By the Numbers

Historically tight spreads make relative value a challenge

Mary Beth Fisher, PhD | January 22, 2021

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

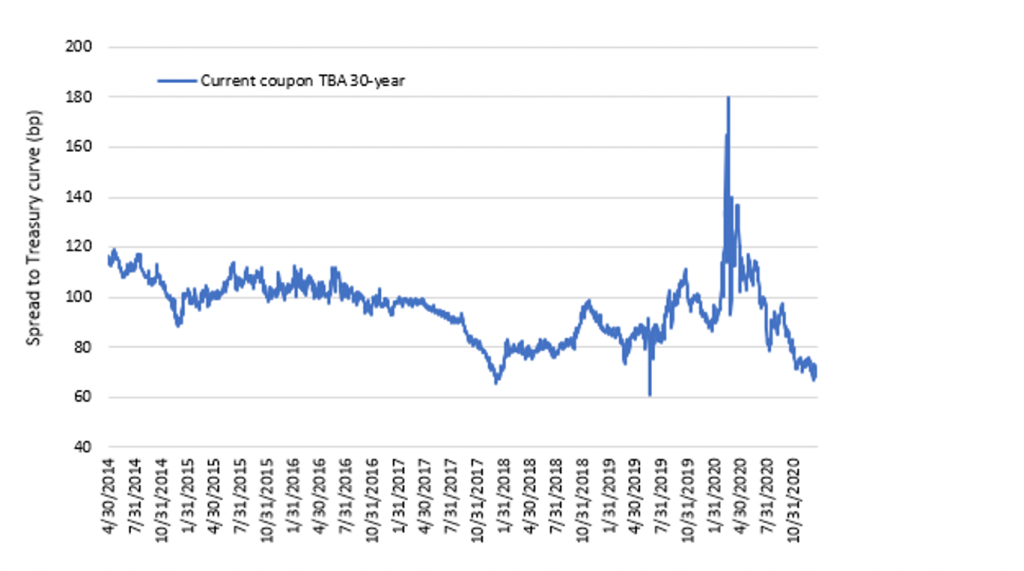

A confluence of factors have pushed most agency residential and commercial MBS spreads to historic tights. Spreads on current coupon TBA pass-throughs stand at a 35-year low, and sequential classes of standard Freddie Mac K-deals and 10/9.5 Fannie Mae DUS also price at new tights. More bespoke agency CMBS such as longer duration DUS pools and some ACES classes have lagged the move tighter and offer investors a little bit of extra yield.

The tailwinds in single-family and multifamily real estate are fairly broad. Fed QE has absorbed a material amount of supply in agency MBS and CMBS, as well as other markets, and broadly served as a backstop to spreads in risk assets. Heavy supply of Treasury debt has also helped tighten spreads. Fiscal stimulus has created an important safety net for parts of the economy, and vaccines have improved prospects for rebound from pandemic. In real estate specifically, single-family home prices continue to rise, multifamily rents—outside of urban core areas heavily affected by pandemic—are trending higher, and supply shortages in both sectors will likely persist for several more years.

