The Long and Short

Back-up in credit spreads carries over into December

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The investment grade corporate bond index widened by 6 bp in November, resulting in a negative excess return of -0.53%. Total return remained relatively flat increasing just 0.06% as Treasuries rallied in response to the risk-off market posture. The most recent move brings the year-to-date spread performance to -28 bp of implied net OAS tightening for 2021, which translates to a positive 2.26% credit return and -0.96% of total return. The IG Index itself meanwhile is trading wide of where it started the year as we enter December.

Our sector weighting view recommendations remain unchanged for December. The two graphics below provide a summary of how APS expects sectors within the IG Index to perform for the next several months on an excess return basis (total return net of commensurate UST return). These weightings serve as a proxy for how we recommend that portfolio managers should position their holdings relative to the broad IG corporate bond market.

Exhibit 1 and 2. APS Sector Recommendations for December 2021

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

Color = recommendation: Green – Overweight, Red – Underweight, Yellow – Marketweight

Size = Market Value within the IG Index

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

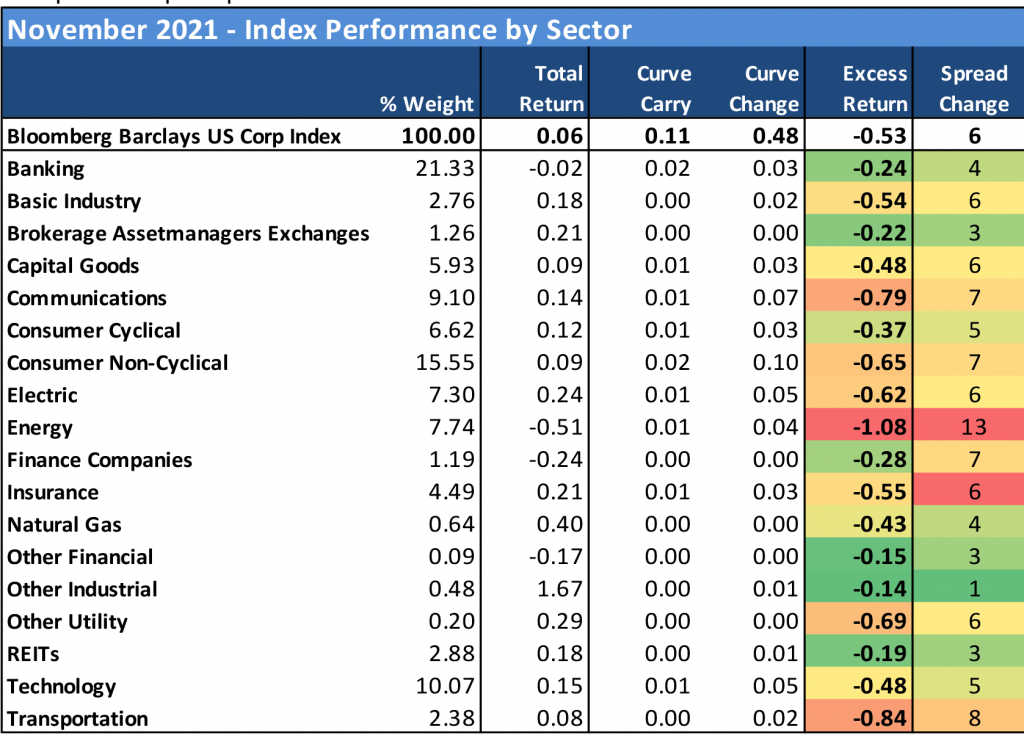

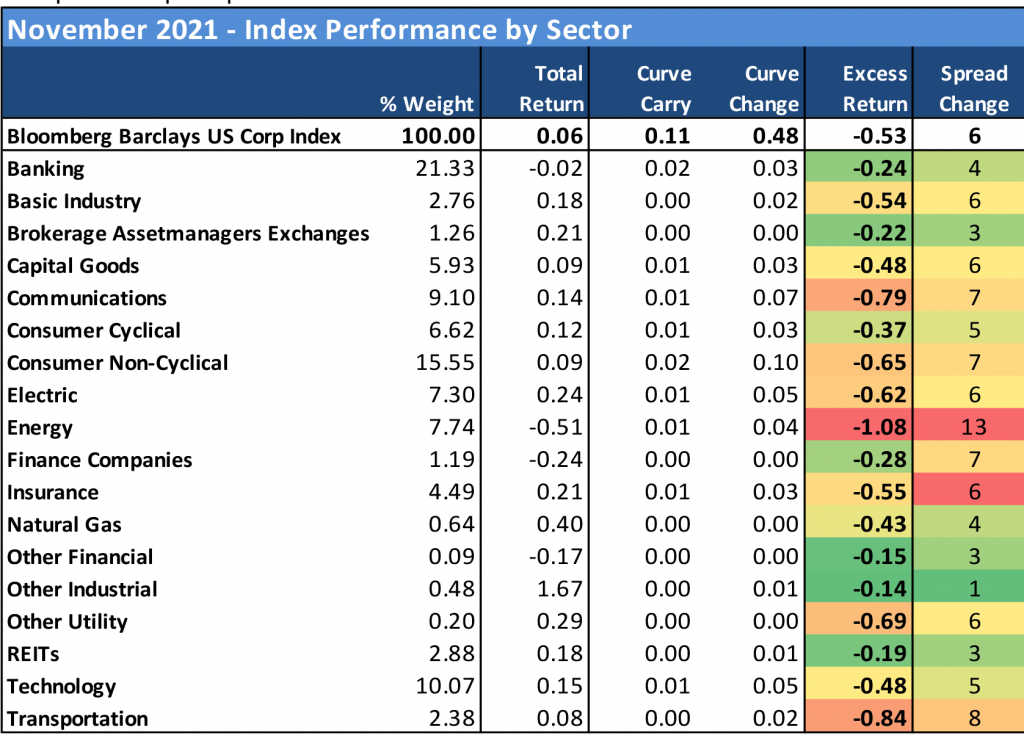

Financial sectors were among the most resistant to the November sell-off in credit as top performances were provided by REITs (-0.19% excess return), brokers/asset managers (-0.22%), banking (-0.24%), and finance companies—due in large part to the aggregate tightening provided by the finalization of the long-anticipated General Electric (GE: Baa1/BBB+*-/BBB) tender offer. The legacy GE bonds that qualify for the finance companies segment were tendered for at premium levels at the close of the month, contributing to the segment’s performance. Consumer-cyclical (-0.37%) rounded out the top 5 performances by sector. Energy (-1.08%) provided the single worst performance in the IG Index as oil fell drastically in the closing sessions of November. The remainder of the bottom 5 performances were logged by transportation (-0.84%), communications (-0.79%), consumer non-cyclical (-0.65%), and utilities (-0.62%).

