The Big Idea

Global strategy | Edging closer to adding duration

Antonio Villarroya | July 7, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Excerpted from Santander CIB, Interest & Exchange, July 3, 2023, and edited for US Portfolio Strategy.

While the banking crisis that rattled financial markets less than three months ago seems to have had limited macroeconomic consequences so far, it is the relentless policy tightening by the world’s central banks that should keep investors worried. There is more reason to worry in some countries than in others. The US and euro zone both look set to get tighter. But the UK really stands out. Policy looks likely to go higher for much longer, bringing us closer to the point of adding duration.

Higher rates outweigh a modest tightening in credit

In the US, while borrowing from the Fed’s new Bank Term Funding Program seems to have stabilized at a pretty high $100 billion, commercial bank deposits have increased by $220 billion in the last six weeks and they now stand ‘just’ 4% below their 2022 highs and $3.8 trillion above pre-Covid levels. And that is despite the $900 billion that have entered US money market funds in the last 12 months. More importantly for the macro picture, bank loans are back above levels before the collapse of Silicon Valley Bank, even for commercial real estate (Exhibit 1).

Exhibit 1: US bank loans: weekly changes and total amount (USD bn)

Source: Bloomberg, Santander

So, although those March events will add some credit tightening to the main advanced economies, its degree will be limited compared to the tightening caused by the sheer amount of official rate increases. In fact, given their performance in previous cycles, both the availability of loans and actual loan volumes could deteriorate further in coming months (Exhibit 2 and Exhibit 3).

Exhibit 2: NFIB survey; lending conditions and rates

Source: Bloomberg, Santander

Exhibit 3: Euro area money aggregates and loan growth

Source: Bloomberg, Santander

Services and core inflation fail to follow the headline trend

In the meantime, the inflation picture does not seem to be evolving as policymakers probably would like. And while the headline component seems to have clearly left its peak behind and is decelerating fast– and inflation swaps suggest it will fall further in coming months – the same cannot be said of the core component (Exhibit 4). In fact, core CPI in the three major regions is still not only clearly above central banks’ medium-term targets, but at (or not far from) multi-year highs, especially in the UK (Exhibit 5).

Exhibit 4: US, UK and EUR headline inflation (YoY)

Source: Bloomberg, Santander

Exhibit 5: US, UK and EUR core inflation (YoY)

Source: Bloomberg, Santander

Obviously, the divergence between headline and core inflation is to a large extent caused by the base effect of energy prices given their sharp spike in the first half of 2022 following the Ukraine invasion. But the composition of the core component in these countries is also worth analyzing. While goods inflation is falling fast, services inflation remains much stickier. In fact, in the preliminary euro area June CPI release, services inflation reached an all-time high of 5.4% year-over-year, clearly above the 2010-2020 average of 1.5% (Exhibit 6). Interestingly, among the main sub-indices, services related to recreation, at 7.6% year-over-year, seem to be the fastest growing category.

Exhibit 6: Euro area goods vs. services inflation (YoY)

Source: Bloomberg, Santander

In the US, while still above target and above most goods prices, services inflation at least seems to have peaked recently (Exhibit 7). ‘Rent of Shelter’ is the main category in this index and, given its lagging relationship with house prices and the recent evolution of the latter, this component is likely to continue falling.

Exhibit 7: US headline, core, goods and services CPI (YoY)

