The Big Idea

Alternatives for protecting earnings from lower rates

Tom O'Hara, CFA | March 3, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Banks have started reigning in some of their asset sensitivity, which is when asset coupons reset faster than liability coupons. Asset sensitivity produces strong bank earnings when rates rise, but interest income falls when rates start heading lower. Banks can reduce asset sensitivity in a variety of ways, one being to add duration to their investment portfolios.

Long duration bond portfolio alternatives

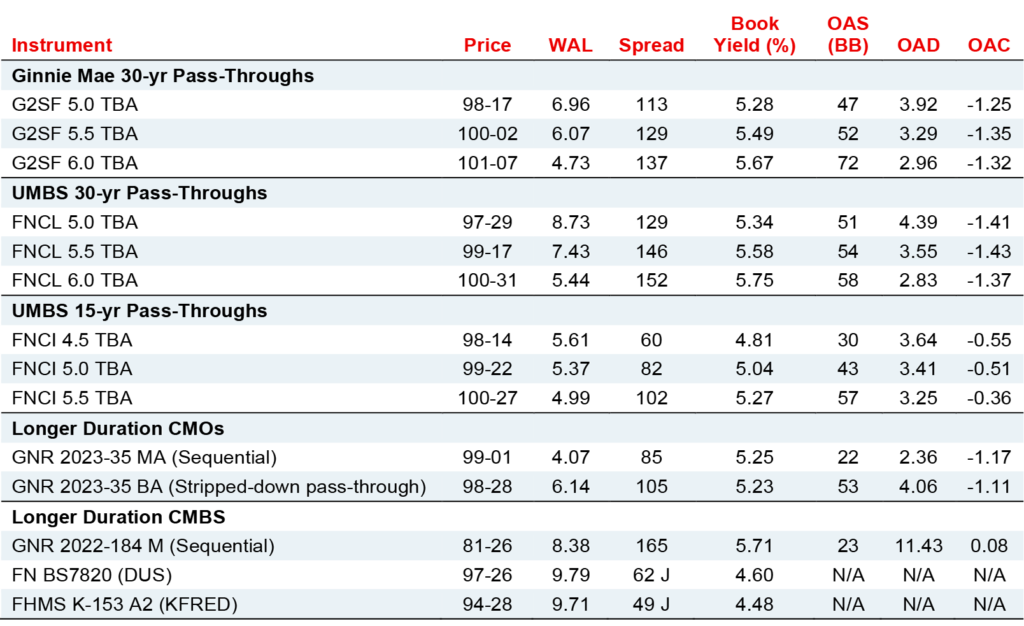

Banks looking to reduce asset sensitivity by adding longer-duration securities to their portfolios have several alternatives, each presenting some advantages and disadvantages depending on the bank’s primary objectives (Exhibit 1). For banks looking to add the most amount of duration in a hurry, the UMBS 30-year pass-through 5.0% securities have one of the longest average lives on the list but come at a relatively tight option-adjusted spread (OAS) compared to other UMBS 30-year coupons. This is also true for Ginnie Mae 30-year and UMBS 15-year securities, where the lower coupons with longer durations all have tighter OAS. Unfortunately, most of the wider OAS higher-coupon pass-throughs also come with premium dollar prices, which banks have historically avoided mostly to sidestep the accounting complexity. Therefore, banks looking to add a lot of duration dollars quickly should focus on UMBS 5.0% and 5.5% coupon pass-throughs, which have wider OAS and longer durations than their Ginnie Mae counterparts and still trade at discounts.

Exhibit 1: Long duration bond portfolio alternatives

All spreads are to the interpolated Treasury curve, mid, unless otherwise noted.

Source: Bloomberg, SCIB

An additional consideration is each securities’ regulatory capital treatment. Given the strong loan growth in 2022 that is continuing so far into 2023, most banks have seen some deterioration in their regulatory capital ratios as most loan types carry higher risk-weightings than the cash and securities banks are allowing to run-off to make space on their balance sheets. Over the past year, banks have generally favored 0% risk-weight securities such as Ginnie Mae pass-throughs to help repair their capital ratios and have been less interested in the 20% risk-weight that is typical for Fannie and Freddie securities (Exhibit 2). For the median bank in our SCIB tracking group, the allocation to 0% risk-weight Treasuries and Ginnie Mae securities increase by four percentage points. And as Ginnie Mae’s generally carry higher yields than Treasuries, Ginnie’s have broadly been the security of choice, somewhat accounting for the currently tighter OAS vs UMBS for 5.0% and 5.5% coupons. Many banks are willing to sacrifice a couple of basis points of OAS to achieve a superior capital result.

Exhibit 2: Bank portfolio allocation to 0% risk-weight securities increases by 4 percentage points in 2022

Source: S&P Capital IQ, SCIB

How to manage the increased volatility of longer duration securities

While longer-duration securities should be helpful in pushing the bank’s asset-liability management profile to a more advantageous position for a falling interest rate environment, longer-duration brings increased price volatility. As rates have gone up over the past year, securities portfolios market values have declined. While accounting classification has no impact on market value, securities accounted for as available-for-sale (AFS) have their negative marks reflected as declines in tangible capital through the Accumulated Other Comprehensive Income (AOCI) account. One way to avoid these negative capital adjustments is to instead to account for securities as held-to-maturity (HTM). In 2022, there was a significant increase in the percentage of banks’ securities portfolios that were accounted for as HTM (Exhibit 3).

Exhibit 3: Banks increase securities portfolio allocation to HTM by 12 points (median) in 2022 to protect capital going forward

Source: S&P Capital IQ, SCIB

Of course, the primary purpose of a bank’s securities portfolio is to serve as a pool of liquidity when a bank needs it. HTM accounting is quite restrictive, and the sale of any security out of HTM is usually only allowed under very specific circumstances, such as a change in regulatory policy. Otherwise, sales of HTM securities could ‘taint’ all of the securities with that designation, requiring mark-to-market on the entire position and creating strained auditor and regulator relationships for years to come.

Other strategies for decreasing asset sensitivity

In addition to buying longer-duration securities, banks employ a variety of strategies to increase their overall duration of equity to reduce asset sensitivity. Banks may look to execute a receive-fixed swap against longer-dated debt issuance to effectively convert their liability into a floating pay instrument. Similarly, banks could execute receive-fixed swaps against floating rate assets such as commercial and industrial loans, thereby converting those loans into longer duration fixed rate assets. Keeping in the derivatives space, interest rate floors could be purchased to supplement net interest income in a declining rate environment.

Recent evolution of asset sensitivity for U.S. banks

In anticipation of a possible recession, many banks started to proactively decrease their asset sensitivity in 2022 and continue to do so (Exhibit 4). This shows up in the 1-year gap-to-assets ratio, which takes the amount of assets with coupons resetting within one year less the liabilities with coupons resetting in one year divided by the bank’s total assets. The median of this ratio for this group of banks declined by 2 points in 2022 from 30 to 28, and the chart shows that the ratio was trending lower throughout the year for almost all banks in the SCIB tracking group. The higher the ratio, the higher the asset sensitivity, and the more banks will suffer lower interest income when rates fall.

Exhibit 4: 1-year gap-to-assets ratio declined by a median of 2 points in 2022

Source: S&P Capital IQ, SCIB