The Long and Short

A playbook for proposed new NAIC rules

Dan Bruzzo, CFA | June 25, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The National Association of Insurance Commissioners (NAIC) is currently weighing two proposals on how to change its existing risk-based capital charges for fixed income securities. Insurers should anticipate these changes and start to think about maximizing return to capital at each ratings level. Other investors in corporate debt should think about where insurer demand may shift and the impact it could have on spreads.

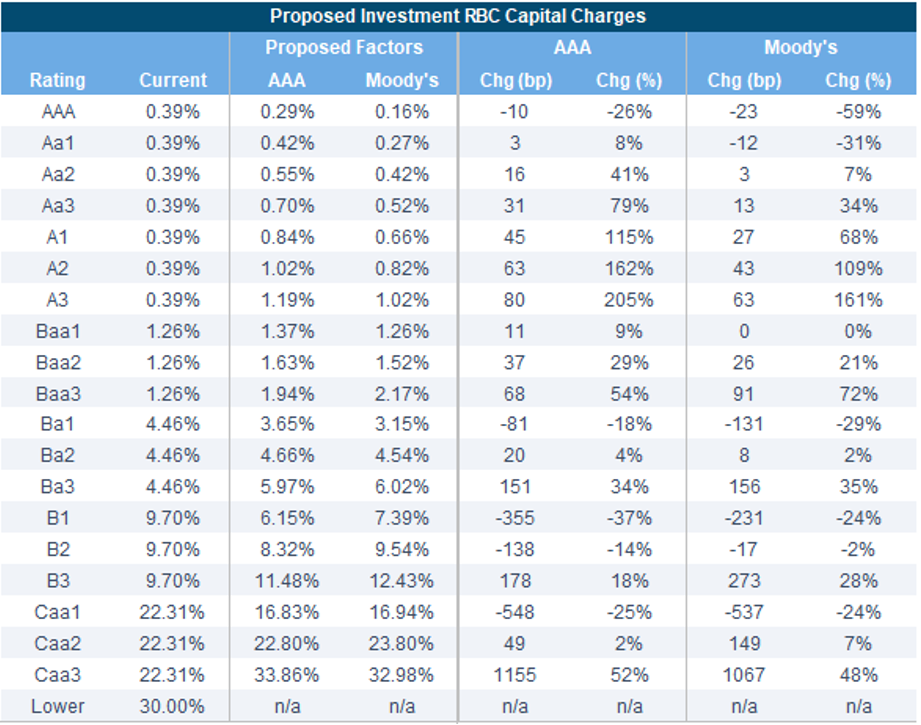

For roughly 30 years, the NAIC has relied on a 6-point designation—NAIC 1 through NAIC 6—for assessing risk of insurers’ fixed income securities. For much of the last decade, the organization has weighed moving to a more granular system that would assign different RBC charges to all 20 of the rating notches for fixed income securities. The first proposal came from the American Academy of Actuaries (AAA) in conjunction with the NAIC, and a second proposal came independently from Moody’s (Exhibit 1). Now the NAIC is expected to make a final decision on how to proceed by year-end 2021, although nothing has been finalized or any timeline for implementation set.

Exhibit 1. Proposed NAIC score RBC charges

Source: CreditSights Inc. All rights reserved

Nevertheless, the proposed changes have significant potential ramifications for the corporate bond market – ones that could significantly impact risk compensation at various ratings levels across the credit spectrum. Insurance companies hold roughly a third of the $10.6 trillion in outstanding US corporate bonds.