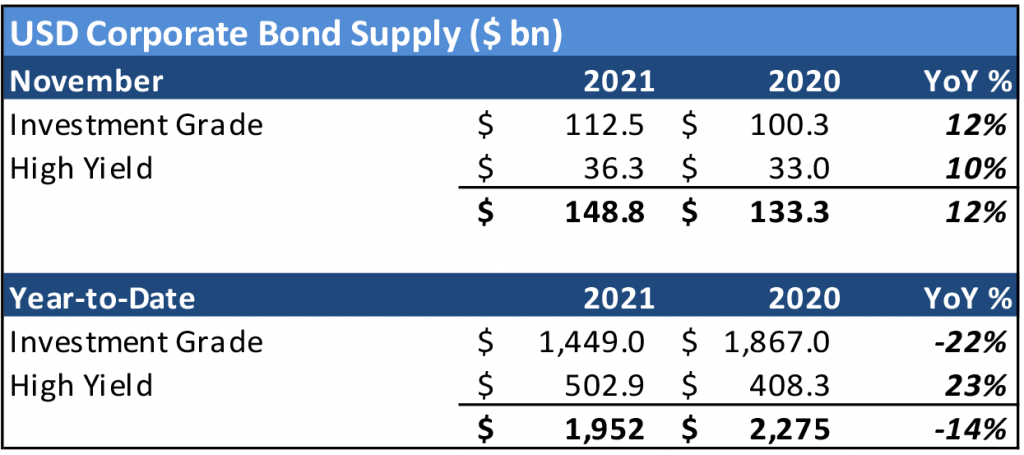

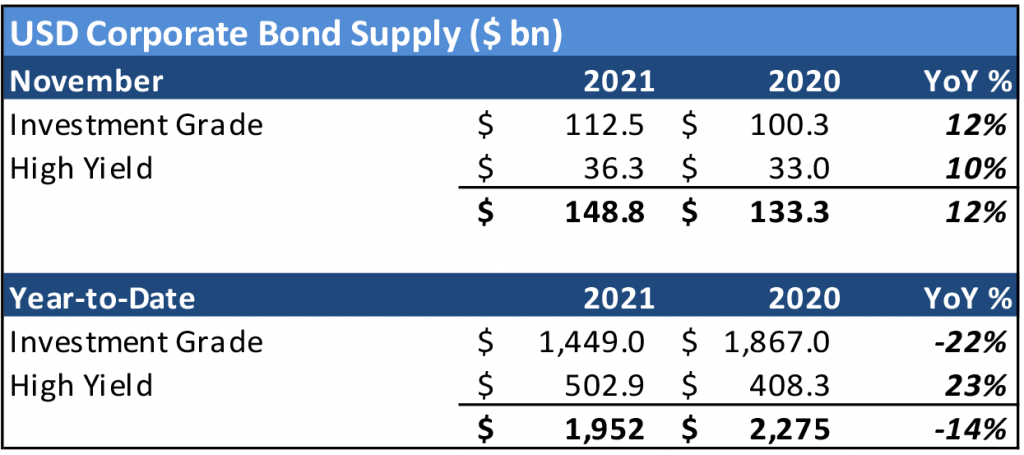

New issue volume for the IG corporate bond market modestly exceeded expectations at $112.5 billion in November and continued to outpace the prior year period for the second consecutive month. Jumbo deals from Baxter (BAX: Baa1*-/A-*-/A-*-), HSBC Holdings (HSBC: A3/A-/A+), Westpac (WSTP: Aa3/AA-), and Canadian Pacific (CP: Baa2/BBB+) contributed to the overall active tone from issuers throughout the month. The market is estimating another $55 billion in supply for December, which is keeping volume on pace to reach $1.5 trillion by year-end. The high yield market provided an additional $36.3 billion in November, just modestly edging out the prior year period.

Exhibit 3. Supply Recap

Source: Bloomberg LP

Exhibit 4. Weakness in energy, communications and transportation amidst the abrupt back-up in spreads

