By the Numbers

Limited MBS supply should cushion the impact of taper

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Through most of the pandemic, the Fed and banks have combined to absorb all net MBS supply along with MBS sold by other investors. But the Fed is likely to start tapering MBS purchases this year and bank demand could slow at the same time. Other investors would likely demand wider spreads to pick up the slack. But slowing home sales has pulled net monthly MBS supply down, which should reduce the pressure on spreads when the Fed tapers.

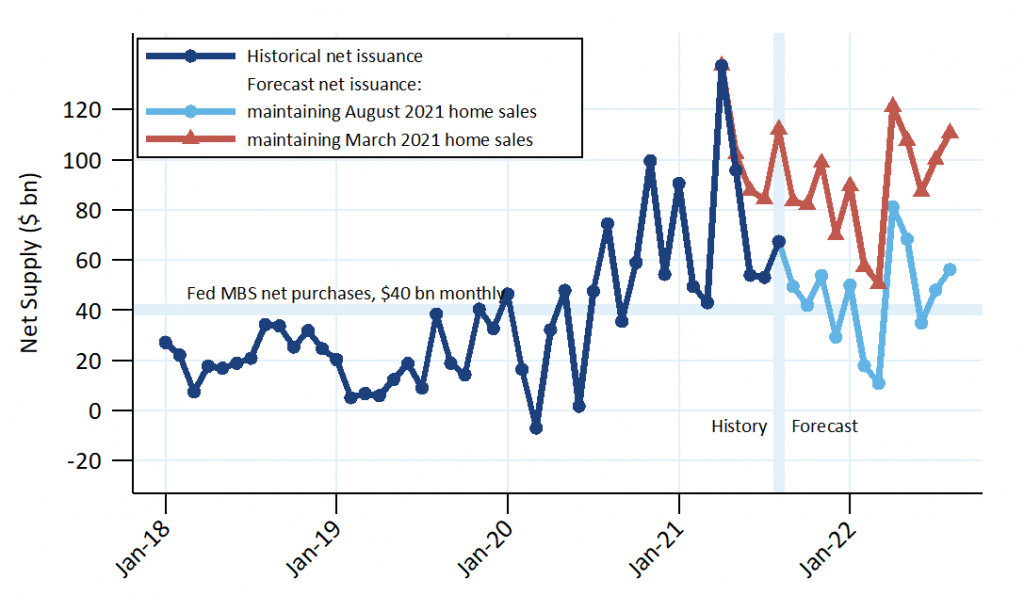

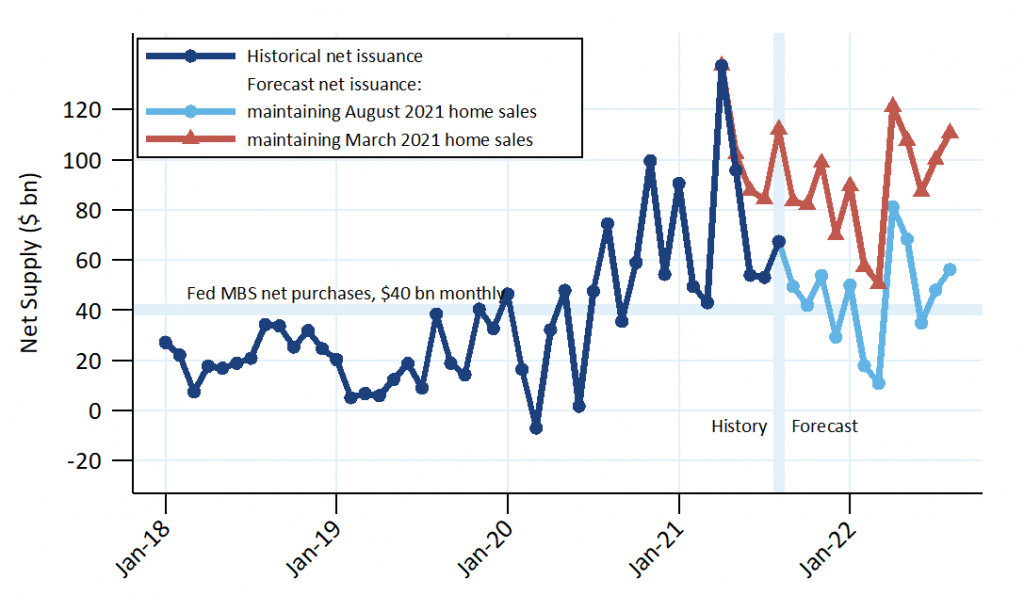

Amherst Pierpont’s monthly net MBS supply model predicts that lower home sales should drop net supply from roughly $90 billion a month through much of 2020 to roughly $45 billion a month over the next year (Exhibit 1). The dark blue line shows historical net supply through August. Net supply fell sharply after the peak in April. The red line shows the forecast using home sales data through March 2021. The model accurately predicted supply in May but was