By the Numbers

Analysis and projected losses of FRESB loans in special servicing

Mary Beth Fisher, PhD | February 26, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Since 2017, only a couple dozen of the nearly 200 Freddie Mac small balance loans that have been transferred to special servicing have ultimately been liquidated or paid-off. Among those most recently liquidated were three loans which had been in Covid-19 forbearance prior to default. Over half of the nearly 150 FRESB loans currently in special servicing are due to monetary defaults following Covid-19 forbearance. Over the next six months to 12 months, a significant portion of those loans could come to some resolution, including many potentially liquidated out of FRESB deals. Based upon a range of potential default and loss severity assumptions, the most negatively impacted FRESB B-pieces could incur cumulative losses of 6% to 8%.

Welcome to special servicing

There are two primary ways for a loan to end up transferred to special servicing: a monetary default or a non-monetary default. A monetary default is typically the result of delinquent principal and interest payments, though it can also be due to delinquent property taxes, fees or other required reserves. A non-monetary default can be triggered by a variety of factors including legal issues that arise regarding the property or the borrower, outstanding maintenance, insurance or employment issues, or a breach of any number of loan covenants.

The role of the special servicer is to work with the borrower to either cure the default and return the loan to performing status, or shepherd the loan and borrower through work out. Work out can include sale of the property by the borrower, liquidation of the property by the special servicer, sale of the property at auction or other disposal methods. The proceeds from liquidation result in full or partial payoff of the outstanding loan balance, all accrued delinquent payments plus all expenses, fees and penalties.

Removing a non-performing loan from a deal

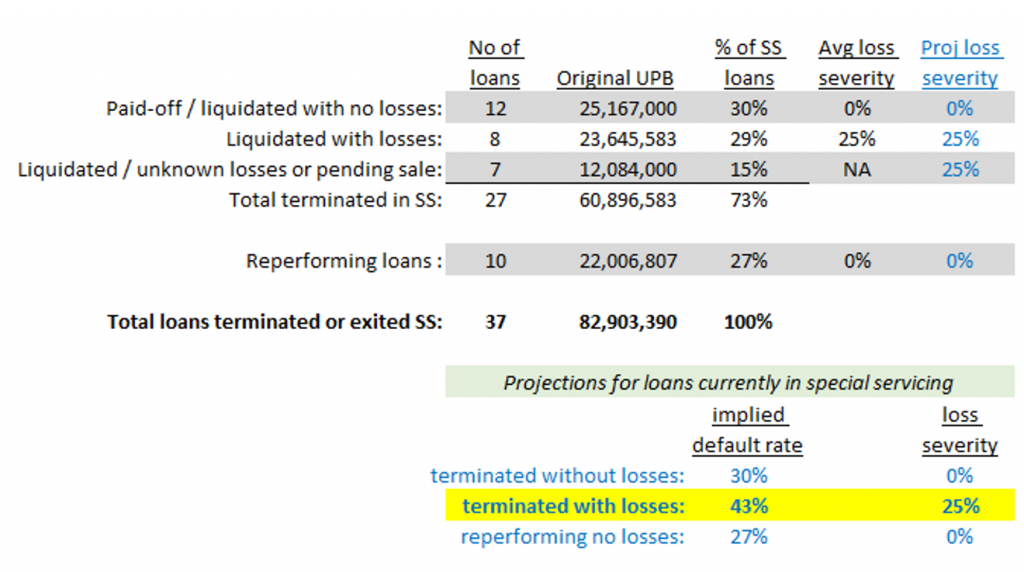

There are 27 loans to date that have been terminated or bought out of FRESB deals due to non-performance (Exhibit 1). Some key points:

- Twelve of the 27 non-performing loans (44%) were paid off in full, in some instances including yield maintenance or prepayment penalties. This can be due to a sale by the borrower during special servicing, a foreclosure sale that recovers more than the amount due, a repurchase or substitution of the loan in the deal, or an alternative workout pursued by the borrower or special servicer.

- Eight of the 27 terminated loans (30%) have initial losses with estimated loss severities ranging from 6% to 49% of the original loan balance. Three of those loans were transferred to special servicing when they defaulted coming out of Covid-related forbearance and were promptly liquidated (highlighted in yellow).

- Seven of the terminated loans (26%) have losses that cannot yet be determined. Two of the loans indicate that the property has been liquidated, but losses, if any, are not yet listed. The five loans (in SB58) have been paid off in the deal but liquidations of the properties are still pending, so eventual losses, if any, cannot yet be estimated.