Source: Bloomberg, Santander

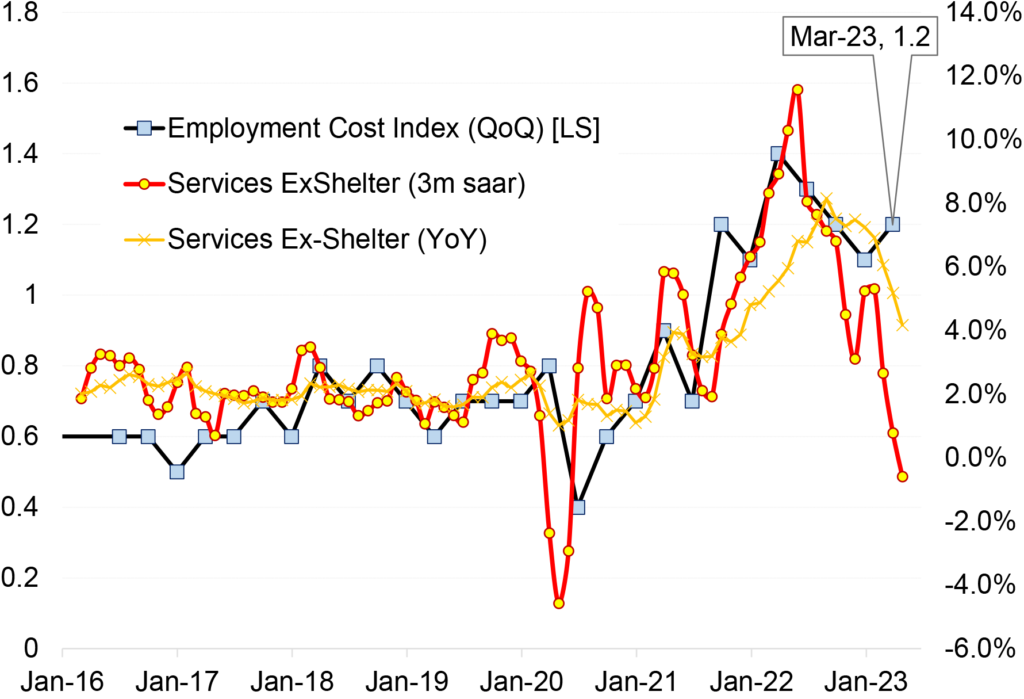

Moreover, the closely watched ‘Services ex-Shelter’ category fell to 4.2% year-over-year in May 2023, from 5.2%. It is worth keeping an eye on this measure as, despite this good news, it has historically been highly correlated to labor costs, which have not seen any significant easing recently, given the extremely tight labor markets in these regions (Exhibit 8).

Exhibit 8: US Services ex-shelter CPI vs. ECI (QoQ)

Source: Bloomberg, Santander

Higher, for (much) longer

Given the surprising health of labor markets bearing despite aggressive policy tightening of the last 12 to 18 months and the resilience of core and services inflation, policymakers are finding that they have no choice but to lengthen their tightening cycles, not only aiming for higher terminal rates but also keeping them at ‘sufficiently restrictive’ levels for longer than previously anticipated. At the start off the year, advanced economies’ central banks looked likely to complete their tightening cycles by mid-year. But now some moderate further policy adjustments in the euro area and the US look likely in the second half of this year, and much tighter monetary policy in the UK with the BoE now expected to take Bank Rate to 6% before year-end (Exhibit 9).

Exhibit 9: Fed funds rate expectations by FOMC meeting (bp)

Source: Bloomberg, Santander

Interestingly, while the discounted peak in UK official rates is currently at record highs, the expected ECB and Federal Reserve terminal rates are, despite their recent adjustment, still below the early March (pre- SVB) levels (Exhibit 10). As a reminder, while in his March 7 report to Congress Fed Chair Powell discussed the possibility of accelerating the pace of the Fed’s policy adjustments, the reality is that the Fed ‘skipped’ the recent June FOMC in its already 500 bp-long tightening cycle. But what matters most is not whether the terminal fed funds rate is 5.25% or 5.75% but rather the fact that the Fed has successfully shifted market expectations of possible rate cuts at each of the upcoming FOMC meetings, to chances of potential hikes now priced in (Exhibit 11).

Exhibit 10: Official rate increases in major economies and expectations for 2H23

Source: Bloomberg, Santander

Exhibit 11: Discounted terminal rates for the ECB and the Fed

Source: Bloomberg, Santander

For the ECB, despite the aforementioned macro concerns, especially in Germany, following the ‘very likely’ hike on July 27, look for a heated debate when policymakers meet on September 14. But despite a further decline in headline inflation, the updated macro projections look unlikely to show a clear improvement in their long-term inflation expectations or deterioration in the labor markets and costs after the sharp upward revision to the 2023 and 2024 core inflation forecasts (+0.5% to 5.0% and 3.0%, respectively) and 2023-2025 unit labor costs. Only a material decline in August preliminary core and services inflation (to be released on 30 August) will likely make the ECB refrain from taking its DFR to 4%, although the central bank might try to join the ‘skip a meeting’ central bank camp, which already includes the RBA, the BoC and the Federal Reserve.

