Uncategorized

Getting ahead of market returns in 2021

admin | November 20, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

Markets have done a generally exceptional job this year pricing to changes brought on by pandemic. The economy, Fed and fiscal policy and politics have all changed, but more lays ahead. The market still underestimates the impact of likely renormalization on the yield curve and on lower-rated credits. It has missed signs of opportunity in non-bank debt and in the debt of certain niche issuers and securitization platforms. And it may not appreciate the enhanced returns available to investors that do the increasingly hard work of analyzing informationally intensive assets. All of these areas offer opportunities to add to market returns in 2021.

A steeper yield curve

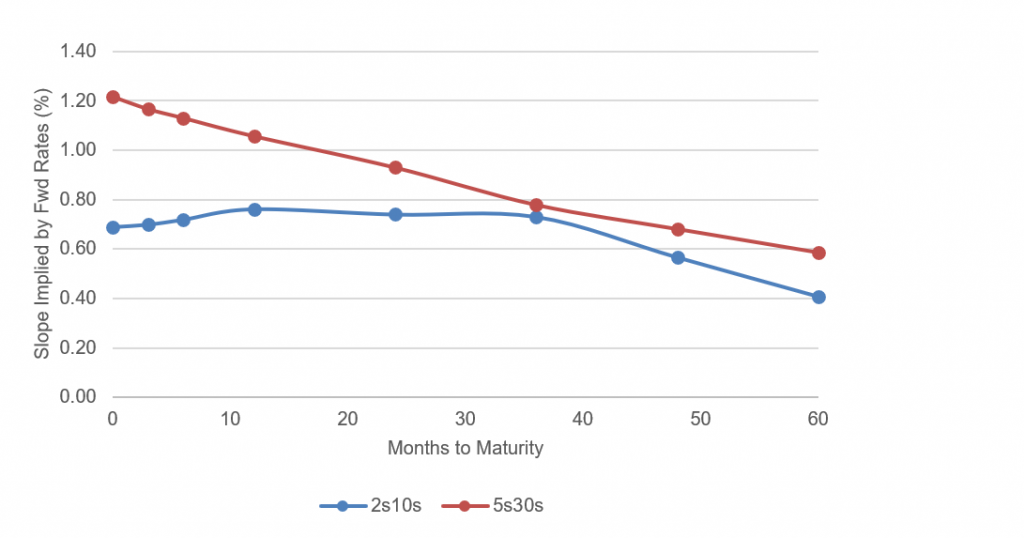

A steeper US yield curve should provide one of the first sources of extra return next year. Forward rates imply the slope of 2- to 10-year rates will only steepen from 69 bp currently to 76 bp a year from now (Exhibit 1). The 5- to 30-year curve actually flattens over the next year from 123 bp to 106 bp. Both set a low bar for outperformance. The cost of positioning for a steeper curve is minimal for now, and the likely course of pandemic, monetary and fiscal policy make a strong case.

Exhibit 1: Forward rates imply limited steepening in 2s10s, flattening in 5s30s

Source: Bloomberg as of 18 Oct 2020, Amherst Pierpont Securities

Steepening has become much likely with the improving odds of renormalization from pandemic by the end of 2021. The recent news of 95% efficacy for the Pfizer and BioNTech vaccine and 94.5% for Moderna means the pace of renormalization now largely depends on distribution and vaccination rate. Natural infection, a minor amount of natural immunity and vaccination will need to create immunity for somewhere between 40% to 70% of the population, according to a recent study by Oliver Wyman. At that point, the infection stops spreading. The US has good odds of getting there by December 2021 through a rising case count and vaccination of as little as 30% to 50% of the population. Broader vaccination shortens the timeline. Renormalization should lift growth, tighten labor markets and raise longer nominal rates.

Fed policy had already set steepening in motion before the vaccine news. QE had started pushing up inflation expectations, at least as measured by the spread between 10-year notes and TIPS, the same way it did after the 2008 financial crisis. The Fed’s announcement at Jackson Hole of flexible average inflation targeting, with its allowance for inflation above 2%, also pushed up breakeven spreads. FAIT anticipates a Fed that will keep short rates pinned down even as unemployment falls and inflation rises. The combination of QE, FAIT and pandemic renormalization adds a new inflation risk premium to longer rates while holding down the front end of the curve.

Growth and inflation expectations should also get a modest lift from fiscal policies including pandemic stimulus and policies in trade, immigration, housing and student debt that stand to get bipartisan support.

The risks to a steeper curve increase if the Fed choose to concentrate QE in longer Treasury debt or if private demand for safe, liquid, long-duration debt runs well above expectations. A shift in Fed policy seems unlikely, and insurers and pension funds look more inclined to take more rather than less risk to overcome generally low rates.

