By the Numbers

Preparing for a precipitous slowdown in GNPL prepayments

Mary Beth Fisher, PhD | January 28, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Rising yields in the long end of the curve are driving commercial mortgage rates higher, and multifamily property price appreciation has come off the boil. If sustained, both trends should cause prepayments to slow precipitously in the coming months. If 10-year Treasury rates rise as high as 2.00%, it could lift the standard Ginnie Mae project loan commitment rate into the 2.75% to 3.00% range. Wide dispersion of coupons should continue, but the slowdown in property price appreciation should eventually result in fewer borrowers refinancing into premium loans and taking equity out of the property. That would significantly reduce prepayment speeds in loans with high penalty points attached, which surged during the pandemic.

Based on the recent sell-off, most standard rate, pandemic-vintage Ginnie Mae project loans—those originated at $104 price—are already breakeven to 50 bp out-of-the-money to refinance. A zero to negative refi incentive historically pushes prepay speeds below 3 CPR (Exhibit 1). Loans that have not refinanced but whose coupons remain in the money will likely show signs of burnout, depressing speeds long-term. This was evident in 2018, when rates had risen, and speeds for loans which still had significant prepay incentives were far below normal, averaging 20 CPR instead of being closer to 40 CPR (Exhibit 1). By comparison, during the pandemic the exceptional multifamily property price appreciation helped push prepay speeds well above historical averages for most loans in the money to refinance.

Exhibit 1: Ginnie Mae project loan S-curves by refinance incentive

Note: The refinance incentive is calculated as the loan coupon versus the weighted average project loan commitment rate.

Source: Ginnie Mae, Intex, Amherst Pierpont Securities

Prepays recently spiked higher at the end of 2021

The relatively low rates of November and December pushed prepayment speeds higher across agency CMBS. In Ginnie Mae project loans, the weighted average prepayment speed in December was 28.1 CPR (Exhibit 2). This was faster than any other month of 2021 except for February, which had a 32.6 CPR when 10-year Treasury rates were hovering just above 1.00%.

Exhibit 2: Ginnie Mae project loan prepay speeds by vintage

Source: Ginnie Mae, Amherst Pierpont Securities

An important factor driving GNPL prepay speeds is the level of the project loan commitment rate, or PLC rate. This does not tend adjust nearly as quickly as the 10-year Treasury rate or the Ginnie single-family current coupon rate (Exhibit 3). When 10-year Treasury rates were well below 1.00% for much of 2020, the spread between the 10-year Treasury yield and PLC rates was quite high, and PLC rates only gradually came down from 3.5% to 2.5%. Spreads also compressed as rates began to rise, so prepayments and refinances remained attractive.

Exhibit 3: Ginnie Mae project loan commitment rates

Source: Ginnie Mae, Amherst Pierpont Securities

Prepay speeds accelerated in 2021 across all penalty buckets (Exhibit 4) compared to pre-pandemic averages. The highest speeds were for loans with an 8% penalty premium—meaning the penalty for prepaying the loan is equal to 8% of the outstanding balance—and 0% penalty premium. Speeds for both of those buckets averaged 45 CPR in 2021. This is likely driven by borrowers selling or refinancing properties due to the very strong multifamily property price appreciation that began in the latter half of 2020 and continued throughout 2021, allowing them to more easily roll the cost of the penalties into the new loan due to the increased equity.

Exhibit 4: GNPL S-curves by penalty bucket

Source: Ginnie Mae, Amherst Pierpont Securities

This was not unique to Ginnie Mae. December prepayment speeds for Freddie and Fannie multifamily aren’t available until next month, but November speeds already show an uptick. In Freddie floating-rate loans (K-F deals) speeds were relatively benign in the first half of 2021 then started to accelerate in the second half as fixed rates began to climb and the Fed indicated the approach of a hiking cycle. Speeds for a selection of Freddie K-F deals in 2021 are shown in Exhibit 5.

Exhibit 5: FHMS K-F floater prepayment speeds (by deal, voluntary)

Source: Freddie Mac, Intex, Amherst Pierpont Securities

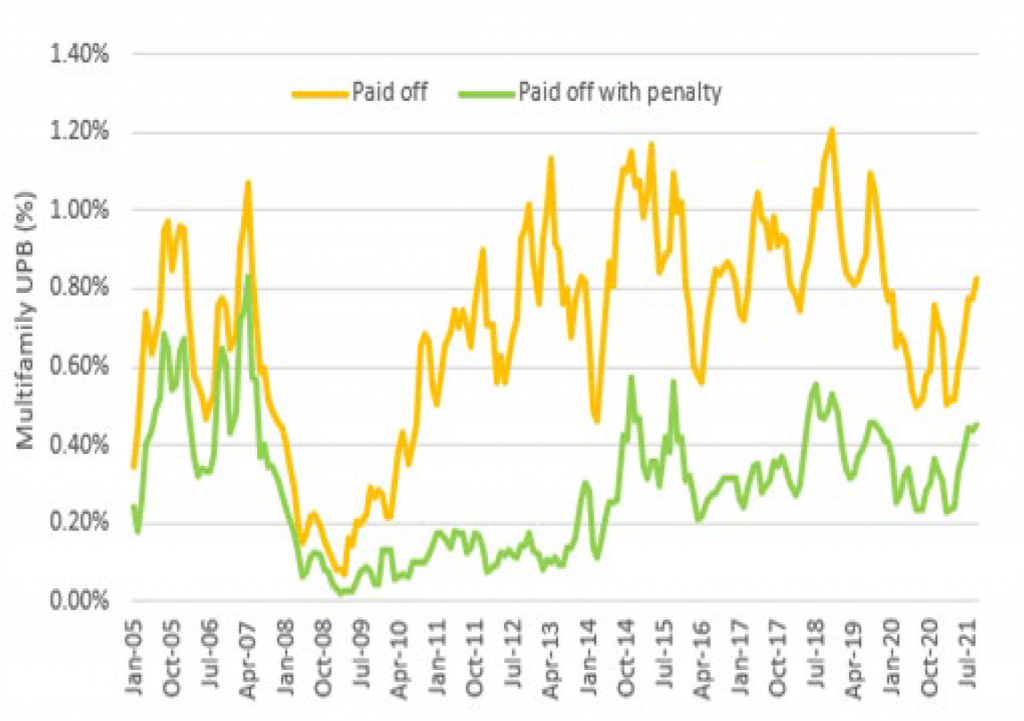

The strong property price appreciation over the past decade has resulted in a steady flow of Fannie Mae DUS borrowers prepaying their loans despite the yield maintenance or penalty premiums typically required to do so (Exhibit 6).

Exhibit 6: Fannie Mae multifamily loan payoffs

Note: Data shows the percentage of Fannie Mae multifamily UPB paid off each month, using a 3-month rolling average. Data through Q3 2021.

Source: Fannie Mae, Amherst Pierpont Securities

Multifamily property price appreciation will likely slow in 2022, but the underbuilding of housing—particularly workforce housing, which the GSEs have a mandate to support—should take years to resolve. The longer-term outlook for the sector remains robust, and investors can benefit from what should be low involuntary prepayments due to delinquencies.