By the Numbers

Trading the option-adjusted price of premium CLO debt

Steven Abrahams | April 5, 2024

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Tighter yield spreads in most risk assets since October have pushed a significant share of CLO debt above par. But CLO debt has limits on how high it can go. Debt investors sell embedded options to CLO equity that limit price gains in the debt—among others, the option to refinance debt at tighter spreads and the option to default. Either one can wipe out any price premium. Factors that affect option value should also affect the price premium. That sounds good in theory, and, clearly in the last few months, works well in fact.

Using a small sample of trades above par in ‘AAA’ CLO debt since early October, a handful of debt features manage to explain more than half the observed trade-to-trade change in price premium. Those features all bear on option value:

- The CLO debt refinancing incentive

- The time left in the non-call period

- The market value overcollateralization, and

- A measure of broad market perception of leveraged loan credit risk

A simple statistical model of these influences shows the relative impact of each.

The key embedded options

Almost every CLO gives the equity class the option to refinance debt after a certain period of time. Debt typically refinances when margins over SOFR on new debt drop materially below the margins on the existing debt. The equity class can issue new debt, pay off the old debt and deal expenses and lower the net cost of funds. And since any excess spread between the CLO loan portfolio yield and the cost of funds—net of ongoing expenses—goes to equity, the equity class has incentives to refinance.

Every CLO also gives the equity class the option to default on debt or pay off less than the full amount of principal due. For practical purposes, that usually happens—if it happens at all—as a deal winds down after the reinvestment period. And it only happens if cash flow, recoveries on defaulted loans or market prices on loans prove insufficient to cover the principal due. Default might seem a realistic risk only for junior or mezzanine classes. But pricing on senior classes can be sensitive to default risk, too. Default reduces subordination levels for all classes. Rising default risk for any class in a deal hurts every class, if only through the risk of downgrade.

CLOs have other embedded options, described in detail in Santander US Capital Market’s Quick Guide to CLO Debt and Equity. But the refi and default options are the two elephants in the CLO option room.

Limits to price upside

CLO debt then amounts to a long position in a riskless non-callable floating-rate asset and a short position in the refi and default options. The value of those options show up in the initial margin over SOFR when the debt gets issued. The greater the market estimate of future refi and default risk, the greater the margin. Refi and default risk are linked, of course, since lower default risk usually means tighter spreads and higher refi risk. And higher default risk usually means wider spreads and lower refi risk. It all gets compounded into the margin.

The short position in options can weigh on price appreciation in CLO debt. If expected credit risk drops after issuance and spreads tighten, the price of the floater should rise to reflect the present value of its higher margin. A non-callable par ‘AAA’ CLO floater might have a weighted average life and spread duration of around six years. A 25 bp drop in spreads consequently should push a par class to $101.50, and a 50 bp drop to $103.00. But callable CLO classes rarely trade that high. As spreads tighten, the value of the refi option goes up. The value of the floater may go up, but the short position in options drives it down.

The value of the option in theory should depend on a few things:

- The current margin

- The available new margin

- Timing of option exercise

- Future volatility of margins

- Cash flows expected during the life of the option

The market can capture most of that information in a few measures:

- The difference between current and new margin (bp)

- Time left in the non-call period or, equivalently, the deal (years)

- Expected deal default risk (market value overcollateralization in percent)

- Market perception of credit risk over time (‘AAA’ 5NC3 NI spread in bp)

A snapshot of premium ‘AAA’ trading

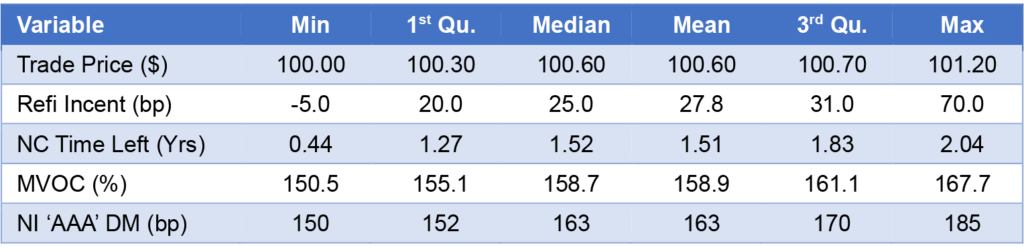

From October 3, 2023, through March 19, 2024, Santander US Capital Markets saw 49 trades above par in ‘AAA’ CLO debt. For each we measured price, refi incentive, non-call time left, MVOC and the new issue ‘AAA’ discount margin (Exhibit 1).

Exhibit 1: Summary of measures on 49 trades in premium ‘AAA’ CLOs

Note: From Oct 3, 2023, through Mar 19, 2024.

Source: Santander US Capital Markets.

