The Big Idea

High property appreciation could lift prepayments in OTM loans

Mary Beth Fisher, PhD | April 8, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Prepayment speeds even for agency multifamily loans without interest rate incentives to refinance could still run between 5 to 10 CPR if price appreciation on the properties over the next decade stays strong. This is based on the experience of 2012 Ginnie Mae project loans, which prepaid faster than average despite having below-market rates for most of a decade. Multifamily price appreciation should continue for several more years at a more normalized, pre-pandemic rate. This could lift speeds above long-term averages for all agency multifamily loans issued before to mid-2020.

Assessing multifamily property price appreciation

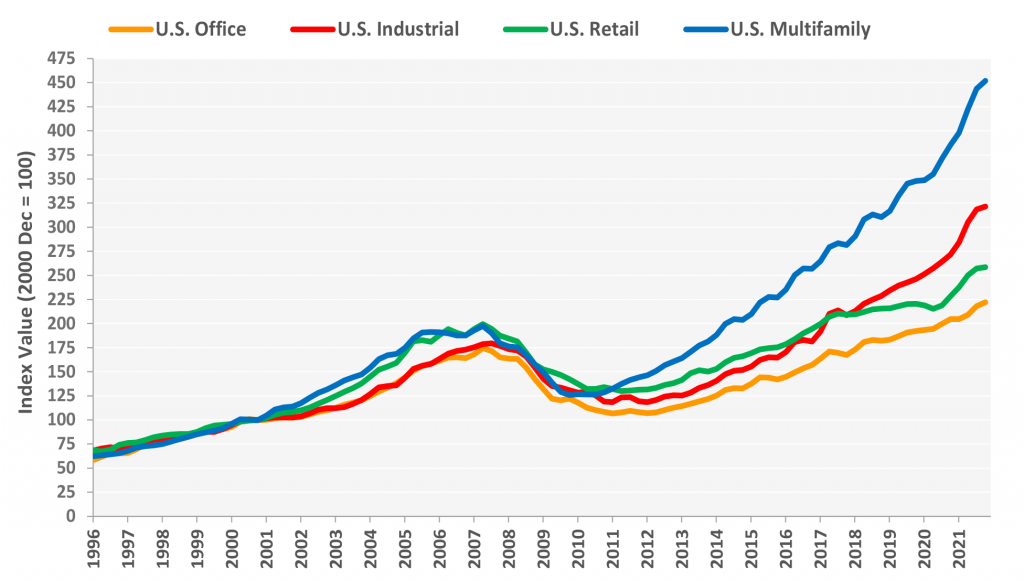

Multifamily property price appreciation hit a local trough in 2010 in the wake of the financial crisis, bottoming out slightly ahead of other commercial real estate sectors (Exhibit 1). The multifamily sector saw steady and at times sharp declines in property prices from late 2007 through the third quarter of 2010. Multifamily home price appreciation turned positive during the last quarter of 2010, running at 2.3% year-over-year, and began to gain positive momentum in 2013. Multifamily property price appreciation averaged 11.7% year-over-year from 2012 through 2019, outpacing that of all other CRE sectors. During 2021, multifamily property price appreciation accelerated, averaging 17.5% year-over-year. The rapid rise in interest rates since the end of 2021 has caused CRE prices across all sectors to stagnate, with price appreciation flat to slightly negative.

Exhibit 1: Commercial real estate price appreciation by property type

Note: Data is quarterly through December 2021. CoStar’s property price indices shown are market value, repeat sales indices that are equal-weighted.

Source: CoStar.

