By the Numbers

A short, sweet snapshot of P&C insurer investments

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

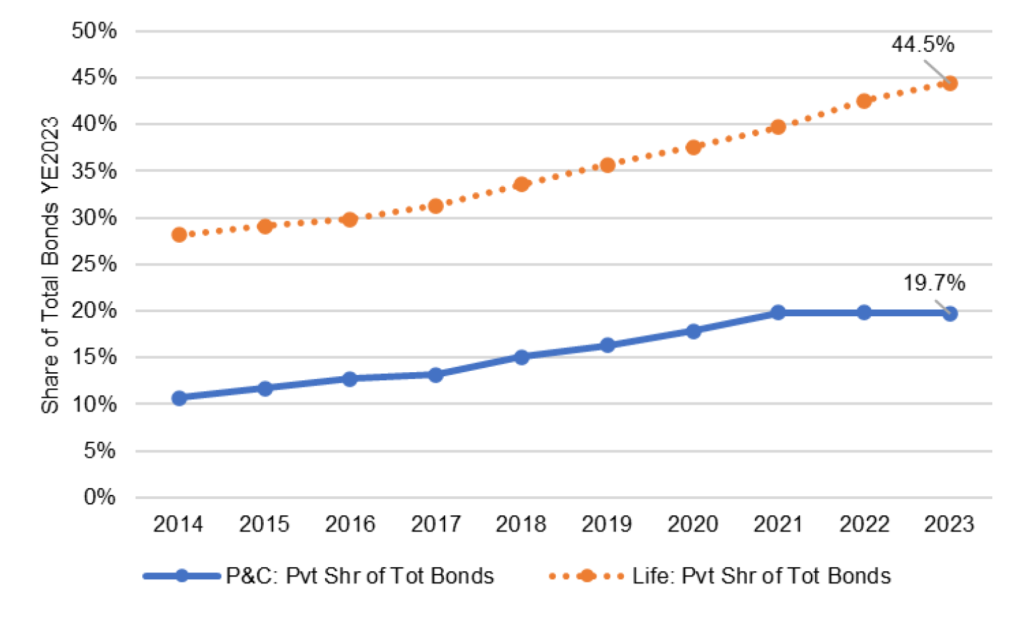

P&C insurers followed their lifer peers in posting record investment portfolio balances last year, raising yields and improving portfolio credit quality. But unlike the lifers, appetite for private debt plateaued and higher allocations to equities, cash, government bonds and higher-rated corporate and CLO debt spoke to a sharper emphasis on liquidity. Makes sense for insurance lines with frequent and sometimes volatile claims. The median P&C corporate bond is ‘A’ instead of lifers’ median of ‘BBB+’. And the median P&C maturity is 4.2 years instead of lifers’ 8.1 years. Allocation to mortgage loans and CLOs is also smaller than lifers’. A chartbook of results is here.

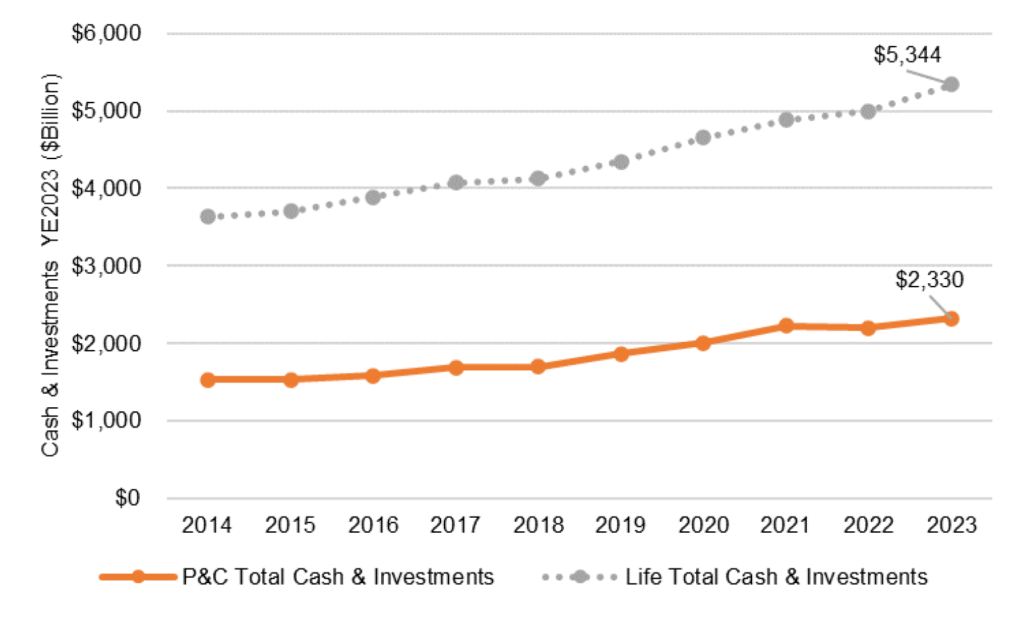

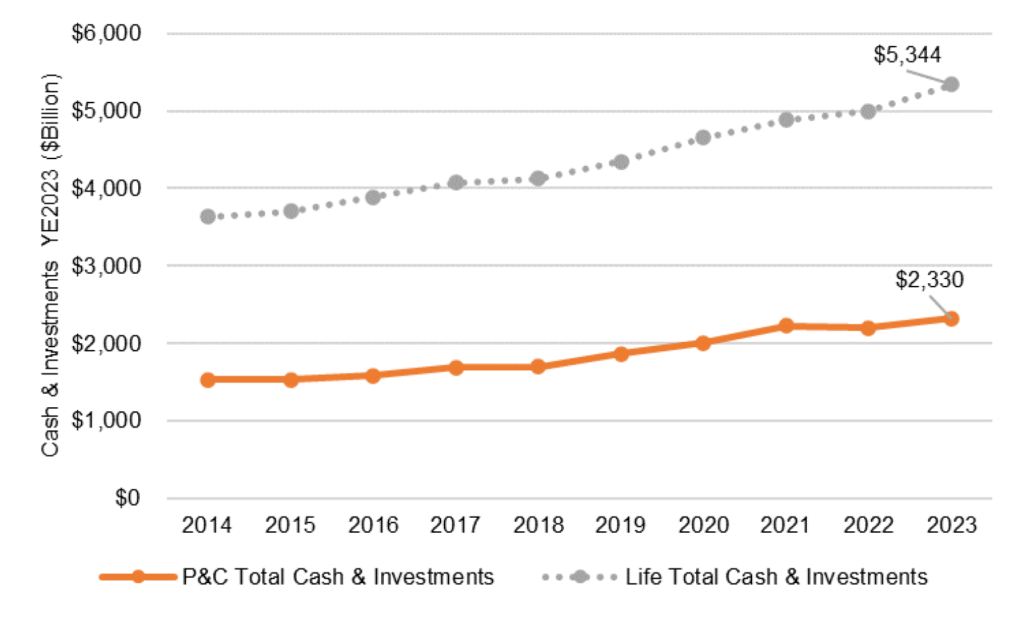

P&C insurers now hold a record $2.3 trillion in cash and investments but are only 44% as large and continue to grow more slowly than life portfolios

Note: P&C holdings grew 5.9% in 2023, faster than the 4.8% 9-year CAGR. Life holdings grew 6.9% in 2023, faster than the 4.4% 9-year CAGR. Data shows statutory filings only, excluding affiliates investment. Statutory filings do not include investments at non-operating hold cos, non-insurance op cos or foreign subsidiaries.