too high in June through August, mostly because the forecast for new home sales was too high. The blue line shows the net supply forecast using the home sales data reported in August, and as a result is much lower than the March forecast.

Exhibit 1: Net supply should drop because of slowing home sales

August forecast assumes 5.88 million existing home sales and 740,000 new home sales. May forecast assumes 6.08 million existing home sales and 955,000 new home sales.

Source: Bloomberg, Amherst Pierpont Securities

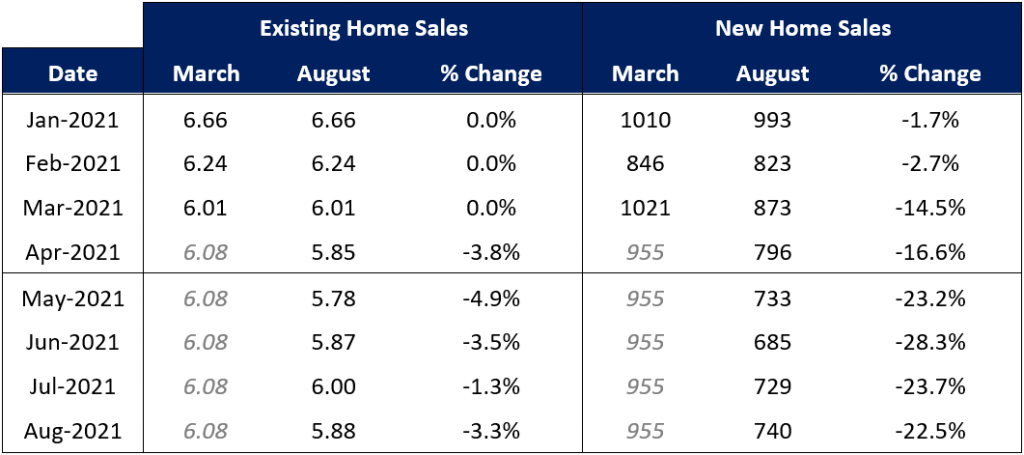

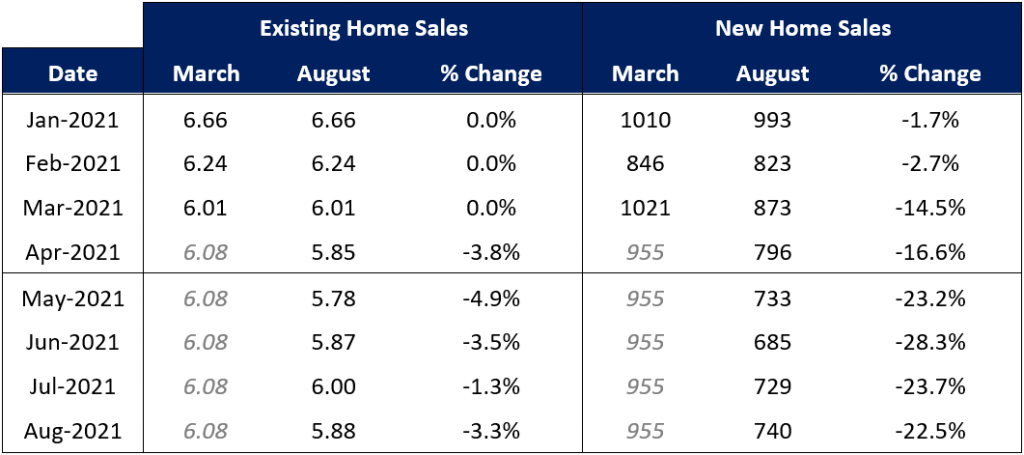

The pace of home sales is a large driver of new supply in the agency MBS market. Existing and new home sales jumped during the pandemic, reaching the highest levels since early 2007. Both indices peaked in early 2021 but fell sharply in the spring and summer (Exhibit 2). The table shows historical home sales data as reported in through March and reported through August. The March columns also shows the Bloomberg consensus forecast for April and assumes the forecast will remain unchanged after April.