Rates pivoting around the curve’s very long end

In the recent period of sharp readjustment of policy expectations by the three major central banks, their 10-year yield has remained well correlated to front-end movements, but with relatively low betas, especially in the euro zone, while 10-year GBP and USD swaps have replicated 25% to 30% of the movement in 2-year rates (Exhibit 12). Interestingly, 30-year tenors actually declined moderately in the three markets in June. We might finally be close to the time to go clearly long duration. But we are not there yet.

Exhibit 12: Changes in 2y-10y-30y USD, GBP and EUR govies in June 2023

Source: Bloomberg, Santander

Antonio Villarroya

antvillarroya@gruposantander.com

Banco Santander, S.A.

IMPORTANT DISCLOSURES

This report has been prepared by Banco Santander, S.A. and is provided for information purposes only. Banco Santander, S.A. is registered in Spain and is authorised and regulated by Banco de España, Spain.

This report is issued in the United States by Santander US Capital Markets LLC, in Spain by Banco Santander, S.A., under the supervision of the CNMV and in the United Kingdom by Banco Santander, S.A., London Branch (“Santander London”). Santander US Capital Markets LLC is registered in the United States and is a member of FINRA. Santander London is registered in the United Kingdom (with FRN 136261, Company No. FC004459 and Branch No. BR001085), and subject to limited regulation by the UK’s Financial Conduct Authority (“FCA”) and Prudential Regulation Authority (“PRA”). Santander US Capital Markets LLC, Banco Santander, S.A. and Santander London are members of Santander Group. A list of authorised legal entities within Santander Group is available upon request.

This material constitutes “investment research” for the purposes of the Markets in Financial Instruments Directive and as such contains an objective or independent explanation of the matters contained in the material. Any recommendations contained in this document must not be relied upon as investment advice based on the recipient’s personal circumstances. The information and opinions contained in this report have been obtained from, or are based on, public sources believed to be reliable, but no representation or warranty, express or implied, is made that such information is accurate, complete or up to date and it should not be relied upon as such. Furthermore, this report does not constitute a prospectus or other offering document or an offer or solicitation to buy or sell any securities or other investment. Information and opinions contained in the report are published for the assistance of recipients, but are not to be relied upon as authoritative or taken in substitution for the exercise of judgement by any recipient, are subject to change without notice and not intended to provide the sole basis of any evaluation of the instruments discussed herein.

Any reference to past performance should not be taken as an indication of future performance. This report is for the use of intended recipients only and may not be reproduced (in whole or in part) or delivered or transmitted to any other person without the prior written consent of Banco Santander, S.A..

Investors should seek financial advice regarding the appropriateness of investing in financial instruments and implementing investment strategies discussed or recommended in this report and should understand that statements regarding future prospects may not be realised. Any decision to purchase or subscribe for securities in any offering must be based solely on existing public information on such security or the information in the prospectus or other offering document issued in connection with such offering, and not on this report.

The material in this research report is general information intended for recipients who understand the risks associated with investment. It does not take into account whether an investment, course of action, or associated risks are suitable for the recipient. Furthermore, this document is intended to be used by market professionals (eligible counterparties and professional clients but not retail clients). Retail clients must not rely on this document.

To the fullest extent permitted by law, no Santander group company accepts any liability whatsoever (including in negligence) for any direct or consequential loss arising from any use of or reliance on material contained in this report. All estimates and opinions included in this report are made as of the date of this report. Unless otherwise indicated in this report there is no intention to update this report.

Banco Santander, S.A. and its legal affiliates (trading as Santander and/or Santander Corporate & Investment Banking) may make a market in, or may, as principal or agent, buy or sell securities of the issuers mentioned in this report or derivatives thereon. Banco Santander, S.A. and its legal affiliates may have a financial interest in the issuers mentioned in this report, including a long or short position in their securities and/or options, futures or other derivative instruments based thereon, or vice versa.

