By the Numbers

A transitional environment for Ginnie Mae project loans

Mary Beth Fisher, PhD | January 7, 2022

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The most prepay sensitive loans in the agency CMBS universe are Ginnie Mae project loans. The Omicron-driven rally in November and December resulted in a pick-up in speeds, but the longer-term outlook is for prepayments to moderate in 2022 as interest rates rise and multifamily price appreciation slows. Mid-duration classes of project loan deals should extend to have similar average lives as some Freddie K-series A1 and A2 classes but will likely outperform on total return in a modest sell-off.

The defeasance requirements attached to standard fixed-rate Freddie K-series loans mean that investors are insulated from voluntary prepayments for all but the final six months of a loan. The A1 class typically amortizes very slowly and pays off near the end of its 7-year average life while the standard A2 classes are effectively bullets until the A1 class is paid down.

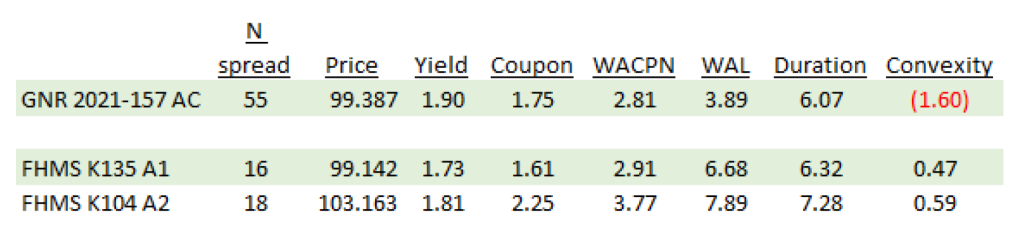

Ginnie Mae project loans, by contrast, are subject to significant prepayment risk and the bonds show both duration drift and negative convexity. A comparison of a GNPL bond to similar duration A1 and A2 helps (Exhibit 1). The GNF 2021-157 AC bond picks up 17 bp and 9 bp of yield, respectively, over the FHMS K135 A1 and FHMS K104 A2 bonds. The GNPL duration is slightly shorter and the bond is negatively convex due to the prepayment risk, whereas the Freddie K bonds have positive convexity similar to bullets.

Exhibit 1: Comparison between GNPL mid-duration and Freddie K A1 and A2 classes

Note: The projected yield of the GNR 2021-157 AC assumes a prepayment speed of 15 CPJ. Indicative levels only as of 1/5/2022.

Source: Bloomberg, Amherst Pierpont Securities

Preparing for modestly higher rates

Financial market nervousness around the Omicron variant appears to be subsiding, and the 10-year Treasury seems to be re-pricing back towards the 1.70% area. The last time the 10-year Treasury was above 2.00% was during the second half of 2019: the Fed was in an easing cycle, and the Fed funds target rate was gradually being lowered from a peak of 2.50% to 1.75%. There are certainly scenarios that could push the 10-year Treasury above 2.25% in 2022 – persistent, non-transitory inflation being the most likely culprit – but the long-end of the yield curve shows little conviction in that forecast. It’s possible the 10-year Treasury is in a 2.00% to 2.25% range when the Fed begins hiking in the second quarter or second half of 2022 and the curve begins to bear flatten.

Even a modest sell-off in rates should cause GNPL bonds to extend in duration as prepayment speeds fall, but it can outperform the A1 and A2 until its WAL eclipses that of the other securities (Exhibit 2). The GNPL bond is projected to outperform the A1 and A2 classes on a total return basis by 17 bp and 6 bp, respectively, at current rate levels. That outperformance will deteriorate as rates sell-off vs the shorter WAL A1 until about a 25 bp increase and is then projected to underperform. The outperformance vs the longer WAL A2 is projected to persist up to about a 40 bp parallel shift of the curve. The underperformance begins when the WAL of the project loan meets and exceeds that of the A2. Notably the GNPL bond begins to underperform almost immediately for any rally in rates due to the pronounced negative convexity and its shorter WAL.

Exhibit 2: The GNPL class outperforms the A1 and A2 in a modest sell-off

Note: Analysis assumes parallel yield curve shifts and a 12 month horizon. CPJ is estimated based on yield curve shifts. Data as of 1/5/2022. Indicative levels only.

Source: Bloomberg, Amherst Pierpont Securities

The other upside of investing in Ginnie Mae project loans for banks and insurance companies is the 0% risk weighting. This lowers the amount of capital that needs to be held, compared to the 20% risk weighting of non-government guaranteed agency securities.

A note on prepayment speeds

Prepayment speeds for Ginnie Mae project loans have been faster than models project for years. Strong multifamily property price appreciation and the declining prepayment penalty system have contributed to a counterintuitive dynamic where low WALA loans with high prepayment penalties have at times had the highest prepayment speeds; while seasoned, high WALA loans with low prepayment penalties often require very large refi incentives to prepay (see How seasoning impacts refi incentives in Ginnie Mae project loans). A modest rise in the 10-year rate to 2.00% would still leave a significant portion of the universe of outstanding project loans in the refinance window. Multifamily property price appreciation is beginning to slow and should plateau somewhat in 2022, but transaction volumes and refinance incentives based on equity takeout could remain strong. Both of these factors argue for speeds not falling as quickly as projected and WAL not extending as rapidly, which would improve the projected performance of GNPLs in a modest sell-off.