By the Numbers

An overhang of aging warehouses should leave CLO spreads soft

This material is a Marketing Communication and does not constitute Independent Investment Research.

New issue CLO spreads have continued to soften in October, and the overhang of aged CLO warehouses may be a factor. Twelve broadly syndicated CLOs priced so far this month at a median ‘AAA’ spread of 218 bp over SOFR, 18 bp wider than the median level in September. New issue spreads may stay weak until investors see signs of easing in aged warehouses.

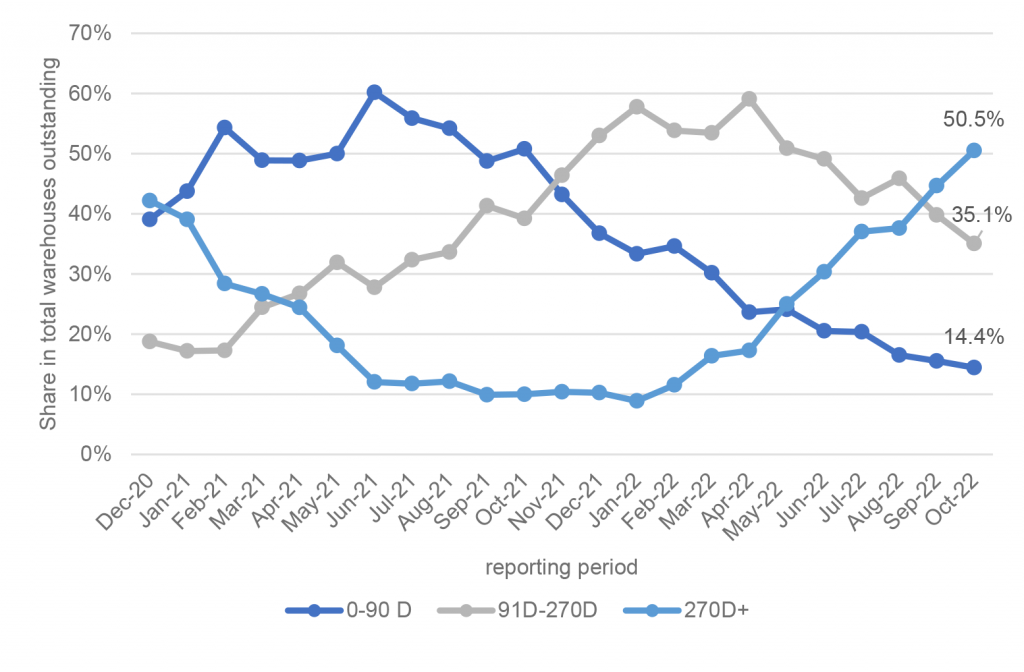

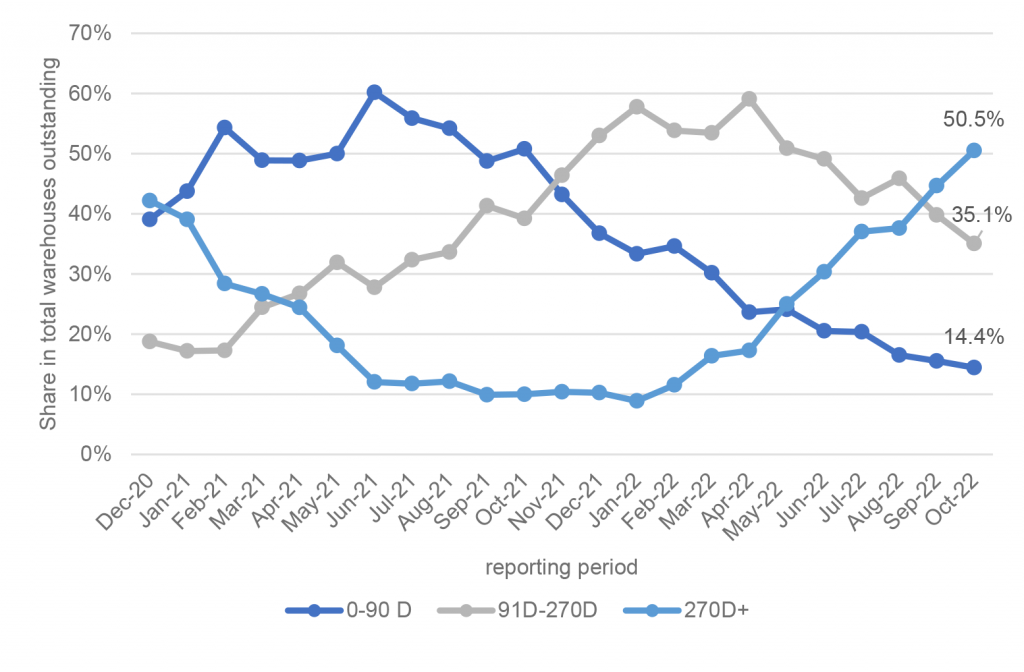

Over 50% of warehouses were open for more than nine months at the end of 3Q

The number of outstanding warehouses has been declining since the spring, but the average age of warehouses continues to climb. According to the US Bank, the number of warehouses under its administration decreased to 97 in September from 103 a month ago, but 49 warehouses or 50.5% have been open for more than nine months. By contrast, only eight warehouses, or 9% were aged more than nine months at the beginning of the year (Exhibit 1).

Exhibit 1. Aged warehouses continue to build up

Note: Share represents the number of warehouses in each age bucket over the total outstanding warehouses. Warehouse data is shown for the reporting month, reflecting activity in the prior month. Data reflects warehouse lines administered by US Bank only. The estimated U.S. Bank market share is around 50%-52%.

Source: US Bank, Amherst Pierpont Securities

The rising share of aged warehouses implies a growing number of CLO deals may be stuck. The current market price of loans in aged warehouses are likely lower than the purchase price, especially those purchased at the beginning of the year. With leveraged loan prices down 6.7% this year, lenders to aging warehouses face mounting credit and market risk may eventually pressure managers for an exit strategy. CLO managers have a few options:

- Liquidate loans in the market and end the warehouse relationship

