By the Numbers

Freddie Mac shakes up CRT with a tender offer

Chris Helwig | September 10, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Freddie Mac within the last week announced its first tender offer ever for STACR credit risk transfer bonds, posting bids for $650 million of securities at prices from $0.39 to $0.96 above recent market levels. The offer seems designed to pull the plug on costly credit protection. The tendered securities show high implied guarantee fees and are part of deals that cover large multiples of likely losses in the protected loans. Barring any changes in capital rules, the new tender offers may be a guide to securities the agency would bid for in the future.

Freddie Mac announced its on tender on September 7 for eight seasoned mezzanine STACR securities. Based on the weighted average factor, if the tender is fully executed, Freddie Mac would retire just over $550 million of insurance-in-force or roughly one quarter of the outstanding float of the eight targeted bonds. Of course, Freddie Mac maintains the right to upsize the offer.

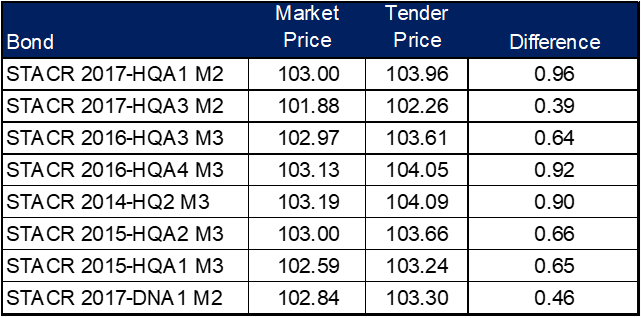

The eight deals tendered include seven high LTV transactions and one low LTV deal. The deals include seven actual loss deals and one fixed-severity transaction. Deals tendered were generally thicker last cash flows with higher stated margins where the savings associated with retiring the securities were material relative to the running guarantee fee that Freddie Mac receives on the loans. And there is a priority for bonds tendered by Freddie Mac where bonds with higher implied guarantee fess get priority over those with lower ones. Tender prices range from roughly three eights of a point to nearly a point over recent market clearing levels (Exhibit 1).

Exhibit 1: List of tendered bonds, estimated market and tender prices

Source: Freddie Mac, Amherst Pierpont

Capital rules enacted by Federal Housing Finance Agency in December materially diluted savings from issuing CRT, at least compared to previously proposed frameworks. Benefits from issuing CRT have been dropped by roughly 50% compared to the FHFA’s 2018 draft capital proposal. This dilution has led Freddie Mac to transfer smaller slices of risk since the new capital rule. The tender looks to be consistent with Freddie Mac’s broader optimization of risk transfer.