Source: Bloomberg Barclays US Corp Index

Exhibit 5. Flight-to-quality apparent late in the month

Source: Bloomberg Barclays US Corp Index

Exhibit 6. Long paper underperforms amidst risk-off market posture

Source: Bloomberg Barclays US Corp Index

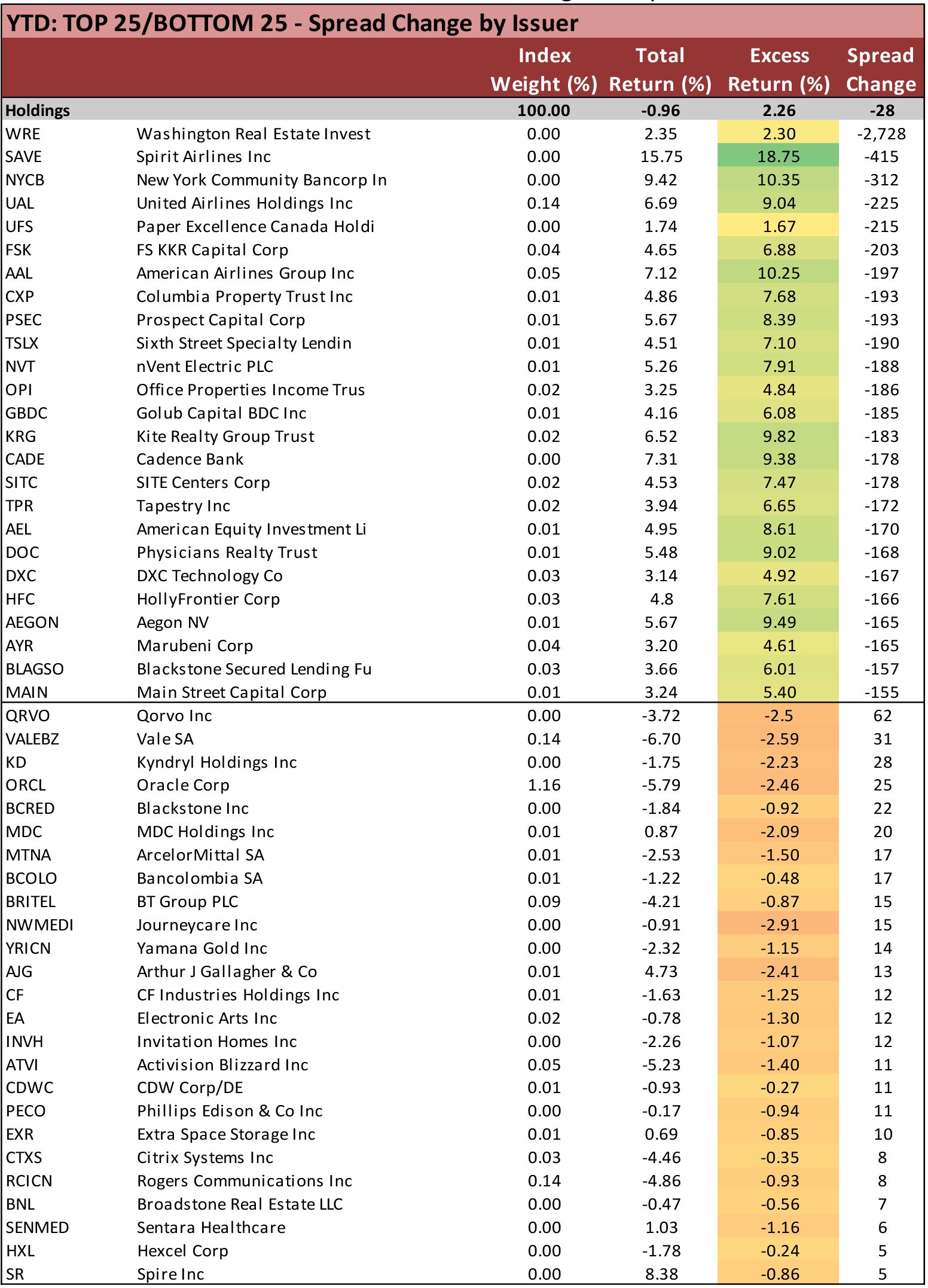

Exhibit 7. Mixed bag among the top performers, while airlines and energy prominent among the worst performing credits