Source: from CreditSights, “US Life Ins: Investment Portfolio Trends YE2023

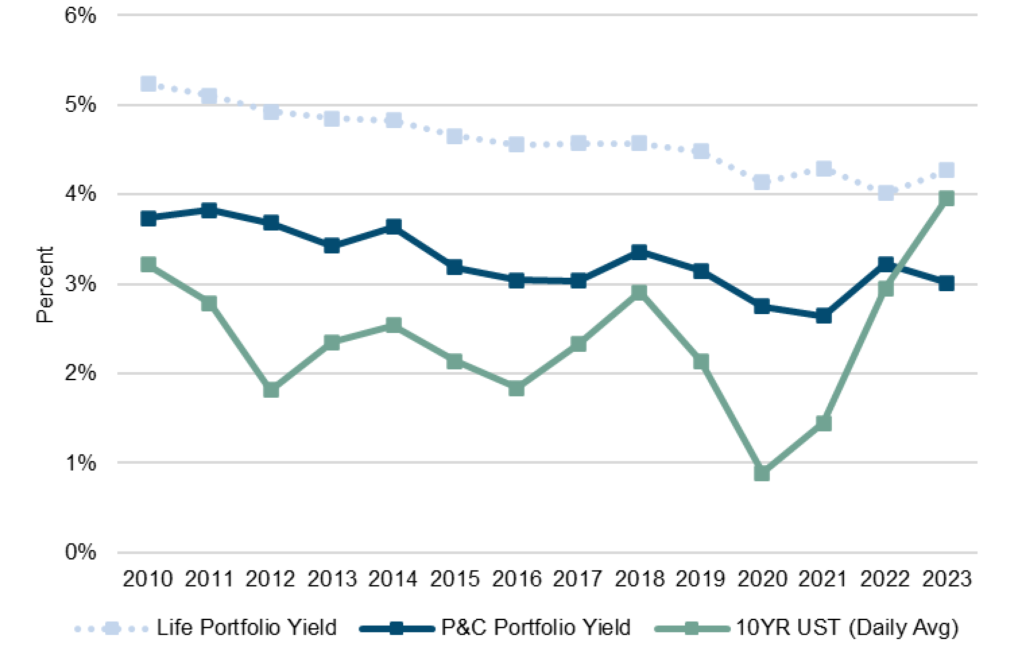

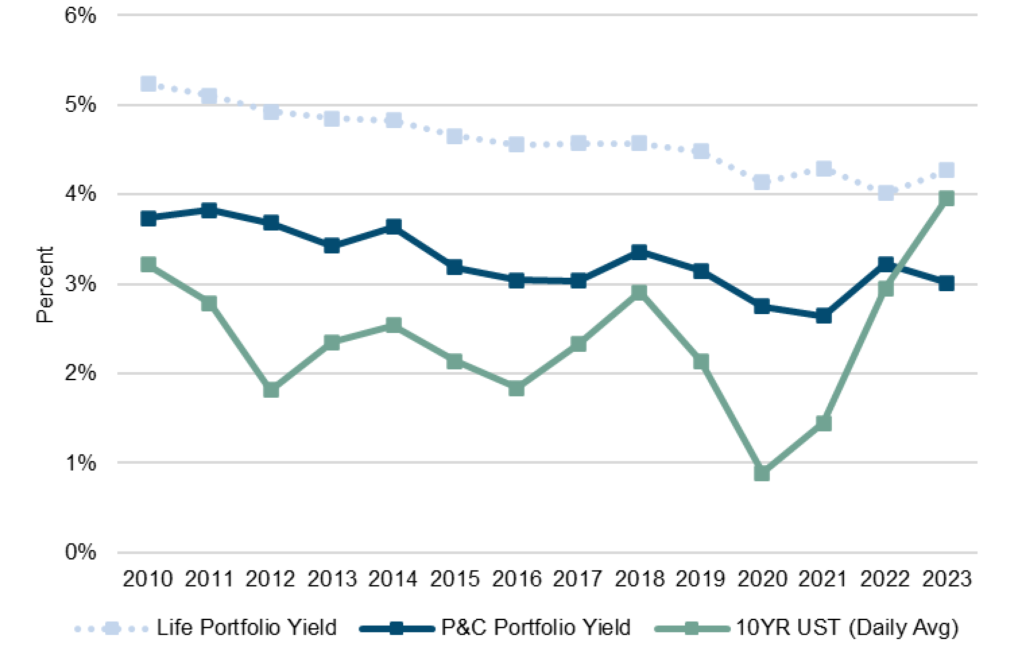

P&C yields dropped 21 bp into YE2023, skewed by Berkshire Hathaway’s results; yields ex-BRK would have moved 11 bp higher

Note: Excluding BRK, CreditSights estimates industry yield would go from 3.22% to 3.33%.