The curve could flatten episodically over the next few months as the pandemic builds in the US, pushes up mortality, limits economic activity and raises concerns about permanent damage to parts of the economy. Those things also raise the chances of offsetting fiscal response from Washington.

The current slope of 2s10s and 5s30s is well below the median slope since the Fed introduced QE in November 2008. The median 2s10s slope is 145 bp, and the median 5s30s is 147 bp (Exhibit 2). There is a reasonable case that equilibrium long rates may now be at historic lows, limited potential steepening. Nevertheless, the 2s10s slop is at roughly half its historic median. That should leave plenty of room for steepening.

Exhibit 2: Current slopes are well below medians in the era of Fed QE

Source: Bloomberg as of 18 Oct 2020, Amherst Pierpont Securities

The cost of positioning for a steeper curve is low, with a duration-neutral position in 2- and 10-year Treasury debt needing to steepen less than 2 bp over the next year to show profits. A duration-neutral position in 5- and 30-year Treasury debt would need to steepen by less than that. Portfolios could also position in MBS, corporate debt, structured products and other sectors by leveraging exposure to 2-year debt and reducing exposure to 10-year or longer debt. MBS derivatives such as IIOs embed exactly this position. Even though surveys of funds managers show three quarters expect a steeper curve, market pricing has set a low bar for generating good extra return in rates this way through 2021.

Lower-rated credits

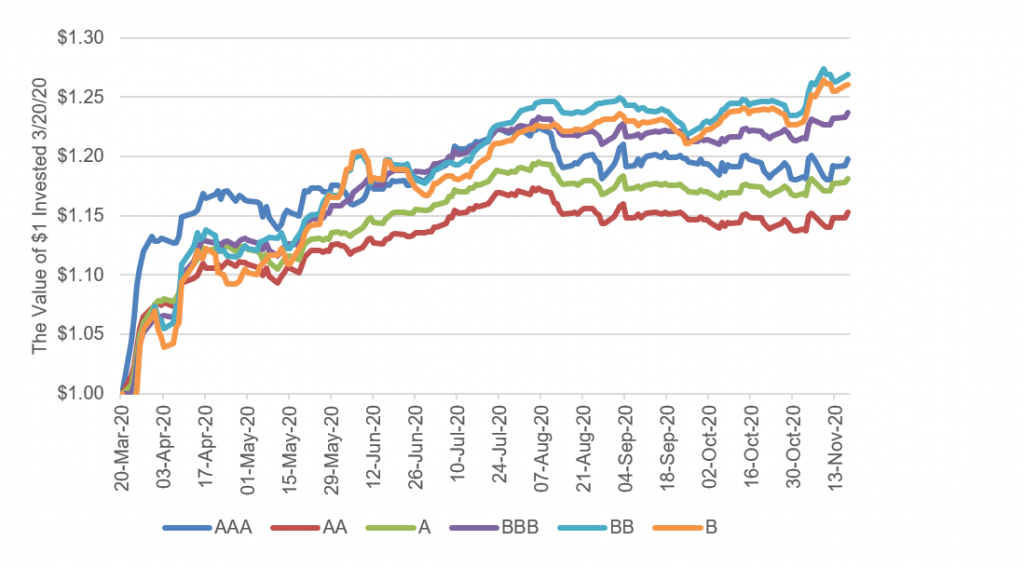

Pandemic renormalization and monetary policy should make broad areas of corporate and structured credit a second source of extra return, especially lower-rated credits leveraged to economic growth and offering higher yield. The lower the debt rating, the bigger the potential bump from renormalization and QE. Since the Fed launched QE in March and announced it would buy corporate debt, lower credits have steadily outperformed higher credits, except for the thinly traded set of ‘AAA’ names (Exhibit 3). QE has steadily absorbed safer assets and forced investors looking for yield into risks a tier or two higher than usual. Pandemic renormalization and the growth associated with it should further lift lower-rated credits, which are typically more leveraged and most sensitive to small changes in growth and earnings. The biggest impact should come in areas most affected by pandemic: energy and commodities, transportation and leisure, hotels, restaurants and other personal services.