Source: Bloomberg Barclays US Corp Index

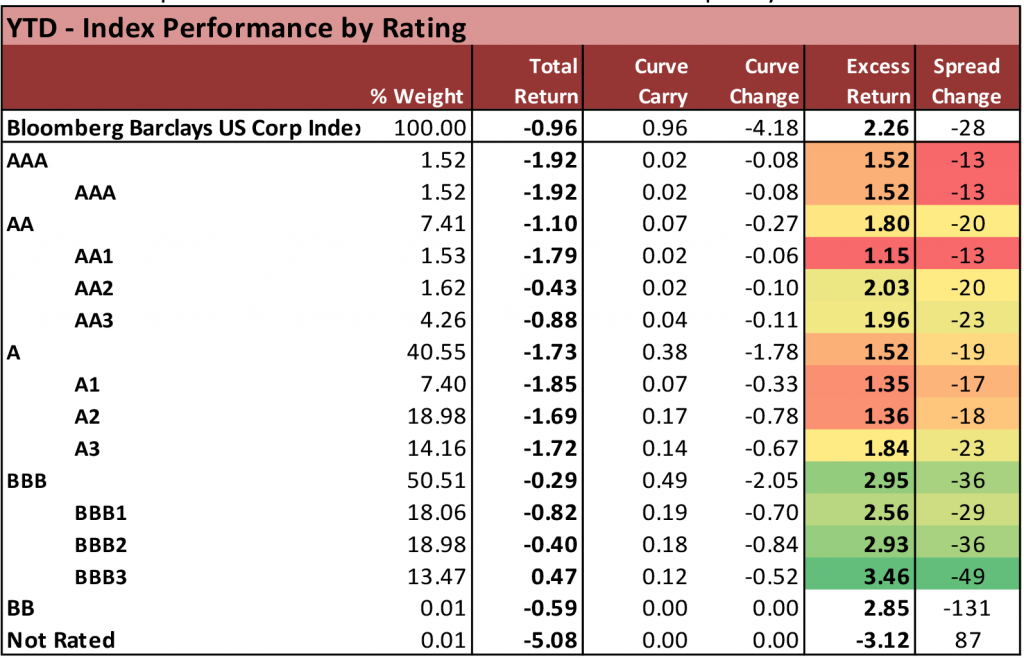

Year-to-Date Index Performances

Exhibit 8. Energy and Finance Cos have remained the prevailing credit trades YTD, while tech and banking underperform

Source: Bloomberg Barclays US Corp Index

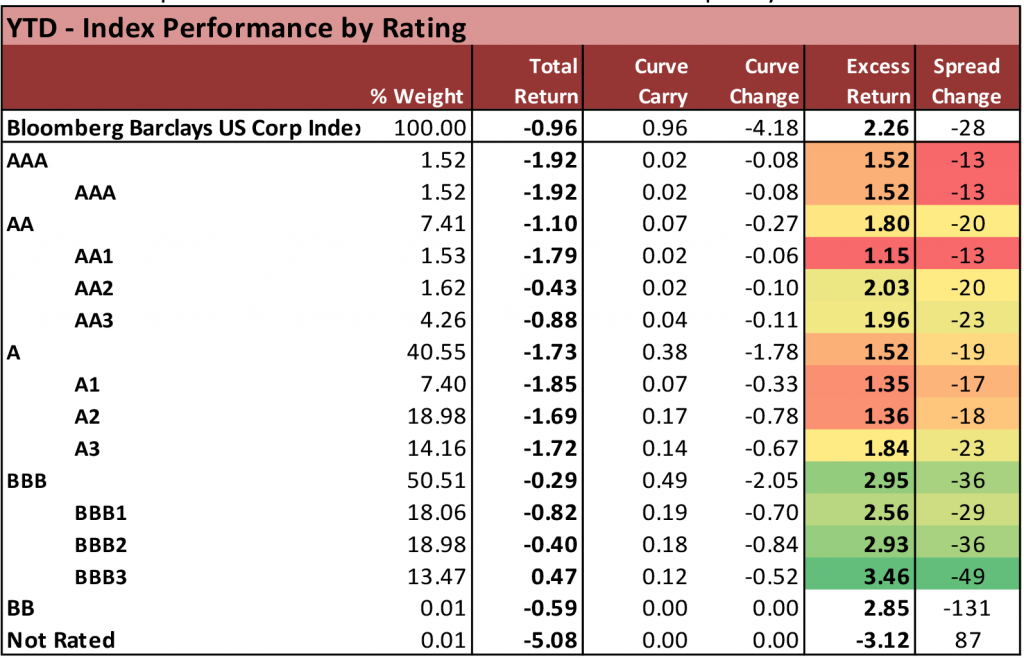

Exhibit 9. Investors have sought higher-yielding, lower-rated credits YTD even as more recent preference has been for more stable credit quality