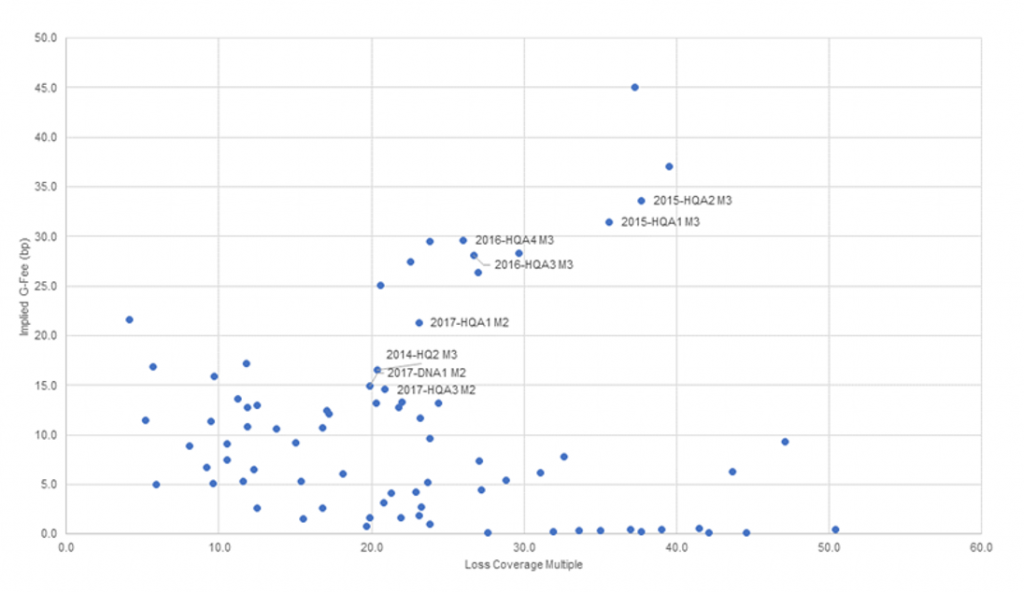

Beyond capital considerations, Freddie Mac may have looked to pare back some costly protection. Elevated prepayment and delinquency rates have combined to lock-out and deleverage outstanding CRT structures. This has materially increased loss coverage multiples. Seasoned CRT last cash flows now commonly provide credit enhancement that is upwards of 20 times the losses projected by Amherst Pierpont models. CRT liabilities are becoming larger percentages of the reference pool, increasing the cost of risk transfer relative to guarantee fee that Freddie Mac receives. The stated margin and tranche thickness of each STACR mezzanine bond implies a guarantee fee. Comparing the implied guarantee fee across the universe of STACR last cash flows shows that the bonds Freddie Mac chose to tender had both some of the highest implied guarantee fess and loss coverage multiples (Exhibit 2).

Exhibit 2: Tendered tranches shows high implied g-fees and high loss coverage

Source: Freddie Mac, Amherst Pierpont

If successful, the tender may encourage Freddie Mac to make more offerings. Based simply on the implied guarantee fee, bonds like STACR 2016-HQA1 and 2016-HQA2 M3 could be likely candidates. M3 classes of 2016 vintage STACR deals backed by low LTV collateral could be candidates to be tendered in the future as well.

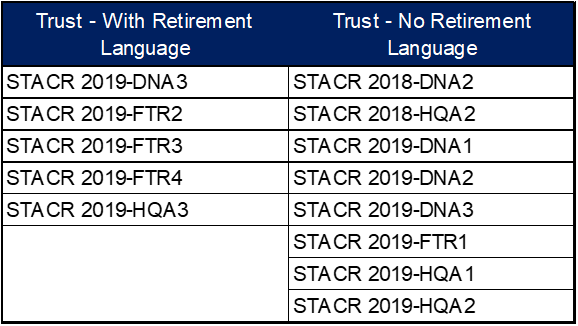

Future tenders will likely also be governed by Freddie Mac’s ability to retire the securities once they are repurchased. Freddie Mac can tender deals that are unsecured general obligations of Freddie Mac, the structure employed in deals issued from 2013 to 2017. REMIC transactions issued in 2019 and later contain language that allows Freddie Mac to retire notes as well. Five non-REMIC deals contain early retirement language as well. However, certain 2018 and 2019 Trust/144A deals do not have early retirement language. The absence of early retirement language would not preclude Freddie Mac from having the ability to purchase these securities from investors. However, it is likely more operationally challenging for Freddie Mac to buy these bonds back and effectively own a long and short position in the credit risk (Exhibit 3).

Exhibit 3: Certain STACR trust deals may be more difficult to tender

Source: Freddie Mac, Amherst Pierpont

In terms of implications for the CRT market going forward, the move by Freddie Mac should not be viewed as a reduced commitment to the program but more so a strategy that is complimentary to their optimization of risk transfer under the new capital rules. The tender should have limited impact on the pricing of CRT going forward as the option to tender bonds effectively creates a long put option for investors. But given that the put may never be exercised and lacks a defined strike price and expiration, its value to investors is likely fairly negligible. Additionally, the potential premium that Freddie Mac would be willing to pay over the market price of bonds would likely be capped by the savings associated with releasing capital held against these positions which may be fairly negligible given the risk profile of the reference loans, potentially making it less feasible to tender longer dated, higher premium CRT.