- Across this group of terminated loans, the average time spent in special servicing before the loan is bought out of the pool is 10 months or 0.85 years

Exhibit 1: Non-performing FRESB loans – paid-off

Note: *Termination occurs when the loan is bought out of the pool. This can be concurrent with or prior to liquidation or other resolution. **Initial loss is estimated using the amount listed as initial loss as a percentage of the original UPB. Loss amounts tend to be revised over time, sometimes months after the property is liquidated. Loans that have transferred to SS because they have matured but not paid off are excluded. All data as of 1/25/2021 tape date.

Source: Bloomberg, Amherst Pierpont Securities

Estimating loss severities

Importantly, only one of the loans in the entire group (in SB5) was liquidated prior to 2020 and is included in Freddie Mac’s multifamily loan performance (MLPD) database where the loss severity can be calculated based on Freddie’s stated credit losses (or recoveries) on the loan. Freddie’s MLPD is currently only updated through Q4 2019 though they have said they expect to update it soon. To get a more recent estimate of loss severities it’s worthwhile to compare cumulative losses on B-pieces of loans for deals that include loans that have terminated with known initial loss estimates (Exhibit 2).

Exhibit 2: Estimated loss severities based on cumulative losses in B-pieces

Note: Data as of 2/23/2021 with tape date 1/25/2021.

Source: Bloomberg, Amherst Pierpont Securities

Obviously, the cumulative losses in these FRESB B-pieces are a little bit higher than the known initial loss amounts on the terminated loans, probably due to the inclusion of additional expenses. These projected loss severities are 25% on average for the loans with losses.

Considerations around Covid-related forbearance

One of the primary concerns for agency multifamily B-piece investors is that loans that default after Covid-19 forbearance could have higher loss severities due to the backlog of missed payments. So far, only three loans have been terminated that were in Covid-19 forbearance. All three of those loans were for properties in Brooklyn where the borrowers were granted a 3-month forbearance period as of April 1 last year. The loans subsequently defaulted and were placed into special servicing on August 7. The properties were quickly liquidated and the initial losses disclosed indicate relatively low initial loss severities from 17% to 22%, well below historical severities.

Historical multifamily loan loss severities tend to average 30% to 40% over long periods of time. The low severities on FRESB loans terminated after Covid-19 forbearance could reflect some unique characteristics. All three of the Brooklyn loans were originated in the spring of 2016. The properties were liquidated for values that were roughly 110% of the outstanding principal balance. The comparatively short period in forbearance and speed with which the special servicer was able to dispose of the properties—the loans spent five months in special servicing compared to an average time of 10 months for the other terminated loans—possibly contributed to the low initial loss severity.

Loans that exit special servicing as performing loans

Some small balance loans that are put into special servicing later exit as performing loans without going through liquidation or workout (Exhibit 3).

- From the start of the small balance program in 2015, there have been 9 loans put into special servicing – for reasons that had nothing to do with the pandemic – and then later resolved.

- Three of those 9 reperforming loans were for properties that suffered damage during Hurricane Harvey and required extensive repairs and reconstruction. Those loans spent 15 months on average in special servicing.

- Of the 13 loans listed in Exhibit 2, 3 of them exited special servicing by entering Covid-related forbearance. It seems likely that would have qualified for forbearance earlier but did not apply. Loans in forbearance are not in special servicing as long as they are performing – meaning they are not yet required to make payments or they are performing during the repayment period. From here forward we drop those 3 loans and assume only 10 loans have exited special servicing as reperforming loans.

Exhibit 3: Loans that exited special servicing as performing loans

Note: All data as of 1/25/2021 tape date.

Source: Intex, Bloomberg, Amherst Pierpont Securities

In total, since the beginning of the small balance program, 182 loans have entered special servicing:

- There are 145 loans (80%) currently in special servicing, discussed in the following section, which are nearly evenly split between those which are in special servicing due to pandemic and non-pandemic related reasons;

- There are 27 loans (15%) which have resolved via workout, including the 3 that were recently liquidated after exiting Covid-related forbearance;

- And 10 loans (6%) that resolved special servicing and are re-performing, including one loan that defaulted after Covid-related forbearance and was significantly modified.

Question: Is it possible to estimate potential losses to B-pieces by projecting the outcomes of the 145 loans currently in special servicing?

Answer: Yes, but there is a broad range of loss estimates and reasonable people can disagree on the methodology and outcomes.

