The Big Idea

Reserves, liquidity and QT

Stephen Stanley | February 10, 2023

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

While a number of financial market analysts have been calling for an early end to the Fed’s balance sheet reduction program, I believe that balance sheet runoff will persist for at least a couple of years. The FOMC itself has been remarkably quiet on the subject for months, but over the past few weeks, several Fed officials finally raised the topic and echoed the view that balance sheet runoff will probably continue for a long time.

Market chatter

Several money market specialists have been vocally arguing for months that the Fed will likely be forced to cut its balance sheet reduction program short, perhaps as early as the first half of 2023. The logic is that bank reserves have declined faster than expected and will soon near the minimum level necessary to support the banking sector. Any further contraction beyond that point would create stress in the money markets and dictate that the Fed reverse course and add reserves back into the banking system.

The case for a steady hand

I argued in two pieces last year that the Fed would need to reduce its balance sheet for years to get back to the appropriate level of liquidity in the financial system. In my view, calls for an early end to the Fed’s runoff schedule are misguided for at least a couple of reasons.

Bank reserves versus overall liquidity. First, the assessment of the status of liquidity levels laid out above is incomplete. It is true that bank reserves have fallen rapidly. This is the mirror image of the fact that bank deposit rates are traditionally sluggish, especially on the way up. In contrast, investors’ alternatives typically see rates move up more quickly when the Fed is raising policy rates. For example, money market funds offer a yield that roughly tracks market rates, percentage points higher currently than deposit offerings at most banks.

As a result, retail and institutional savings are flowing out of the banking system and into the nonbank portion of the financial complex. Since the beginning of June, when Federal Reserve balance sheet reduction began, bank reserves are down by over $325 billion to just over $3 trillion. Over the same period, the Fed’s reverse RP program, a proxy for excess liquidity in the nonbank sector, has actually grown by $184 billion.

The mistake that the popular view noted above makes is to focus only on the level of banking reserves, rather than to examine overall financial liquidity. The fact that the Fed is still taking in over $2 trillion every day in its reverse RP program is incontrovertible evidence that the financial system as a whole remains grossly oversupplied with liquidity.

Of course, the distribution of liquidity between banks and nonbanks is far from predetermined. If, in fact, bank reserves begin to exhibit a degree of scarcity, banks are free to bid for deposits more aggressively in an effort to maintain their reserves. Up to now, that has not proven necessary because banks have been awash in unwanted reserves. If that changes, presumably banks will work harder to stem the outflow of deposits, which would in the process tip the allocation of overall liquidity at the margin toward the banks and away from the nonbank sector.

In addition, the Fed itself has the power to influence the mix. Right now, the reverse RP rate represents one of the most attractive options available to money market funds and thus continues to attract over $2 trillion per day. The Fed could tip the scale by lowering the RRP rate that it offers. Even a tweak of a few basis points could materially alter the money market landscape. I suspect that this may be an option once the financial system gets closer to balance, but, for now, it remains necessary for the Fed to drain massive amounts of liquidity due to the still-massive size of its balance sheet.

Rate policy and balance sheet policy. There is a widespread presumption among financial market participants that balance sheet runoff must end the minute the Fed begins to reduce its funds rate target. This stems from the oft-repeated mantra from Fed officials that it would be problematic for the two main levers of monetary policy to be pushing in opposite directions at the same time.

However, this topic has mostly come up in the context of ending QE before beginning to hike rates, both in the mid-2010s and in 2021 and early 2022. Moreover, this discussion always took place in the context of a zero-rate policy stance.

The prospect of potentially cutting rates while maintaining balance sheet reduction at some point in 2024—or possibly, but not likely, 2023—is a wholly different proposition. Assuming that the Fed raises rates somewhat above 5% and then pauses for an extended period, the stance of policy will be considerably restrictive. At some point, inflation will hopefully recede by enough to allow the Fed to reduce the degree of restrictiveness. That first move and the next several after that would not be accurately characterized as “easing,” but as a reduction in the extent of tightness.

Depending on the economic context, it would be perfectly reasonable for the Fed to continue normalizing the balance sheet while at the same time bringing the funds rate target back down toward a neutral stance. Of course, if the economy is plunging into a deep recession, dictating an aggressive Fed response, balance sheet policy would need to fall into line. Nevertheless, as long as the economy is muddling through and particularly if there is no prospect of a return to zero rates, then there is no compelling reason that the Fed could not continue to reduce the size of its balance sheet at the same time that it is bringing the funds rate down to a less restrictive level.