- Inject fresh equity capital to the aged warehouses

- Negotiate for a warehouse maturity extension

- Do a CLO takeout with an affordable structure

Since most warehouses today do not have mark-to-market triggers, this may be the least likely option a manager will choose. A lender-forced warehouse liquidation could weigh on already beaten-down leveraged loan prices. More importantly, it is credit negative news to investors and may push spreads wider on all of a manager’s outstanding CLOs.

Equity injection becomes an expensive option for managers. For example, a 90% advance rate in a $200 million warehouse will require $20 million initial equity capital. The advance rate in warehouses is usually set as a percentage of the lower purchase price and market price. If the market price of loans dropped by 7% from par, a manager needs to put in an additional $12.6 million equity capital into the warehouse.

That leaves the possibility of negotiating for a maturity extension. The success of the negotiation highly depends on the relationship between lenders and managers as well as both parties’ outlook on the market. However, maturity extension does not solve the overhang problem but only kicks the can down the road.

A CLO takeout remains the ultimate solution for managers to clear their warehouses. In the primary market, investors have already demanded higher spread concession this year under the rising risk of recession, not to mention if a CLO were packed with all underwater loans. The rising share of aged warehouses implies to investors a wave of CLOs may have to tap the market as those warehouses approach maturity. And that supply overhang will only weigh on demand in the primary market and push spreads out further. Since managers may have little power in setting spread levels this year, they work on the structure to keep the arbitrage working. For example, the primary market has seen a rising share of static CLOs. A static CLO helps managers to reduce liability costs as the ‘AAA’ tranche will amortize after the deal closes.

