The Big Idea

Households are still flush

Stephen Stanley | March 11, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Household balance sheets usually suffer in an economic downturn as workers lose their jobs and their incomes and as asset values, most notably stocks, soften. But household finances improved during the pandemic, leaving consumers well-positioned for a spending spree as the economy reopens. The latest numbers on income, savings, real estate values and investment portfolios all underscore that households remain flush.

Income gains

The extremely aggressive fiscal response in the spring of 2020 was predicated on the notion that the federal government needed to fill a massive hole that would develop in household finances due to a prolonged period of high unemployment. As it turns out, the economy and in particular the labor market recovered more quickly and more forcefully than anticipated so that by late 2020, wage and salary income had already recovered to the pre-pandemic level on top of generous federal payments.

One of the pitfalls of using fiscal policy to finely calibrate the economy is that decisions sometimes become political. That appears to have occurred with a second round of rebate checks approved in December 2020 and the massive $1.9 trillion Covid relief package enacted in 2021. The latter was quite clearly, in retrospect, overkill.

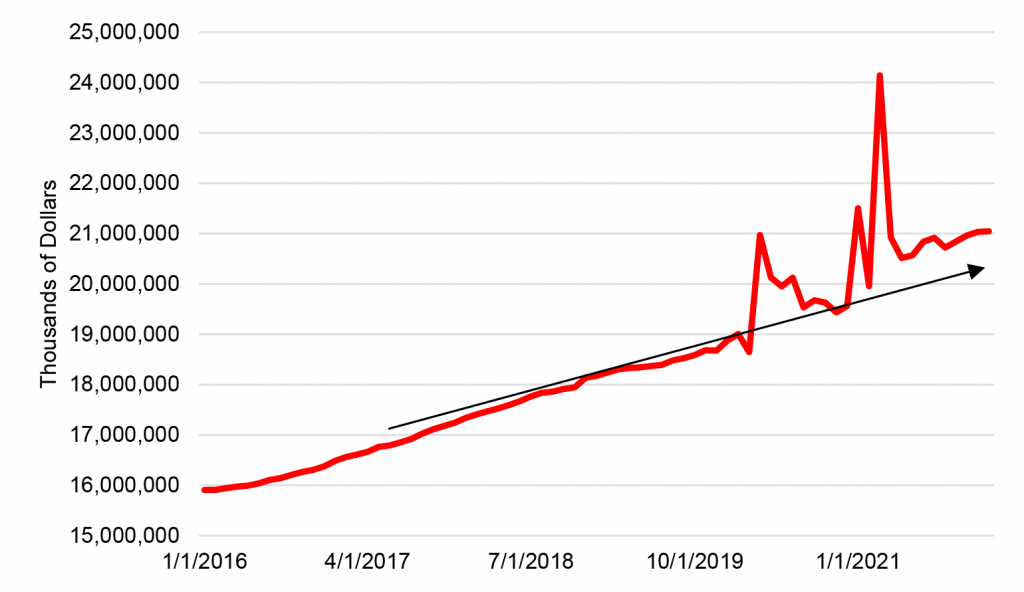

Personal income spiked several times over the past few years, reflecting waves of federal largesse, but even with a return to a normal pace of transfer payments in recent months, personal income is running well above what the pre-pandemic trend would have implied by at least $1 trillion, or about 5%.

Exhibit 1: Personal income continues to run above pre-pandemic trend

Source: BEA.

Extra liquidity

With regular income growth more than sufficient to support solid spending, households in the aggregate saved the bulk of the federal government largesse. It stands to reason that households would accumulate extra funds as their opportunity to spend on certain items, such as international travel, dining out, concerts, sporting events and so on was diminished. Many families have been building up a stockpile for the day when the pandemic restrictions are fully lifted.

The savings rate, which is a flow, ebbs up and down with the pandemic. When Covid surges, most recently in December, spending suffers and savings spikes. Then, as cases fade and restrictions are lifted, spending resumes and the savings rate normalizes. Many observers confuse flows and levels. A number of analysts cite the savings rate receding to roughly the pre-pandemic range as a sign that consumers have burned through their savings and are tapped out. However, the savings rate returning to normal merely means the pace, or flow, of savings is returning to normal, which means that households have not even begun to tap into the extra reserves accumulated over the past two years.

