The Big Idea

Targeting a labor force participation rate

Stephen Stanley | November 12, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Labor demand has revived faster and more vigorously than expected coming out of pandemic. But one of the great economic mysteries of 2021 has been the sluggish rise in labor force participation, which has left firms unable to staff up sufficiently and sparked widespread labor shortages. Participation should improve considerably over the next several months. Supplemental unemployment benefits have expired, schools are back to near-normal operations and health concerns should be fading. Detailed analysis indicates that simply declaring participation needs to get back to pre-pandemic levels, as several Fed officials have suggested, is not the best gauge of whether the economy has returned to full employment.

Labor force participation

Labor force participation is determined from the Bureau of Labor Statistic’s monthly household survey. Two survey questions allow calculation of several key labor measures. First: Are you employed? If yes, then the person is designated as employed. If the answer is no, then: Did you actively seek work last month? If yes, then the person is classified as in the labor force and unemployed. If no, then the respondent is designated as out of the labor force. Labor force participation consequently includes everyone who is employed or unemployed. The labor force participation rate (LFPR) is the sum of the employed and unemployed divided by the working age (16 and over) population.

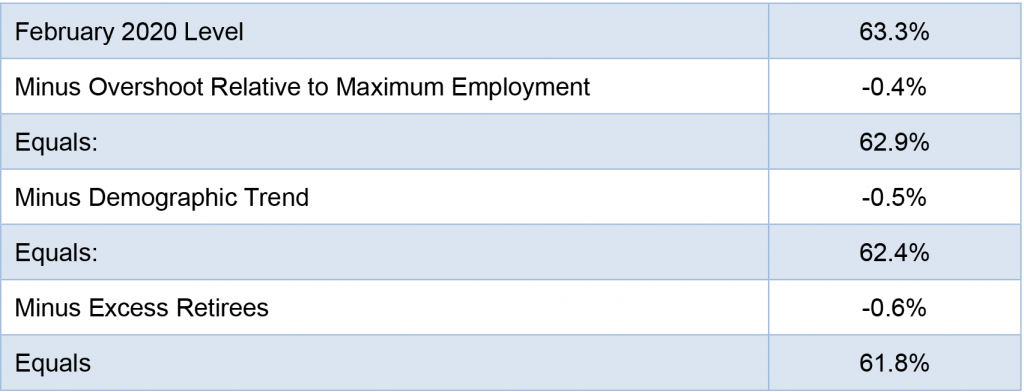

The extraordinarily tight labor market just before the pandemic had driven labor force participation well above 63% (Exhibit 1). The LFPR fell sharply during the lockdowns and then recovered partially in the summer of 2020. Over the course of this year, it has crept higher but remains well below pre-pandemic levels.

Exhibit 1: The labor force participation rate has not yet recovered from pandemic

Source: BLS.

Gauging the correct target LFPR

Fed officials would like to see the economy return to maximum employment. They have defined that concept to include not just a certain level of the unemployment rate, which the latest round of FOMC economic projections from September pegged at 4.0%, but also an adequate level of labor force participation. In theory, if the unemployment rate sinks to the desired level but a large number of people who were formerly in the labor force but could be coaxed to work remain on the sidelines, then there is in some sense still slack in the labor market. A tricky question is what is the proper target for the LFPR?

To start, it is worth noting that the labor market was running hot in early 2020. The unemployment rate had dropped below 4% in 2018 and was running around 3.5%, the lowest in more than 50 years, just before Covid hit. The last half a percentage point or so in the ascent of the LFPR during the last expansion arguably reflected the unusually tight labor market. It is also worth noting that average hourly earnings were running at a relatively stable growth rate of around 2.5% until the unemployment rate slid below 4% and then began to steadily accelerate until early 2020, another indication that the labor market was unsustainably tight.

