, and not exceed 65% for manufactured homes. The second lien is due-and-payable when the first lien is paid off; Freddie Mac will not resubordinate the second lien. Freddie Mac will purchase the loans through the cash window using spot pricing. Forward pricing may come later. Securitization is expected to commence within six to nine months of the first purchases.

The program is currently only being proposed at Freddie Mac. However, Fannie Mae has securitized second liens under it’s “2L” pool prefix in the past. This was last done in 2010. Fannie Mae will likely need to offer this program if Freddie Mac makes it permanent. Fannie Mae must maintain similar prepayment speeds as Freddie Mac in its UMBS pools and generally needs to have similar products and business practices. If the second lien program lowers the convexity of discount UMBS pools, then Fannie pools could start to trade at a pay-up to Freddie’s pools.

It is also unclear whether Freddie Mac will enhance disclosures for its first liens that add second liens. For example, will they provide a direct link between the two loans? Or add fields to the loan disclosures to describe certain attributes of the other associated loan? This sort of information will be meaningful for investors in Freddie Mac’s first lien and second lien MBS.

An opportunity for mortgage originators

Rapid home price appreciation over the last few years, especially from mid-2020 through mid-2022, has left many borrowers with large equity positions in their homes. The most common way to access that equity is to do a cash-out refinance. The cash-out refinance involves paying off the existing mortgage and replacing it with a new, higher balance mortgage. The borrower receives the difference in the balances. However, many borrowers’ mortgages have note rates that are well below the prevailing rate for a new mortgage and the whole loan balance is shifted to the new rate.

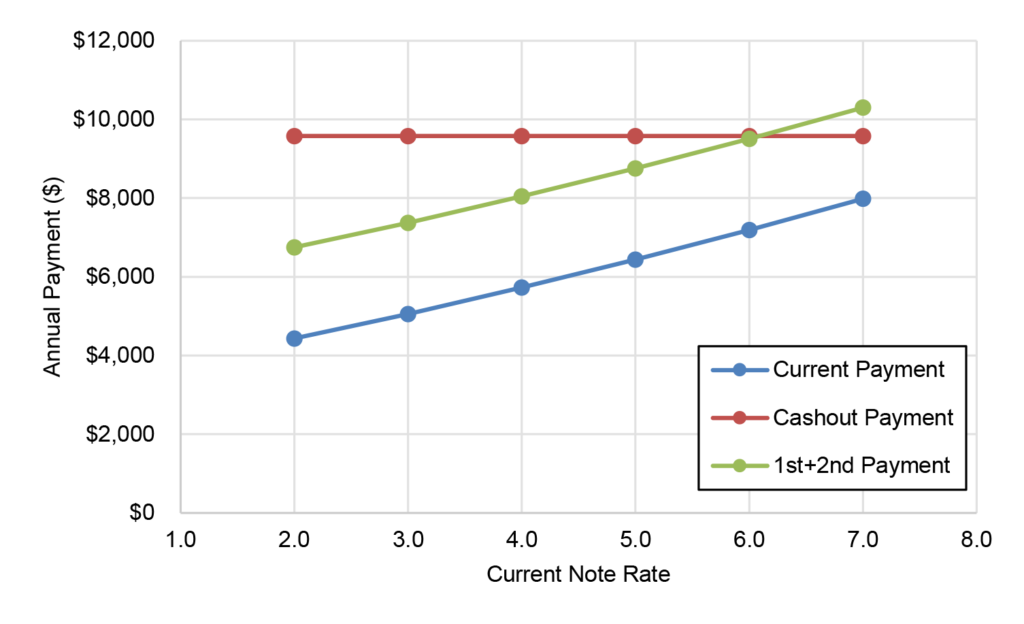

A second lien may be a more efficient way for borrowers with low-rate mortgages to access home equity, especially for smaller second loans. The borrower does not have to prepay the first mortgage when taking out a second lien, so only pays a higher rate on the second lien’s balance. One example considers the annual payments for a 50% LTV, $100,000 current balance loan with various note rates (Exhibit 1). This is compared to (1) tapping 10% additional home equity with a 60% LTV cash-out refinance at a 7% note rate and (2) the combined payment of the current first lien and a 10% LTV second lien with a 10% note rate. A borrower with a 6% note rate should be relatively indifferent to using a cash-out refinance or a second lien; below the 6% note rate a borrower should prefer the second lien.