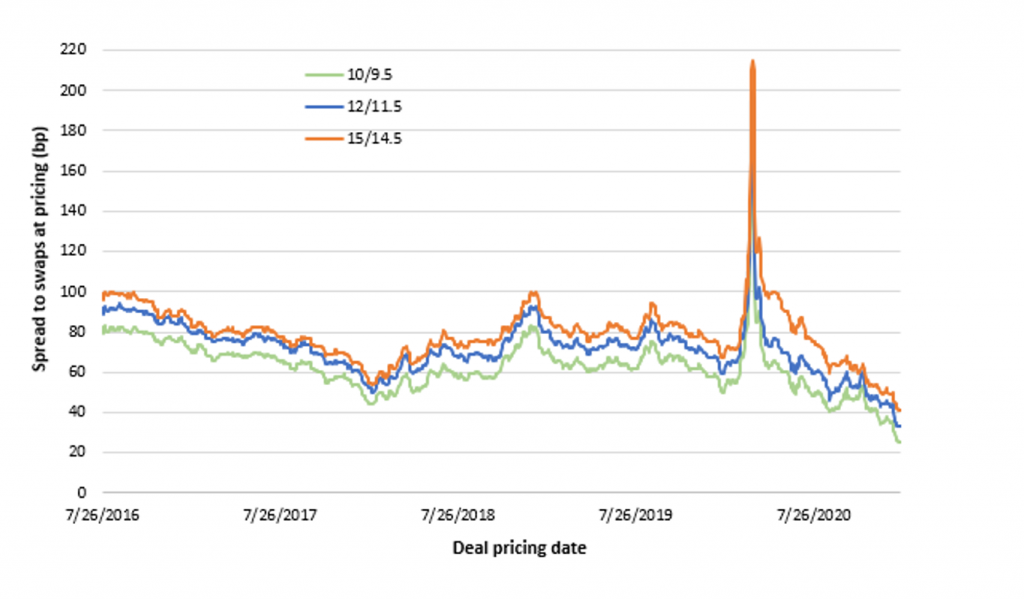

The combination of these factors has tightened agency MBS and CMBS spreads to historic lows (Exhibits 1 and 2). Spreads in other fixed income products have been tightening as well. In private-label CMBS, broad measures of spreads are close to pre-pandemic lows, but the mix of property types in conduit deals include retail and lodging properties. Even the safest private-label ‘AAA’ securities have higher credit risk than agency CMBS.

Exhibit 1: Agency TBA nominal spread to Treasuries

Note: The mortgage spread is the current coupon TBA yield (MTGEFNCL Index) versus a 50-50 blend of the on-the-run 5-year and 10-year Treasury yield.

Source: Bloomberg, Amherst Pierpont Securities

Exhibit 2: Agency CMBS and US CMBS Aaa-rated index option adjusted spreads (OAS)

Source: Bloomberg, Amherst Pierpont Securities

Robust demand for the benchmark of agency CMBS market depth and diversification – standard Freddie Mac K-deals – has contributed to a relentless collapse in spreads (Exhibit 3). The A1 class with the shortest weighted average life has recent deal spreads below 20 bp: the FHMS K123 A1 priced on January 21 at 18 bp. The larger, longer WAL A2 came at 21 bp and the A3 at 26 bp. All spreads were 8 bp through the early December levels of the K122 deal.

Exhibit 3: Freddie Mac K-deal class spreads at pricing

Note: Spreads are for standard K-deals only.

Source: Bloomberg, Freddie Mac, Amherst Pierpont Securities

Fannie Mae DUS pool spreads are also at historic lows, though they continue to trade back of similar WAL K-deal classes (Exhibit 4). The 10/9.5 pools in recent offerings have priced in the 25 bp to 27 bp range, with 12/11.5 at 33 bp and 15/14.5 at 41 bp.

Exhibit 4: Fannie Mae DUS pool spreads at pricing date

Note: Spreads are interpolated for classes between issuance dates. Source: Bloomberg, Fannie Mae, Amherst Pierpont Securities

