The Big Idea

A macro picture of debt security supply and demand

Steven Abrahams | June 25, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The net supply of debt securities surged during the first year of pandemic at a pace rarely seen. But demand not only rose to meet supply, it also lowered yields and tightened spreads in the process. The Fed and correlated demand from money market funds and banks stood in the middle of the Treasury and agency dynamics, while mutual funds and international investors dominated corporate and foreign debt. With the Fed and its partners now eyeing the door, the dynamics in these markets and the relative performance of the assets look set to change.

A pandemic surge in debt securities supply

Treasury securities, corporate and foreign debt securities, and agency debt and MBS grew through pandemic at some of the fastest rates in recent memory. From March 2020 through March 2021, Treasury debt grew by $4.4 trillion or 22.7% (Exhibit 1). Corporate and foreign debt securities rose $1.3 trillion or 9.1%. And agency debt and MBS rose $457 billion or 4.7%. These sectors easily outpaced the rest of the debt securities markets.

Exhibit 1: Outstanding debt securities jumped from March 2020 to March 2021

Note: Data show absolute growth in debt from 1Q2020 to 1Q2021 in the bars and percentage growth at the end of each bar.

Source: Federal Reserve Z.1, Financial Accounts of the United States, June 10, 2021, Amherst Pierpont Securities

The reasons for the surge in debt securities varied across markets. Recession, the CARES Act and other pandemic relief efforts required debt funding for government expenses. Corporations tapped the debt markets primarily for general corporate purposes, but that included warehousing liquidity given new uncertainty about revenues and expenses through pandemic. Net supply of agency debt and MBS reflected surging demand for housing multiplied by some of the strongest home price appreciation since the early 2000s.

The relative pace of growth in these debt markets looks likely to shift in 2021 and beyond. Growth in Treasury debt should drop significantly with the Congressional Budget Office expecting $1.4 trillion in fiscal 2021 and roughly $1 trillion each in 2022 and 2023. Corporate and foreign debt issuance also looks likely to cool with most needs for liquidity already met and some pressure building for companies to deleverage. Net supply of agency debt and MBS, however, should rise. Demand for housing has remained extremely strong, and Amherst Pierpont projects net issuance could approach $1 billion in 2021, which would double the pace through pandemic so far.

A narrow surge in pandemic debt securities demand

Despite the growth spurt, the market flashed steady signals that demand kept outstripping supply. Yields on US Treasury debt generally tightened to sovereign curves for Germany, Switzerland, the UK, Japan and other global sovereign benchmarks. Corporate debt spreads tightened through most of pandemic to the Treasury curve. Agency debt and MBS spreads, too, tightened to historic levels.

