By the Numbers

A market update to the CLO warehouses

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The share of CLO warehouses aged nine months or more stayed relatively flat at 64% in March, according to US Bank. Despite market volatility and banking turmoil, the monthly pace of new warehouse openings has been consistent since June. The number of warehouses closed for CLOs each month exceeded the number of new warehouses in most periods. And CLO managers have kept up their efforts to spread out risk.

The market may also need to keep an eye on warehouses provided by Credit Suisse. Year-to-date, Credit Suisse has led the underwriting of two new deals in the US including KKR 2023-46 and Whitebox 2023-4A. Credit Suisse has led the underwriting of 31 CLO managers’ deals in the last three years, including some frequent issuers that may indicate a warehouse relationship (Exhibit 1). A European CLO warehouse line provided by Credit Suisse to Carlyle recently terminated, according to Bloomberg, and loans subsequently liquidated.

Exhibit 1: Credit Suisse underwrote many CLO managers’ deals

Note: table above only lists managers with Credit Suisse underwritten deals over $1 billion in the past three years. Numbers reflect the dollar amount of the deal size at closing.

Source: PitchBook LCD, Santander US Capital Markets LLC.

The share of warehouses by outstanding age were stable in the month

In March, warehouses outstanding for more than nine months fell by one to 56. The number of warehouses open for less than three months and those open between three and nine months remained steady (Exhibit 2). Historically, US Bank has administered roughly half of the market’s outstanding CLO warehouses.

Exhibit 2: The share of warehouses by age had little change during the month

Note: Warehouse data are shown for the reporting month, reflecting activity in the prior month. Share is calculated by the count of warehouse in each age category. Data reflect warehouse lines administrated by US Bank only.

Source: US Bank, Santander US Capital Markets LLC

Warehouses closed for CLOs have outnumbered new warehouses

The number of outstanding warehouses has fallen from 112 in June to 87 in March, down 22% and consistent with the resilient issuance in the primary market. (Exhibit 3).

Exhibit 3: Total warehouses outstanding have dropped to below 90 this year

Note: Warehouse data are shown for the reporting month, reflecting activity in the prior month. Data reflect warehouse lines administrated by US Bank only.

Source: US Bank, Santander US Capital Markets LLC

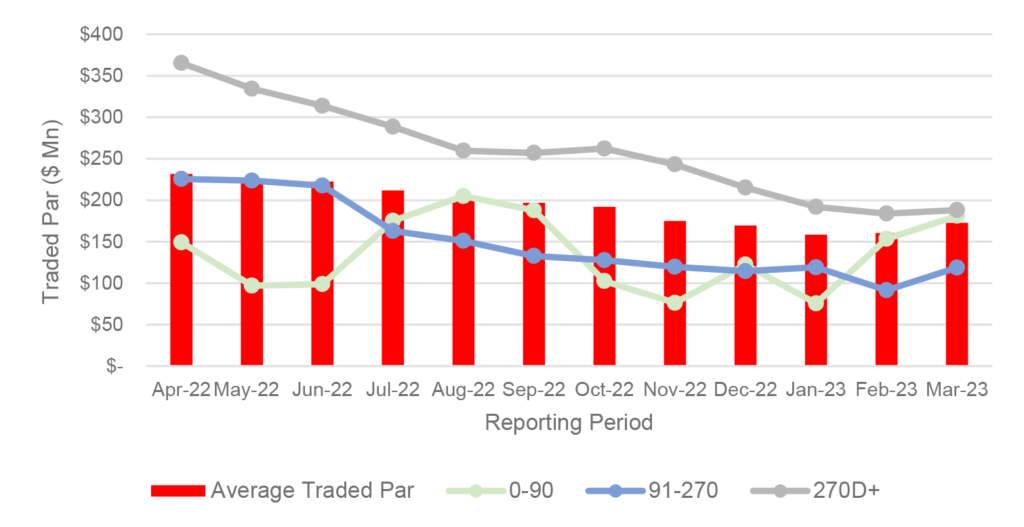

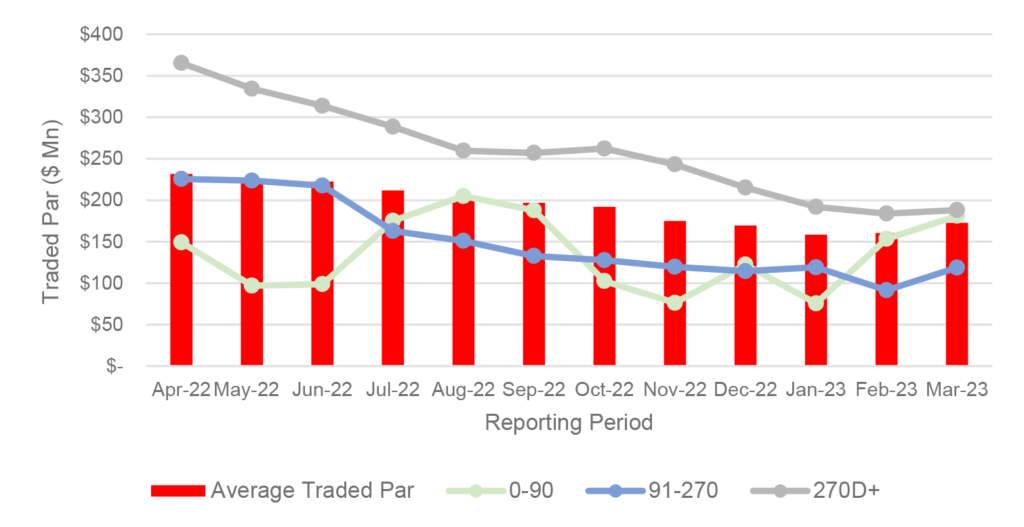

The average par balance in warehouses increased in March

The average par balance in warehouses rose to above $170 million in March, driven by a 23% increase in warehouses open for less than nine months (Exhibit 4). In contrast, the average par balance in aged warehouses remained stable. The rise of the average par balance in younger warehouses may reflect a surge in CLO managers’ purchase activity to take advantage of recent loan price weakness.

Exhibit 4: The average traded par in warehouses increased over the month

Note: Warehouse data are shown for the reporting month, reflecting activity in the prior month. Data reflect warehouse lines administrated by US Bank only.

Source: US Bank, Santander US Capital Markets LLC

CLO managers’ diversification efforts continue

The largest five industry sectors’ exposure in CLO warehouses declined over the last year from 38% to 31.6%. CLO managers’ allocation to the energy sector has recently risen to 5.3%. Healthcare exposure, on the other hand, has declined from 7.2% to 4.6% in a year (Exhibit 5). Exposure to technology services has dropped out of the Top Five in recent months.

Exhibit 5: Top five industry sectors in warehouses have been lowered to 31%

Note: Percentage represents the aggregate loan par balance in one industry over the total par balance in all outstanding warehouses. Industry concentration in each individual warehouse may vary. Warehouse data is shown for the reporting month, reflecting activity in the prior month. Data reflects warehouse lines administrated by US Bank only.

Source: US Bank, Santander US Capital Markets LLC

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.