Exhibit 2: New home sales fell sharply after March

Gray italicized data from 5/12/2021 are projections using the consensus forecast reporting by Bloomberg at that time. The 9/30/2021 column includes revisions for January through March, and actual home sales from April through October.

Source: Bloomberg, Amherst Pierpont Securities

New home sales slowed sharply after the March report and the consensus forecast was too high. The new home sales data from January through March was adjusted lower; the March print fell 14.5%. And new home sales from April through August ranged from 16.6% to 28.3% below the consensus forecast. Existing home sales also slowed, but the March forecast was only 4% too high. Demand for homes remains strong, but the housing market is suffering a supply shortage. Tight inventory is suppressing home sales.

The Fed is expected to start tapering their MBS purchases soon, and lower net supply reduces the risk of spread widening. Banks had been the primary buyer of the excess supply, roughly $50 billion per month, that the Fed could not buy. But banks may not have been willing to boost their purchases higher as the Fed steps back. In fact, there may have been pressure to cut purchases at the same time. But now private investors are only buying roughly $5 billion each month and should find it much easier to grow that amount when the Fed starts to taper.

This material is intended only for institutional investors and does not carry all of the independence and disclosure standards of retail debt research reports. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This message, including any attachments or links contained herein, is subject to important disclaimers, conditions, and disclosures regarding Electronic Communications, which you can find at https://portfolio-strategy.apsec.com/sancap-disclaimers-and-disclosures.

Important Disclaimers

Copyright © 2024 Santander US Capital Markets LLC and its affiliates (“SCM”). All rights reserved. SCM is a member of FINRA and SIPC. This material is intended for limited distribution to institutions only and is not publicly available. Any unauthorized use or disclosure is prohibited.

In making this material available, SCM (i) is not providing any advice to the recipient, including, without limitation, any advice as to investment, legal, accounting, tax and financial matters, (ii) is not acting as an advisor or fiduciary in respect of the recipient, (iii) is not making any predictions or projections and (iv) intends that any recipient to which SCM has provided this material is an “institutional investor” (as defined under applicable law and regulation, including FINRA Rule 4512 and that this material will not be disseminated, in whole or part, to any third party by the recipient.

The author of this material is an economist, desk strategist or trader. In the preparation of this material, the author may have consulted or otherwise discussed the matters referenced herein with one or more of SCM’s trading desks, any of which may have accumulated or otherwise taken a position, long or short, in any of the financial instruments discussed in or related to this material. Further, SCM or any of its affiliates may act as a market maker or principal dealer and may have proprietary interests that differ or conflict with the recipient hereof, in connection with any financial instrument discussed in or related to this material.

This material (i) has been prepared for information purposes only and does not constitute a solicitation or an offer to buy or sell any securities, related investments or other financial instruments, (ii) is neither research, a “research report” as commonly understood under the securities laws and regulations promulgated thereunder nor the product of a research department, (iii) or parts thereof may have been obtained from various sources, the reliability of which has not been verified and cannot be guaranteed by SCM, (iv) should not be reproduced or disclosed to any other person, without SCM’s prior consent and (v) is not intended for distribution in any jurisdiction in which its distribution would be prohibited.

In connection with this material, SCM (i) makes no representation or warranties as to the appropriateness or reliance for use in any transaction or as to the permissibility or legality of any financial instrument in any jurisdiction, (ii) believes the information in this material to be reliable, has not independently verified such information and makes no representation, express or implied, with regard to the accuracy or completeness of such information, (iii) accepts no responsibility or liability as to any reliance placed, or investment decision made, on the basis of such information by the recipient and (iv) does not undertake, and disclaims any duty to undertake, to update or to revise the information contained in this material.

Unless otherwise stated, the views, opinions, forecasts, valuations, or estimates contained in this material are those solely of the author, as of the date of publication of this material, and are subject to change without notice. The recipient of this material should make an independent evaluation of this information and make such other investigations as the recipient considers necessary (including obtaining independent financial advice), before transacting in any financial market or instrument discussed in or related to this material.