The Long and Short

Applied Materials Inc. performance should flatten curve

Meredith Contente | August 13, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

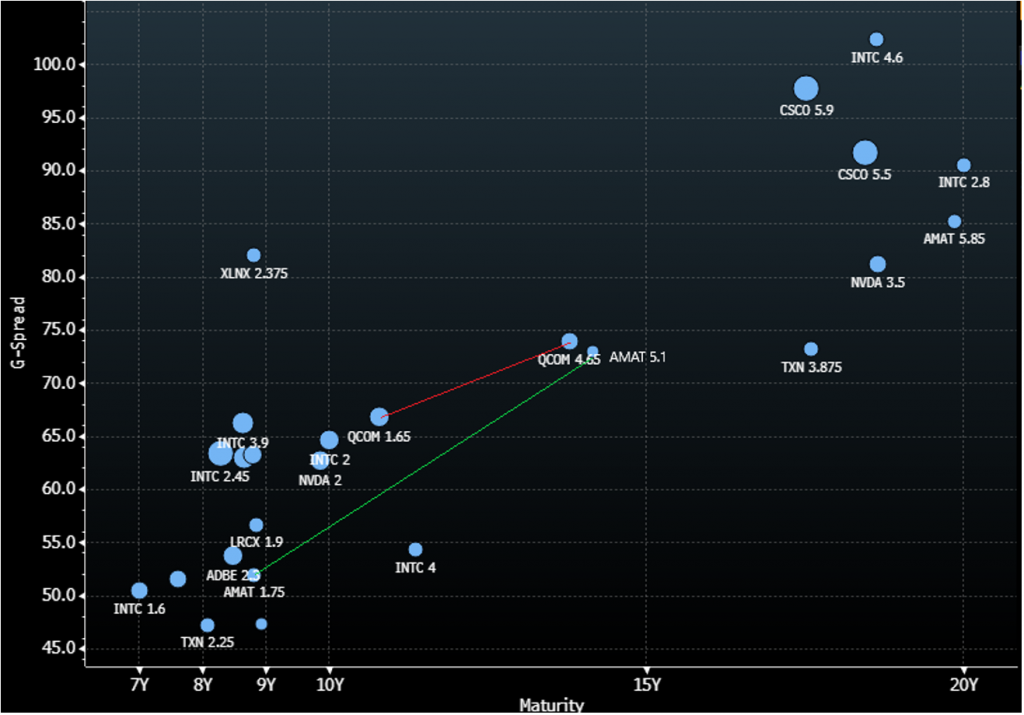

Applied Materials Inc.’s (AMAT, A2/A) intermediate curve should flatten relative to peer Qualcomm Inc. (QCOM – A2/A-), creating a relative value opportunity. QCOM’s curve is much flatter, at roughly 8 bp, while AMAT’s is over 20 bp. AMAT is rated one notch higher at S&P than QCOM and remains in a net cash position of just over $1 billion, versus a net debt position of roughly $3.1 billion at QCOM. While both credits generate strong free cash flow, QCOM has been a bit more aggressive with shareholder remuneration, distributing roughly 60% of free cash flow to equity holders via dividends and share repurchases versus approximately 43% at AMAT. There is upside potential in AMAT 5.1% 2035 bonds of roughly 10 bp if AMAT’s curve continues to flatten as operating results exceed consensus estimates.

Exhibit 1. Single-A Technology 7yr-20yr Curve

Source: Bloomberg TRACE; APS

Record Second Quarter Results

AMAT posted record quarterly revenue of $5.58 billion in 2Q21, which was up a strong 41% from the year-ago period, and at the high end of management’s guidance range. Results were fueled by broad-based strength across its semiconductor businesses as secular trends have created sustainable demand. Semiconductor Systems witnessed record revenue of approximately $4.0 billion, up 55% year-over-year. Additionally, the Semiconductor unit saw its operating margin increase 800 bp year-over-year, to 39%, which is the unit’s highest operating margin in roughly 14 years. AMAT noted that for the first time, customers are providing capital spending guidance for multiple years in the future, underscoring the demand sustainability. Furthermore, AMAT’s prowess in materials engineering has been critical in developing and delivering new chip technologies amidst the market chip shortage caused by the pandemic.

At the Applied Global Services unit, subscription revenues continue to grow. Management noted that 90% of AMAT’s reported services business is composed of recurring services and parts revenue, which helps to support the top line as well as free cash flow. For the quarter, nearly 70% of services and parts booking were subscription based. Furthermore, roughly half of those subscriptions had terms of at least three years. The operating margin was 30% in the quarter, up 100 bp sequentially and 400 bp year-over-year. Management noted that this quarter was the highest margin quarter for the unit in nearly 15 years.

In the Display & Adjacent Market division, revenues grew 3% year-over-year but the operating margin contracted 300 bp year-over-year. Margins have contracted due to investments in the next wave of OLED (organic light-emitting diode) products, including foldable smartphones, tablets and TVs. Now that the investments have been completed, AMAT has guided to increasing the margin to over 20% in the coming quarter with a longer term target in the 25%-30% range.

Exhibit 2. AMAT Fiscal 2Q21 Segment Results

Source: AMAT Fiscal 2Q21 Company Presentation; APS

Agencies Upgrade on Strong Performance

Earlier this week, S&P upgraded AMAT’s rating one notch, to A, with a stable outlook. The agency noted that the upgrade reflects the company’s strong business expansion and resilient operating performance through semiconductor cycles. S&P expects AMAT’s strong revenue growth (of roughly 30%) to continue for the remainder of fiscal 2021. Furthermore, S&P expects AMAT’s EBITDA margin to expand with the top line growth and sees the margin in the 32% area, up from 28.7% posted at year-end 2020. Aside from the top line and margin growth, S&P also believes that AMAT will maintain its strong balance sheet and management’s conservative financial policy will help keep leverage low. While share repurchases are likely to increase, AMAT is not expected to move into a net debt position and at worst will keep a net-cash neutral position.

We note that back in April, Moody’s upgraded its rating to A2 with a stable outlook reflecting expectations for continued strong operating performance and the maintenance of conservative financial policies. Moody’s noted that AMAT has a long history of financial conservatism which includes large cash positions and low leverage (close to 1.0x). The company’s credit profile is further supported by its growing base of recurring subscription revenues.