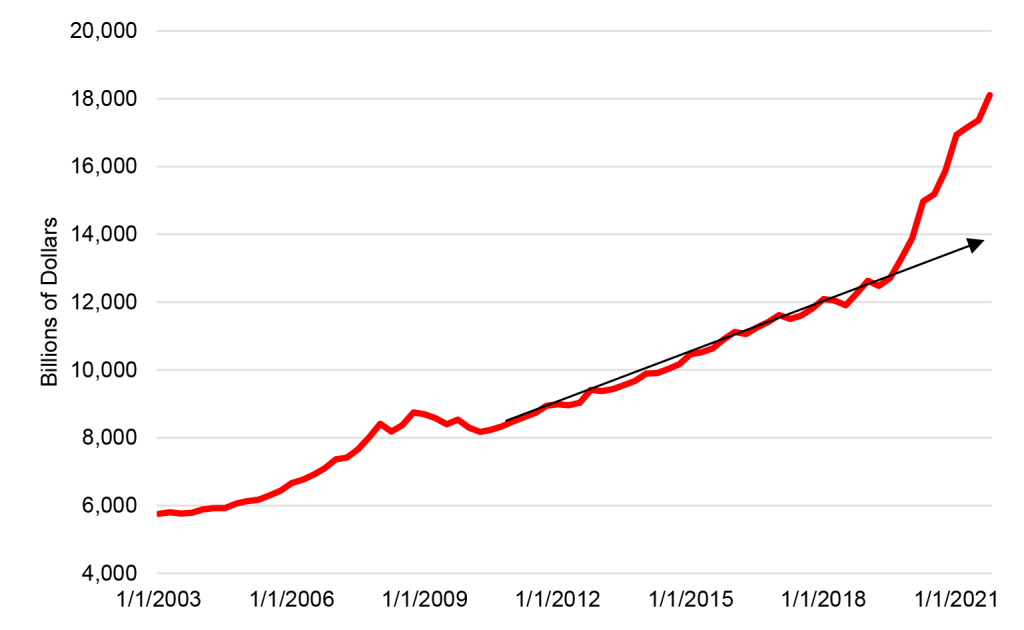

The Federal Reserve’s Financial Accounts data released on Thursday confirm this. On the household balance sheet, liquid assets, consisting of checking account, savings account, and money market fund balances, continued to surge through the end of 2021 (Exhibit 2). As is clear, the trajectory of the measure showed steady growth for years and then exploded over the past two years. For much of the past decade, the gauge rose by roughly $500 billion a year. In contrast, it surged by $2.7 trillion in 2020 and by another $2.2 trillion last year. In the fourth quarter of last year, liquid assets jumped by more than $700 billion to above $18 trillion, an increase well in excess of the typical full year rises prior to the pandemic. This is an especially impressive result in light of the fact that there were no rebate checks or other major fiscal payments during the period.

Exhibit 2: Household Liquid Assets

Source: Federal Reserve.

Since the end of 2019, households’ holdings of liquid assets have risen by nearly $5 trillion in just two years. Extrapolating the pre-pandemic trend to provide a benchmark of what might have happened in the absence of Covid, liquid assets are about $4 trillion higher than they might normally have been in the absence of the pandemic.

By the way, this is a big reason why I am not especially worried about the deleterious effect of inflation on the consumer. While families would undoubtedly prefer to spend all of their $4 trillion cache on a big vacation to Europe or a visit to Disney than on filling their gas tanks, there should be no doubt that households have the wherewithal to weather an energy price spike.

A wealth kicker

As if the burst in income and in liquid assets were not enough, households are also enjoying a massive appreciation of asset holdings. Typically, in a recession, asset values, especially for equities, drop. The extraordinary support to financial markets and the economy offered by fiscal and monetary policy stimulus led to a massive run-up in home and stock values.

Household real estate holdings rose by $8 trillion and household equity holdings jumped by more than $15 trillion in 2020 and 2021. In total, household assets surged by $35 trillion during the past two years, pushing net worth for households from $117 trillion at the end of 2019 to just over $150 trillion at the end of last year. Families may not need this cushion for quite some time given their liquidity position in the aggregate, but the increase in wealth certainly further bolsters households’ financial positions.