Exhibit 1. Cash-out refinance vs 2nd lien break even, 10% LTV increase.

Note: Assume current 30-year loan is $100,000 UPB, 50% LTV. Cash-out loan is 30-year, 60% LTV. 2nd lien is 20-year, 10% LTV. Note rates for new first and second liens as of 4/18/2024.

Source: Santander US Capital Markets.

At breakeven there are still advantages to using a second lien. The prepayment option of the combination of loans should be more valuable than for the cash-out refinance. For example, a borrower able to curtail his mortgage could apply the curtailments to the second lien. The second lien may be refinanceable at times when the first lien is still out-of-the-money. Perhaps origination costs will be lower since the second lien balance is smaller. The borrower may be able to take out even more equity by refinancing that second lien. And the second lien is a 20-year loan so will naturally pay down faster.

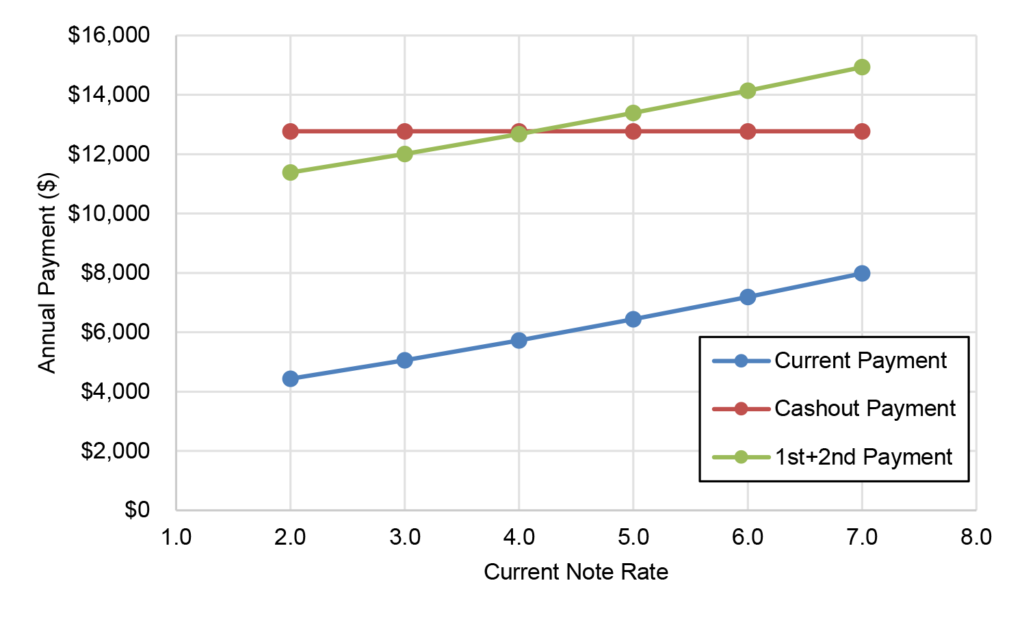

However, if the borrower needs more equity, then a cash-out refinance may look better for more borrowers. A second example considers the same 50% LTV, $100,000 balance loan (Exhibit 2). But this borrower is considering borrowing an additional 30% LTV, using either an 80% LTV cash-out refinance at 7% or adding a 30% LTV second lien at 10%. The breakeven point drops to a 4% note rate. This suggests that most borrowers will only consider smaller second liens. Only borrowers that desperately need lots of cash will consider larger second liens, and those borrowers may already be using cash-out refinances.

Exhibit 2. Cash-out refinance vs 2nd lien break even, 30% LTV increase.

Note: Assumes a current 30-year loan is $100,000 UPB, 50% LTV. Cashout loan is 30-year, 80% LTV. 2nd lien is 20-year, 30% LTV.

Source: Santander US Capital Markets.

These analyses assume a second lien would carry a 10% note rate. However, Freddie Mac’s proposed program may be less risky than the typical loans placed in a non-agency securitization. One reason is that Freddie Mac will own the credit risk on both the first and second lien, so faces less risk than a private securitization if the second lien were to default. If Freddie’s guarantee fees are lower than levels implied by the private market then agency borrowers would receive a lower note rate, lowering the breakeven point between a second lien and a cash-out refinance.