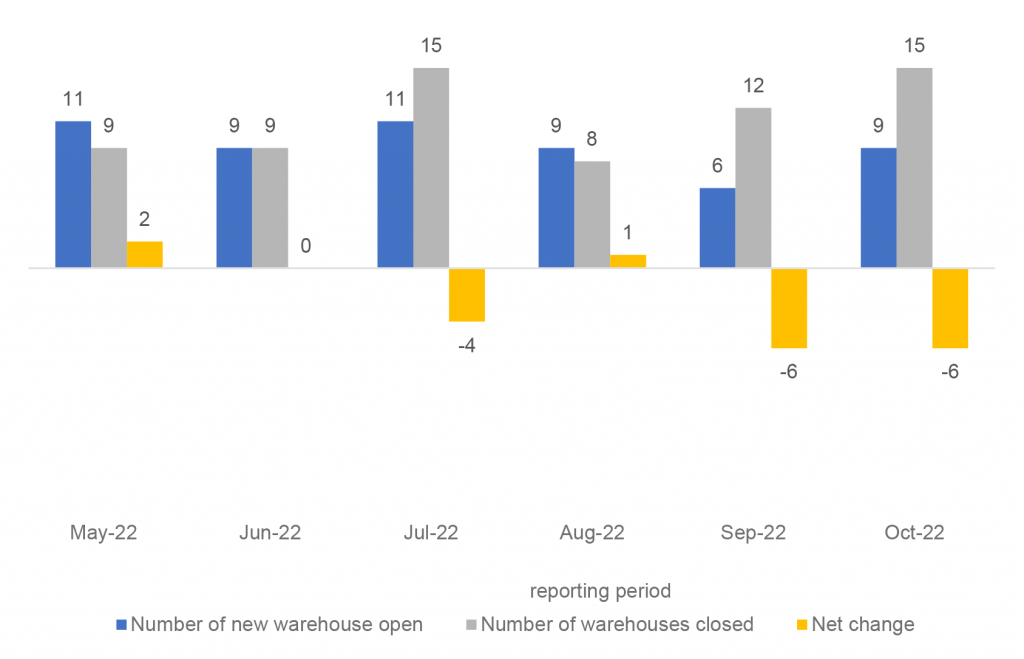

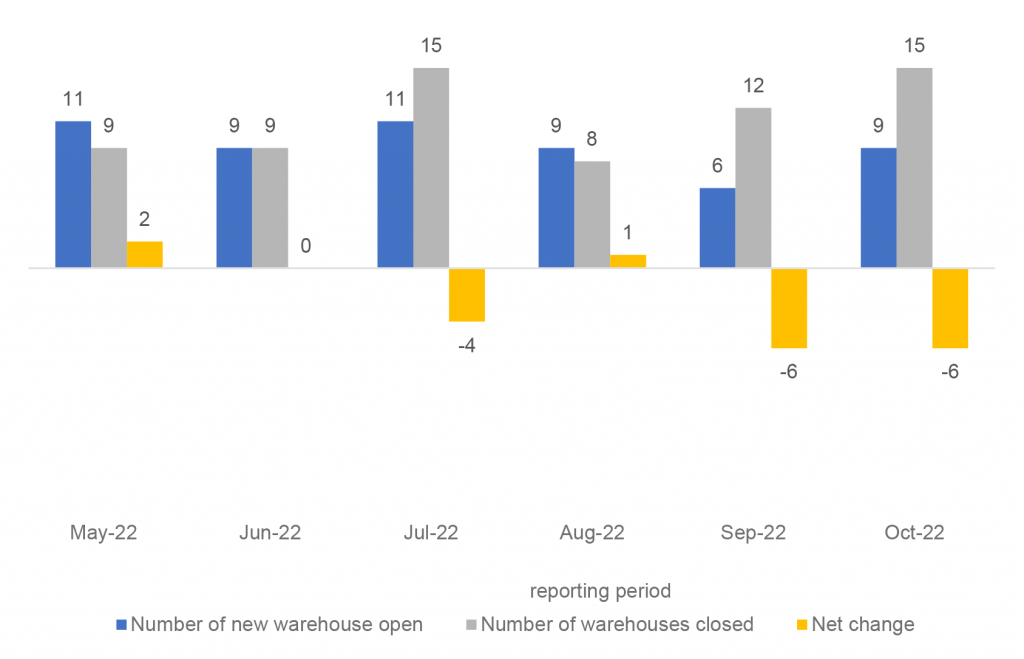

Warehouses closed out for CLOs may be younger warehouses

The average number of new warehouses opened each month has been around nine since the spring. But the number of warehouses rolling off into CLOs picked up recently, causing the overall decline of the outstanding warehouses. For example, nine new warehouses opened in September but 15 were closed, a net change of six, according to the US Bank data (Exhibit 2). Most warehouses closed out for CLOs may be the young warehouses, part of the reason for the rising share of aged warehouses.

Exhibit 2. The number of warehouses closed outpaced warehouses opened

Note: Warehouse data is shown for the reporting month, reflecting activity the month before. Data reflects only warehouse lines administered by US Bank. The estimated U.S. Bank market share is around 50%-52%.

