The Long and Short

Good results, a focus on cutting debt at CVS

Meredith Contente | August 5, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

CVS posted better-than-expected second quarter results with double-digit top line growth in both its pharmacy services and health care benefits businesses. The rise of new Covid variants has led to increased testing, including OTC tests, and an uptick in vaccinations, both running higher than the company previously forecasted. The strong performance allowed the company to increase full-year guidance once again. The long end of the CVS curve looks like the best relative value.

Management has remained focused on bringing leverage to its low 3.0x target, with continued debt reduction. Leverage is now within the company’s target range and while CVS should continue looking for M&A opportunities, if none materialize, management should continue to direct a portion of free cash flow to reduce debt further.

While the best peer comp for CVS is Walgreens Boots Alliance Inc. (WBA – Baa2 (n)/BBB), it makes sense to track CVS relative to The Kroger Company (KR – Baa1/BBB), too. While spreads have widened and curves have flattened over the past year, CVS’ curve has historically been trading through KR’s curve. The back end of KR’s curve has tightened, and now trades through CVS. For those who can add duration, the best relative value is in CVS long-dated bonds (Exhibit 1).

Exhibit 1. CVS vs. KR Yield Curves

Source: Bloomberg TRACE; APS

Double-Digit Top Line Growth

CVS posted consolidated revenue growth of 11% in the quarter which reflected growth across all business lines. The Pharmacy Services unit (CVS’ largest business line), witnessed strong top line growth of 11.7%, reflecting increased pharmacy claims volume (up 3.9%), brand inflation and growth in specialty pharmacy. Specialty pharmacy saw very strong revenue growth of 21%, largely due to new business wins. The Health Care Benefits segment also witnessed double-digit top line growth of 10.9%, driven by growth across all product lines. Medical membership was up 3.8% to 24.4 million, with the biggest increase witnessed in the Government line (up 8.8% to 7.4 million). Importantly, the Medical Benefit Ratio expanded 120 bp to 82.9%, reflecting medical cost trends the remain modestly favorable versus management’s pricing assumptions. Commercial medical cost trends are now in line with pre-pandemic levels while government cost trends are just slightly below pre-pandemic levels. The Retail/LTC unit saw 6.3% revenue growth due to increased prescription and front store volumes, which have included the sale of OTC Covid test kits.

Full-Year Guidance Raised Again

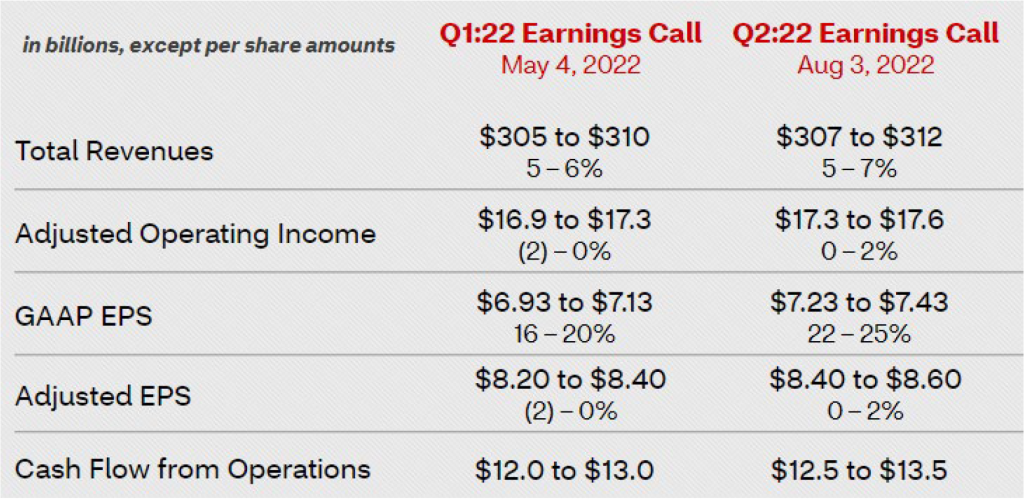

Given the strong performance, management raised full-year guidance once again for revenues, adjusted operating income and adjusted EPS. Additionally, management raised guidance for cash flow from operations this quarter. Total revenues are now expected to be in the $307 to $312 billion range, translating to growth of 5%-7%. This is up from original guidance of 4%-6% growth, and up from the 5%-6% growth forecasted last quarter. Adjusted operating income is now being guided to the $17.3 to $17.6 billion range, or flat to up 2% year-over-year. At year end, CVS had expected adjusted operating income to be down in the 1%-4% range. Last quarter it had revised that guidance to be flat to down 2%. Adjusted EPS is now expected to be in the $8.40-$8.60 range which is $0.20 higher than guidance provided last quarter and $0.30 higher than guidance issued at year-end. Cash flow from operations will now be in the $12.5 to $13.5 billion range, up $500 million from previous forecasts. Management kept capital expenditures unchanged which bodes well for the free cash flow line.

Exhibit 2. CVS Updated Guidance

Source: Company Presentation; APS

Debt Reduction Continues – Liquidity Strong

CVS paid down $1.5 billion of long-term debt in the quarter, bringing its total net debt reduction since the close of the Aetna (AET) acquisition to $22.5 billion. We estimate that lease-adjusted leverage at the end of the second quarter stood at 3.2x. Subsequent to quarter-end, CVS redeemed AET’s 2.75% notes due 11/15/22 ($1.0 billion) and announced shortly before its earnings release that it will be redeeming both the 2.75% and 4.75% notes that are set to mature on 12/1/22, for an additional pay down of $1.65 billion. Based on the additional debt reduction, leverage should drop roughly another tick to 3.1x.

CVS ended the quarter with just under $15 billion of cash and equivalents, which means that post the additional debt reduction, its cash position remains a very strong $12.35 billion. CVS also maintains three separate revolvers that are each $2 billion in size and remain untapped, adding $6 billion of extra liquidity. CVS only has one bond maturing in 2023, $1.25 billion due on 12/5/23, putting them in a very favorable position to not have to tap the debt market should interest rates continue to rise.