By the Numbers

Equipment ABS as an alternative to prime auto loan and lease

Jason Delanty | May 19, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Three equipment ABS deals came to market in the last week all at wide spreads to the prime auto and card ABS deals in the market as well. A track record of strong credit performance in equipment ABS as well as its relatively deep buyer base and liquidity help frame equipment ABS as an attractive alternative to prime auto loan and lease ABS. A quick review of the mechanics of equipment securitization highlights the relative value opportunity.

Performance profile

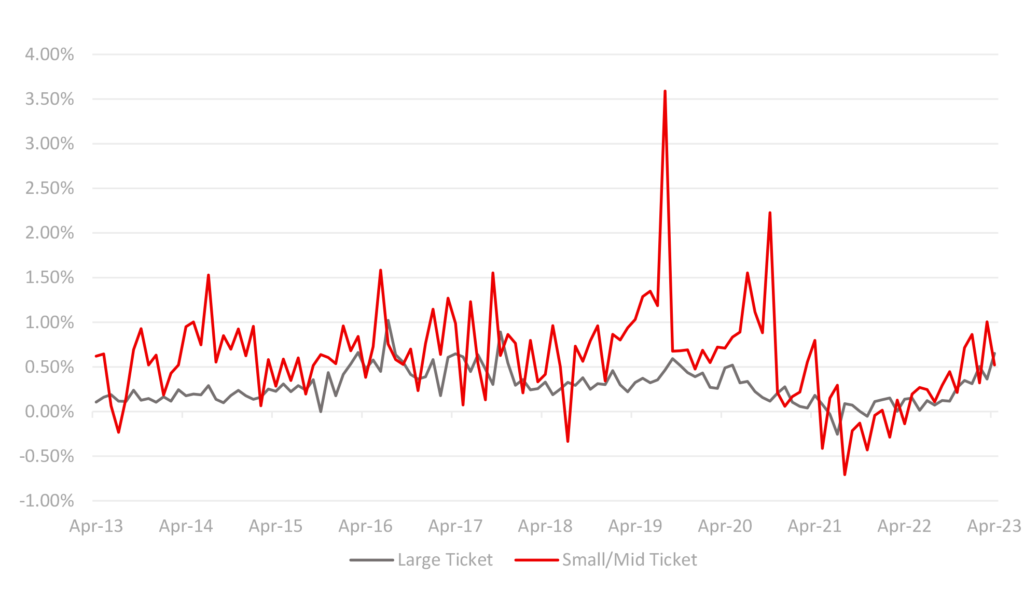

The equipment ABS market boasts strong credit performance over the last 20 years. Based on Kroll’s equipment ABS index over the last decade, annualized net losses for rated deals in both large- and small-to-mid-ticket equipment segments appear to be normalizing relative to strong performance in 2021, but remain well within the context of historical norms.

Exhibit 1: KBRA equipment ABS index annualized net losses return to normal

Source: Bloomberg, Santander US Capital Markets

Structural familiarity

Equipment ABS is typically structured to pay sequentially across senior and subordinated classes, with credit enhancement derived from some combination of subordination, overcollateralization, reserve account and excess spread. Transactions will often market WAL profiles in line with auto loan and lease ABS, ranging from a 2a7-eligible money market tranche to a 3- to 4-year WAL for the last cash flow.

Expanding liquidity

Historically, familiar players with an established equipment ABS presence have dominated primary activity. From 2011 to 2015, three sponsors—John Deere, CNH and General Electric—represented two-thirds of total primary volume. General Electric divested its equipment financing business in 2015. And following its exit from the securitization market there existed an opportunity for a new swath of ABS sponsors to enter.

In recent years, equipment ABS expansion has been driven by players benefitting from the sector’s deepening investor base, an attractive ABS funding landscape and robust origination volumes in a period of economic expansion. The number of unique sponsors in the space increased from an average of 12 to 13 a year from 2011 to 2015 to roughly 18 a year in subsequent years. Small- and mid-ticket issuance outpaced primary volume growth in other segments, expanding 128% and 62% by volume and deal count over the past five years, respectively.

Diversified industry exposure

The most frequent market participants will typically price two to three deals in a year, with deal sizes ranging from $300 million to $500 million in names like Commercial Credit Group (CCG) and Octane Lending (OCTL), to $800 million and up for larger ticket lenders like John Deere (JDOT) and De Lage Landen (DLLMT, DLLAD). Taking a cross- section of recent transactions offers a glimpse into the collateral diversity of the broader sector (Exhibit 2):

Exhibit 2: Equipment ABS sponsor snapshot

(1) Transaction pricing the week of 5/18/23.

