The Big Idea

Banks tap $648 billion of federal liquidity in a week

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The Fed provided $292 billion in cash to banks in the week ending March 15, according to the H.4.1 report released March 16, including an extraordinary loan to the FDIC. And along with $356 billion of gross borrowing the same week from the FHLBank system, the $648 billion in total funding signals intense bank demand for liquidity. That heightened preference for liquidity will almost certainly limit bank appetite for lending and investing in the short run.

The Fed discloses an extraordinary loan to the FDIC

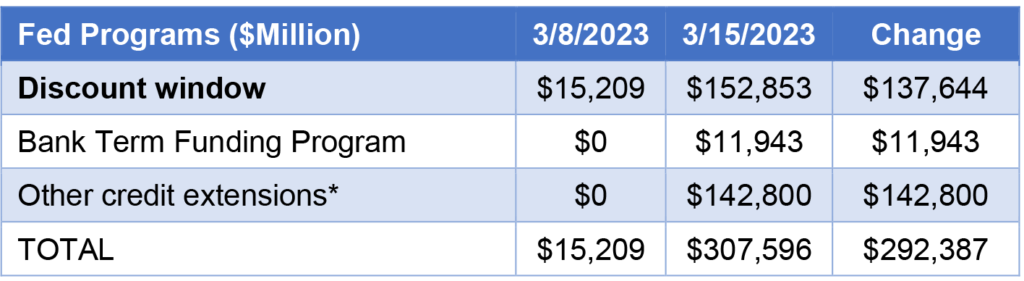

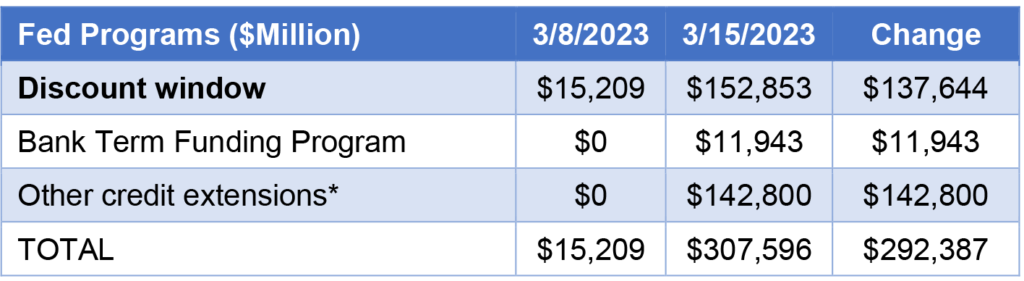

Nearly $138 billion of Fed lending came through the discount window, nearly $12 billion through the new Bank Term Funding Program (BTFP) and nearly $143 billion through loans to banks set up by the FDIC to manage the resolution of SVB and Signature Bank (Exhibit 1). Low use of the BTFP may reflect the lack so far of a detailed public outline for getting access, although some banks have suggested concerns about drawing regulatory attention.

Note: * Includes loans that were extended to depository institutions established by the Federal Deposit Insurance Corporation (FDIC). The Federal Reserve Banks’ loans to these depository institutions are secured by collateral and the FDIC provides repayment guarantees.

Source: Federal Reserve H.4.1

As Bill Nelson at the Bank Policy Institute points out in a March 17 note, the loans to the FDIC’s bridge banks look the most surprising. “As far as I know,” Nelson writes,” the Fed has provided no other information on these loans. The lending itself is extraordinary and possibly unprecedented. The Fed is essentially lending to another government entity.”

Nelson speculates that the Fed is lending under Section 13(13) of the Federal Reserve Act, which allows lending to an almost unlimited set of borrowers with few restrictions.

Nelson also notes that on Monday, March 13, the FDIC drew $40 billion from the deposit insurance fund and then repaid the fund the next day. There was $128.2 billion in the FDIC fund at the end of 2022 “My guess is the Fed decided to lend to the bridge banks to keep the FDIC flush,” Nelson continues. “Any appearance that the FDIC is running out funds would not help with depositor confidence.”

Record issuance from the FHLBanks

The FHLBanks have seen record demand to borrow. The FHLBanks issued $167 billion in debt on March 13, $122 billion on March 14 and $67 billion on March 15. A substantial portion of the debt came in overnight form, which borrowers repay the next day. Gross issuance likely overstates net demand.

Most money likely invested in cash at the Fed

Total bank reserves held at the Fed for the week ending March 15 went up by $435 billion, suggesting banks put most of the funds raised from the Fed and the FHLBanks in overnight reserves at the Fed. Banks have reported anecdotally for years that regulators prefer Fed reserves over any other asset for meeting liquidity tests.

Impact of liquidity preference

The collapse of SVB and Signature Bank and the sharp uptick in bank demand for liquidity stands to have immediate impact on bank funding and asset preferences. In the short run, banks seem likely to store more liquidity at the Fed and hesitate to deploy into loans or securities. How long that liquidity preference lasts will depend on lessons drawn by bank management, boards, regulators and rating agencies in the weeks and months ahead.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.