Source: Bloomberg Barclays US Corp Index

Exhibit 10. Long paper has held up as the preferred strategy YTD

Source: Bloomberg Barclays US Corp Index

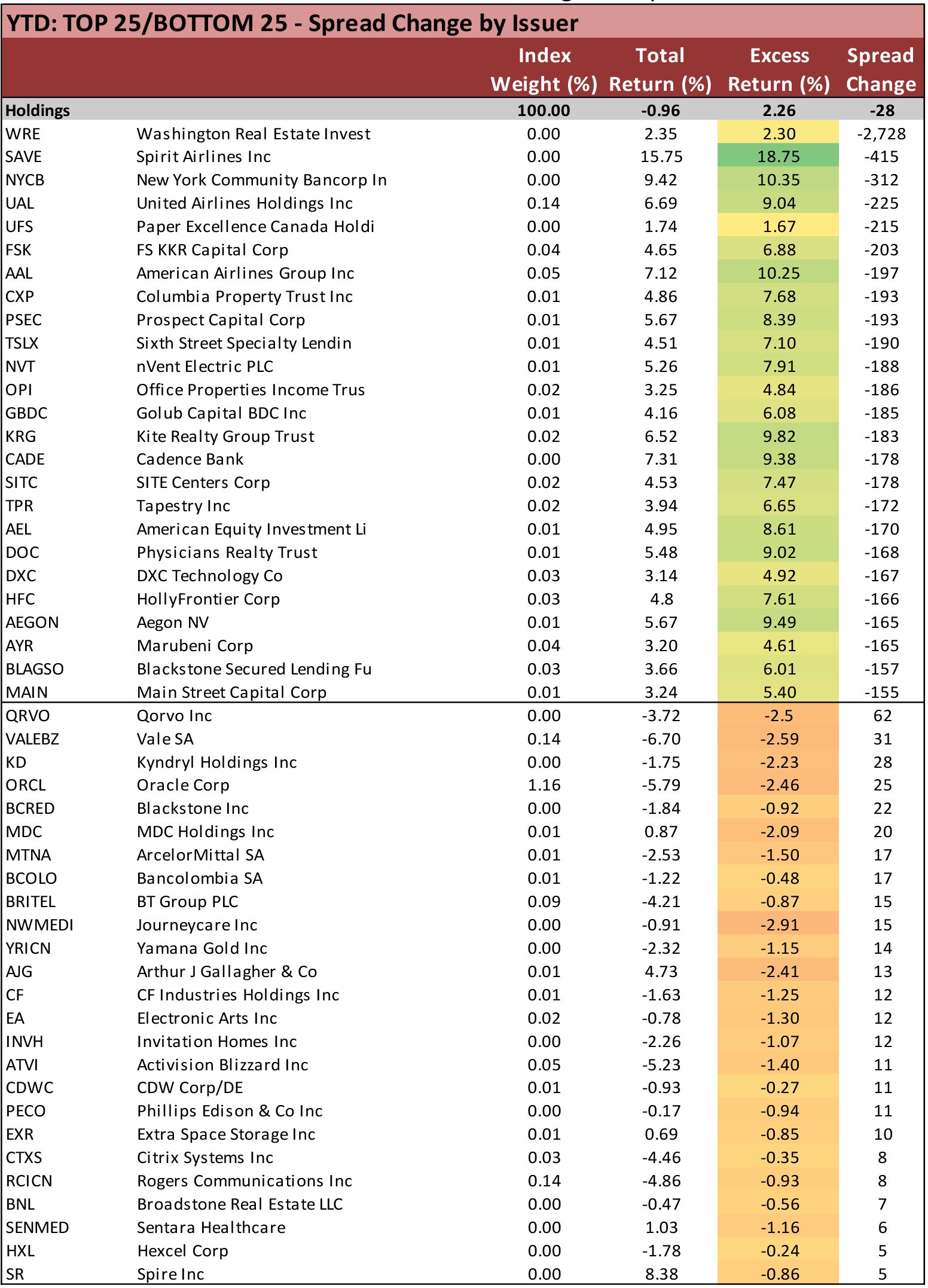

Exhibit 11. Airline credits and BDCs remain among the top credit trades of 2021

Source: Bloomberg Barclays US Corp Index

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.