The potential size of the agency second lien market could exceed $600 billion. The breakeven analysis suggests that borrowers with a note rate below 6% and a current LTV below 70% could consider a 10% second lien instead of a comparable cash-out refinance. A conservative estimate applies haircuts to those thresholds—the borrower’s note rate must be below 5%, the combined LTV will not exceed 75%, and the borrower must have gained at least 10% home equity since origination through amortization and home price appreciation.

The current balance of owner-occupied mortgages in Agency MBS pools that meet those parameters is $2.6 trillion. The potential market size, assuming each of those borrowers added a 10% LTV second lien, is $626 billion. Not every borrower will want a second lien, of course. But the non-agency market issued about $7 billion second lien securities since the start of 2023, so this suggests there is a lot of untapped potential.

This program should open the door for more originators to offer second liens. The loans initially will be sold to Freddie at the cash window, alleviating the lender from the complexity of marketing the resulting pool. Freddie Mac will be able to create pools backed by loans from multiple lenders and sell the pools through its cash window auctions. These lenders will be able to market second liens to their borrowers, probably without the typical restrictions associated with marketing offers to refinance. That could greatly increase the origination volume for these loans. A cash-out refinance may still make sense for borrowers with loans priced at a modest discount to par (or higher) since the cash-out would benefit from the liquidity of TBA-deliverability. But most outstanding loans are deep out-of-the-money and should prefer a second lien to a cash-out refinance.

An opportunity for agency MBS investors

An agency guaranteed securitization outlet for second liens should attract a larger investor base than existing non-agency securitizations. Investors in agency MBS pools only need to worry about credit risk insofar as it influences prepayment speeds. Pools backed by second liens will not be deliverable into TBA contracts so may trade below the TBA price for that same coupon. If the second liens have similar convexity to first liens, then they are likely to trade at wider option-adjusted spreads to TBA.

This collateral may be particularly suited for use in CMOs, which lose the liquidity benefit of using TBA-deliverable collateral. Historically there have been healthy markets for non-deliverable pools, notably pools of high-balance loans and pools backed by loans with LTV greater than 105% originated under the Home Affordable Refinance Programs. But issuance of those pools has dried up—higher loan limits have allowed most jumbo loans to be delivered into TBA pools and the HARP program is no longer offered.

It is likely that the convexity of agency second-lien pools may be lower than that of agency first-liens with the same loan size and note rate, assuming these borrowers have similar refinance opportunities for the second liens as they do for the first liens.

A second lien should have more lock-in as a discount, and a higher S-curve deep in-the-money, compared to a first lien with the same loan size, note rate, and no associated second lien. For example, consider a homeowner with a weighted 6% cost of funds—a second (loan A) lien associated with a 3% first lien—and a 6% first lien (loan B) with no second lien, both for the same loan amount. Loan A will have more lock-in than loan B because the Loan A borrower also faces the lock-in of the 3% first lien. This will slow speeds when the loans are below par.

When the loans are in-the-money, loan A’s speeds should increase alongside loan B’s speeds as rates drop. However, loan A should have an additional “bump” faster if rates drop far enough to push its associated first lien in-the-money. If the small balance of a second lien confers prepay protection, then that loan then that protection will disappear if the first lien becomes refinanceable.

It is unclear whether the limited prepayment history of non-agency second liens will be relevant to agency loans that have access to numerous lenders offering agency refinances. And non-agency prepayment history is limited since most origination has occurred since the start of 2023 and mortgage rates have not moved much.

The push and pull on Agency MBS prepayment speeds

The proposed second lien program will have a complicated effect on prepayment speeds of the associated first liens—some factors point to faster speeds; other factors point to slower speeds. The more obvious effects may be those that slow speeds—prepayments from cash-out refinances would go down, the borrower’s higher LTV may make it harder to trade up to a more expensive home, and any curtailments would be put towards the second lien instead of the first lien. But there are arguments that these effects are small—there may not be many cash-out refinances in lower coupons, modest LTV increases may leave enough equity to finance a more expensive home, and perhaps the borrowers that take out a second lien are not the borrowers that curtail their loans.

Faster speeds may arise because the borrower has less lock-in. A borrower with a 3.5% mortgage that takes out a 10% second lien with a 10% LTV has a roughly 4.5% blended rate. Imagine that borrower later needs to move into a new home, and the prevailing mortgage rate is 7%. Without the second lien the comparison is 7% on the new loan compared to 3.5% on the existing loan. But if the borrower had added the second lien, the comparison would be the 7% new loan to the 4.5% blended rate of the existing loans. But the borrower’s LTV would also be higher, potentially making it harder to move.

