By the Numbers

Inflation crimps margins at Sysco

Meredith Contente | November 12, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

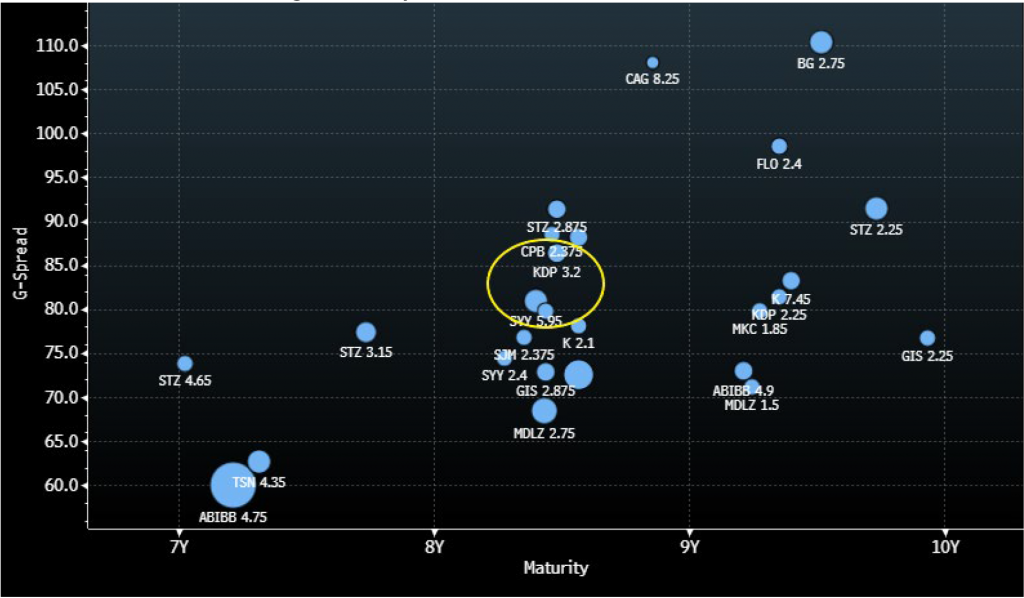

Sysco Corporation’s (SYY, Baa1 (n)/BBB/BBB (n)) recently posted third quarter 2021 results highlighted how inflation is taking its toll on margins. Despite management’s comments that inflation was effectively managed, gross margin contracted 110 bp while the adjusted EBITDA margin declined 90 bp. The company was able to offset a small fraction of inflationary pressure by managing operating costs, but the EBITDA margin decline is notable given that it’s a relatively low margin business. After an impressive recovery from pandemic-induced wides, SYY debt spreads are now too tight relative to the margin risk. Investors should look to sell the name and move into credits that are managing inflation better, such as Keurig Dr. Pepper (KDP – Baa2/BBB/BBB).

Exhibit 1. BBB Food & Beverage 7-to-10-year curve

Source: Bloomberg TRACE; APS

Select financial data for SYY comparing this quarter relative to the 2 year-ago period highlights the impact of inflation (Exhibit 2). While SYY spreads have made a dramatic comeback from the pandemic lockdown lows, when SYY issued 10-year bonds in 2/20 at +525 bp which are now trading at +81 bp g-spread, the rate of inflation is much greater than anticipated which will continue to impact margins. Peer KDP’s gross margin contracted only 10 bp from the third quarter of 2019 while its EBITDA margin expanded 340 bp (to 29.7%). Currently, KDP 3.2% 2030 bonds are trading roughly 3 bp (g-spread) behind SYY 5.95% 2030 bonds (Exhibit 1). Given the coupon difference, accounts can take out over 20 points of premium doing that swap.

Exhibit 2. SYY 3Q21 vs. 3Q19* Financial Data

*Used 3Q19 for better comparison purposes

Source: Company Reports; APS

Inflation Running Higher Than Modeled

SYY witnessed a rate of inflation of 13% in the third quarter, which came in much higher than expected. Management noted that they expect a similar rate of inflation for the current quarter. Furthermore, any taper to inflation is not expected to happen until later in 2022 and much later than what the company had previously modeled. Given the dynamic operating environment management did make one caveat that it is hard to predict when inflation is going to moderate. While SYY noted that they plan to pass through the majority of COGs inflation, they commented that continued double-digit inflation is bad for the industry as it will force them to push back on suppliers or find alternate suppliers. However, the supply chain bottlenecks may make than somewhat impossible at this point, which is why SYY believes inflation will taper much later than they modeled at the beginning of the year. Additionally, SYY discussed that inflation is not only impacting the obvious areas such as meat and poultry, but items such as fats and shortening, which are used to cook most menu items. The ability to pass through costs to the consumer only happens if the consumer remains robust and strong. With the consumer being faced with inflation on non-discretionary items as well, we think there is a potential for the consumer to start to push back in 2022.

Share Repurchases to Resume as Leverage Approaches Target

SYY announced a $5 billion share repurchase program in May of this year and now plans to commence share repurchase activity this quarter. Currently the company is looking to execute up to $500 million of share repurchases by the end of the fiscal year. SYY was able to eliminate covenant restrictions on its debt that prohibited it from buying back shares. SYY feels comfortable resuming share repurchases as it expects to hit its net leverage target of 2.5x-2.75x by fiscal year end. In order to hit its target, management is looking to repay its $450 million of bonds that come due in June 2022. Management is also prepared to take further actions with respect to its debt portfolio should margins continue to contract. We note that net leverage currently stands at 3.9x and management will need to not only repay the June 2022 maturity but see margins expand roughly 120 bp from current LTM levels. In our view, this will require management to pass through all COGs inflation while managing operating costs very effectively. Any further increases to inflation could put a wrench in hitting the leverage target. For comparison purposes, we note that KDP’s net leverage currently stands at 3.2x and management is forecasting to be at or below 3.0x by calendar year-end 2021.