Source: from CreditSights, “US P&C Insurance: Investment Portfolio Trends YE2023

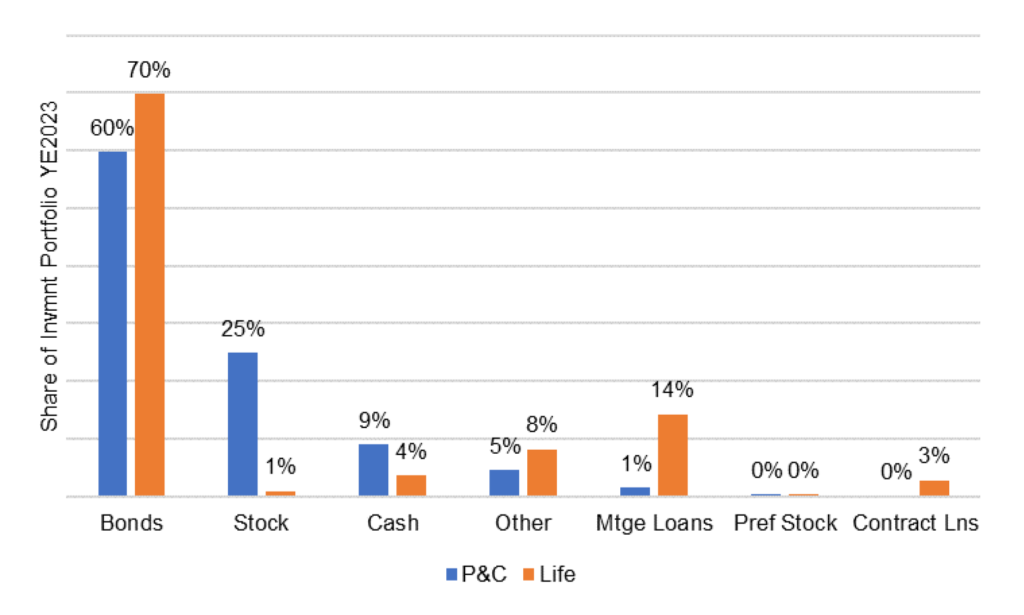

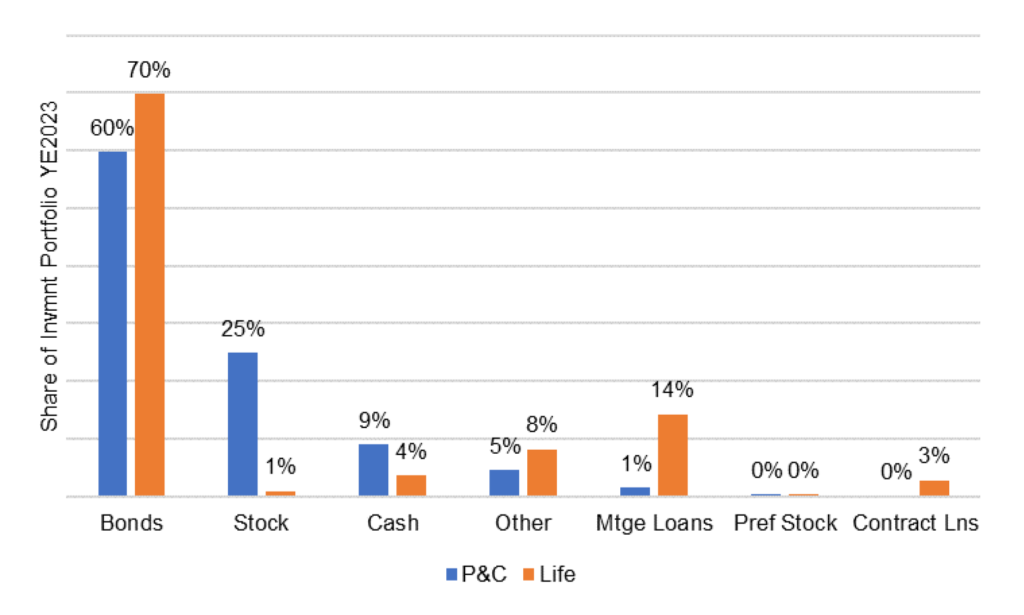

Bonds still dominate P&C portfolios at YE2023, but higher balances in equity and cash relative to lifers’ highlight liquidity needs

Note: Fixed income share has dropped 6 percentage points in the last decade with mortgage loans and alternatives picking up the slack. Data shows statutory filings only, excluding affiliates investment.

Source: company reports, S&P CapIQ, CreditSights.

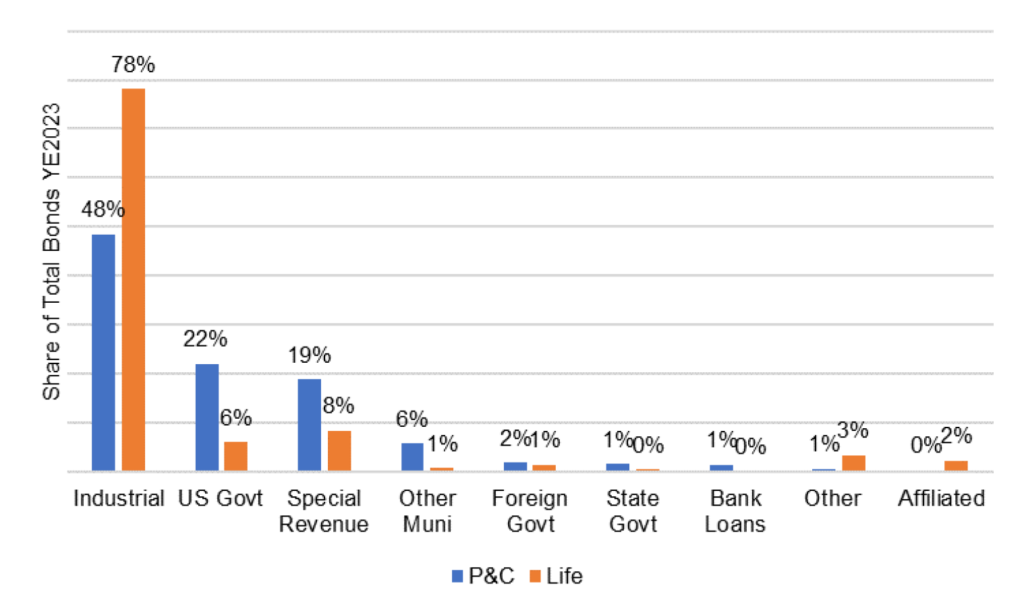

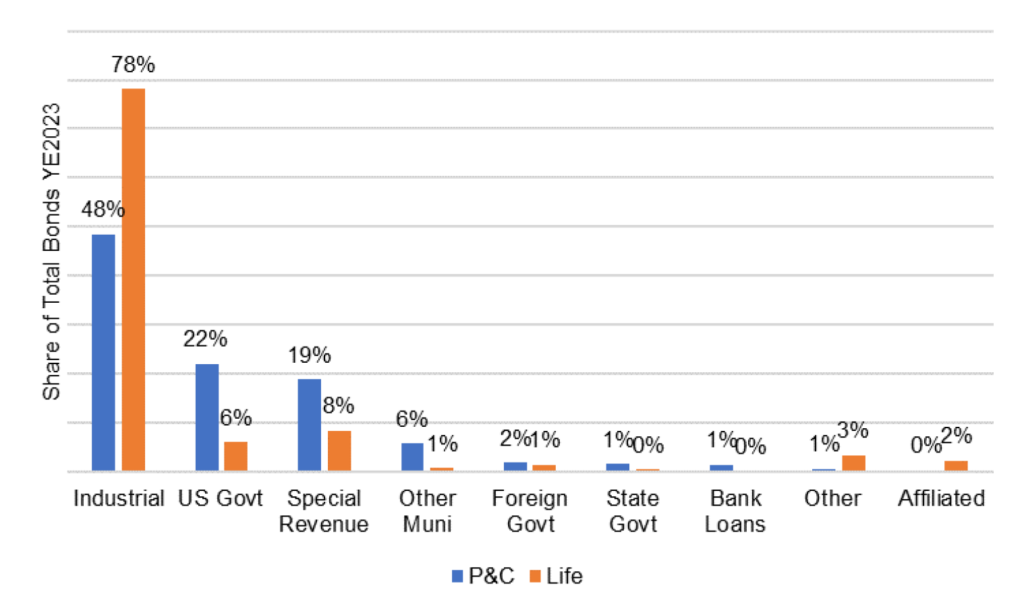

Industrial bonds—NAIC-speak for corporate, structured credit—dominate bond holdings, but Treasury and muni holdings show liquidity, tax needs