Source: US Bank, Amherst Pierpont Securities

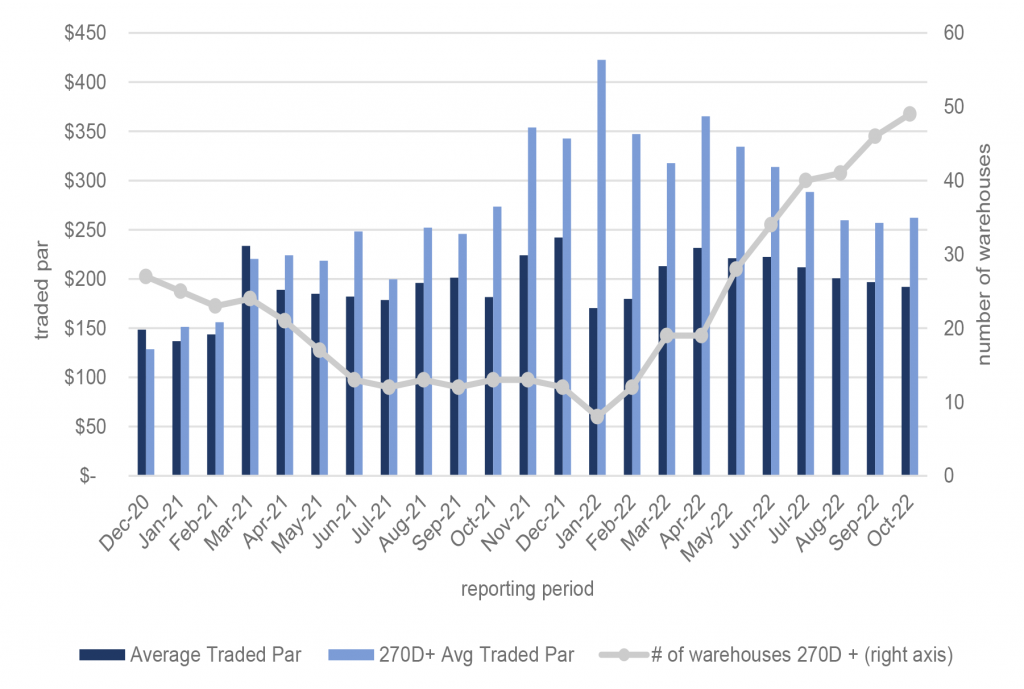

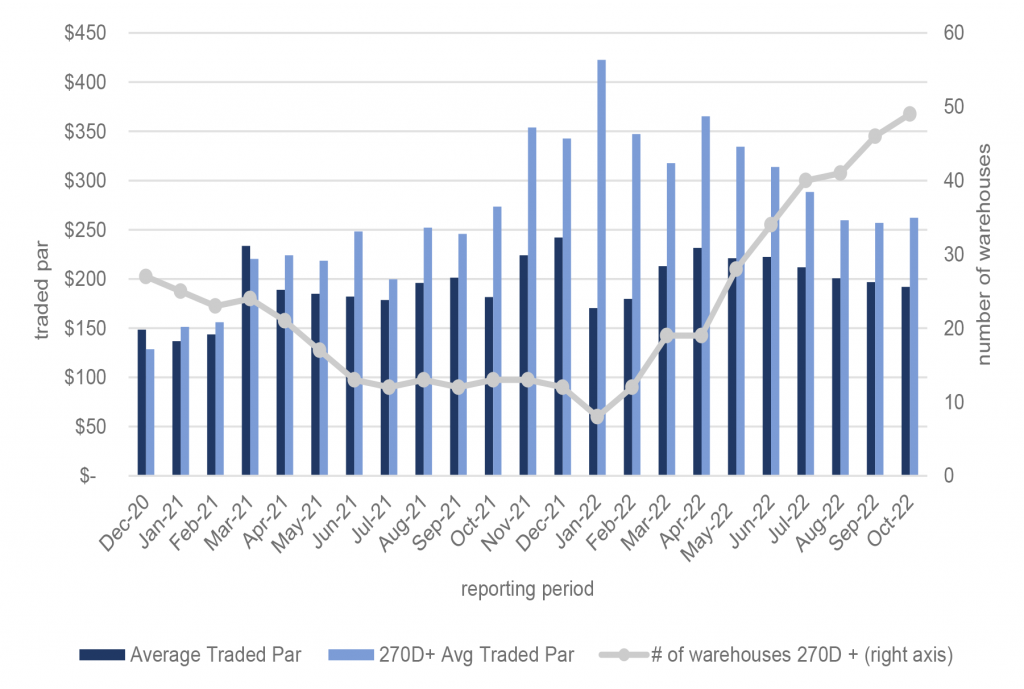

Trading activities may indicate a close to fully built portfolio in the aged warehouses