Out-of-the-money loans prepay at or below 2 CPR over long periods of time

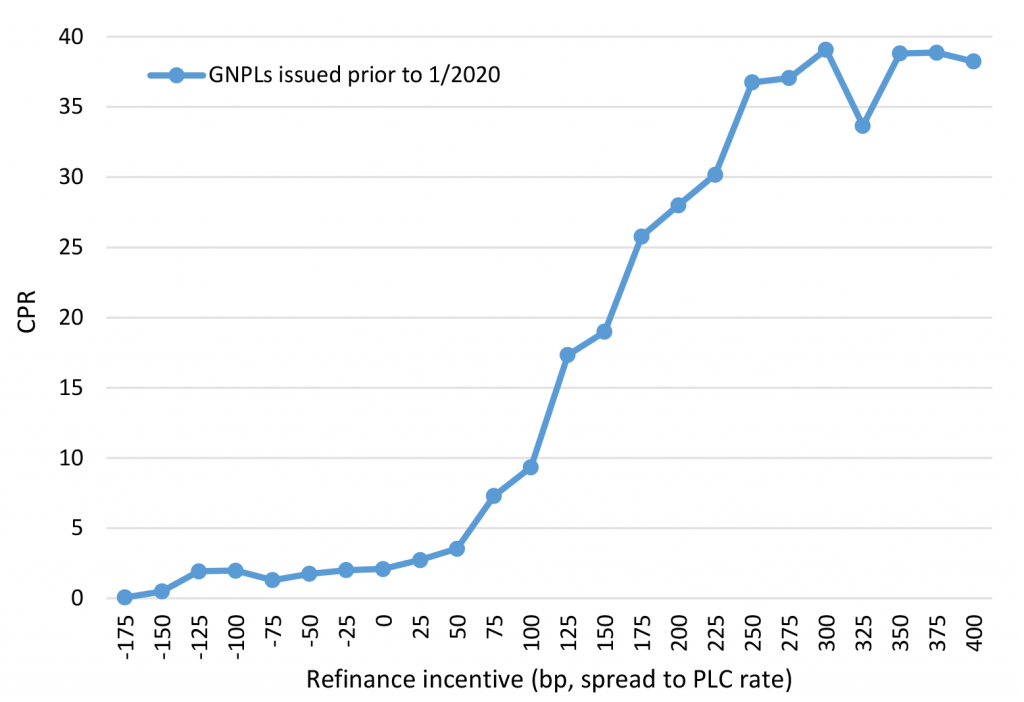

A long-term S-curve for Ginnie Mae project loans shows that prepay speeds post-lockout vary from a high of nearly 40 CPR for loans with large refinance incentives above 250 bp to a low near zero (Exhibit 2). Multifamily loans that have zero to negative refinance incentives are out-of-the-money to prepay. Long term averages show that these loans have tended prepay at 2 CPR for refinance incentives between 0 and -125 bp. Those speeds drop closer to 0 CPR for loans with deeply negative refi incentives of -150 bp or more.

Prepay speeds can vary significantly by vintage based on the seasoning of the loan, the amount of equity built up in the property due to home price appreciation or depreciation, and the ease of refinancing. Prepay speeds on GNPL hit 50 to 55 CPR in 2021 for loans deep in-the-money to refinance. In 2018 the 10-year Treasury rate was at a recent high and project loan commitment rates were steady at around 4.00%. GNPL with small to negative refinance incentives still prepaid slightly faster at 3 to 4 CPR thanks to several years of strong price appreciation.

Exhibit 2: S-curve by rate incentive for GNPL

Note: Prepayment speeds are post-lockout based on the spread to the project loan commitment (PLC) rate. Weighted average speeds for all loans issued from 2001 prior to January 2020, with prepay speeds calculated beginning October 2015.