Note: Industrial bonds, alternatives and affiliated securities have picked up share in the last decade with other types of bonds losing share. Data shows statutory filings only, excluding affiliates investment.

Source: company reports, S&P CapIQ, CreditSights.

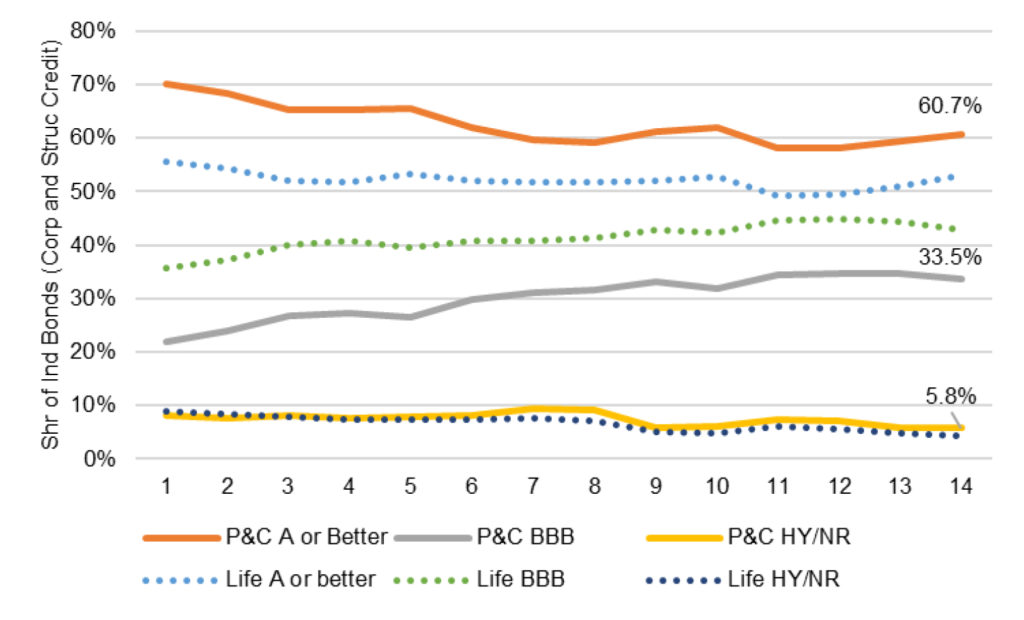

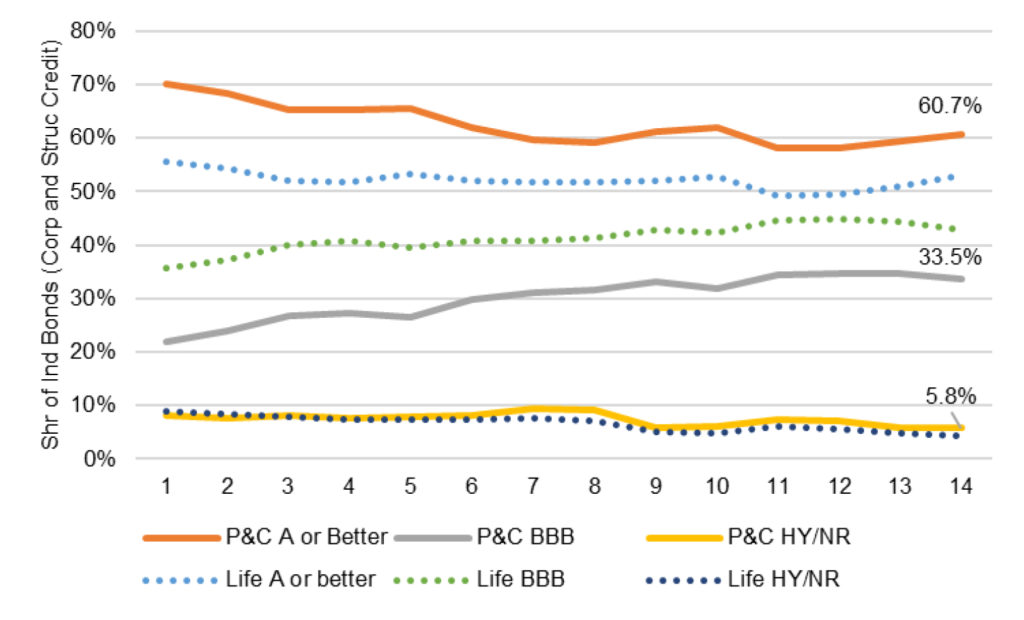

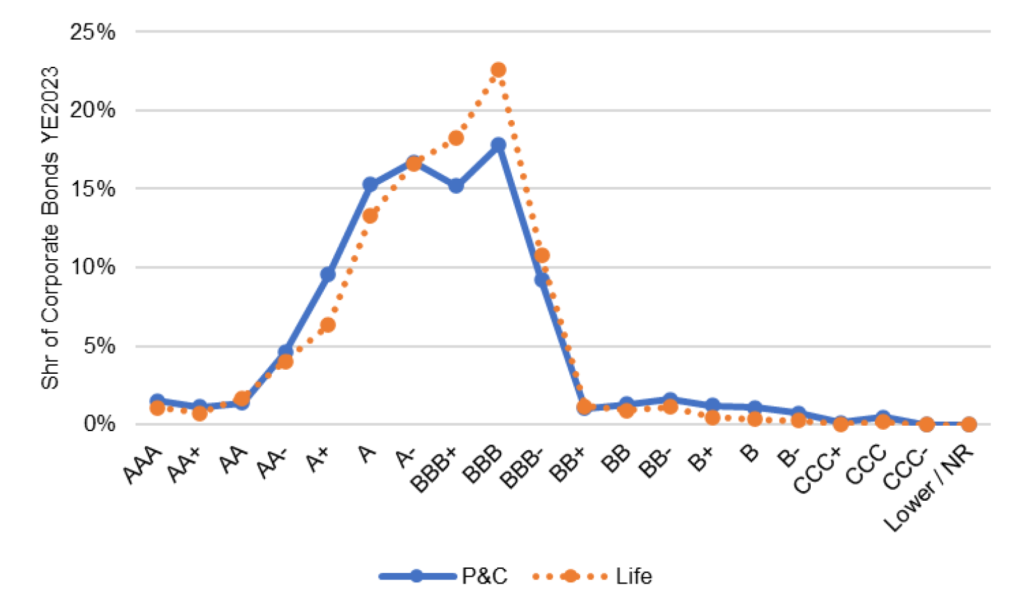

P&C bond credit quality has improved since the NAIC reset capital in 2020 to favor higher ratings; P&C holds higher quality than life portfolios

Note: statutory filings only, excluding affiliates investment. Source: company reports, S&P CapIQ, CreditSights.