Balance sheet update

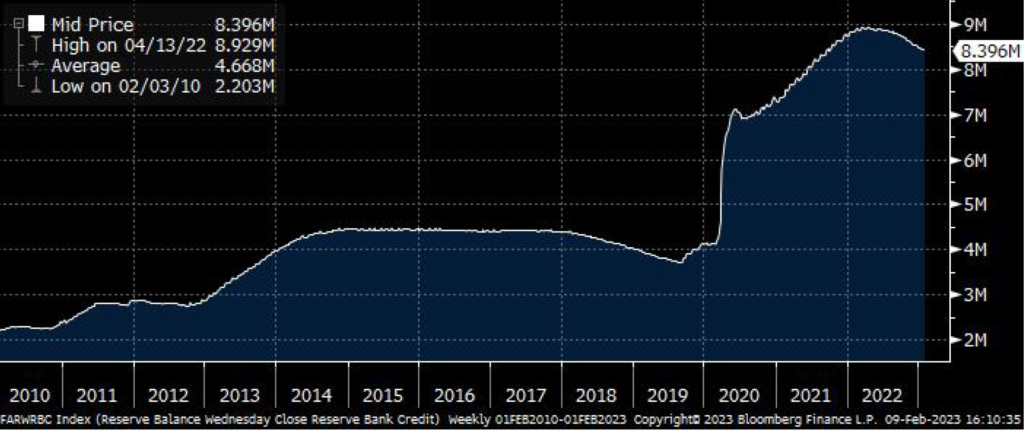

Total size. The normalization of the Fed’s balance sheet began in June, and progress so far has been limited. After pumping up its balance sheet by nearly $5 trillion from the end of 2019 to early 2022, the Fed has managed to reduce the size by less than $500 billion in eight months, from $8.9 trillion to $8.4 trillion (Exhibit 1).

Exhibit 1: Federal Reserve balance sheet

Source: Federal Reserve via Bloomberg.

Assuming that the Fed’s balance sheet was about the proper size at the end of 2019 (at which time, it was just over $4 trillion), the economy would have needed about 7.5% growth in bank reserves a year just to get to $5 trillion for the current appropriate size of the balance sheet. So, the current reading, at $8.4 trillion, is certainly still trillions of dollars too large, even if you believe, as some analysts do, that bank reserves are nearing the necessary level.

Composition. In addition to the absolute size of the balance sheet, the Fed is also struggling with the composition of its securities portfolio. Shrinking the Treasury portfolio is straightforward, as the Fed knows exactly how much it has maturing at each settlement data. Given how it has structured its runoff strategy, the Fed can mechanically hit its $60 billion runoff target every month for the foreseeable future until it exhausts its remaining $285 billion bill portfolio. That’s $720 billion per year, off of a current size of about $5.4 trillion.

The MBS holdings are more problematic. The Fed does not control the pace of runoff. And, predictably, with mortgage rates having soared due to the Fed’s rate hikes, prepayment speeds have plunged. The FOMC set a maximum pace of runoff of $35 billion per month, but it is not even coming close to that clip. Over the eight months of balance sheet runoff, the Fed’s MBS holdings are down by a grand total of less than $100 billion and currently sit at $2.62 trillion.

In the fall, the Fed was reaching about $20 billion per month in MBS runoff. That has declined to around $17 billion in the past two months. It appears that prepay speeds may continue to fall, so that the pace of MBS runoff may decline further going forward.

The problem here for the Fed, aside from the slower pace of overall runoff that this yields, is that policymakers seek to return their portfolio to Treasuries-only over time. However, it is shedding the type of securities that it ultimately wants to hold on to at a rapid pace, while it is struggling to offload the ones that it most wants to get rid of.

There has been very little discussion of selling MBS outright as of yet, and Chair Powell noted recently that it was not under active debate. I am not sure that the Fed would ever do so, but the more passive runoff slows, the stronger the case for outright sales becomes.

What Fed officials have said

After months of complete silence from the Fed, three Fed officials addressed the topic in January, and their comments support the view that balance sheet runoff will continue for the foreseeable future. Here is what they said:

Lorie Logan, Dallas Fed President (Logan ran the Fed’s portfolio at the New York Fed prior to taking the top job in Dallas, so she is especially well-versed on the balance sheet):

“Bank reserves are currently far more than ample. And more than $2 trillion of excess liquidity is parked in our overnight reverse repo facility. If we saw some modest money market rate pressures in this environment, I would not interpret it as a sign that liquidity is scarce. It would simply be an incentive for banks to redistribute liquidity where it’s needed.

The process of redistribution from the overnight reverse repo facility to banks won’t necessarily be perfectly smooth. Banks can’t perfectly predict deposit outflows. But over time, if a bank sees reserves fall lower than it would prefer, it can attract more funding by increasing the rates it pays on deposits or wholesale borrowing. I think it is important to allow markets to work to redistribute liquidity in this way, so that the FOMC can reduce the balance sheet to an efficient size. In addition, the Fed’s Standing Repo Facility (SRF) provides a backstop against excessive interest rate pressures or shortfalls in reserves. I would be comfortable seeing some temporary usage of the SRF while balances in the overnight reverse repo facility remain high, as part of the process of redistributing liquidity.

With the SRF as a backstop and the power of market incentives to redistribute liquidity, I am confident that we have room to continue running off our assets for quite some time.”

John Williams, New York Fed President:

According to a Market News story, “The Federal Reserve’s balance sheet reduction program is expected to continue despite bank reserves falling faster than expected to around USD3 trillion, New York Fed President John Williams said Thursday.

The roughly USD2 trillion deposited in the Fed’s overnight reverse repo facility will act as a buffer as demand for reserves fluctuate, he said.”

Chris Waller, Fed Governor:

“We have the standing reverse repo facility and every day firms are handing us over $2 trillion in liquidity they don’t need. They give us reserves, we give them securities. They don’t need the cash. It sounds like you should be able to take $2 trillion out and nobody will miss it, because they’re already trying to give it back and get rid of it.”