The Big Idea

The real real in rates

Steven Abrahams | July 23, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The US rates market continues to defy expectations at least for readers of the drumbeat of headlines about inflation. Inflation is throwing its biggest party in more than a decade, and there is a robust debate about how long it will last. It seems difficult then to understand how the 10-year note within the last week could trade briefly below 1.13%. But the market has priced more to liquidity than inflation since rates peaked this year in April. To turn the trend to lower rates around, the market has to believe the Fed will start slowing and eventually reverse the flow of liquidity or that growth beyond 2023 will soak it up or both.

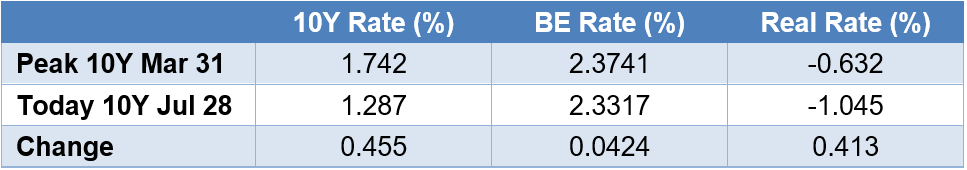

From the peak of 10-year rates at the end of March to their levels this week, almost all the movement has come not from repricing of inflation but from repricing of real rates (Exhibit 1). The 10-year rate has dropped more than 45 bp since March, but only 4 bp came from a shift down in implied inflation. The rest came from a repricing of real rates more than 41 bp lower. In the rate volatility of the last week, most of the action again came not in breakeven rates but in real rates.

Exhibit 1: Almost all the drop in 10-year rates since March has been in real rates

Source: Bloomberg, Amherst Pierpont Securities

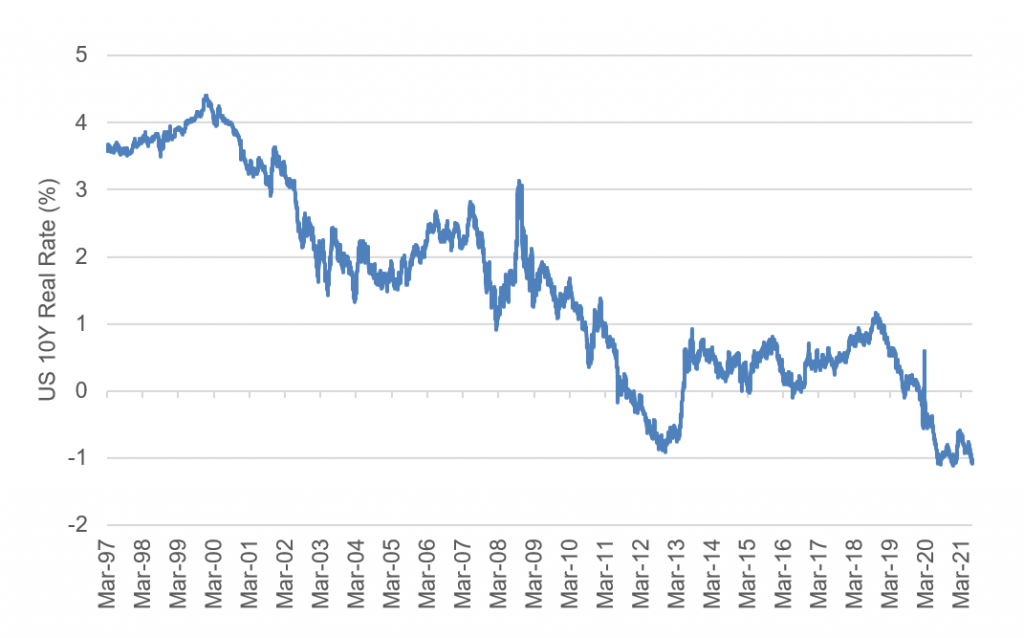

Real rates reflect market expectations about the clearing price for money—the rate where the offered supply of funding clears against the demand to borrow. Real rates today, at negative 107 bp, are near their lowest level since at least the 1990s (Exhibit 2). It is worth noting the 10-year real rate last approached current levels in the spring of 2013, shortly before the Fed signaled it eventually would taper QE and consequently triggered the taper tantrum. Arguably in 2013, the market believed a steady flow of Fed liquidity and weak prospects for growth would leave the market awash in cash and real rates low for a decade.