Fed officials concluded from the last expansion that the economy could safely run hot, with the labor market tight, because a sub-4% unemployment rate from 2018 through early 2020 was accompanied by inflation at or below the Fed’s 2% target. Indeed, the FOMC chose to alter its entire monetary policy framework based on the experience of that period. The committee has committed to maintaining its policy rate at the zero bound at least until the economy reaches maximum employment and inflation is likely to run modestly above 2%, a sharp departure from how policy was conducted since the Great Inflation of the late 1970s.

Unfortunately for the Fed, inflation has exploded in 2021. While officials are not ready to abandon their brand-new framework, the economic assumption behind it, that the economy, and in particular the labor market, could run hot without sparking higher inflation, has been sorely challenged by recent developments. A better target for LFPR is a level roughly consistent with maximum employment, not one signifying an unsustainably hot labor market, such as in February 2020.

Labor force participation and demographics

The BLS defines the working age population as 16 and over, which means that the aging of the U.S. population is generating a secular downtrend in labor force participation. As a higher proportion of the population enters retirement age, the overall labor force participation rate will, all else equal, move lower.

One way to account for this phenomenon is by creating an alternative labor force participation rate that adjusts for the changing age composition of the population. This involves taking the weights of the various age groups at some particular date and applying those constant weights to the actual LFPRs over time for each age bracket. This creates a hypothetical series measuring what labor force participation would be if the age composition of the population never changed. This alternative series can be compared to the actual LFPR series to ascertain how much of a difference shifting demographics are making.

This exercise reveals that the evolving age composition of the population has lowered the LFPR by about half a percentage point since the pandemic began, further cutting the gap between the current LFPR and our ideal target.

Retirement during Covid

People may have chosen to sit out from the workforce during Covid for a number of reasons. Exceedingly generous unemployment benefits and other federal payments likely played a role. Health concerns certainly have dissuaded some from working. Still others have been unable to hold a job because of caregiving responsibilities. Finally, a number of older workers chose to retire last year.

It stands to reason that people who were close to retiring before Covid hit and lost their jobs would have decided to just bring forward their retirement. In addition, the surge in asset values would have made it easier for those nearing retirement age to step away. Usually, in a period when unemployment spikes, asset values drop, jeopardizing retirees’ financial plans and delaying retirement, but the 2020 episode was unique in that asset values increased dramatically.

The data bear out that retirements last year spiked. Various researchers have crafted estimates of the magnitude of this phenomenon. A senior economist at the St. Louis Fed recently published a brief piece examining Covid retirements. He estimated the trend in the percentage of retirees in the population since Baby Boomers began reaching retirement age in 2008 and then extrapolated that trend line forward.

Comparing that trend estimate with the actual spike in retirees suggests that there were close to 3 million excess retirements due to Covid.

That number should probably be thought of as an upper bound on the impact of Covid retirements on labor force participation. Some of those people could in theory be enticed back to work under the right circumstances, though retirees typically have a very low propensity to return to work once they have made the decision to step away. In addition, many of the people who retired at the age of, say, 62 or 63 last year would have been retiring anyway in a few years’ time. Many of the excess retirees during Covid simply brought forward retirements that were going to eventually happen anyway. That means that the “excess retirements” relative to the pre-pandemic trend should erode over the next several years. Still, even if we assume for now that the excess number of near-retirement-age workers who have permanently left the labor force due to Covid is 1.5 million, half of the 3 million estimated by the St. Louis Fed economist, that would be worth about six tenths of a percentage point on the LFPR.