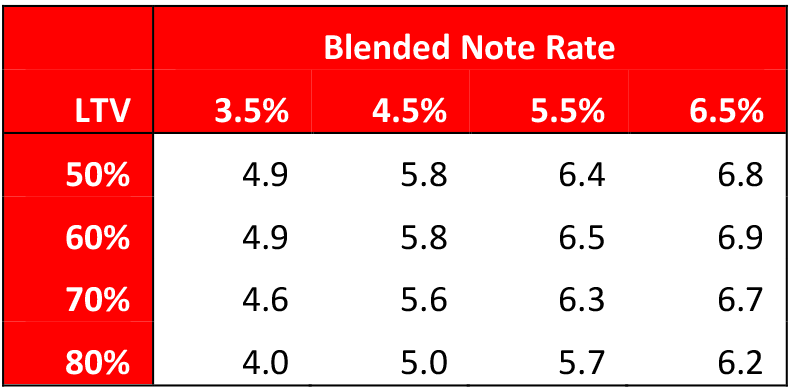

Yield Book’s prepayment model assumes the lock-in effect is stronger than the LTV effect (Exhibit 3). This compares the projected 1-year prepayment speeds for loans with several loan-to-value ratios and note rates. Prepayments from refinancing are excluded. The lock-in effect changes speeds by as much as 1.0 CPR if the note rate moves from 3.5% to 4.5%; the effect is smaller at higher note rates. The LTV curve is virtually flat below 60% LTV and is steepest when approaching 80% LTV.

Exhibit 3. Turnover prepayment sensitivity to LTV and lock-in.

Projected 1-year prepayment speeds for a 30-year loan with the given LTV and note rate.

Source: Yield Book, Santander US Capital Markets.

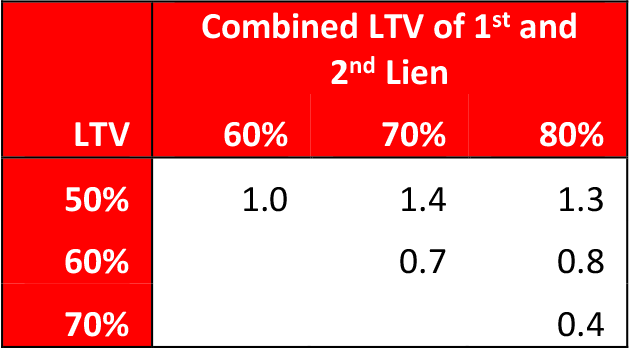

Faster speeds from less lock-in is generally larger than slower speeds from higher LTV, especially for low starting LTVs and low second lien LTVs (Exhibit 4). This table shows the projected change in one-year CPR for several combinations of starting and combined LTVs, using the data presented in Exhibit 3. For example, the table shows that adding a 10% LTV second lien to a 50% LTV first lien could push speeds 1.0 CPR faster. For a 3.5% mortgage and a 10% second lien note rate, every 10% additional LTV adds about 1.0% to the blended note rate. In Exhibit 3, speeds move from 4.9 CPR in the 50% LTV/3.5% note rate cell to 5.8 CPR in the 60% LTV/4.5% note rate cell; the difference is the 1,0 CPR printed in Exhibit 4 (there is rounding error).

Exhibit 4. Potential speed increase after adding 2nd lien.

Projected change in 1-year CPR after borrower adds a second lien. Each 10% increase in LTV raises the blended note rate roughly 100 bp; i.e. 100 bp less lock-n.

Source: Yield Book, Santander US Capital Markets.

Furthermore, borrowers taking out a second lien are likely signaling their intention to remain in that property for a while. Some borrowers may use the funds to improve the home. This could be repairs or upgrades, including major renovations like adding a room. Most people don’t make major repairs just before moving since they would not recoup the full investment; having made the home improvement may boost lock-in. Other borrowers may need to use the funds to pay for large expenses like college education. Although these borrowers are not making an investment in the property, they may find it more difficult to trade up to a more expensive home. Many borrowers rely on the leveraged equity gains in their existing home to help finance the purchase of a new home.

A second lien program may have a larger effect on some specified pool types. For example, on average cash-out refinance FICO scores are roughly 25 points below the FICO scores of purchase loans. Prepayment speeds are also faster for discount pools with low FICO scores. Therefore, it could be there is more cash-out activity in those pools that would be redirected into second liens, slowing speeds. One reason these borrowers may be using a cash-out refinance is to consolidate credit card debt with a very high interest rate. That might make financial sense even though the borrower is paying off the low-rate mortgage. Using a second lien will likely be a better choice for most of those borrowers.