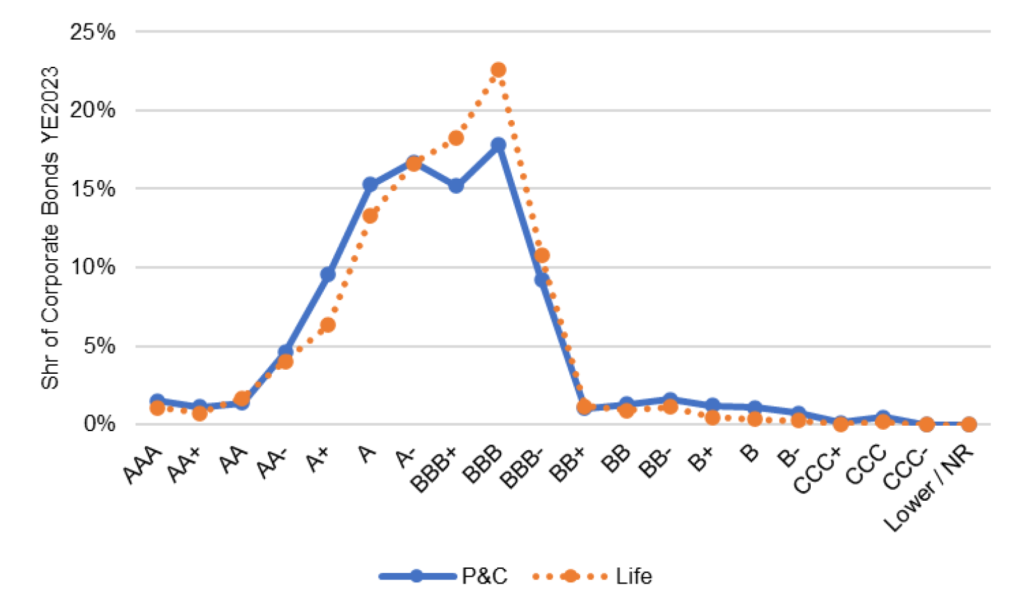

The median P&C corporate bond is ‘A’, the median life corporate is ‘BBB+’

Note: statutory filings only, excluding affiliates investment. Source: company reports, S&P CapIQ, CreditSights.

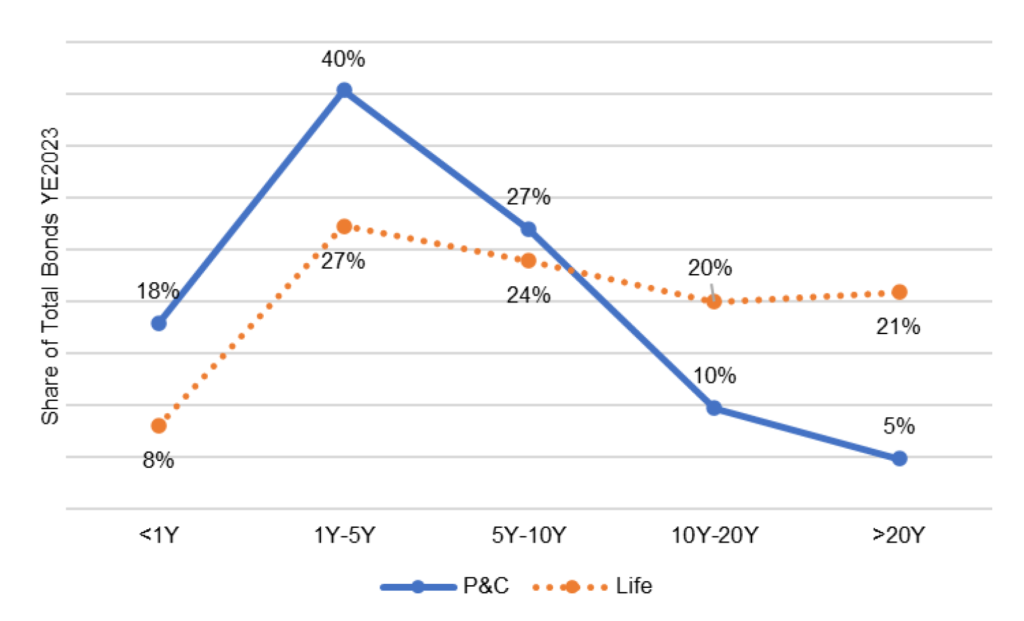

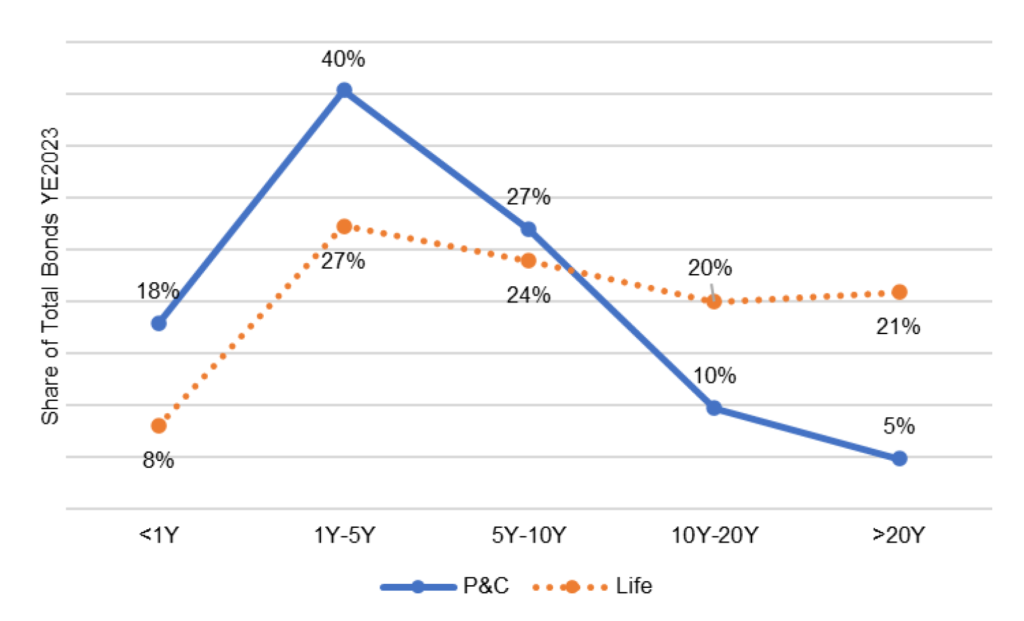

The median P&C bond maturity is 4.2 years, the median life maturity is 8.1 years

Note: Life insurers increasingly have barbelled around the middle of the yield curve, holding more 1Y-5Y and 10Y-20Y maturities and shrinking exposure to 5Y-10Y. Data shows statutory filings only, excluding affiliates investment.

