By the Numbers

Modest signs of stress begin to emerge in CRE CLOs

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Investors on the lookout for deterioration in commercial real estate have been keeping an eye on commercial real estate collateralized loan obligations (CRE CLOs), but performance remains relatively robust. CRE CLOs are particularly credit and rate sensitive, as the collateral is comprised of bridge or transitional loans for properties that are being heavily renovated, repositioned or repurposed. The loans are floating-rate and often require interest rate caps, which has dramatically increased the cost of debt service since the Fed began hiking. But 97% of outstanding CRE CLO collateral remains current on its payments. And the 3% of loans that have missed payments are mostly in the early stages of delinquency, with outsized representation from office properties.

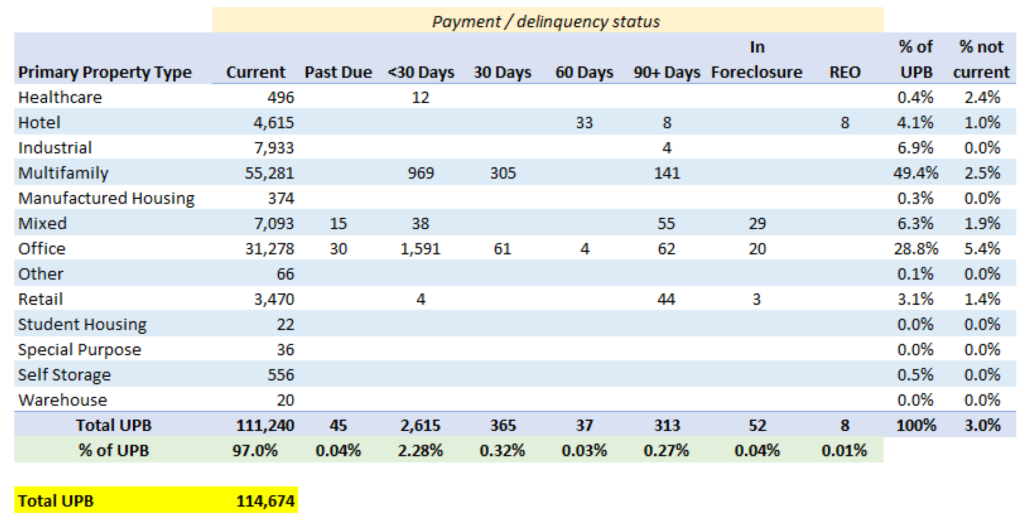

Of the $115 billion CRE CLO collateral currently outstanding, nearly half is multifamily (49%) with office being the next largest property type at 29% (Exhibit 1). Three percent of loans were not current as of their January 2023 payment, with the bulk of those loans (2.32%) past due or less than 30 days delinquent. Early stage delinquencies are dominated by office properties, where over 60% of loans past due or less than 30 days delinquent are office. Overall, 5.4% of outstanding office CRE CLO collateral is not current, compared to 2.5% of multifamily and 2.4% of healthcare properties.

Exhibit 1: CRE CLO performance weighed down by office

Note: Amounts in millions. Loans with unidentified property type were excluded. Data as of January 2023.

Source: Intex, SCIB US

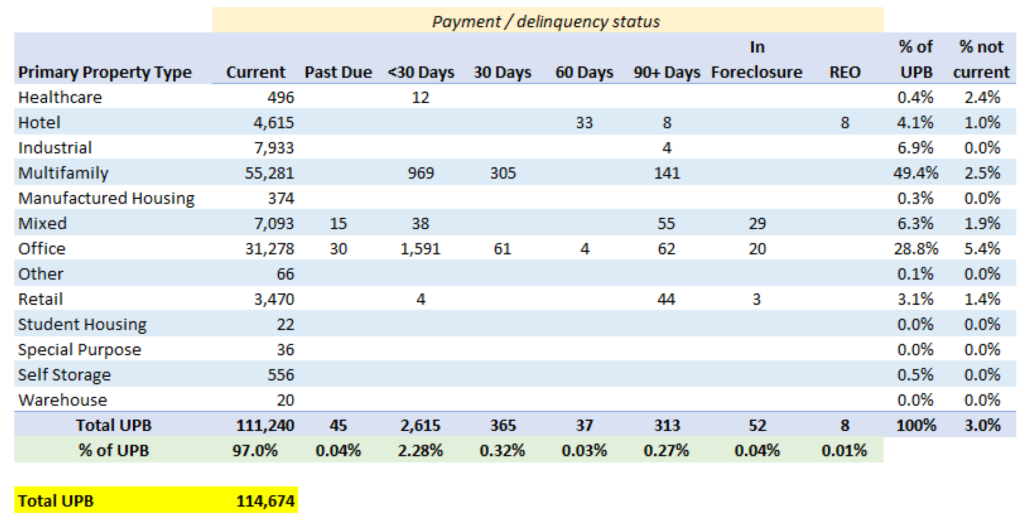

Among CRE CLOs with any delinquencies in January, the percent of collateral non-current averages 7%, with a range from a low of 1% to a high of 85% (Exhibit 2). The deals with high percentages of non-current loans tend to be seasoned deals from 2019 where a lot of the original collateral has paid off.

Exhibit 2: CRE CLO deals with non-current loans

Note: Amounts in millions. Data as of January 2023.

Source: Intex, SCIB US

It’s unclear if these CRE CLO delinquencies portend a rise in CMBS delinquencies more broadly. The current CMBS delinquency rates reported by Trepp have been stable to declining for over a year, with a CMBS delinquency rate of 2.94% in January, and multifamily delinquencies declining below 2%. However, those CMBS delinquencies are heavily skewed towards loans 60+ days delinquent, with only 12 bp of loans in the 30-day delinquent bucket.

Long-term delinquencies in CRE CLO deals are relatively rare, since delinquent or troubled loans tend to be bought out of the trust quickly by the sponsor. The sponsor typically retains the bottom 15% to 20% of principal exposure, and delinquent loans can trip credit triggers that could result in ratings downgrades. It’s to the benefit of the sponsor to buy out the loan quickly and resolve it.

The risk profile between CRE CLOs and standard CMBS also varies. Conduit CMBS is entirely fixed-rate and historically has had 10-year terms. A few recent new issue conduit deals have come as 5-year deals and more are expected, though the loans are still fixed-rate. Single-asset single-borrower (SASB) deals have historically been a mix of 5- to 10-year maturities with some fixed- and some floating-rate. However, all but one SASB deal issued in 2022 were floating rate, so the costs for those borrowers have risen as well.

The vast majority of the 3% of non-current CRE CLO loans are in the early stages of delinquency. Whether they will be brought current, obtain modifications or transition to non-performing loans is worth monitoring over the next few months, as it could be an early warning signal for CMBS credit quality more broadly.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.