Exhibit 2: US 10-year real rates have neared record lows

Source: Bloomberg, Amherst Pierpont Securities

It may not be déjà vu all over again, but investors have grounds to expect that the supply of funds will outstrip demand to borrow. In particular:

- Massive liquidity. The Fed and global central banks have poured liquidity into the financial system on a completely new scale during Covid and arguably conditioned the system to expect high levels of liquidity in the future. Bank regulators also seem inclined to support a system with high levels of reserves, and that was true even before Covid following the September 2019 stresses in repo markets. It will likely take years to draw down reserves. Preferences for higher bank reserves come on top of the case made by former Fed Chair Bernanke for a global savings glut, with central banks outside the US holding high balances of currency reserves. The glut may have moderated, but it has not gone away. Consumers have saved more in the last year, but it is too early to make the case that will persist.

- Potential low growth and low investment demand. It is hard to separate expected growth from investment demand; growth can draw out investment demand and investment demand can drive growth. But we have seen both run below historic averages leading up to Covid. US labor force growth has been low and slipped further during Covid, and productivity has run low, too. Over the next few years, productivity growth may even run below the roughly 1% average of the last decade as many low-productivity jobs in retail and travel return. Labor force and productivity are the gears of GDP, and both have turned slowly. Levels of capital investment have generally dropped. We may see a rebound in capital investment as economies reopen, but it is unclear investment will go beyond niches left open by Covid.

For rates to go higher, the market will have to expect Fed liquidity to moderate or reverse, growth to drive up demand to borrow or both. That will require some artful policy. The Fed can begin to taper and eventually raise rates, but it has to do that in a way that sustains expectations of sufficient growth afterwards. That will likely take some persuading. The Fed in several episodes has raised rates to the point of tipping the economy into recession. The rates market has a long memory.

In the meantime, it remains a heavy lift for rates to rise back to their peaks of earlier this year until the Fed shows its hand on the timing and pace of tapering. Investors that need yield will have to keep using the levers available: taking prepayment or call risk, taking credit risk, taking liquidity risk or taking some combination of all of the above.

* * *

The view in rates

Fed RRP balances closed Friday above $877 billion. And with the Treasury General Account at the Fed still holding $225 billion more in funds than the Treasury’s $450 billion target at the end of June, more cash will likely flow into the money markets and end up posted to the RRP.

Settings on 3-month LIBOR closed the week at 12.5 bp, still within basis points of the lowest setting ever. There is only minimal credit premium in the front end of the market. Fed tapering should keep cash pouring into the front end into the second half of 2022, so money market rates look likely to remain low into 2022, as well.

The 10-year note has finished the most recent session at 1.28%, down 1 bp on the week after dipping as low as 1.13% during the week. Breakeven 10-year inflation is at 235 bp, up on the week by 1 bp. The 10-year real rate finished the week at negative 107 bp, down 2 bp on the week. As noted earlier, real rates are driving the market.

The Treasury yield curve has finished its most recent session with 2s10s at 108 bp, 1 bp steeper than a week ago. The 5s30s curve has finished at 120 bp, steeper by 5 bp.

The view in spreads

Bearish on MBS, more bullish on corporate and structured credit. The prospect of Fed tapering and heavy net supply should keep weighing on MBS spreads until the Fed shows its hand and the market can price the impact. The market has already priced additional risk of soft demand and steady supply, with the nominal spread of par 30-year MBS to the 7.5-year Treasury at 73 bp, wider from the end of May by 11 bp. Spreads look vulnerable to going still wider as the Fed likely leans into tapering or tapering-and-hiking faster than its 2013-to-2015 cycle.

In credit, benchmark investment grade cash spreads have widened only 2 bp from the end of May and should continue to outperform MBS. Demand from mutual funds, international portfolios and insurers looks healthy. Low rates should continue supporting corporate balance sheet strength. Ratios of EBITDA to interest expense are in the middle of the range despite high ratios of debt to EBITDA. Investor demand for yield should keep spreads relatively tight. A strong economy should help credit spreads, but relative value flows at money managers could still soften credit spreads if MBS gets wide enough.

The view in credit

Fundamental credit generally looks good, helped by Covid reopening and low rates. Consumers finished the first quarter of 2021 with net worth up $5 trillion. Aggregate savings jumped again as did home values and investment portfolios. Consumers have not added much debt. Corporate balance sheets have taken on more leverage, although mitigated by strong cash balances and low interest costs. EBITDA-to-interest-expense is at healthy levels. Strong economic growth in 2021 and 2022 should lift most EBITDA and continue easing credit concerns. Eventually, rising interest expense in 2023 should compete with EBITDA growth. Fundamental credit should hinge on whether the Fed can orchestrate a soft landing as it starts to tighten financial conditions.