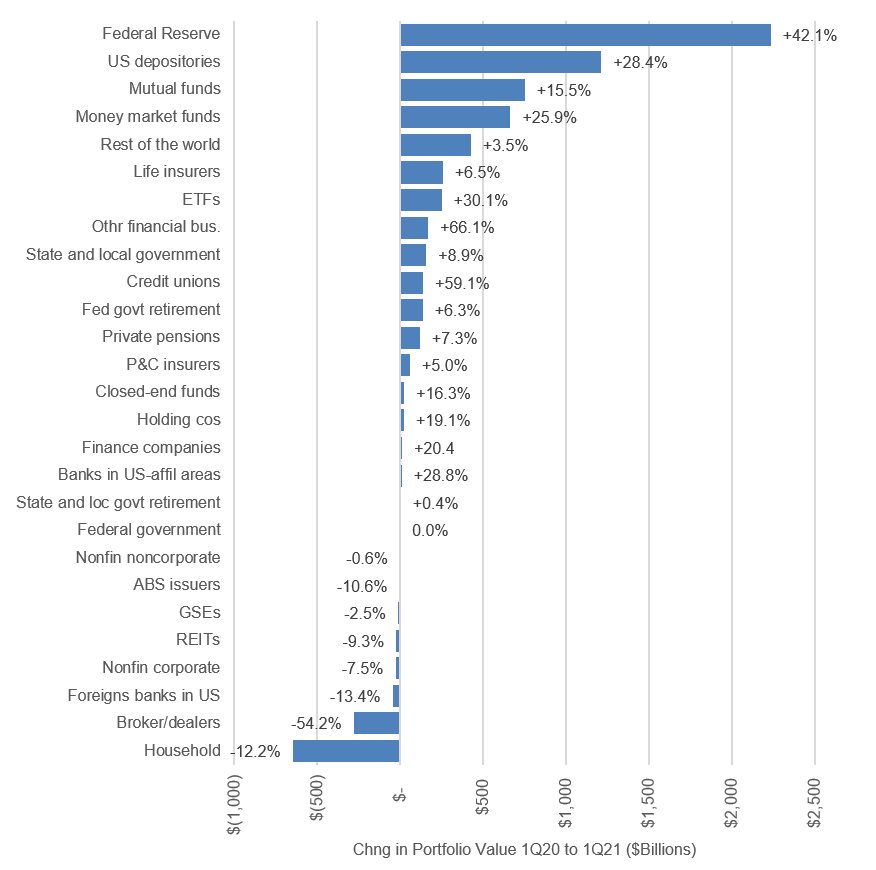

A range of different types of investors participated, but a handful really made the difference. The Federal Reserve, banks and other depositories, mutual funds, money market funds and international investors absorbed $5.3 trillion or more than 94% of the growth in US debt securities (Exhibit 2). Even through there are material differences across these portfolios, the Fed and banks are tied closely together through the banking system and often are heading into or out of the debt securities market in the same direction. Other portfolios made a small difference in absorbing the pandemic debt surge.

Exhibit 2: Top 5 investors took down 94% of 1Q20-1Q21 debt securities growth

Note: Data show absolute growth in investor portfolio from 1Q2020 to 1Q2021 in the bars and percentage growth at the end of each bar.

Source: Federal Reserve Z.1, Financial Accounts of the United States, June 10, 2021, Amherst Pierpont Securities

Demand may not outstrip supply as easily going forward, especially with the Fed leaning toward tapering. Not only will tapering directly reduce Fed demand, it also should reduce the flow of cash into the financial system—cash that often washes up on bank balance sheets and in balances at money market mutual funds and then gets subsequently reinvested. As the Fed goes, so goes these sources of indirect demand for debt securities.

The pending dynamic in Treasury debt: supply exceeds demand

Even within the Top 5 marginal buyers of new debt securities through pandemic, these portfolios did not play equally across assets, starting with the Treasury market. The Federal Reserve absorbed $1.5 trillion with money market funds absorbing another $1.1 trillion. By comparison, other portfolios in the Top 5 and beyond absorbed modest amounts.

Exhibit 3: Portfolios that absorbed $4.4 trillion in Treasury debt through pandemic

Source: Federal Reserve Z.1, Financial Accounts of the United States, June 10, 2021, Amherst Pierpont Securities

While marginal growth annual in Treasury debt should drop toward $1 trillion through 2023, it is likely to come as marginal Fed demand drops from $80 billion a month or $960 billion a year before tapering to $0 afterwards. At the same time, the deceleration in the pace of liquidity added to the market by the Fed should also slow asset growth at money market funds and their demand for Treasury debt. It is unlikely that banks and other depositories could fill the gap left by the Fed and money market funds. Other investors will have to step in, or yields may need to rise to draw them in.

The pending dynamic in corporate and foreign debt: supply balances demand

In corporate and foreign debt, international investors led the way by adding $504 billion followed by mutual funds with $445 billion. International demand for corporate debt, which also includes debt issued by securitization trusts, reflects longstanding core European demand and rising demand in recent years from Asia. Negative yields in Europe and near-zero yields in Japan have pushed many portfolios into US corporate debt. Mutual funds demand partly reflects the growing share of corporate debt in US bond market indexes and partly reflects relative value as corporate spreads initially trailed the tightening in agency MBS

Exhibit 4: Portfolios that absorbed $1.3 trillion in corporate and foreign securities

Source: Federal Reserve Z.1, Financial Accounts of the United States, June 10, 2021, Amherst Pierpont Securities

Even though growth in corporate and foreign debt also looks likely to slow, demand looks likely to keep up. This market is much less dependent on demand from the Fed, depositories or other correlated portfolios. Low rates in Europe and Japan are likely to persist and keep demand from those portfolios healthy. Steady inflows to mutual funds should keep demand at least at an index level of allocation with relative value driving any deviations. And demand from life insurers, who fall just below the Top 5 net buyers in the first year of pandemic, should be strong as economic growth drives premium growth. Of the major categories of debt securities—Treasury, corporate and foreign and agency debt and MBS—corporate looks like the place where supply and demand look most likely to stay in sync.