In the event interest rates drop the borrower with a deep out-of-the-money first lien and an in-the-money second lien could refinance the second without affecting the first lien. That prepayment optionality adds value to the borrower using the first+second combination over a cash-out refinance.

Whether speeds on discount MBS rise or fall ultimately depends on all how many potential cash-out borrowers use a second lien instead, how many new borrowers take out second liens, and the relative effect on speeds from changes in LTV, lock-in, and curtailments. And this analysis suggested that Yield Book’s lock-in effect is too strong, so may be overstating the potential speed increase of borrowers that take second liens. This author’s sense is that the aggregate effect will be slower discount speeds and lower convexity for discount UMBS.

Trouble ahead for non-agency issuers

A GSE program to securitize second liens is likely to grow the size of the total second lien market by lowering the barriers to entry for approved Freddie Mac lenders. However, it is also likely to capture origination that otherwise would have flowed into the non-agency shelves. These platforms may need to focus more on loans that do not meet Freddie Mac’s parameters—home equity lines of credit (HELOCs) are a prime example. It is also possible that Freddie Mac’s guarantee fee may be high enough that there is room to compete, as with loans for investment properties and second homes. But the FHFA and Freddie Mac sees this lending as directly supporting Freddie Mac’s mission, while investment properties and second homes may not, so it is likely that pricing will be competitive.

The proposed program also requires that Freddie Mac own the first lien. This gives Freddie Mac insight into the performance of both loans and simplifies loss mitigation for delinquent loans. For example, the typical second lien holder may have difficulty forcing foreclosure and would be second in line for recoveries, even if the borrower only defaulted on the second lien. But Freddie Mac owns the first lien, so would be first in line regardless of which lien defaulted. And seeing the total performance of both liens would permit Freddie to offer more effective loss mitigation strategies. It expects this to lower the cost of servicing delinquent loans, which may lower the credit cost borne by the borrower.

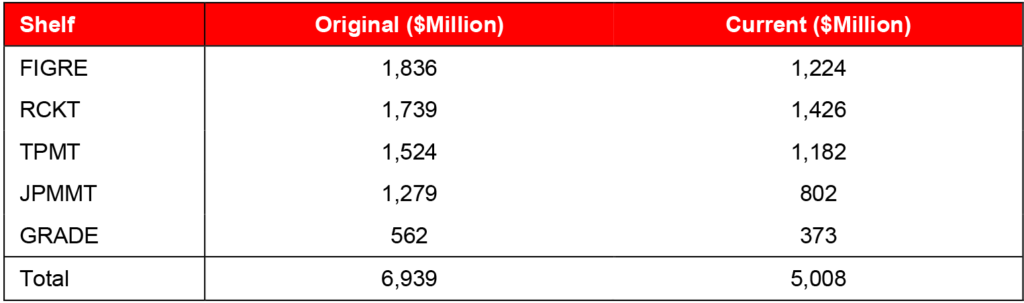

There are a handful of platforms that have been issuing non-agency securitizations backed by various types of second liens, including closed-end seconds and home equity lines of credit (HELOCs). Issuance picked up after interest rates jumped higher in 2022. The large shelves are Figure Lending’s FIGRE, Soluda Grade’s GRADE, J.P. Morgan’s JPMMT, Rocket Mortgage’s RCKT, and Cerberus’ Towd Point TPMT (Exhibit 5).

Exhibit 5. Non-agency second lien deal volume in 2023 and 2024.

Includes closed-end second lien deals and HELOC deals. Data compiled on 4/18/2024.

Source: Bloomberg, Santander US Capital Markets.

Faster refinances for non-agency second lien deals

Prepayment speeds could increase for loans in non-agency deals. If agency execution is cheaper than non-agency then any second liens associated with first liens owned by Freddie Mac may be able to refinance into an agency-eligible second lien.

And a political twist

Furthermore, this is still a proposal. The FHFA and Freddie Mac are soliciting comments before launching the pilot with limited volume. And it will take another six to nine months to start pooling the loans. That means the November election is a wild card—if former President Donald Trump were to win and install a new director of the FHFA who wants to shrink their footprint, then this program may not get off the ground.