The Long and Short

CVS continues expanding beyond retail pharmacies

Meredith Contente | September 9, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

CVS Health Corporation (CVS) recently announced that it would be acquiring Signify Health Inc. The deal further expands CVS’ reach beyond traditional brick-and-mortar pharmacies into more diversified health services, complementing its 2018 purchase of Aetna. The acquisition will be leverage neutral and should not impact CVS’ current Baa/BBB ratings. Recent weakening of CVS paper relative to healthcare peers, which could be exacerbated during the heavy new issue cycle in September, should be considered a buying opportunity.

The all-cash, $8 billion deal is expected to close by June 2023 and is considered leverage neutral as CVS plans to finance the deal with its strong cash position. The deal is not expected to have any ratings impact as the use of cash underscores management’s commitment to its ratings. Any overall spread widening experienced with the influx of new issue activity post Labor Day Weekend would be considered a better buying opportunity for the CVS credit. The CVS curve has weakened relative to its BBB Healthcare peers particularly in the front end and back end of the curves over the past month (Exhibit 1). AET 2.8% 6/15/23 bonds are currently yielding 3.9% which we view as attractive for 9-month paper.

Exhibit 1. CVS Spread Curve vs. Health Care BBB Curve (Now vs. Month Prior)

Source: Bloomberg TRACE; APS

Who is Signify Health?

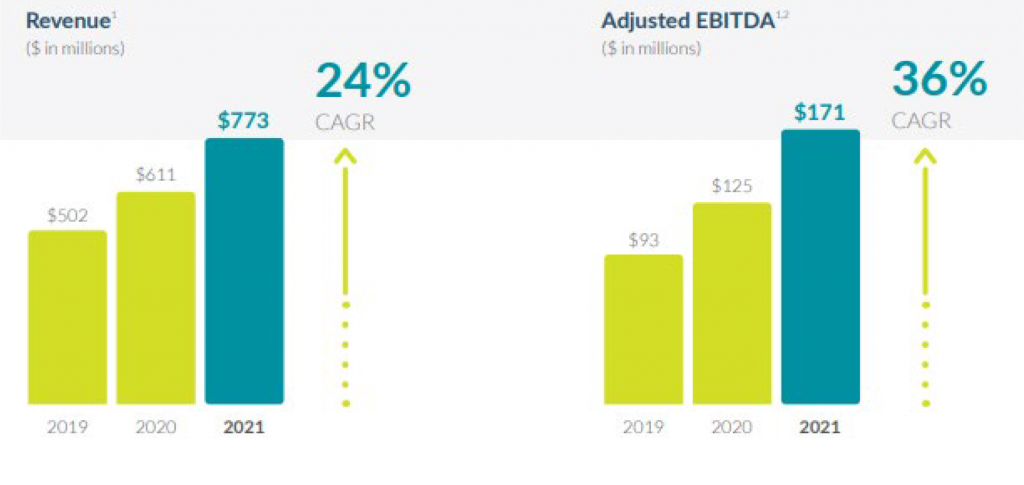

Signify Health Inc. (SGFY) was created to include the home as part of the health care continuum, moving away from the traditional facilities-based view, while creating value-based payment programs. Through SGFY’s platform, they coordinate a suite of clinical, social and behavioral services to address healthcare needs, all from the comfort of an individual’s home. This helps to prevent adverse events that drive up healthcare costs, especially for the elderly and those with compromised immune systems. SGFY maintains a network of over 10,000 clinicians (physicians, nurse practitioners and physician assistants) and completed close to 2mm in-home evaluations in 2021. SGFY has witnessed explosive growth through the pandemic, with revenues and adjusted EBITDA up 24% and 36%, respectively, on a 3yr CAGR basis (Exhibit 2). Over the same time-period, they witnessed a CAGR of 33% for in-home evaluations.

Exhibit 2. Signify Financial Highlights

Source: Company Presentation; APS

Terms of the Deal

CVS will acquire SGFY’s stock for $30.50/share, which translates to a transaction value of roughly $8bn. CVS noted that they expect to fund the transaction with cash on hand and remain committed to their current IG ratings. The deal is considered leverage neutral given that CVS will fund with existing cash and the fact that SGFY was in a net cash position at the time of the deal announcement. CVS had more than enough cash on the balance sheet as it ended the most recent quarter with nearly $15bn of cash on hand. The transaction has been approved by the Board of Directors of both CVS and SGFY. The deal remains subject to approval by a majority of SGFY shareholders as well as regulatory approval. CVS has noted that private equity funds that are affiliated with New Mountain Capital, which owns roughly 60% of SGFY’s common stock, have agreed to vote in favor of the transaction. The deal is expected to close in 1H23.

S&P Weighs In

Shortly after the announcement, S&P noted that the deal would not affect CVS’ current BBB rating or its positive outlook. The agency also noted that the deal is within its expectations for CVS to broaden into more diversified health care services while enhancing its connection to customers at home. CVS’ adjusted leverage at then end of 6/30/22 was 2.7x, below the company’s target of low 3.0x, giving them flexibility to pursue deals. The fact that they are using cash to fund the acquisition underscores management’s commitment to the current ratings. CVS management has noted that they plan to deploy about $10bn in fiscal 2022 to pursue M&A, which could all be funded with cash on hand. S&P has noted they will be monitoring management and their strategy moving forward relating to M&A. Results year-to-date have been solid and the agency expects the back half of the year to continue to be stable for CVS, supporting its ability to further pursue smaller M&A transactions without compromising the balance sheet.