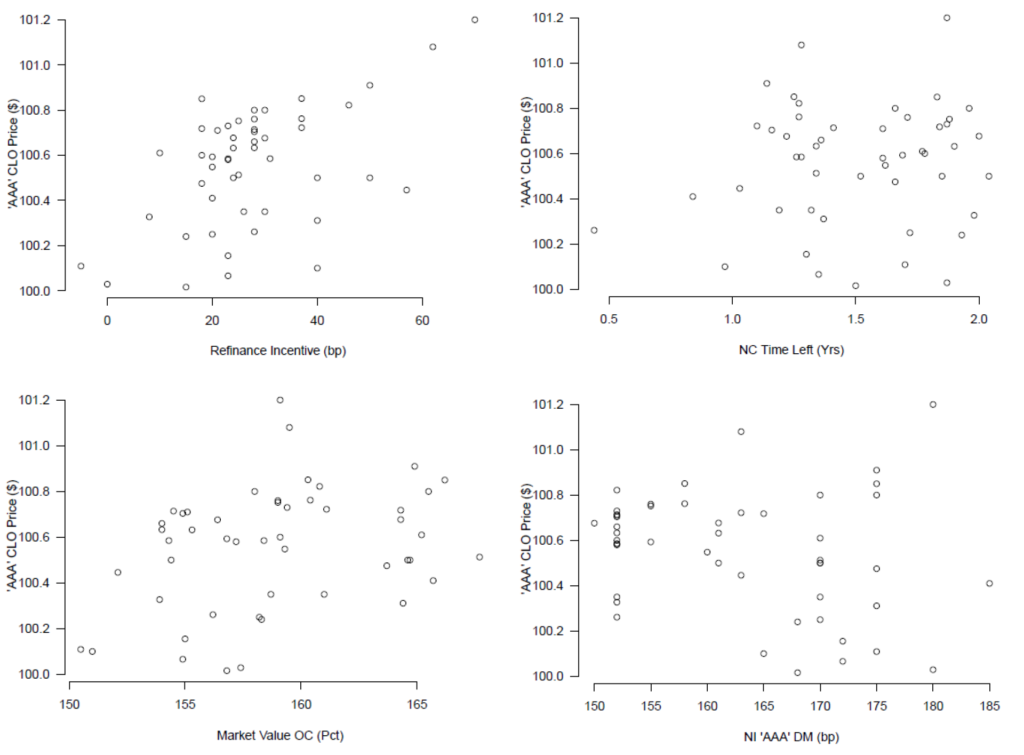

The major relationships between price and these key predictors run in the expected direction (Exhibit 2):

- As the gap between a security’s current margin and the par new issue margin rises—its refinancing incentive—the price of the security rises reflecting the increasing value of the higher coupon and the partially offsetting value of the refi option

- As the time left in the non-call period increases, the price of the security rises reflecting the longer window for collecting the higher coupon and the falling intrinsic value of the refi option

- As the market value overcollateralization increases, putting the default option further out-of-the-money, the value of the security rises, and

- As the new issue discount margin rises, reflecting rising market concern about credit or, alternatively, rising expected margin volatility, the values of the refi and default options rise and the value of the security falls

Exhibit 2: Relationship between ‘AAA’ CLO price and key predictors

Source: Santander US Capital Markets

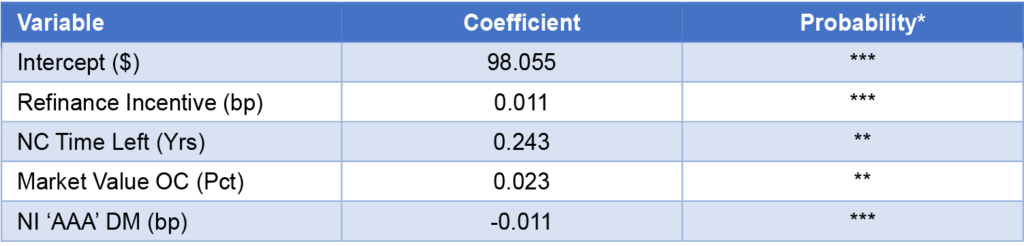

These individual relationships do not capture their combined ability to predict a ‘AAA’ CLO price premium or their relative importance. A multiple regression does capture it very roughly and explains 58% of the variance in observed price premium with all variables highly statistically significant (Exhibit 3)

Exhibit 3: Predicting ‘AAA’ CLO price premium using key variables

Note: Probability of parameter equal to zero *** = < 0.001, ** = < 0.01. Multiple R-squared: 0.58 on 44 df.

Source: Santander US Capital Markets.

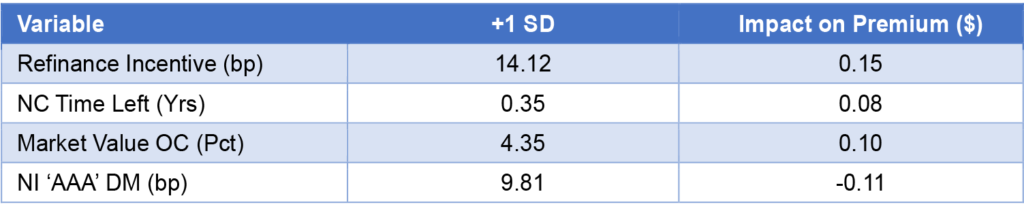

Absolute regression coefficients do a poor job of showing relative importance, so it helps to show the impact of a one standard deviation change in each variable—a change historically with roughly equal likelihood of happening across the variables. A one standard deviation rise of roughly 14 bp in refinance incentive, for example, would raise the ‘AAA’ CLO price premium by $0.15. A one standard deviation rise in new issue discount margin would lower the premium by $0.11, a similar move in MVOC would raise the premium by $0.10 and an increase in time left in the non-call period would raise the premium by $0.08 (Exhibit 4).

Exhibit 4: Price impact of a one standard deviation move in key variables

Source: Santander US Capital Markets.

This simple study clearly has some weaknesses. The most obvious is that the price impact of refinancing incentive should depend on the time left in the non-call period. As a CLO approaches the end of non-call, for example, the price should move towards par regardless of even a large refinancing incentive as investors anticipate the refi and repayment at par. In other words, the relationship between refi incentive and price is nonlinear. The limited data here makes estimating that interaction unreliable. The limited data also means that another sample of premium ‘AAA’ CLO trades could produce different results. This is a good start, but not a finish.

Despite the weaknesses, this quick study suggests that viewing CLOs through an options lens offers good intuition for how the debt will price. The factors that option theory suggest should affect pricing do show a significant relationship to recent pricing in premium CLOs. The market looks as if it’s trading the option-adjusted price of CLO debt. That’s the right thing for CLO debt investors to focus on.