By the Numbers

Influences on the securitization choices for investor loans

Chris Helwig | August 20, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

In the wake of limits put on the amount of investor loans that Fannie Mae and Freddie Mac can buy, mortgage investors have focused keenly on the private-label MBS market’s ability to provide an efficient alternative. To date, it appears private-label MBS has demonstrated its ability across both prime and non-QM sectors. Given this, it begs the question of whether private financing of investor loans is a transitory phenomenon or an integral source of liquidity for owners of investment properties going forward.

The private-label market’s role in financing investor properties will likely depend on a handful of factors, some which are fundamentally unique to the private market and permanent in nature while others may be more transitory. Some of these factors include the following:

- The ability of the private-label market to more efficiently price credit risk through subordination rather than fixed loan-level pricing adjustments, and the subsequent impact on best execution

- Greater flexibility in funding and capitalizing Mortgage Servicing Rights in private-label transactions

- Greater latitude in underwriting loans backed by investment properties, specifically the use of a property’s rental income rather than the borrower’s

The PLS market: subordination and best execution

Mortgage originators are ultimately in the business of best execution, and the viability of private-label financing, particularly for GSE-eligible investor loans, will likely depend in large part on whether the private-label market can provide a higher price for investor loans. Originators of GSE-eligible loans have the alternative of pooling and selling the loans into specified pool execution. One factor that will drive private-label pricing for an investor loan is the amount and cost of credit enhancement required. While the private-label market can provide more granular and efficient pricing of credit risk in an investor pool, this will only be a part of what drives best execution. Other factors include specified pool pay-ups, the ‘AAA’ bond price relative to its TBA benchmark, the value assigned to excess interest relative to the fixed-bond coupon and fixed costs associated with private-label issuance.

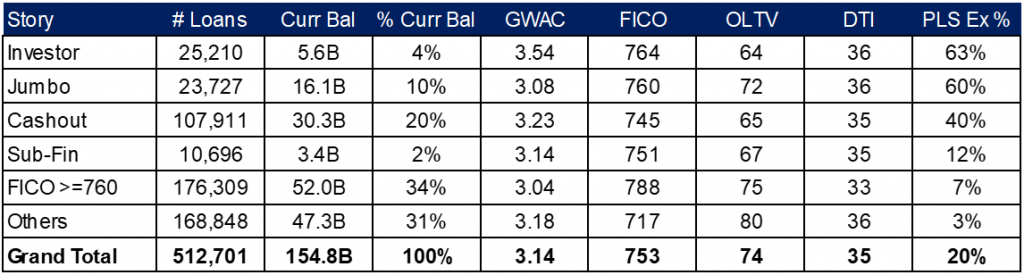

Looking at the population of loans delivered to the GSEs in June shows that after taking all these factors into account and assuming the private-label ‘AAA’ pass-through prices at $1-16/32 behind its UMBS benchmark, roughly two-thirds or 63% of investor loans would have achieved a higher price in private-label execution (Exhibit 1). If ‘AAA’ pass-through execution were to widen to $2-0/32 back of TBA, 43% of investor loans would still fetch greater than a quarter point higher price in private-label execution. Additionally, this sample is exclusive of agency-eligible investor loans that originators sold to private-label conduits in June, so the total percentage of agency-eligible investor loans that would have seen a better private-label price is appreciably greater than the two-thirds estimate. Current pricing clearly points to elevated amounts of agency-eligible loans flowing into private-label trusts in the near term. Based on Amherst Pierpont estimates, another $15 billion in agency-eligible investor loans may flow through private-label issuance by the end of this year.

Exhibit 1: Roughly two thirds of investor loans achieve a higher price in PLS

Source, Fannie Mae, Freddie Mac, Amherst Pierpont

Looking further down the road, the amount of private-label issuance backed by agency-eligible investor loans should be predominantly decided by a few factors.

- The TBA dollar roll. As the Federal Reserve begins to taper purchases of agency MBS, enhanced carry from rolling TBA contracts should decline. Lower carry in TBA generally allows for increases in specified pool pay-ups which are likely currently capped due to special dollar rolls, particularly in lower coupons.

- The bid for credit. Continued elevated amounts of private-label issuance will depend on a strong and steady capital markets bid for the credit risk. As evident in the spring of last year, the capital markets appetite for credit risk can be quite volatile.

- Structure of the credit enhancement. Credit enhancement on loans that flow to the GSEs is funded through the loan’s interest in the form of a running guarantee fee while credit enhancement in private-label MBS is funded through principal subordination. As valuations on the principal and interest components of a loan change, best execution will change along with those valuations. Given this, the amount of loans that get better pricing in private-label can change materially if the valuations on the principal and interest components of the mortgage loans do so as well.

MSR funding and capitalization

A more fundamental advantage that the private-label market maintains over agency execution is substantial flexibility in assigning value to a strip of base servicing. Basel III increased the amount of capital banks are required to hold against MSRs from eight points of capital to twenty points, and capital requirements can grow to the full market value of MSRs that exceed a certain threshold. In response to both these regulatory changes and the pristine nature of loans that banks originated, banks sought to change the amounts of base servicing held against mortgage loans. The goal was to more accurately reflect the actual cost of servicing a performing loan. Subsequently, some banks began to construct variable compensation servicing agreements where a pre-defined amount of compensation would be passed on to the servicer and would increase if a loan required special servicing. And if loans are performing, the amount of base servicing an originator is required to capitalize is very small.

Conversely, if originators choose to sell an investor loan to the GSEs, they are required to create and capitalize a minimum 25 bp base servicing strip. And that appears unlikely to change. Before to the 2008 crisis, the GSEs did launch pilot programs that allowed originators to hold less than 25 bp of base servicing. Unfortunately, one of these programs was piloted with ill-fated Countrywide Financial, where the cost of servicing large populations of delinquent and defaulted loans ultimately well exceeded the reduced base servicing strip.

And while variable servicing compensation structures were initially adopted by banks that faced more onerous requirements for capitalizing servicing, it appears they may be attractive for non-banks as well. Given the current low level of interest rates, current coupon IO multiples, especially those on what are viewed to be more positively convex investor loans, are substantial and will only expand given a back-up in rates. The amount of up-front capital that an originator would have to post against a 25 bp strip is substantial, likely close to six times the coupon currently and will only increase as rates sell off. Given this, non-bank originators, especially those that operate in capital light framework will likely begin to adopt these servicing agreements more broadly, potentially driving more loans to private-label execution.

Debt service coverage underwriting

The private-label market, specifically the non-QM market, also affords originators and sponsors of securitization significantly more latitude in the source of income used to underwrite an investor loan, albeit at the cost of risk retention. Originators can underwrite investor loans using a property’s actual or estimated rental income rather than the borrowers. Against the backdrop of strong rent growth across many MSAs— upwards of 15% year-over-year in MSAs like Phoenix, according to CoreLogic—underwriting using growing rental incomes should help increase private market share financing and expand the scope of financing alternatives for investors who may not otherwise qualify for loans based solely on personal income. Additionally, as the prices of loans going onto non-QM trusts have increased, so have the advance rates on par bonds issued by sponsors of these deals creating more favorable economics for sponsors of non-QM trusts and reducing the amount of par bonds they are required to hold to meet risk retention requirements against investor loans underwritten using debt service coverage.