The Long and Short

Kellogg repackages itself

Meredith Contente | June 24, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Kellogg Company (K) is planning to split into three companies as part of a portfolio transformation to unlock value and focus on the faster growing snacks business. This aligns with the company’s acquisitions over the past 10 years, which have largely focused on the snacks sector and emerging markets. Capital structures and dividend policies have not yet been determined, but management is committed to maintaining its investment grade ratings as it transforms into the Global Snacking Co. Kellogg can likely hold on to its mid-BBB ratings if it repays some debt post spins, while maintaining its current financial policies.

K will become a Global Snacking Company that will still operate in the international breakfast sector, which includes the North American frozen breakfast category. K will look to spin its North American cereal business (which includes its Caribbean cereal operations) as well as its plant-based foods unit. Kellogg generated $14.2 billion of revenues in fiscal 2021 and $2.3 billion of EBITDA, which means the Global Snacking Co. will maintain the majority of both sales and EBITDA (Exhibit 1). Both spins are targeted to be completed by year end 2023, with the spin of the North America Cereal Co. to happen prior to the spin of the Plant Co.

Exhibit 1. Kellogg Portfolio Transformation

* All net sales and adjusted-basis EBITDA figures are based on the Company’s unaudited 2021 results.

Source: Company Presentation; APS

Global Snacking Co. – A Global Portfolio with Strong Growth Momentum

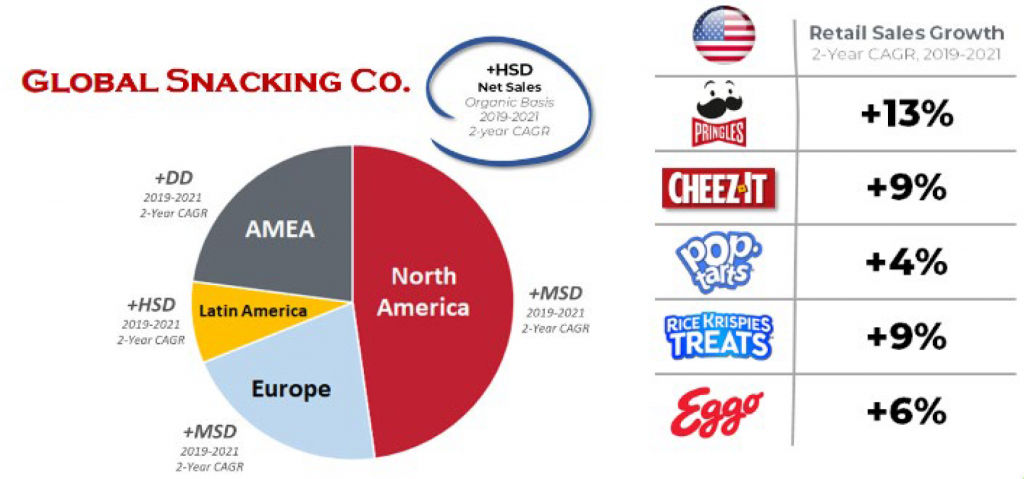

Over the past decade we have witnessed strong growth trends in the snacking category, which has sparked numerous acquisitions, including Campbell’s acquisition of Snyder’s-Lance, to garner a better foothold in the sector. K’s snack portfolio has benefited from that growth with most of its snacking brands posting a 2-year sales CAGR in the high single-digit/low double-digit range (Exhibit 2). The Global Snacking Co. will have a portfolio of world-class snack brands including Pringles, Cheez It, and Rice Krispies Treats to name a few. Additionally, management noted that 80% of net sales for the Global Snacking Co. will come from global snacks and emerging markets. Margins in the snacking business tend to be higher than the cereal business and based on the net sales and EBITDA estimates (Exhibit 1), we note that the Global Snacking Co. will have EBITDA margins in the 17.5% range. This compares favorably to the 16.2% EBITDA margin for the consolidated company on a LTM basis. Management noted that EBITDA margins at the unit will expand over time driven by operating leverage, revenue growth management, improved productivity and increasing emerging market scale. We expect K will look to target margins closer to peers such as Mondelez International Inc. (MDLZ – Baa1 (*-)/BBB), whose EBITDA margin was 20.5% on a LTM basis.

Exhibit 2. Global Snacking Co. Geographic Breakdown and CAGR

Source: Nielsen; Company Presentation; APS

S&P Changes Outlook to Negative

Subsequent to the announcement, S&P changed its outlook from stable to negative while affirming the current BBB senior unsecured rating, as well as the A-2 commercial paper rating. S&P noted that the negative outlook reflects the potential for ratings to be lowered after the transaction occurs if the Global Snacking Co. employs more aggressive financial policies. As mentioned before, management is committed to its Investment Grade ratings for the unit and noted on its call that they plan to keep existing financial policies. Currently, leverage is roughly 3.3x, just below the 3.5x threshold for the ratings and is expected to remain at or below that level prior to the transactions occurring. S&P will assess the Global Snacking Co.’s diversity and scale, as well as its leverage target and acquisition strategy for the entity when deciding if it will affirm the current BBB rating. Should the rating be downgraded to BBB-, the commercial paper rating will be reduced to the A-3 level.

Maintaining mid-BBB Ratings Requires Debt Reduction

We estimate that debt/EBITDA at the Global Snacking Co. would rise from approximately 3.3x currently to roughly 3.8x post spins, assuming no debt reduction. Based on the current EBITDA level for the Global Snacking Co. ($2.0 billion) and assuming no EBITDA growth, we estimate that K will need to repay roughly $300 million of debt to hit the 3.5x leverage threshold for the current rating, and nearly $700 million of debt to bring leverage down to the current level of 3.3x. Management noted that the balance sheet will have flexibility to pursue M&A and/or share buybacks, therefore we expect management will look to keep leverage a few ticks below the 3.5x threshold. That said, proceeds from any debt raised at the North America Cereal Co. could be used to dividend back to the Global Snacking business to be used for debt reduction. Given K’s timing for the spins to be completed by year-end 2023, we note that upcoming debt maturities ($1.36 billion through year-end 2023) provide a debt reduction path for the entity, versus having to execute a tender offer. We believe management will want to maintain mid-BBB ratings in order to keep its current P2/A2 CP ratings, especially in a rising rate environment. Furthermore, we note that since being rated by Moody’s and S&P, K has never had ratings drop below the mid-BBB level. That said, K has never operated with CP ratings below the P2/A2 level.