The Big Idea

Burning a hole in their pockets

Stephen Stanley | June 25, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The economic shutdown that prevented consumers from spending on a variety of services over the last year along with generous federal government payments in the form rebate checks and supplemental unemployment benefits has left households with massive funds burning a hole in their pockets. With the economy fully reopened, that money represents a tailwind for consumer demand that may last for years.

Balance sheet update

The Fed’s quarterly Financial Accounts of the U.S. came out on June 10 offering data through the first quarter of 2021. Among other things, this report offers a quarterly snapshot on household finances. The state of the household balance sheet has arguably never been better.

Household assets rose by more than $5 trillion in the first quarter to over $150 trillion. As usual, the two largest line items on the household asset ledger were real estate and equity holdings. Both surged in value in the first three months of this year, real estate by $900 billion and equities by $2.4 trillion..

Household liabilities meanwhile only increased by about $200 billion, mainly reflecting a rise in home mortgage debt. Consumer credit was down in the quarter and has been essentially flat since the end of 2019, as many households used the windfall from federal payments to pay down debt.

As a result, the net worth of households jumped by another $5 trillion to $137 trillion, up by almost $20 billion or 16% over the past five quarters.

Spending money

A steep increase in unrealized capital gains on homes and stock portfolios may make people feel wealthier but may result directly in only a limited boost to consumer spending. After the experience of the past 20 years, having seen both the stock market and the housing market endure gut-wrenching swoons, households are likely to be much slower to spend those unrealized gains, what economists call the wealth effect.

However, there is one particular portion of the household balance sheet that stands out, based on its unusual behavior during the pandemic and its potency to propel consumer spending.

Households’ liquid assets, as defined by the Fed’s count of currency, bank deposits, and money market fund shares, has surged since the end of 2019. The jump likely reflects two factors. First, consumers’ ability to spend, especially on a variety of services, was severely restricted during the lockdowns last year and still impeded significantly until very recently. Second, federal efforts to provide payments to households to offset lost labor income due to the pandemic substantially overshot the mark, pushing personal income far above pre-pandemic levels.

As surveys have suggested, households spent a fraction of the rebate checks, perhaps around one-quarter, and used most of the rest to either pay down debt or save. The bulk of the savings was parked in liquid vehicles, perhaps indicating that households wanted to keep the funds handy for a day (now come) when they could spend more freely.

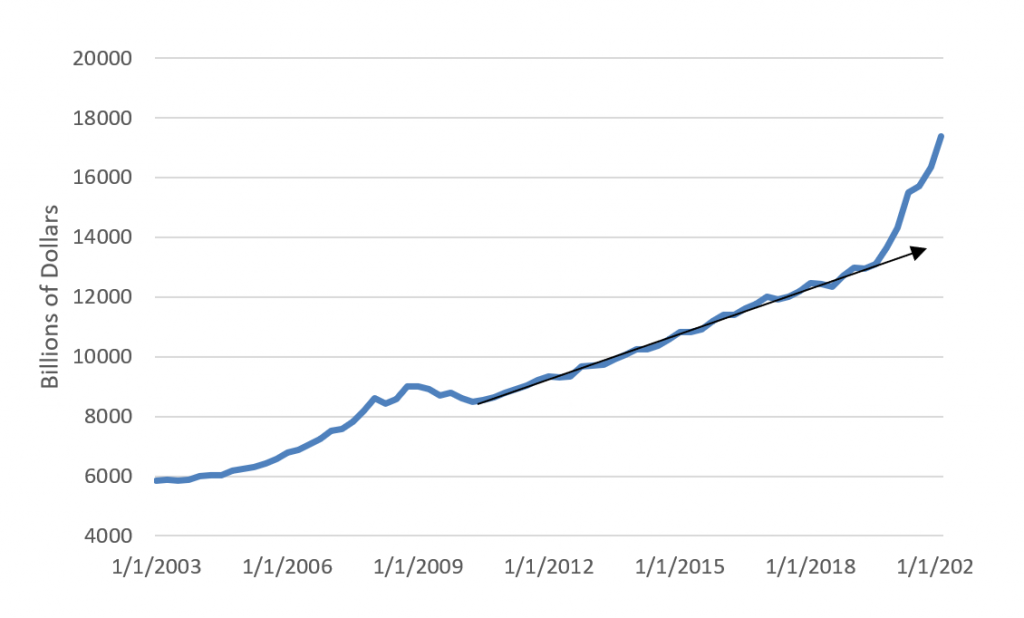

The trajectory of liquid assets showed steady growth for years and then exploded over the past year or so (Exhibit 1). For much of the past decade, the gauge rose by roughly $500 billion per year. In contrast, in 2020, it surged by $2.7 trillion. Then in the first quarter of 2021 alone, partly on the back of yet another round of rebate checks (the largest yet) and the reinstatement of supplemental unemployment benefit checks ($300 per week), liquid assets soared by $1 trillion to more than $17 trillion.

Exhibit 1: Household liquid assets

Source: Federal Reserve.

Since the end of 2019, households’ holdings of liquid assets have risen by nearly $4 trillion in just five quarters. Extrapolating the pre-pandemic trend to provide a benchmark of what might have happened in the absence of COVID, liquid assets are about $3 trillion higher than they might normally have been as of the end of the first quarter.

Not quite over yet

Federal largesse should add to households’ cash stockpile for another quarter or two. A portion of the last round of rebate checks was actually paid out in April and May. In addition, supplemental unemployment benefits remained in place through most of the second quarter nationally and will not expire in close to half the states (accounting for most of the beneficiaries) until early September.

The April data on personal income showed that the personal savings rate, while down from March, remained near 15%, more than double the pre-pandemic norm, confirming that consumers are still building their stockpiles.

Moreover, even when the federal payments wane, the labor market looks exceedingly strong. Despite the level of payroll employment still running millions below the pre-pandemic benchmark, overall wage and salary income already exceeds the February 2020 level, and with job growth likely to explode in the coming months and with wages surging in a number of industries, the end of federal support may not necessarily mean the end of the boom times for households.

Now for the Fun Part…

The $3 trillion or so in excess liquid assets represents one of the most important driving forces for an upbeat economic forecast. One question is: how will households choose to spend their windfall? All at once, little by little, or, in theory, not at all? The most likely answer seems to be little by little, which would mean that the state of the household balance sheet will be a tailwind for consumer spending for years to come.

In fact, even if households were inclined to do so, it seems doubtful they would be able to spend such a massive amount of money all at once. Already, it is evident what happens when demand overwhelms supply, as homes and new and used motor vehicles are hard to come by and are surging in price. Airfares to and hotels in popular vacation spots will prove similarly difficult and expensive to procure over the next several months. If households do behave as if their money is burning a hole in their pockets and try to spend their excess funds as soon as possible, it will only add to the current inflation problem.