Source: company reports, S&P CapIQ, CreditSights

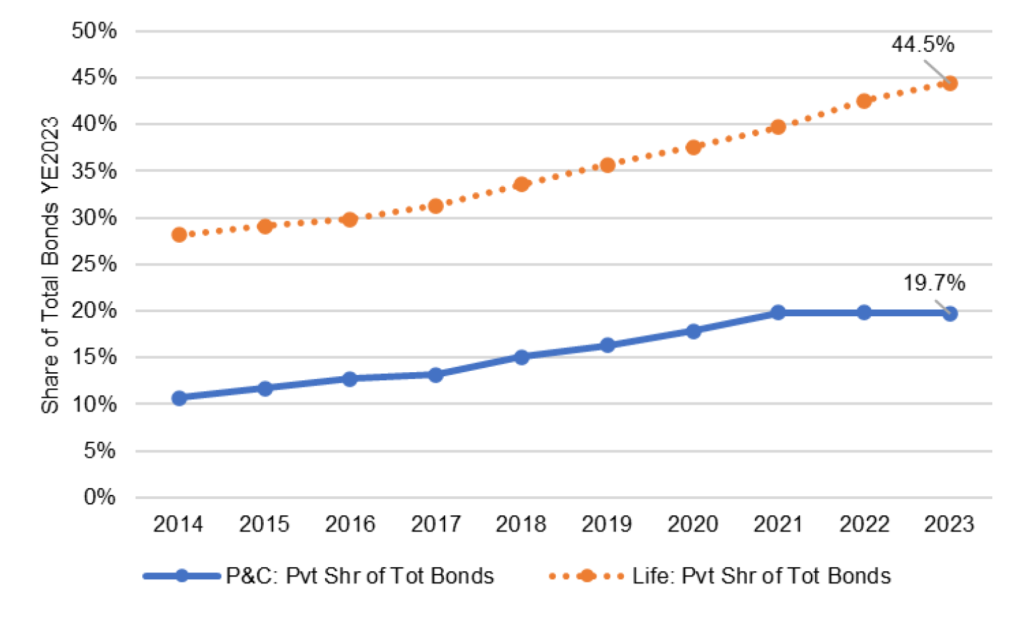

P&C share in private securities, including 144A and other forms, has flattened as life share in private securities continues to rise

Note: statutory filings only, excluding affiliates investment.

Source: company reports, S&P CapIQ, CreditSights.