Source: Santander US Capital Markets.

Who

The Lenders: Captive finance companies provide financing for specialized industries such as construction and agricultural equipment, trucking and transportation, and technology. Independent equipment financing companies are often more diversified in their equipment portfolios, providing financing across a wider array of industries and supported by independent product competency, instead relying on an original equipment manufacturer’s balance sheet, product suite, and distribution network. De Lage Landen is a great example of the scale at which these independents may operate, having issued priced two transactions year-to-date totaling $1.7 billion.

The Borrowers: End-users can range from investment grade corporate obligors to unrated small and medium-size businesses. There are also instances where service providers will be the direct obligor and sub-lease the equipment to another entity, providing asset life-cycle services as required by a service contract. The service providers are required to make rental payments to the lender so long as that end-user is performing.

What

The Trust Assets: Equipment ABS is secured by loan or lease receivables collateralized by commercial or personal-use equipment. Collateral can be differentiated not only by industry, but also by the cost profile of the equipment itself. You may see deal collateral categorized as small or mid-ticket, where overall cost buckets can be segmented as follows:

- Micro: <$25,000 (Office technology—desktops and laptops, copiers)

- Small: $25,000-$100,000 (Office technology—printing, communications, servers)

- Mid: $100,000-$500,000 (Transportation, transportation, construction, agricultural)

- Large: >$500,000 (Specialized medical equipment, computer systems, aircraft, railcar, container)

Collateral narrative and how to read it

Obligor, industry, and geographic concentration are key risk considerations for an equipment ABS transaction and can have outsized impacts on cashflow expectations if not appropriately assessed.

Obligor: Risk is typically measured by a credit rating, whether that be a proprietary risk-assessment or agency-assigned. Obligor diversity is usually less of an issue in small-ticket transactions as the lower financed balances as a percentage of the overall securitized pool necessitate more granular overall composition. A caveat to this could be collateral secured by business technology infrastructure receivables, where we see enterprise technology solutions for a single obligor representing a large proportion of the securitized assets.

Industry: Receivable performance can be highly correlated with economic cyclicality, and industry-specific risks should be weighed appropriately when analyzing a pool of receivables. For example, trucking and transportation-related loan performance has historically displayed a strong correlation to US economic health, whereas agricultural equipment receivables demonstrate low cyclicality and are more significantly impacted by idiosyncratic events. Intuitively, construction-industry credit performance and new receivable origination has been disproportionately impacted by periods of depressed real estate demand, such as that witnessed between 2008 and 2011.

Geography: Region-specific weather or environmental events, as well as the health of local economies, can significantly impact the performance of receivables exposed to such risks.

New issue pricing

Looking more closely at this week’s deal pricing, pricing yields for ‘AAA’, fixed rate senior equipment ABS hovered 25 bp to 90 bp back of comparable ‘AAA’ yields on prime auto loan ABS. That discount narrows when looking at equipment ABS versus auto lease ABS, which makes sense given the current pricing relationship between auto loan and lease collateral; it should be noted that the yield difference may be somewhat embellished by the shorter maturity-profiles typical for prime auto lease securitizations versus equipment ABS, and the current shape of the yield curve. Particularly interesting are the De Lage Landen 1-year WAL, A2 tranche, where the spread differential versus the comparable WAL Toyota A2 has gapped from 29 bp in late January to 63 bp as of May 17 (Exhibits 3 and 4).

Exhibit 3: New issue pricing for week ending 5/19/23

(1) Pre-pricing estimates provided by S&P, Moody’s

(2) Consumer-backed equipment loan and lease receivables

Exhibit 4: Weighted average ‘AAA’ yield pickup for equipment ABS vs. prime auto loan / lease

Equipment ABS presents an opportunity for ABS investors to diversify collateral and obligor exposure away from more traditional consumer-backed auto receivables. Given equipment ABS’s extensive performance history across collateral segments, low credit loss expectations and the robust structural protections available to ABS investors at the senior level, current ‘AAA’ pricing versus prime auto loans appears fundamentally dislocated, and presents a compelling entry point for front-end investors to diversify away from their auto ABS exposure.