The Long and Short

A tough June sets up perhaps a better July

Dan Bruzzo, CFA | July 8, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

After modest gains in May, the investment grade corporate bond index headed south again in June, producing the third worst month of excess returns so far this year at -1.78%. Aggregate OAS widened 25 bp and total return for corporate bonds was -2.80% for the month as rates continued to rise. US investment grade bond funds saw nearly $26 billion in outflows in June. Higher beta credit took the hardest hit, and few parts of the Index escaped the punishment to risk assets throughout the month.

We are not making any changes to our sector relative value views this month. The graphic below provides a summary of how APS expects sectors within the IG Index to perform for the next several months on an excess return basis (total return net of commensurate UST return). These suggestions serve as a proxy for how we recommend that portfolio managers should position their holdings relative to the broad IG corporate bond market. The relative value recommendations consider a six-month time horizon.

Exhibit 1. APS Sector Recommendations for June 2022

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

Color = recommendation: Green – undervalued, Red – overvalued, Yellow – neutral

Size = Market Value within the IG Index

Exhibit 2. Monthly Excess and Total Returns for the IG Index

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

The anatomy of this month’s sell-off was not particularly surprising given the broad markets’ collective aversion to risk assets. Higher beta credit suffered the worst of the losses with low-BBB corporate bonds registering a massive -2.46% excess return for the month on 40 bp of aggregate spread widening. Communications (-2.60% excess return) produced the single worst performance by sector, followed by basic industry (-2.54%), finance companies (-2.19%)—which saw a staggering +61 bp in OAS widening for June—energy (-2.11%) and insurance (-1.96%). There were not many places to hide by sector, but those areas that saw greater resistance to the broad sell-off included: utilities (-1.45%), banking (-1.50%), consumer cyclical (-1.58%), technology (-1.60%), and surprisingly REITs (-1.71%). Within the finance companies segment, business development companies (BDCs) continue to serve as among the most sensitive areas of credit; while on the other end of the spectrum, universities and medical centers are among the defensive credits, albeit in limited volume.

Although the League tables for investment grade corporate bond issuance read $136 billion for the month of June, just below last year’s figure, the actual volume for true corporate bond issuance was closer to $70-75 billion, which fell well short of the roughly $90 billion in estimates for the month. Borrowers stood down and delayed their debt issuance needs amidst the heightened global volatility that kept demand for paper at bay. The last three weeks of the month produced just $25 billion in total volume, including a very rare week with zero issuance. Expectations for July remain extremely muted with consensus estimates around $80 billion for the typically, seasonally slow month. A reversal in sentiment could obviously surprise to the upside if some of the issuers that remained on the sidelines in June choose to revisit their postponed deals.

Exhibit 3. Gross and Net Supply Recap

Source: Bloomberg LP, LEAG Tables, new debt and maturity SRCH

Exhibit 4. Annual IG Corporate Debt Issuance (and YTD)

Source: Bloomberg LP, LEAG Tables, new debt and maturity SRCH

Exhibit 5. Weekly Mutual Fund Flows year-to-date

Source: Bloomberg LP, Refinitiv/Lipper weekly flow data

Exhibit 6. New Issue by Sector

Source: Bloomberg LP, LEAG Tables, new debt and maturity SRCH

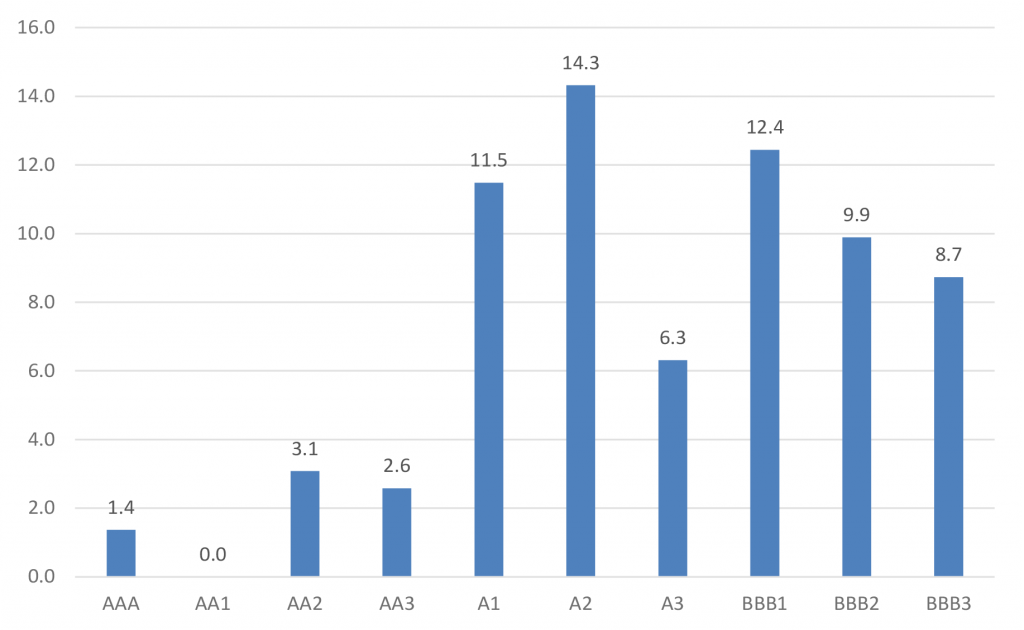

Exhibit 7. New Issue by Rating

Source: Bloomberg LP, LEAG Tables, new debt and maturity SRCH

Exhibit 8. New Issue by Tenor

Source: Bloomberg LP, LEAG Tables, new debt and maturity SRCH

Exhibit 9. Flight to quality favors communications, consumer, tech, and utilities

Source: Bloomberg Barclays US Corp Index

Exhibit 10. The late month recovery in credit was very much a flight to quality

Source: Bloomberg Barclays US Corp Index

Exhibit 11. Long-dated paper benefits as treasuries rally off the wides

Source: Bloomberg Barclays US Corp Index

Exhibit 12. Once again business development companies (BDC) are among the hardest hit in the washout in credit; universities and medical centers fare best

Source: Bloomberg Barclays US Corp Index