Source: Ginnie Mae, Amherst Pierpont Securities

Out-of-the-money prepays in a high HPA environment can average 5 to 10 CPR

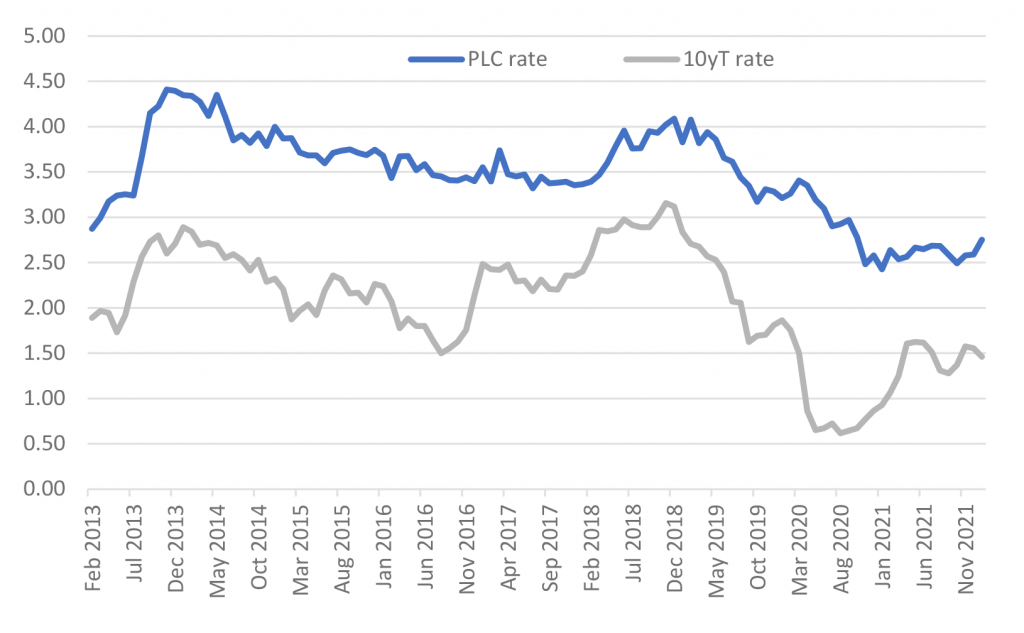

The best comparison for the period ahead is probably 2012. In 2012 the 10-year Treasury was at a local low, trading between 1.50% and 2.00%. The spread between the 10-year Treasury and project loan commitment rates was about 100 bp, so PLC rates were between 2.50% and 3.00% for most of the year. Rates began to rise in mid-2013 and PLC rates rose above 4.00% (Exhibit 3). Multifamily investors who borrowed at average PLC rates in 2012 would not be in-the-money to refinance until mid-2020, when the pandemic drove rates much lower.

Exhibit 3: GNPL commitment rates and 10-year Treasury rates

Note: PLC rates are for $104 priced loans.

Source: Ginnie Mae, Amherst Pierpont Securities

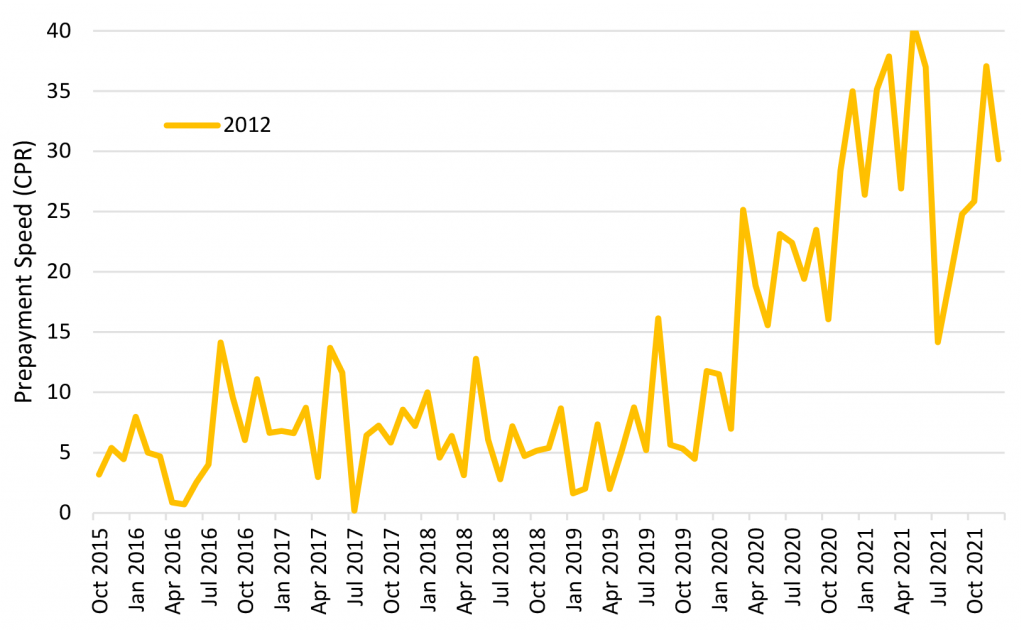

However, these 2012 borrowers did experience multiple years of strong home price appreciation and that resulted in higher prepay speeds over time (Exhibit 4). From late 2015 through 2019, monthly prepay speeds for 2012 vintage loans were typically between 5 and 10 CPR, occasionally spiking as high as 15 CPR. In 2020-2021 as rates fell, these seasoned loans began to roll into-the-money to refinance and speeds rose as high as 40 CPR.

Exhibit 4: Monthly prepayments speeds for 2012 vintage GNPLs

Note: CPR speeds post-lockout, beginning in October 2015.

Source: Ginnie Mae, Amherst Pierpont Securities

The rate back-up has stalled price appreciation across commercial real estate, but that’s not expected to persist. Multifamily in particular is projected to see renewed but lower price growth as fundamentals remain strong and both single-family and multifamily home building is unlikely to catch up to demand for another decade.

Multifamily properties on average experienced 30% price appreciation from December 2019 through December 2021. Loans taken out on properties prior to mid-2020 are likely to exhibit faster than historical average prepayment speeds for all refinance incentives, as borrowers refinance to tap equity or sell properties. Loans taken out from mid-2020 through year-end 2021 will likely remain deeply OTM to refinance, but based on the extent of HPA those loans could also prepay between 5 and 10 CPR over time, similar to 2012 vintage loans.