By the Numbers

A few spots of value in specified pools

Brian Landy, CFA | July 21, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

MBS investor interest in specified pools has grown this year since TBA dollar rolls are no longer trading special. Heavy buying by the Fed and banks in 2020, 2021 and part of 2022 boosted dollar rolls. Investors able to roll positions could lift returns by buying TBA. But the Fed stopped buying MBS last year, and bank demand has stayed low, hurting rolls but making buying pools more attractive than they have been in a few years.

Starting with 30-year 2.0% pools: Texas and loan balance

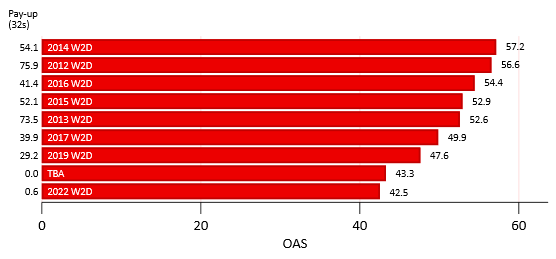

Several types of 30-year with a 2% coupon have substantially wider option-adjusted spreads than the 2% TBA (Exhibit 1). The chart ranks cohorts of vintage and specified pool types from highest to lowest OAS using Bloomberg’s BAM prepayment model. Only cohorts with at least $10 billion outstanding balance outstanding were selected. Bloomberg includes these cohorts, and some smaller ones, in the MBS Index and prices them daily. At the top of the list are 2020 pools backed by 100% Texas collateral, which pick 31 bp OAS to TBA. The 2021 vintage Texas pools are also high on the list. Texas pools offer some prepay protection when in-the-money due to legal restrictions around cash-out refinancing at low loan ages; discount Texas pools have faster housing turnover from a stronger-than-average housing market over the last few years. The Texas pools are also available at low pay-ups to TBA; the pay-ups are printed to the left of each bar.

Exhibit 1. Conventional 30-year 2.0%s, Bloomberg OASs

Source: Bloomberg, Santander US Capital Markets

Some loan balance cohorts are available with similar OAS picks to TBA as those Texas cohorts. For example, 2020 and 2021 vintage pools of loans no larger than $175,000 and $200,000 rank just behind the highest OAS Texas cohort. These pools are available at higher pay-ups, however, ranging from 24/32s to 43.4/32s over TBA.

In 30-year 2.5% pools: Texas and loan balance redux

Low-loan balance cohorts lead the OAS pack in conventional 2.5%s (Exhibit 2). Pools from 2020 and 2021 with maximum loan sizes ranging from $150,000 to $250,000 pick anywhere from 13 bp to 28.1 bp OAS over TBA. These are also high pay-up options, with pay-ups as high as 36.6/32s. Low loan balance pools benefit from faster prepayment speeds from housing turnover, since these borrowers are more likely to need to trade into a larger home. That boosts the value of discount pools. And low loan-balance pools also offer significant prepayment protection if interest rates fall. Both factors contribute to a high price for these loans.

Exhibit 2. Conventional 30-year 2.5%s, Bloomberg OASs

Source: Bloomberg, Santander US Capital Markets

There are a couple low pay-up 2% cohorts that offer high option-adjusted spreads. The 2021 Texas pools pick nearly 21 bp OAS over TBA at only 3.4/32s pay-up. A couple other options are high LTV pools and low FICO pools, although the OAS picks are only around 12 bp.

In 30-year 3.0% pools: seasoning

There are fewer options to choose from in the 30-year 3.0% coupon (Exhibit 3). Many of the typical specified pool types did not meet the $10 billion threshold for this analysis. But the worst-to-deliver (W2D) cohorts from a few older vintages offer 20 bp to 26 bp more OAS than the TBA. These cohorts benefit from seasoning, which typically lifts prepayments from housing turnover. And there is substantial burn-out in these cohorts since those borrowers did not refinance during the pandemic refinance wave. The pay-ups, however, are quite high and there are no low pay-up options that stand out.

Exhibit 3. Conventional 30-year 3.0%s, Bloomberg OASs

Source: Bloomberg, Santander US Capital Markets

In 30-year 3.5% pools: seasoning redux

The 3.5% coupon is like the 3% coupon, with only worst-to-deliver cohorts crossing the UPB threshold for inclusion (Exhibit 4). But the older vintages—2016 and older—pick 10 bp to 15 bp over TBA.

One caveat is that option-adjusted spread analysis depends on the prepayment model used; other models might take a different view of prepayments and value. And Bloomberg’s BVAL pricing isn’t always perfect, which can be seen by a couple cohorts that have negative pay-ups. However, the prices and model mostly seem reasonable, and provide a powerful and accessible tool for investors to screen for value in the MBS market.

Exhibit 4. Conventional 30-year 3.5%s, Bloomberg OASs

Source: Bloomberg, Santander US Capital Markets