By the Numbers

CLO manager performance softens

Caroline Chen | July 7, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

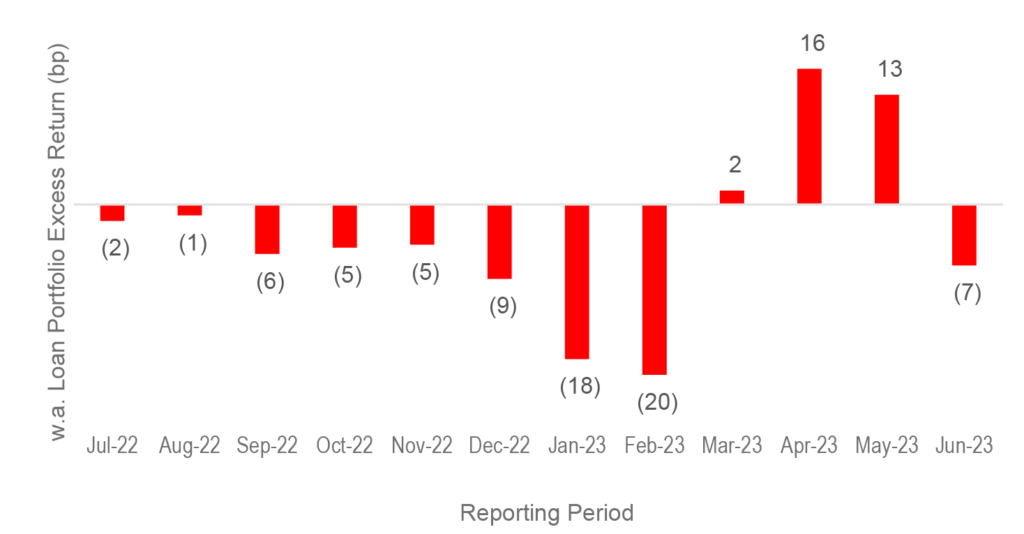

Returns on CLO loan portfolios lagged the broad loan market by 7 bp in the second quarter after adjusting for risk and reporting dates. While average manager performance softened, managers with low-risk portfolios have continued to outperform the loan market index.

Managers’ performance lost to the index through the second quarter

After accounting for CLO reporting dates, the Morningstar/LSTA leveraged loan index returned 1.39% for the three months ending in June. The average loan portfolio for managers with five or more actively tracked deals had a beta to the index of 1.02. With that beta, the average loan portfolio should have returned 1.42%, but managers, weighted by assets under management, instead posted a return of 1.35%, lagging the index by 7 bp (Exhibit 1).

Exhibit 1: Managers’ performance weakened in the latest quarter

Note: Each reporting period includes the most recent three months. For example, reporting period ending in Jun-23 includes the average manager performance in the past three months ending on or before June 20, 2023. The data shows the average excess return relative to the Morningstar/LSTA total return index for 88 managers with five or more active deals.

Source: INTEX, Markit, Santander US Capital Markets LLC.

Only 35 out of 88 managers outperformed compared to 50 in the reporting period ending in May. Individual managers’ excess returns to the index through June ranged from a high of 73 bp to a low of -73 bp.

Low beta managers continue to lead despite a lackluster performance in 2Q

The beta in the Santander US Capital Markets manager model, which summarizes loan portfolio risk, ranged across the managers from a high risk of 1.20 to a low risk of 0.88. High-beta managers, those with a beta greater than or equal to 1.0, underperformed the broad market in nine out of the past 12 reporting periods. For the last three months through June, high-beta managers, weighted by assets under management, lagged the leveraged loan index by 13 bp. Managers of CLO loan portfolios with a beta of less than 1.0, on the other hand, topped the market in 10 out of the past 12 periods (Exhibit 2). Despite the weaker performance of all managers in the second quarter, the low beta managers continue to lead their high beta peers by 20 bp.

Exhibit 2: Low beta managers have maintained the lead

Note: Each reporting period includes the most recent three months. For example, reporting period ending in Jun-23 includes the average manager performance in the past three months ending on or before June 20, 2023. The high beta group includes 60 managers whose beta is over or equal to 1 with a median of 1.05. The low beta group includes 28 managers whose beta is no more than 1 with a median of 0.98.

Source: INTEX, Markit, Santander US Capital Markets LLC.

A small group of 10 managers, mostly low beta managers, outperformed the index consistently in the past four quarters. Six out of the 10 are either owned by large money managers or insurance companies, with the remaining four owned or partially owned by credit alternative funds (Exhibit 3). Of the 10, Napier Park, Allstate and Goldentree are the three managers newly added to the best-performing list.

Exhibit 3: A list of 10 best-performing managers

Source: INTEX, Markit, Santander US Capital Markets LLC

It is worth noting that eight managers on the list, except Generate Advisors and Investcorp, often priced their new issue CLO debt tighter than the peer managers. CLO equity investors may be interested in these managers’ equity positions, whereas CLO debt investors may find debt from Generate Advisors and Investcorp to be good relative value.

Loan prices remain the major contributing factor to managers’ performance

The correlation between loan attributes and managers’ excess returns has generally stayed weak and statistically insignificant, except loan prices showed a rising correlation to managers’ performance through June (Exhibit 4).

Exhibit 4: Loan attributes to managers’ excess returns have stayed weak

Note: Data shows the correlation of each measure, calculated across each manager’s outstanding deals, with excess return or alpha as measured for 88 managers through June 2023.

Source: INTEX, Markit, Santander US Capital Markets LLC.

The rankings

For the three months ending in June, Generate Advisors, Elmwood, Napier Park, Oak Hill and Fortress led all managers with the highest excess return. A list of managers with five or more active deals and their excess returns is below (Exhibit 5). A complete list of managers and their returns is here.

Exhibit 5: CLO manager performance for the three months ending June

Note: Performance for managers with five or more deals issued since January 1, 2011, and tracked by SanCap. Performance attribution starts with calculated total return on the leveraged loan portfolio held in each CLO for the 3-month reporting period ending on the indicated date. CLOs, even with a single manager platform, may vary in reporting period. The analysis matches performance in each period to performance over the identical period in the Morningstar/LSTA Leveraged Loan Index. Where a deal has at least 18 months of performance history since pricing and no apparent errors in cash flow data, the analysis calculates a deal beta. The deal beta is multiplied by the index return to predict deal return attributable to broad market performance. Where no beta can be calculated, the analysis uses the average beta across manager deals weighted by the average deal principal balance over time. Any difference between performance attributes to beta and actual performance is attributed to manager alpha.

Source: INTEX, Markit, Santander US Capital Markets LLC

A link to SanCap’s latest CLO manager bubble chart (Exhibit 6) and to data on more than 120 managers and more than 1,000 active deals is here.

Exhibit 6: SanCap CLO manager bubble chart

Note: The size of each bubble reflects manager long-term beta.

Source: INTEX, Markit, Santander US Capital Markets LLC