Straightforward loss estimate

Extrapolating from the 27 loans bought out of FRESB deals due to non-performance and the 10 reperforming loans does constitute a small sample. That makes it very difficult to generalize from their experience with great confidence. However, the experience with those loans suggests that a healthy portion of the loans currently in special servicing will be bought out of deals over the coming months.

Suppose loss projections for the pool of loans currently in special servicing were pure extrapolations based on the performance of loans that have already exited special servicing either by reperforming or through termination (Exhibit 4).

Exhibit 4: Projected defaults and losses based on historical performance

Note: Loans liquidated with unknown losses are assumed to have the same average loss severity of 25% as those that are already known. Eventual loss severities could be significantly different.

Source: Bloomberg, Intex, Amherst Pierpont Securities

Based on the performance of those loans, expectations would be that 43% of loans currently in special servicing would default with losses, and the average loss severity would be 25% (highlighted in yellow). Projected losses in FRESB B-pieces can then be calculated based on the known percentage of loans that are 90+ days delinquent or in special servicing (Exhibit 5). The B-pieces with the highest cumulative losses are about 6% of the original balance.

Exhibit 5: Projected losses in FRESB B-pieces (43% default rate, 25% loss severity)

Note: a* is that 43% of loans currently in special servicing eventually are terminated and have losses; b* is that the average loss severity of these loans is 25%. Deals that have multiple B-pieces (SB45, SB49, SB56) are not included.

Source: Bloomberg, Amherst Pierpont Securities

Parsing pandemic defaults and losses in FRESB deals

Projecting future losses based on historical performance is always fraught with danger, but particularly so when the period spans one from “normal” to “crisis”. There are 145 Freddie Mac small balance loans currently in special servicing ($348 million in UPB) across roughly 80 FRESB deals (Exhibit 6). These loans are about evenly divided between those that have been in Covid-19 related forbearance (71 loans, $168 million UPB) and those that have not (74 loans, $181 million UPB). All of these loans in special servicing remain in their pools, with the amount of time in special servicing to date ranging from two months to 18 months.

Exhibit 6: Non-performing or special serviced FRESB loans – still in deals

Note: Time in special servicing calculated through 1/25/2021 tape date.

Source: Bloomberg, Amherst Pierpont Securities

The group of 74 loans currently in special servicing that have not been in forbearance could see a range of outcomes. Nine of the loans have no payment default and are in special servicing for other reasons. Those could easily resolve and be moved out of special servicing back to performing status. Two others have matured and are possibly awaiting refinance. Others could trickle through as defaults and workouts in much the same way as the group of 27 prior loans that have terminated. Some of them could have resolutions that payoff the entire outstanding balance plus fees, resulting in zero or low losses. Though on average these loans have already spent over a year in special servicing, which makes it harder for a foreclosure sale or other workout to cure the full amount.

The 71 loans that have transitioned from Covid-related forbearance into special servicing due to payment default may perform similarly to the previous group of Brooklyn loans where the properties are sold quickly. Initial losses could be higher than 25%, as those that are in the 90+ day delinquency bucket appear to all have been in forbearance for six months as opposed to three months. The additional missed payments could result in higher loss severities. Some of the loans could have their forbearance repayment period extended, the interest-only period extended, or other modifications made by the special servicer to allow the borrower more flexibility. The Lydig Avenue loan (Exhibit 3) which went into special servicing after monetary default coming out of forbearance had such modifications and is now performing. Those accommodations will probably be made where at all possible by special servicers if the properties are generating enough cashflow to cure the loan within a reasonable timeframe.

Under assumptions based on the admittedly limited experience of the 27 loans bought out or terminated for non-performance and the 10 which exited special servicing as performing loans, perhaps only one-half of these 145 loans eventually suffer losses that are absorbed by FRESB B-piece holders. That would mean about 75 loans currently in special servicing would be bought out of FRESB deals over the next six months to 12 months. The FRESB deals with the most exposure are shown in Exhibit 7.

Exhibit 7: Projected losses on FRESB B-pieces (50% default rate, 30% loss severity)

Note: a* is that one-half of loans currently in special servicing eventually are terminated and are bought out of deals; b* is that the average loss severity of these loans is 30%. Initial loss severities for loans in COVID-related forbearance have been 20%, but the additional 3 months most loans spent in forbearance could raise these severities closer to historical averages. Deals that have multiple B-pieces (SB45, SB49, SB56) are not included.

Source: Bloomberg, Amherst Pierpont Securities

It is worth noting that based on the most recent data there are 808 FRESB loans that are still in Covid-related forbearance and are performing. It will be important to watch the future progress of those loans.