The average trading activity in the 49 warehouses aged more than nine months went up 2% month-over-month to $262 million in September but was a 9% decline quarter-over-quarter (Exhibit 3). The average traded par in all outstanding warehouses was $192 million as of September, a 9.4% quarter-over-quarter decline as well. Traded par often rises as a CLO ramps up a portfolio and falls after a portfolio is fully built. Once a warehouse is fully built, the pressure for CLO takeout mounts on the manager.

Exhibit 3. The average trading activities in warehouses have been declining

Note: Warehouse data is shown for the reporting month, reflecting activity the month before. Data reflects only warehouse lines administered by US Bank.

Source: US Bank, Amherst Pierpont Securities

During the pandemic, the share of warehouses aged nine months or more was 39% in the third quarter of 2020 and 42% in the fourth 2020, both lower than today’s 50.5% level, according to the US Bank. The potential wave of supply from the aged warehouses coupled with investors’ recession concerns will stretch the already weakened investors’ demand this year and may keep CLO spreads on the soft side.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2026 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.

Important disclaimers for clients in the EU and UK

This publication has been prepared by Trading Desk Strategists within the Sales and Trading functions of Santander US Capital Markets LLC (“SanCap”), the US registered broker-dealer of Santander Corporate & Investment Banking. This communication is distributed in the EEA by Banco Santander S.A., a credit institution registered in Spain and authorised and regulated by the Bank of Spain and the CNMV. Any EEA recipient of this communication that would like to affect any transaction in any security or issuer discussed herein should do so with Banco Santander S.A. or any of its affiliates (together “Santander”). This communication has been distributed in the UK by Banco Santander, S.A.’s London branch, authorised by the Bank of Spain and subject to regulatory oversight on certain matters by the Financial Conduct Authority (FCA) and the Prudential Regulation Authority (PRA).

The publication is intended for exclusive use for Professional Clients and Eligible Counterparties as defined by MiFID II and is not intended for use by retail customers or for any persons or entities in any jurisdictions or country where such distribution or use would be contrary to local law or regulation.

This material is not a product of Santander´s Research Team and does not constitute independent investment research. This is a marketing communication and may contain ¨investment recommendations¨ as defined by the Market Abuse Regulation 596/2014 ("MAR"). This publication has not been prepared in accordance with legal requirements designed to promote the independence of research and is not subject to any prohibition on dealing ahead of the dissemination of investment research. The author, date and time of the production of this publication are as indicated herein.

This publication does not constitute investment advice and may not be relied upon to form an investment decision, nor should it be construed as any offer to sell or issue or invitation to purchase, acquire or subscribe for any instruments referred herein. The publication has been prepared in good faith and based on information Santander considers reliable as of the date of publication, but Santander does not guarantee or represent, express or implied, that such information is accurate or complete. All estimates, forecasts and opinions are current as at the date of this publication and are subject to change without notice. Unless otherwise indicated, Santander does not intend to update this publication. The views and commentary in this publication may not be objective or independent of the interests of the Trading and Sales functions of Santander, who may be active participants in the markets, investments or strategies referred to herein and/or may receive compensation from investment banking and non-investment banking services from entities mentioned herein. Santander may trade as principal, make a market or hold positions in instruments (or related derivatives) and/or hold financial interest in entities discussed herein. Santander may provide market commentary or trading strategies to other clients or engage in transactions which may differ from views expressed herein. Santander may have acted upon the contents of this publication prior to you having received it.

This publication is intended for the exclusive use of the recipient and must not be reproduced, redistributed or transmitted, in whole or in part, without Santander’s consent. The recipient agrees to keep confidential at all times information contained herein.