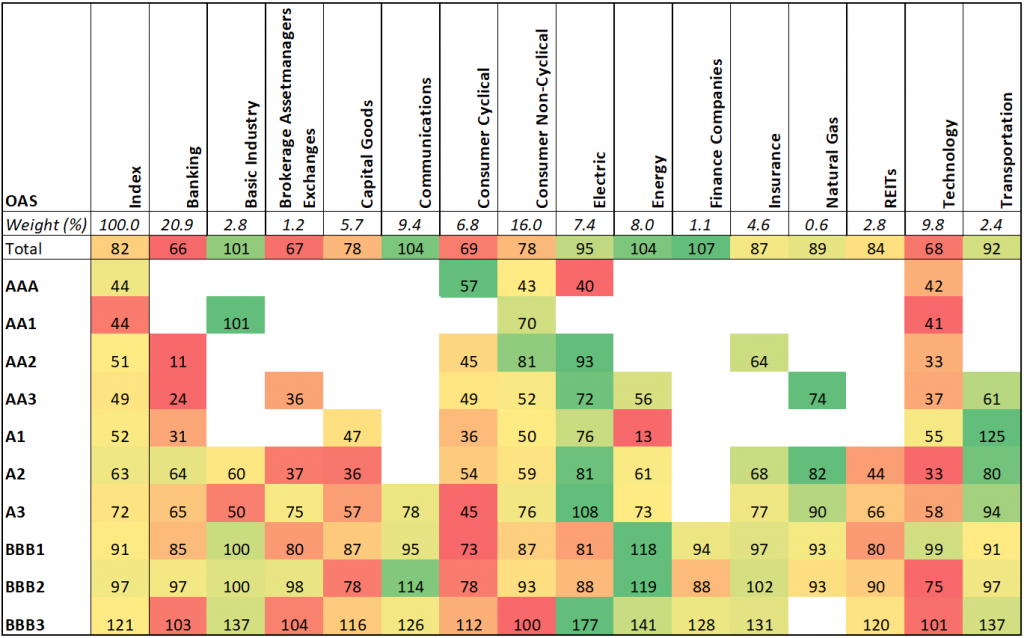

To anticipate how these proposed changes could impact trading strategies in the near-to-intermediate term, it makes sense to take a close look at current spread or OAS across ratings for each major sector in the Bloomberg Barclays IG corporate bond index. The market may see substantial sector rotations as insurance companies reconcile the available spread compensation relative to the new risk-based capital charges that will be assessed to the corporate bond holdings. This is particularly true in the rating categories that are hardest hit by the proposed changes, for example the low single-A and low-BBB rating levels. Therefore, it stands to reason that insurance companies could be moving out of investments where spread does not provide enough risk compensation for the proposed hit to RBC ratios and seek better compensation elsewhere.

The current aggregate spread levels (OAS) vary across each ratings category for the entire IG index available in each individual sector (Exhibit 2). The blanks represent the ratings categories not currently represented in each of the sectors on the chart. Green demonstrates the higher spreads available at each of the individual rating categories, while red depicts the lowest.

Exhibit 2. Aggregate spread (OAS) by ratings and sector

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

Obviously, the sectors with the higher durations will undoubtedly demonstrate higher OAS at each level. Smoothing out this effect involves taking the aggregate spread per turn of duration at each of the rating and sector levels (Exhibit 3). While not perfect, this provides a more comparable scoring system for risk compensation from one sector to the next. Below we provide the highlights we observed from this study, which can provide the outlines for a playbook to navigate the potential changes on the horizon.

Exhibit 3. Spread (OAS) per turn of duration by ratings and sector

Source: Amherst Pierpont, Bloomberg/Barclays US Corp Index

Ten Key takeaways from the sector spread study:

- Investors should seek greater spread compensation than 8.6 bp per turn of duration for the A3 rating category.

- Investors should seek greater spread compensation than 16.8 bp per turn of duration for the BBB3 rating category.

- The best available OAS per turn of duration in the A3 category is being offered by Banking (11.7 OAS/Duration), Consumer Cyclical (11.5), Transportation (11.0) and Broker/AssetManagers (10.4).

- Capital Goods (5.7), Basic Industry (6.5), Consumer Non-Cyclical (6.8), Technology (6.9) and Communications (7.1) offer the least risk compensation at the A3 category.

- Finance Companies (37.2), Transportation (45.4), Broker/AssetManagers (27.4) and Banking (23.3) offer the best risk compensation at the BBB3 rating category.

- Consumer Non-Cyclical (12.1), Communications (12.5), and Capital Goods (14.4) offer the worst risk compensation at the BBB3 rating category.

- Banking (14.5), Energy (11.3), REITs (11.0), and Electric (10.8) are among the highest spread levels at BBB1 rating category – a tranche that would seem limited if any impact by the proposed RBC rule changes and therefore present a relative haven for insurance companies on an RBC basis.

- Opportunities to gain AA risk exposure remain limited to several sectors within the IG index.

- While a strong case can be made for owning Transportation at the AA3, A3 and BBB3 rating categories, outsized OAS for the mid-A-rating is being distorted by Canadian National Railway (CNRCN: A2*-/A*-), which is a large index component and expected to drop to BBB category with the completion of its proposed acquisition of KSU.

- This is going to be an ongoing process; investors should monitor for changes and continue to assess how insurance companies may be reallocating risk to achieve better compensation for each new level of RBC charge.