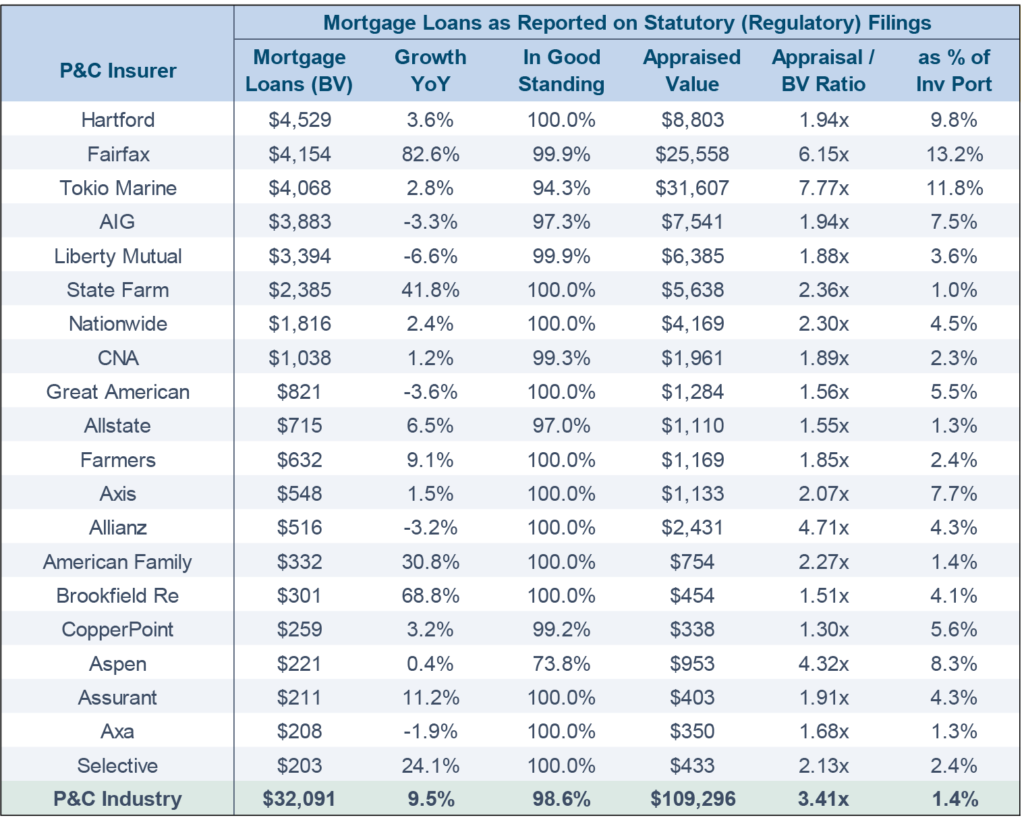

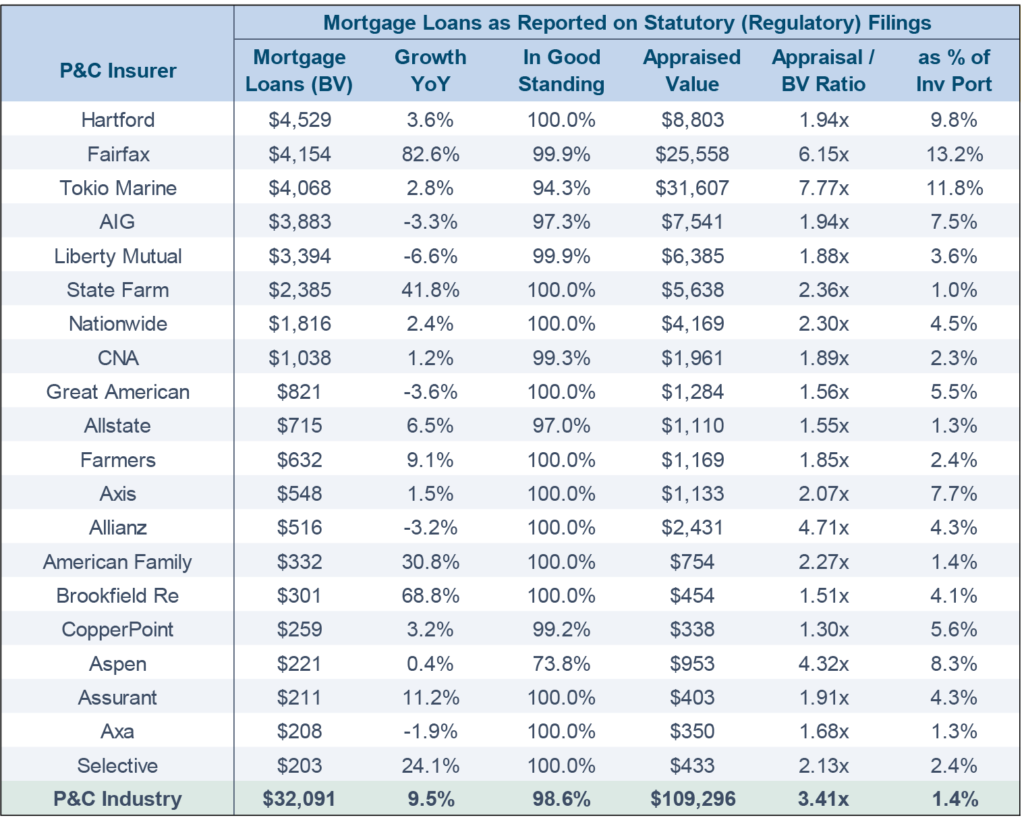

P&C portfolios held $32 billion in mortgage loans at YE2023 or 1.4% of the portfolio while lifers held $734 billion or 13.7% of portfolio

Note $ million.

Source: from CreditSights, “US P&C Insurance: Investment Portfolio Trends YE2023”

