By the Numbers

Good prospects for price appreciation and multifamily prepayments

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Over long periods of time, prepayment speeds for multifamily loans out-of-the-money to refinance average about 2 CPR. But in markets with high cumulative price appreciation, prepayments for some vintages of Ginnie Mae project loans have ranged from 5 CPR to 10 CPR. Those faster speeds can increase returns for owners of the interest-only classes that collect the prepayment penalties. And prospects are good for continued appreciation in multifamily properties.

Two out-of-the-money Ginnie Mae project loan pools recently prepaid when Blackstone bought the properties as part of a $300 million low income housing portfolio deal focused in South Florida. One of the pools (GN CJ1915, original WAC 2.68%) paid off with 10 points of penalties, and the other (GN BX7716, original WAC 2.24%) paid off with 9 points of penalties. This is unlikely to be a one-off event, as outlined in our recent piece, High property price appreciation could lift prepayments in OTM loans.

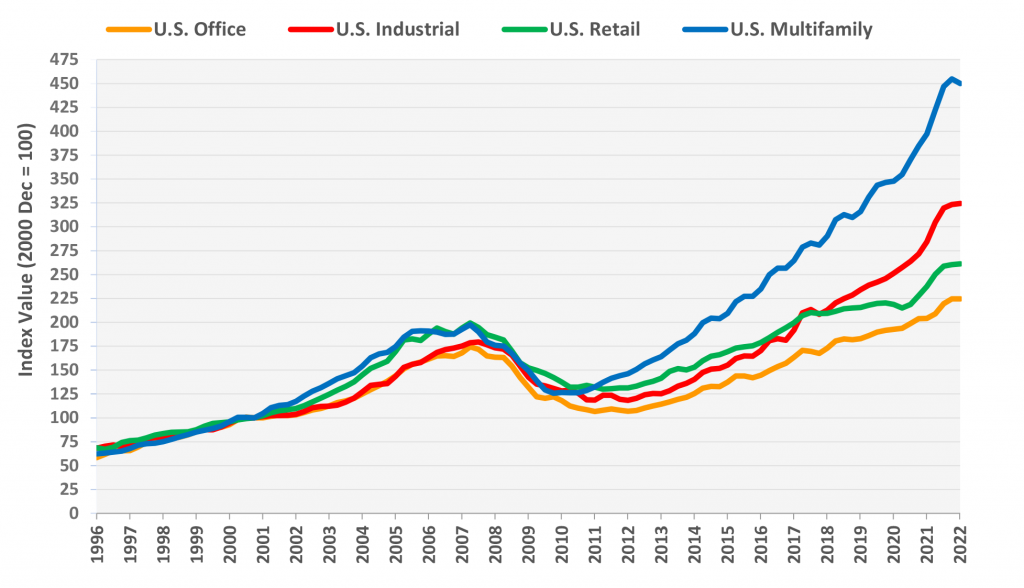

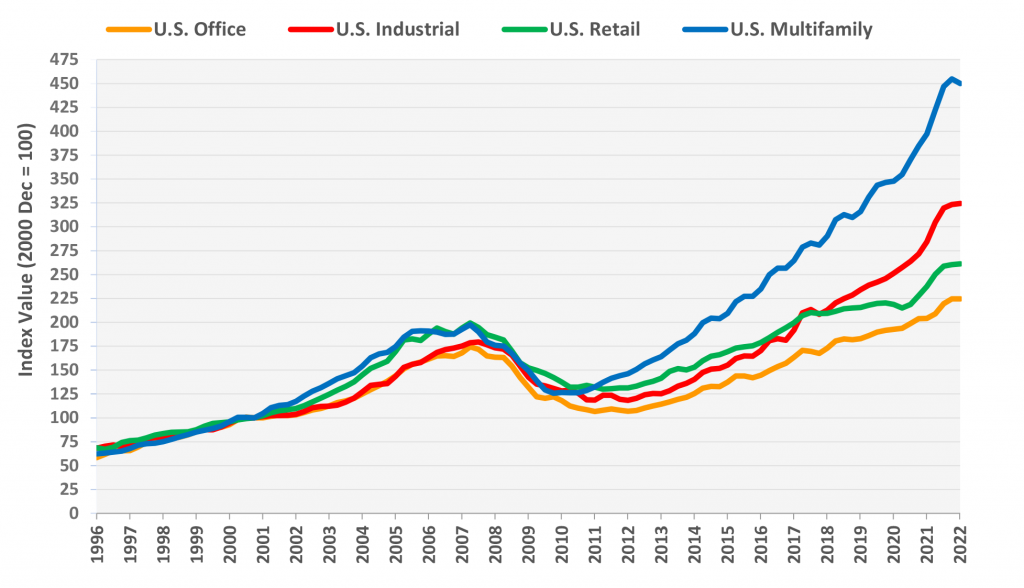

Despite a recent stagnation and slight downturn in commercial real estate property price appreciation across most sectors, multifamily fundamentals and the long-term outlook remain strong (Exhibit 1). Commercial real estate prices peaked in the fourth quarter of 2021 on exceptional transaction volume, then fell in the first quarter of 2022 by 1.3%. Compared to pre-pandemic levels of February 2020, CoStar’s U.S. composite commercial price index is up 26.2%. Multifamily property prices fell 1.0% during the first quarter, after notching an 18.2% rise year-over-year to close 2021, while other major sectors were roughly flat.

Exhibit 1: Commercial real estate property price indices

Note: Quarterly data through March 2022.

Source: CoStar

There are two factors driving continued investment in commercial real estate and the multifamily space in particular. First, economic research has shown that commercial real estate is one of the few asset classes that can serve as an effective hedge against inflation over medium to long periods of time (see Which asset classes effectively hedge inflation?). Second, multifamily leases typically renew yearly, so rent growth can keep pace with inflationary trends easier than, say, office or retail leases which can have 10-year terms. A decade of underbuilding across the housing market collided with pandemic, driving prices higher. New home construction has picked up significantly in both single- and multifamily sectors, but it will take years, if not a decade, for supply to catch up to projected long-term demand.

A note of caution

Although CRE markets are taking a breather and property price appreciation should slow markedly, land prices continue to accelerate (Exhibit 2). Raw land prices increased 6.8% in the first quarter of 2022 and are up 17.5% year-over-year and 26.2% compared to pre-pandemic levels. That move seems reasonable in context of similar price increases in single- and multifamily properties overall but is reminiscent of the run-up during the housing bubble.

Exhibit 2: Land prices surge higher

Note: Indices are quarterly, data through March 2022.

Source: CoStar

The drivers of the price increases are obviously very different this time around, and not due to easy credit standards or otherwise loose lending contributing to a speculative wave. However, there is well established body of economic research, referenced in the CoreLogic article Land Values Drive Home Price Volatility, indicating that volatile land values were primary drivers of home price dynamics during the crisis. Areas where the price volatility of land was highest, tended to have the biggest post-crisis busts in home prices. One point made in the research that is distinct from the current environment is that home prices were not primarily being driven higher due to high costs of construction, but due to the increase the land values themselves, which later declined. This could be an issue to monitor in SunBelt and other areas where the increased cost of land is outweighing higher construction costs.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.