The Long and Short

An elusive leverage target for Verizon

Meredith Contente | July 28, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Verizon (VZ) has announced a waterfall tender offer for up to $1.5 billion of bonds across 14 series of notes. While the tender offer is a slight positive for reducing debt, VZ still has a way to go before it reaches its 1.75x-2.0x net leverage target. Comments on its second quarter earnings call about returning to share buybacks once leverage falls to the 2.5x area indicates that management sees the target as taking much more time than originally expected.

While VZ’s ratings don’t appear to be at risk, there is little upside for spreads relative to T-Mobile US Inc (TMUS), whose leverage is roughly in line with VZ’s. TMUS has been outperforming its peers with respect to subscriber gains and maintains a stronger margin and free cash flow profile. VZ’s tender will not push the needle much with respect to net leverage reduction, therefore it should not serve as a catalyst for spread tightening. However, holders who wish to participate in the tender offer should look to get in by the Early Participation Deadline to take advantage of the $50 early tender premium per bond.

Exhibit 1. BBB Wireless Curve

Source: Bloomberg TRACE; Santander US Capital Markets

Tender offer details

VZ is conducting a waterfall tender that is broken down into two groups across 14 different securities. Both groups have a tender cap of $750 million, translating to a $1.5 billion tender offer in total, unless upsized. Group one contains 10 securities with maturities ranging from 2024 to 2035. Group two has four different securities with maturities ranging from 2028 to 2036. The tender offer includes a $50 early tender premium per $1,000 notional. Both the floating-rate consideration and fixed spread includes the early participation premium, meaning in order to receive the full consideration or tender spread, holders must tender their bonds before the Early Participation Deadline, which is set for 5 pm NYC time on August 7, 2023. VZ is opting for the $50 early tender premium over the standard $30 premium to insure the highest participation rate.

Exhibit 2. VZ Tender Details ($ in millions)

*Includes $50 Early Tender Premium per $1,000 notional

**Subject to a separate $400 million cap (Level 3 Sub Cap)

Source: VZ Press Release; Santander US Capital Markets

VZ noted in the press release that it reserves the right to increase any or all of the applicable caps at any time. Under the Level 3 Sub Cap (Group two, Priority three), this series of notes is subject to a separate $400 million tender cap. The tender offer expires at 5pm NYC time on August 22, 2023. Holders who tender after the Early Participation Deadline but on, or before the expiration date will receive the total consideration/fixed spread less the early tender premium. Again, it behooves holders that want to participate to tender their bonds at or before the Early Participation Date to receive the full consideration.

VZ second quarter results

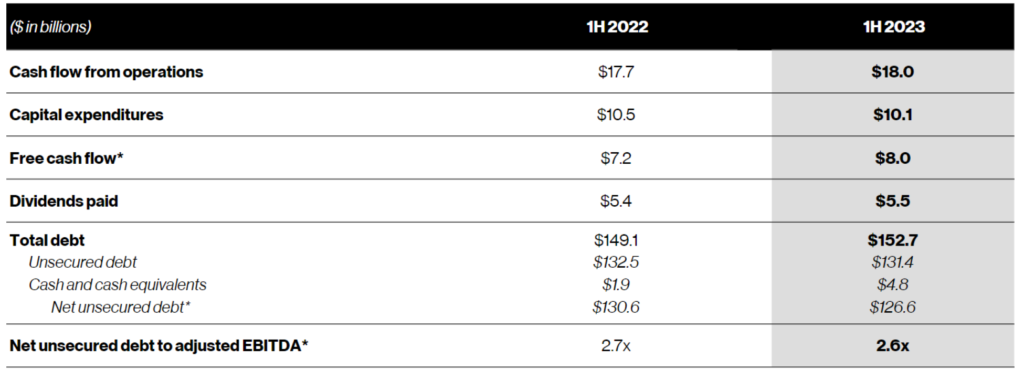

VZ saw revenues decline 3.5% from the year-ago period while adjusted EBITDA grew 0.8% (to $12.0 billion). Management noted that they witnessed solid wireless service revenue growth, which was up 3.8% year-over-year. Wireless witnessed retail postpaid net additions of 612,000, a strong improvement from last year when the company witnessed 215,000 net losses due to increased churn. An improvement to free cash flow, driven largely by a reduction in capital spending led to increased cash on hand, thereby reducing net leverage by a tick to 2.6x.

VZ continues to target net leverage in the 1.75x to 2.0x range, however comments regarding the resumption of share buybacks indicate that this leverage target may take longer to achieve than previously expected. VZ now plans to resume share repurchases when net leverage hits 2.5x. VZ is also looking to maintain a strong dividend growth rate. That said, there may be little excess free cash flow to be used for debt reduction moving forward.

Full year guidance was reaffirmed as management is looking for wireless service revenue growth to be in the 2.5% to 4.5% range. Year-to-date, wireless service revenue growth stands at 3.4%. Adjusted EBITDA is expected to be in the $47.0 billion to $48.5 billion range, indicating a growth range of -1.9% to 1.3% from fiscal year 2022. Adjusted EPS in the $4.55 to $4.85 range will be down from the $5.09 posted last year. Free cash flow is estimated to be $17.0 billion for the year.

Exhibit 3. VZ Free Cash Flow and Net Leverage (1H 2022 vs. 1H 2023)

Source: VZ Earnings Presentation; Santander US Capital Markets

Limited excess free cash flow for debt reduction

While the tender offer is a slight positive for reducing debt, it will have no real impact on net leverage as cash on hand will be used to fund the tender. Moving forward, VZ will have limited free cash flow for debt reduction as the company has further C band obligations to be paid, coupled with lead remediation. Additionally, shareholder remuneration will increase as share buybacks are set to resume. Management noted on the earnings call that VZ has $4.5 billion of C band obligations remaining. Furthermore, there will be a cost associated with lead remediation although its too early to determine what the potential financial impact will be. Management was reluctant to quantify how much lead infrastructure made up their copper network, except to say that it was a small percentage. While VZ sees $17.0 billion of free cash flow for the year, the dividend will consume at least $11 billion. Coupled with the C Band obligation and the announced tender offer, VZ’s $17.0 billion free cash flow for the year is already spoken for. Increased shareholder remuneration will only detract from the company’s ability to conduct meaningful debt reduction next year.