Exhibit 3: Lower-rated credits should outperform through normalization

Source: ICE BoA US Corporate Index Total Return Indices retrieved from FRED, Federal Reserve Bank of St. Louis, Amherst Pierpont Securities

Risk to credit in 2021 comes from the impact of pandemic before vaccination can drive population immunity high enough to slow or stop spread, to allow relaxation of social distancing and to encourage more normal economic activity. Pandemic has threatened to scar the economy since March by driving many small or highly leveraged companies out of business and extending the timeline to recovery. Development of a vaccine in record time takes a big step toward limiting the damage, but now the job of distribution and vaccination comes to the front. Some of the public may resist vaccination, but the Oliver Wyman study argues that a steady flow of natural cases along with vaccination of only 30% to 50% of the public can get the economy substantially back to normal by December next year.

Corporate and structured credit should outperform Treasury debt and MBS in 2021, and high yield should outperform investment grade debt.

Non-bank debt

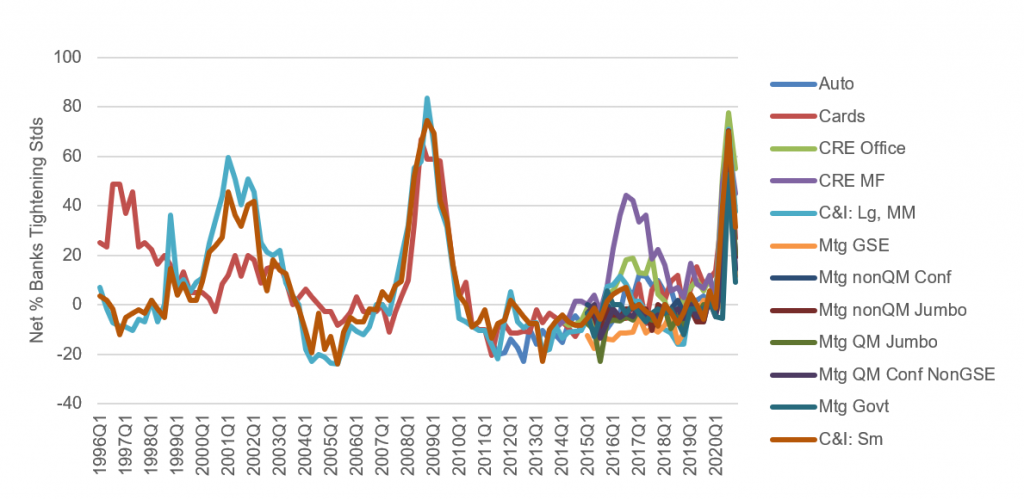

Investors have another opportunity in 2021 by lending to borrowers—companies and individuals—that banks have left behind in 2020. Banks have been lending pro-cyclically for decades, easing lending standards and fueling growth as the economy strengthens and tightening standards as the economy fades. Banks tightened sharply across almost every asset class this year just as they did through the 2008 financial crisis and its aftermath and through the bursting of the Internet bubble in 2001 (Exhibit 4). This has opened the door for non-bank lenders to step into the margin of borrowers that banks have left behind, many of whom have viable businesses through pandemic, or, in the case of individuals, viable prospects of repaying debt despite unemployment or credit blemishes brought on by pandemic.

Exhibit 4: Banks tend to tighten in economic downturns and ease in expansions

Source: Federal Reserve Senior Loan Officer Opinion Survey, Amherst Pierpont Securities.

Investors in non-bank debt in 2021 also stand to benefit when a renormalizing economy brings banks back in succeeding years. The eventual return of bank lenders should ease financial conditions and strengthen company and household balance sheets, lifting the value of loans made while banks stand on the sidelines.

Investors should have a range of opportunities in non-bank debt next year including middle market corporate lending either through CLOs or private structures, subprime consumer debt, non-QM mortgage debt or the private financing of these or other assets. Yields should be attractive relative to more conventional assets, and prospects for credit performance look good.

