By the Numbers

Look for floating-rate CMBS backed by stronger properties

Mary Beth Fisher, PhD | September 30, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Commercial real estate CLOs and single-asset-single-borrower deals are among the best options for investors looking for a combination of commercial real estate exposure, yield, duration and expected performance, even in a modest downturn in the economy. CRE CLOs and SASB deals allow investors to avoid the volatility of long-duration, fixed-rate securities while the Fed is raising rates and focus on property types with more ability to withstand a down cycle.

CRE CLOs: wider spreads but favorable exposure to multifamily

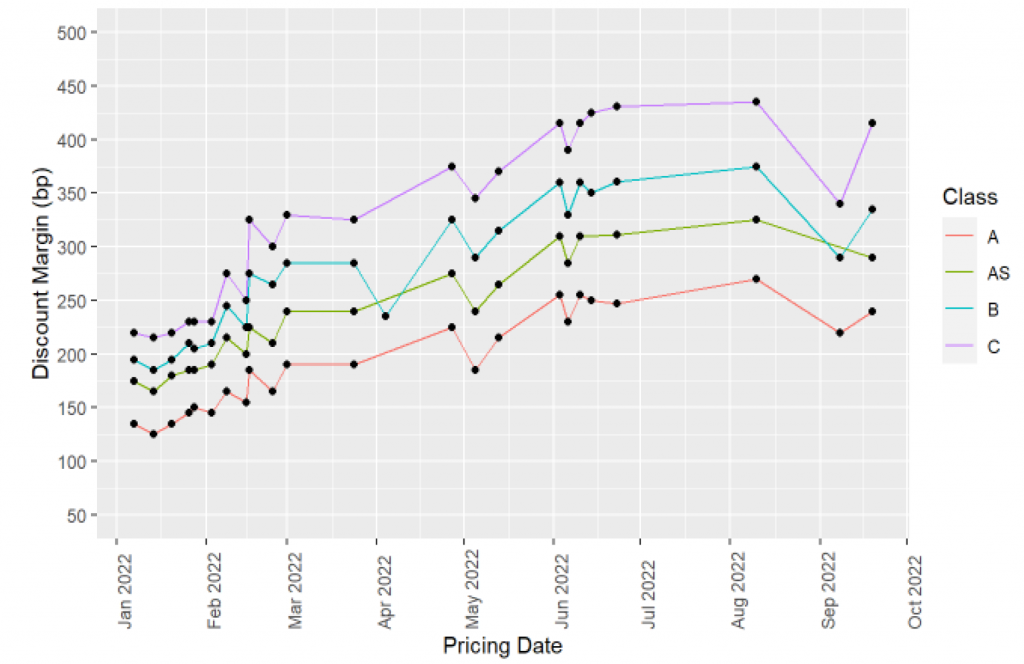

The new issue market for all types of commercial mortgage-backed securities slowed during the summer and then mostly evaporated in late September as rate volatility increased and spreads widened, and issuance of CRE CLOs has been especially thin. Only three new issue CRE CLO deals have priced since the end of June, though discount margins seemed to be consolidating at the early summer levels across ‘AAA’ to ‘A’ classes (Exhibit 1).

Exhibit 1: New issue CRE CLO spreads (‘AAA’ to ‘A’ classes)

Note: Discount margins on date of new issue pricing. Benchmark rate is either 1-month term or 30-day compound average SOFR.

Source: Bloomberg, Amherst Pierpont Securities

Only one of the three deals issued since June included pricing of ‘BBB’ to ‘BB’ tranches, and the issuer likely retained those classes (Exhibit 2). The published pricing indicates a significant tightening in the discount margin of the D and E classes. With 1-month term SOFR currently just above 3.00% and projected to rise as the Fed continues to raise rates, the coupons on some recently issued ‘BBB’ CRE CLOs are running between 7% and 8%.

Exhibit 2: New issue CRE CLO spreads (‘BBB’ to ‘BB’ classes)

Note: Discount margins on date of new issue pricing. Benchmark rate is either 1-month term or 30-day compound average SOFR.

Source: Bloomberg, Amherst Pierpont Securities

There is some additional risk in owning CRE CLOs versus other products in the CMBS universe, as the properties are in transition. They are typically undergoing a substantial renovation, repositioning or repurposing. However, according to the latest Commercial Real Estate Finance Council (CREFC) Update on CRE Debt Marketplace:

“Of the outstanding CRE CLO universe, over 65% consists of loans secured by multifamily, many of which are older, naturally occurring affordable housing (NOAH) properties that accommodate lower-income tenant.”

The fundamental outlook for multifamily is very strong over the next five to 10 years given the longstanding issue of underbuilding. And the affordable sector of multifamily has by far the largest shortfall in supply. Even during a downturn, this overweight of multifamily should temper any potential losses in affected CRE CLO deals from this particular exposure.

Spreads in SASB vary across property types

The discount margins (DM) for single-asset, single-borrower deals vary by property type (Exhibit 3), with industrial, self-storage and multifamily properties typically being the tightest. The discount margins on recent new SASB issues for these stronger property types have been around 400 bp for the usually ‘BBB’ D tranche. Retail and hospitality properties have the widest DMs at issue, and neither has seen a SASB deal come to market since late spring (retail) or early summer (hospitality). Both sectors face the double whammy of having been badly hurt during the pandemic, and also tend to be among the worst performers during economic downturns.

Exhibit 3: New issue SASB spreads (BBB rated D class)

Note: Discount margins on date of new issue pricing. Benchmark rate is either 1-month term or 30-day compound average SOFR. Deals where property type is either mixed use or not identified are not included.

Source: Bloomberg, Amherst Pierpont Securities

The underlying collateral for SASB deals is a loan for a single property, or a portfolio of properties owned by the same borrower. These are typically institutional borrowers with significant capital resources, and the assets tend to be high quality, trophy properties. That is one reason why recent SASB deals backed by office properties have come at very tight levels despite the downturn in the sector—trophy office continues to do quite well.

SASB classes that are equivalently rated to CRE CLO classes tend to have a bit more credit enhancement across the stack (Exhibit 4). The average discount margins are in the same range, but again, this varies a lot by property type for SASB deals. Both CRE CLOs and these floating-rate SASBs have had yields ranging from 5.50% for ‘AAA’ classes to 7.50% for ‘BBB’ tranches as of mid-September. Those DMs have likely widened out over the past two weeks.

Exhibit 4: Comparison of CRE CLO and floating-rate SASB new issues

Note: Discount margins on date of new issue pricing. Benchmark rate is either 1-month term or 30-day compound average SOFR. The D and E classes of the CRE CLO priced 9/8/2022 were likely retained by the issuer.

Source: Bloomberg, Amherst Pierpont Securities

CRE CLOs and SASB deals help investors get commercial real estate exposure without picking up significant interest rate exposure, too. Spreads look attractive, and significant multifamily exposure in CRE CLOs should strengthen the prospects for good credit. SASB has become largely a market for trophy properties, and that should help credit, too.