Summing up

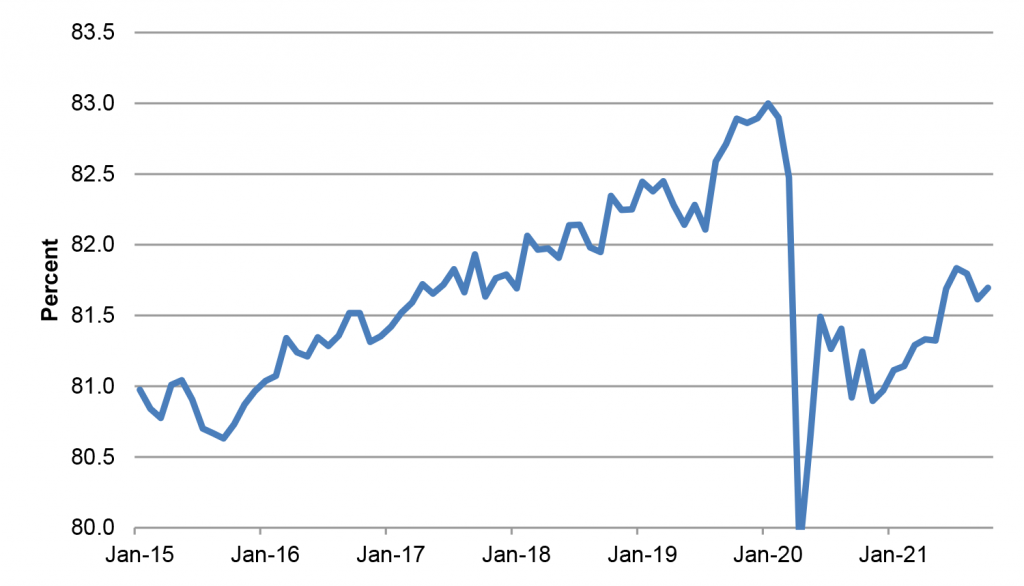

If we combine these three factors, it is possible to estimate a more informed LFPR target than simply to aspire to returning to the February 2020 reading of 63.3% (Exhibit 2). The combined impact of the three factors pushes our refined target LFPR down to 61.8%. The October LFPR reading was 61.65%, so, despite the wide gap between the latest result and the February 2020 level, the economy may be much closer to maximum employment than most Fed officials are contending.

Exhibit 2: Refining a “target” LFPR

Source: BLS, Author’s Calculations.

Prime-age doublecheck

One way to crosscheck our estimate, especially against the impact of shifting demographics and Covid retirees is to focus on the prime-age LFPR, which covers workers aged 25 to 54 (Exhibit 3). This avoids the quirks caused by aging Baby Boomers and early retirees.

Exhibit 3: Labor Force Participation Rate Ages 25 to 54

Source: BLS.

The prime-age LFPR measure gets us to a very similar place. While it is true that the prime-age LFPR was considerably higher in February 2020 (82.9%) than it is now (81.7%), the overshoot of maximum employment from early 2018 to early 2020 accounts for much of the gap. When the unemployment rate was near 4% in early 2018, consistent with the Fed’s estimate of maximum employment, the prime-age LFPR averaged 81.9%, a full percentage point lower than the February 2020 reading. Chair Powell has talked often about the societal benefits of running the labor market hot and drawing in people who have typically had only a marginal attachment to the labor force. However, that view assumes that we can go back to the 2018-2019 state of the world, where the labor market can run hot without sparking inflation. Current circumstances clearly suggest that the 2018-2019 period may have been a historical anomaly.

In any case, the current prime-age LFPR is 81.7%, just a few tenths lower than the early 2018 level. The gap between the actual LFPR and our refined target is basically the same (about two tenths of a percentage point) whether we look at the overall or the prime-age gauge.

Conclusion

All of these calculations are made using assumptions that can be questioned. Crafting a proper LFPR target requires both art and science. However, this approach offers a plausible guess at the rate of labor force participation that is consistent with sustainable maximum employment. What is most interesting is that the shortfall in labor force participation here is actually smaller than the current gap between the unemployment rate (4.6%) and the Fed’s estimate of the optimal sustainable rate (4.0%).

In any case, the labor force is still very much in flux. The impact of supplemental unemployment benefits will fade over the next several months. Hopefully, as schools and day care capacity normalize, more parents will be able to resume their careers. Finally, and perhaps most importantly, if Covid itself is brought under more control in the months ahead, health concerns will ebb. We should have a much clearer view of what a maximum employment post-pandemic labor market looks like in six months’ time. My guess is that, however we choose to define maximum employment, we will be there by next spring.