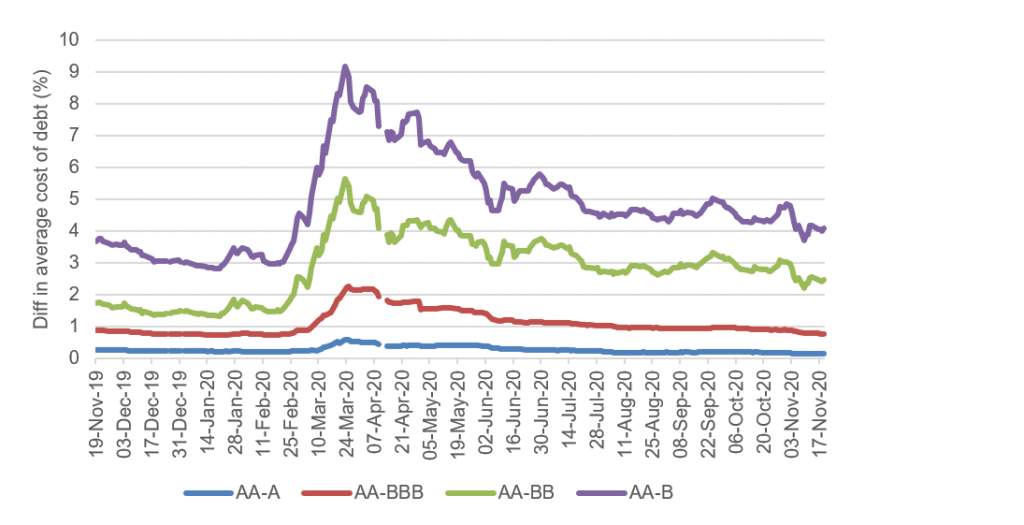

The debt of best-in-class niche players or platforms

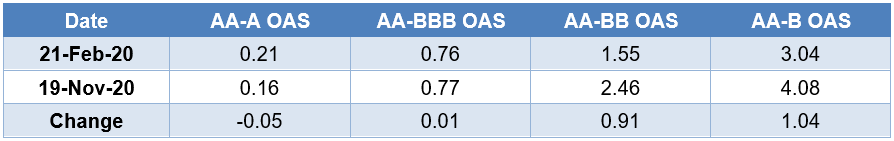

Something else also changed in 2020 that should have steady and investable impact in 2021 and beyond: the rising importance of issuer size and rating for the cost of capital. Size, measured by assets or income, has long affected ratings, with larger companies, all else equal, tending to have higher ratings. The important development in 2020 was the Fed’s decision to lend directly to investment grade companies, giving explicit backing to these larger issuers for now and implicit backing in future systemic crises. Fed backing has already lowered the relative cost of debt and equity for large, investment grade issuers. For example, the spread difference between the average ‘AA’ and ‘A’ corporate issue on February 21, before pandemic, stood at 21 bp (Exhibit 5). Although that widened as pandemic began, it now stands at 16 bp, for a tightening of 5 bp. At the other extreme, ‘B’ issuers on February 21 paid 304 bp more than ‘AA’ issuers and now pay 408 bp more, for a widening of 104 bp. Issuers admittedly have different exposure to underlying economic risk, but the pattern shows up in other investment grade and high yield comparisons. Investment grade is worth a lot more after pandemic than before, and Fed support should keep that in place.

Exhibit 5: The cost of debt for IG issuers has renormalized, but not for HY

Source: ICE BoA US Corporate Index Option-Adjusted Spreads retrieved from FRED, Federal Reserve Bank of St. Louis, Amherst Pierpont Securities

The lower cost of debt capital due to size and rating is likely to accelerate consolidation in many areas, adding to the usual incentives from lower marginal operating costs or more specialization. Corporations, banks, asset managers, CLO managers, mortgage originators and even securitization platforms look likely to face pressure to consolidate next year to better cover costs, and cost of capital has become another clear incentive.

The investment opportunity here is not necessarily to own the debt or equity of the acquiring company but to own the debt or equity of the acquisition target. A range of work argues that acquirers routinely pay full value for the acquisition, so the opportunity is to own the debt of best-in-class niche players likely to get a bid. The debt of those niche players would ultimately trade to the tighter spread of the acquirer.

Informationally intensive assets

A final place where 2021 should offer opportunity is in assets where proprietary information is hard to get, and that market has grown in 2020 with the wide spread of remote working and social distance. Both trends have limited the casual transfer of information that happens when people circulate broadly. Pandemic has broken casual information chains into much smaller pieces. That does not slow the spread of information that can fit in a database or go out over the Internet, but it does slow the spread of information about preferences, priorities, impressions, trust and other intangibles important in complex decision-making. That slows the decision-making often needed to make investments, especially in complex assets that require significant information and analysis.

Investors in complex or leveraged structured products, deep credit, private transactions and other assets requiring collection and analysis of proprietary information should see returns to the effort go up in 2021. The process has become harder to execute and often more expensive in time, money or both. Higher returns are available to compensate.

* * *

Beyond these opening to add to market returns, other broader themes should also play out next year. Except for episodes through the winter where Treasury debt may rally on concerns about pandemic, riskless assets should offer the lowest returns. MBS should continue to offer returns driven mainly by carry, the dollar roll and tightening of spreads to near record levels as the Fed and banks continue to absorb available net supply and more. Investment grade credit should also tighten to record levels, but positions with long interest rate exposure should see that hurt absolute returns. High yield should tighten, too, and offer enough carry and spread duration to offset its moderate rate exposure. Leveraged loans could have an exceptional year through carry, spread tightening and low duration.