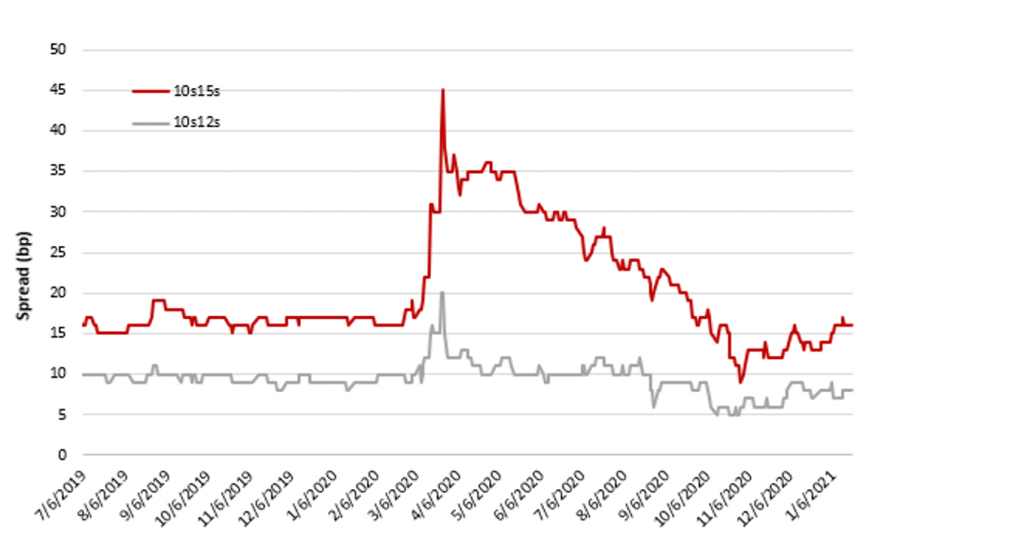

The spread difference between the 10/9.5 and the longer-duration pools had narrowed in the fourth quarter of last year, but has since widened back out somewhat (Exhibit 5). The potential for a more pronounced sell-off in the long-end of the Treasury curve may have tapered the duration appetite of some investors. Those willing to go out to 15/14.5 pools can pick up an additional 15 bp in yield, which is in-line with pre-pandemic levels.

Exhibit 5: Fannie Mae DUS 10/9.5 pool spreads vs 12/11.5 and 15/14.5

Source: Bloomberg, Fannie Mae, Amherst Pierpont Securities

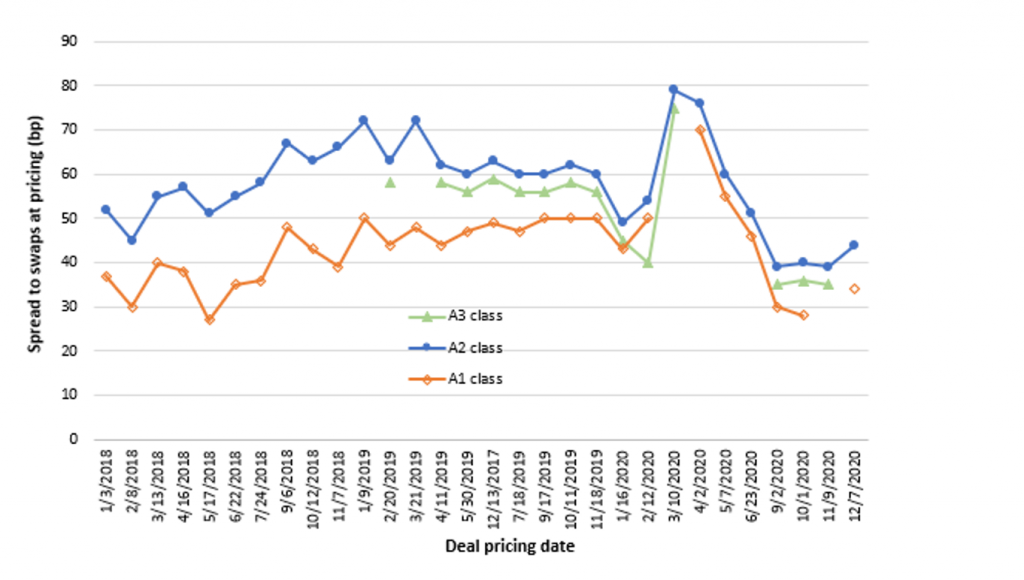

There are other pockets of relative value in the agency CMBS new issue market. Fannie Mae ACES deal spreads have not compressed quite as much as those of DUS and K-deals based on early December spreads when the last large deal priced. Several deals are in the pipeline over the next few weeks, and new issue spreads will probably tighten but still look unlikely to reach the levels of comparable DUS issues. The A2 class of ACES deals looks similar to a collection of 10/9.5 DUS pools, with a similar WAL and comprising 65% to 85% of the deal. The A2s priced at 39 bp to 44 bp during the fourth quarter of 2020, or 5 bp to 8 bp wide of 10/9.5 DUS pools. The more idiosyncratic structures and less frequent issuance has made these deals a good pocket for investors who are willing to commit more time to capture additional yield.

Exhibit 6: Fannie Mae ACES deal class spreads at pricing

Note: Data only includes deals where spreads are tracked by Bloomberg. These tend to be larger sized ACES deals above $500 million in original face.

Source: Bloomberg, Fannie Mae, Amherst Pierpont Securities