Banco Santander, S.A. and its legal affiliates may receive or intend to seek compensation for investment banking services in the next three months from or in relation to an issuer mentioned in this report. Any issuer mentioned in this report may have been provided with sections of this report prior to its publication in order to verify its factual accuracy.

ADDITIONAL INFORMATION

Banco Santander, S.A. or any of its affiliates, salespeople, traders and other professionals may provide oral or written market commentary or trading strategies to its clients that reflect opinions that are contrary to the opinions expressed herein. Furthermore, Banco Santander, S.A. or any of its affiliates’ trading and investment businesses may make investment decisions that are inconsistent with the recommendations expressed herein.

No part of this report may be copied, conveyed, distributed or furnished to any person or entity in any country (or persons or entities in the same) in which its distribution is prohibited by law. Failure to comply with these restrictions may breach the laws of the relevant jurisdiction.

Investment research issued by Santander is prepared in accordance with Grupo Santander policies for managing conflicts of interest. In relation to the production of investment research, Grupo Santander has internal rules of conduct that contain, among other things, procedures to prevent conflicts of interest including Information Barriers and, where appropriate, establishing specific restrictions on research activity. Information concerning the management of conflicts of interest and the internal rules of conduct are available on our website.

COUNTRY & REGION SPECIFIC DISCLOSURES

U.K. and European Economic Area (EEA): Unless specified to the contrary, issued and approved for distribution in the U.K. and the EEA by Banco Santander, S.A. Investment research issued by Banco Santander, S.A. has been prepared in accordance with Grupo Santander’s policies for managing conflicts of interest arising as a result of publication and distribution of investment research. Many European regulators require that a firm establish, implement and maintain such a policy. This report has been issued in the U.K. only to persons of a kind described in Article 19 (5), 38, 47 and 49 of the Financial Services and Markets Act 2000 (Financial Promotion) Order 2005 (all such persons being referred to as “relevant persons”). This document must not be acted on or relied on by persons who are not relevant persons. Any investment or investment activity to which this document relates is only regarded as being provided to professional investors (or equivalent) in their home jurisdiction. United States of America (US): This report is being distributed in the US by Santander US Capital Markets LLC. Any US recipient of this report that would like to effect any transaction in any security or issuer discussed herein should do so with Santander US Capital Markets LLC, which accepts responsibility for the contents of this report. US recipients of this report should be advised that this research has been produced by a non-member affiliate of Santander US Capital Markets LLC and, therefore, as third-party research, not all disclosures required under FINRA Rule 2242 apply. Hong Kong (HK): This report is being distributed in Hong Kong by Banco Santander, S.A. Hong Kong Branch, a branch of Banco Santander, S.A. whose head office is in Spain. Banco Santander, S.A. Hong Kong Branch is regulated as a Registered Institution by the Hong Kong Monetary Authority for the conduct of Advising and Dealing in Securities (Regulated Activity Type 4 and 1 respectively) under the Securities and Futures Ordinance. Banco Santander, S.A. or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is greater than 1%, the specific holding is disclosed in the Important Disclosures section above. The recipient of this material must not distribute it to any third party without the prior written consent of Banco Santander, S.A. China (CH): This report is being distributed in China by a subsidiary or affiliate of Banco Santander, S.A. Shanghai Branch (“Santander Shanghai”). Santander Shanghai or its affiliates may have a holding in any of the securities discussed in this report; for securities where the holding is greater than 1%, the specific holding is disclosed in the Important Disclosures section above. Singapore (SG): This report is distributed in Singapore by Banco Santander, S.A. which has a branch in Singapore. It is not intended for distribution to any persons other than institutional investors, accredited investors and expert investors (each as defined in the Securities and Futures Act 2001 of Singapore). Recipients of this report should contact Banco Santander, S.A., Singapore Branch at researchsingapore@gruposantander.com for matters arising from, or in connection with, this report.

For further country and region specific disclosures please refer to Banco Santander, S.A.