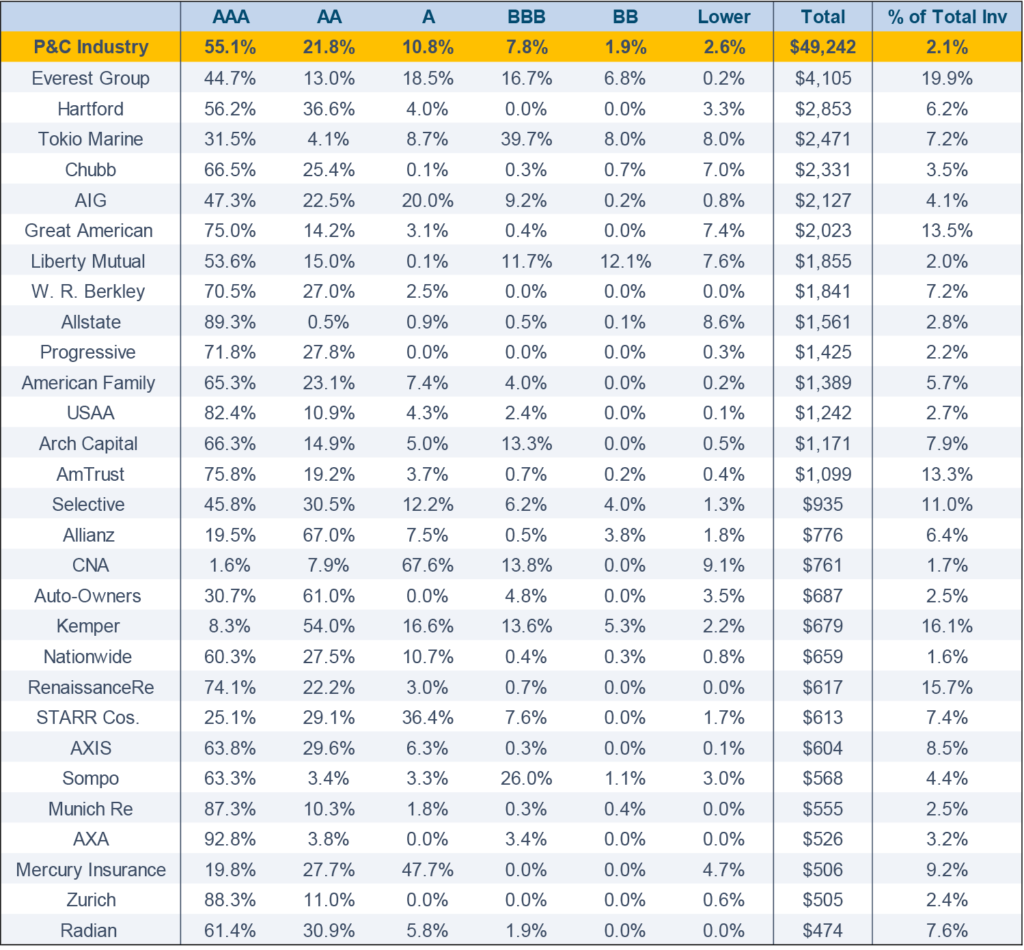

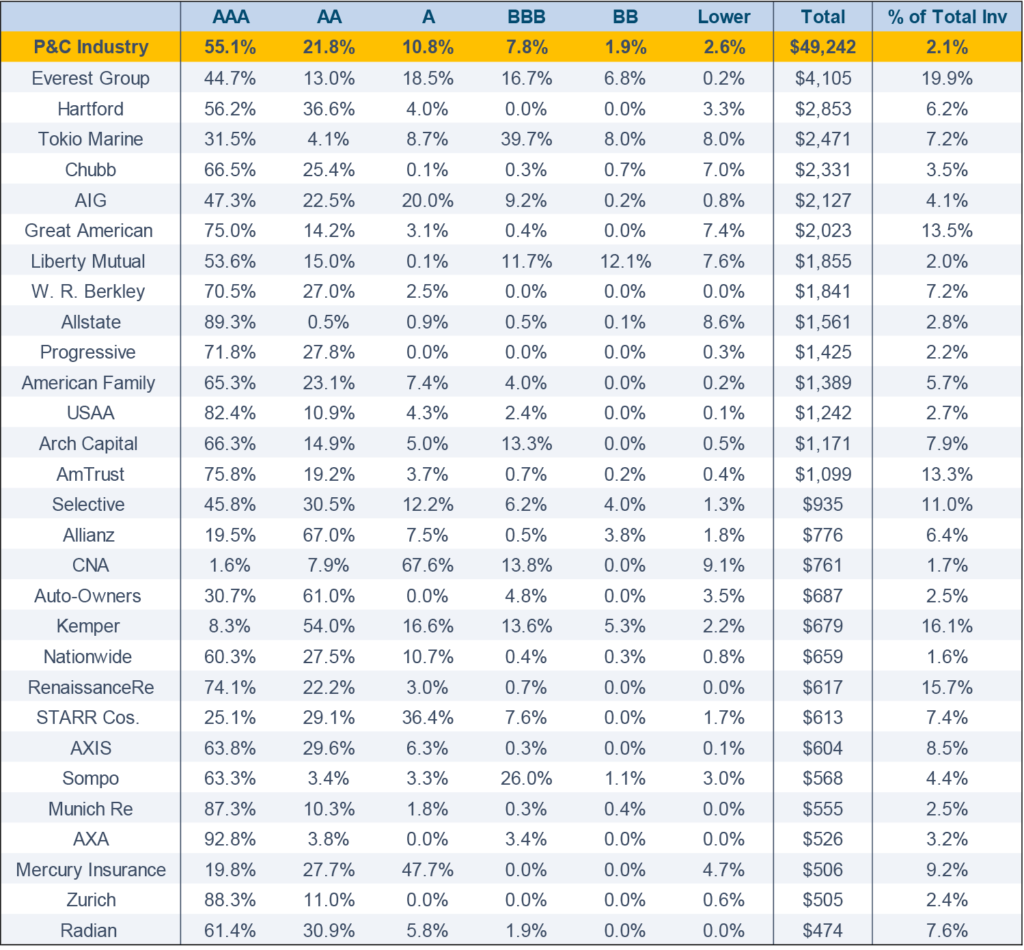

P&C portfolios held $49 billion in CLOs at YE2023 or 2.1% of the portfolio while lifers held $223 billion or 4.5% of the portfolio

Note $ million.

Source: from CreditSights, “US P&C Insurance: Investment Portfolio Trends YE2023”

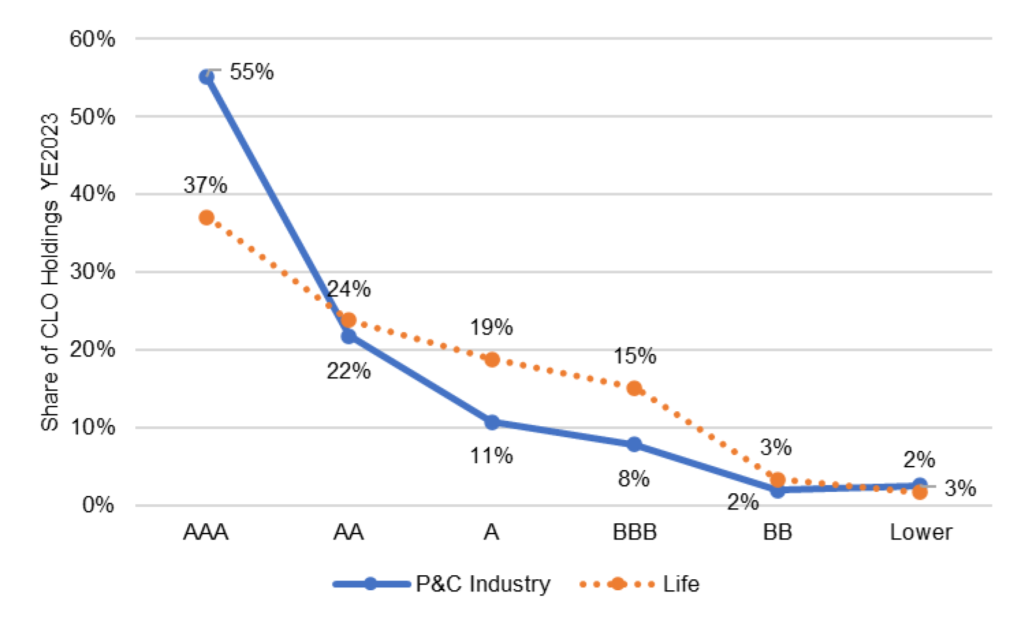

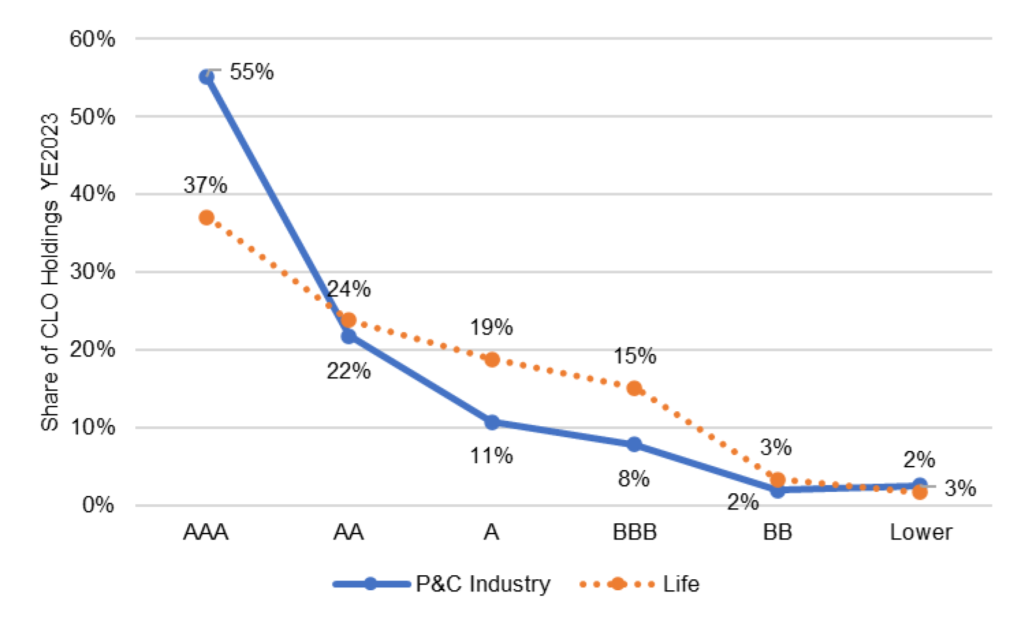

P&C portfolios hold CLOs with higher ratings than life portfolios

Source: from CreditSights, “US P&C Insurance: Investment Portfolio Trends YE2023” and “US Life Ins: Investment Portfolio Trends YE2023”

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.