The pending dynamic in agency debt and MBS: supply outstrips demand

Finally in agency debt and MBS, the Federal Reserve and US banks were extraordinary net buyers. Both the Fed and depositories bought a multiple of the $457 in net new agency debt and MBS. Every other Top 5 category of investor—mutual funds, money market funds, international funds and everyone else—effectively sold to the Fed and banks. The Financial Accounts of the United States does not split debt from MBS. But as my colleague Brian Landy points out elsewhere in this issue, even underneath the modest rise in mutual fund balances in agency debt and MBS is a drop of $280 billion in MBS, so mutual funds were clear net MBS sellers and, presumably net agency debt buyers.

Exhibit 4: Portfolios that bought or sold net $457 billion in agency debt and MBS

Source: Federal Reserve Z.1, Financial Accounts of the United States, June 10, 2021, Amherst Pierpont Securities

Net supply of agency MBS is likely to double in the next 12 months as ongoing housing demand and home price appreciation drive balances up. As Brian Landy also points out in this issue, the market is sensitive to both the Fed and depositories. And that correlation is probably not good for MBS demand on the way out of QE. The most likely backstop for MBS spreads will be mutual funds, but it is hard to pin down the spread that might draw funds in. The last time the Fed tapered through 2014, a drop in oil prices from more than $110 a barrel at the start of the process to less than $40 a barrel at the end sent corporate spreads wider. At the same time, mortgage refinancing dropped significantly. That complicates the use of past tapering as a guide. In general, par 30-year MBS has often been a good buy at nominal spreads of more than 100 bp over the interpolated Treasury curve, and it prices at 67 bp today. Investment grade corporate debt has often been a good buy at more than 120 bp over the interpolated Treasury curve, and it prices at 89 bp today. The current spread between the two sectors is near the average of the last decade but look for relative value investors to start overweighting MBS when it is flat to 10 bp wide of corporates.

The central role of the Fed, depositories and money market funds in the Treasury and agency markets leaves these markets vulnerable to the inflection in Fed policy. The only market where these portfolios do not play is in corporate and foreign debt. And in that market, the conditions driving the core investors look likely to stay in place. Based on the macro picture, credit looks likely to outperform the Treasury and agency debt and MBS markets as the shift in Fed policy gets price in over the balance of the year.

* * *

The view in rates

Fed RRP balances peaked at $813 billion in the last few sessions before closing Friday at $770 billion. The response has been immediate. Overnight Treasury repo and SOFR have obediently stayed around 5 bp. Settings on 3-month LIBOR have moved only a few basis points higher, so the LIBOR-OIS basis has drifted a few basis points higher to 5.25 bp. The front end is still awash in cash, but the Fed has put a higher floor on the complex.

The 10-year note has finished the most recent session at 1.52%, up 7 bp on the week. Implied 10-year inflation at sits at 227 bp. The negative 84 bp 10-year real rate implies is down from a week ago.

The Treasury yield curve has finished its most recent session with 2s10s at 126 bp, steeper from a week ago. The 5s30s curve has finished at 123 bp, also steeper from a week ago.

The view in spreads

MBS spreads have widened notably in recent weeks. Refi risk may be creeping into MBS. Primary 30-year mortgage rates have dropped below 3.0% in several surveys, and data from the Bureau of Labor Statistics show employment in the mortgage industry up 30% from three years ago, giving originators plenty of capacity to chase loans. But a quickening of Fed hikes and the timing of tapering are much bigger issues likely to weigh on spreads.

In credit, low rates should continue supporting corporate balance sheet strength. Ratios of EBITDA to interest expense are in the middle of the range despite high ratios of debt to EBITDA. Investor demand for yield should keep spreads relatively tight. A strong economy should help credit spreads, but relative value flows at money managers could still soften credit spreads if MBS gets wide enough.

The view in credit

Consumers are strong and most corporations in good shape. Fundamental credit should hinge on whether the Fed can orchestrate a soft landing as it starts to tighten financial conditions. Consumers finished the first quarter of 2021 with net worth up $5 trillion. Aggregate savings jumped again as did home values and investment portfolios. Consumers have not added much debt. Corporate balance sheets have taken on more leverage, although mitigated by strong cash balances and low interest costs. EBITDA-to-interest-expense is at healthy levels. Strong economic growth in 2021 and 2022 should lift most EBITDA and continue easing credit concerns. Eventually, rising interest expense in 2023 should compete with EBITDA growth.