Uncategorized

Persistent strong performance in BBB Insurance paper

admin | August 14, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

The collective bid for BBB 10-year and 30-year insurance paper remains extremely strong in the market as investors seek to add both duration and credit risk in sectors with favorable operating dynamics. The Insurance sector has delivered a top-5 performance on both a total return (+3.71%) and excess return (+2.99%) basis versus the overall IG Index (+2.80%, +2.23%) since the end of June. This performance is expected to persist as investors target market segments with favorable risk-adjusted return profiles amidst ongoing uncertainty. Among the names well-positioned to capitalize on this trend, mid-sized Property & Casualty operator Markel Corp (MKL: Baa2/BBB/BBB+) delivered better than expected operating results for 2Q20 in July, and appears well-positioned to maintain stability in the uncertain economic operating environment.

MKL 3.35% 09/17/29 @ +135/10-year; G+141; 2.05%; $110.47

- Markel Corp (MKL)

- CUSIP: 570535AU8

- Amount outstanding: $300 million

- Ratings: Baa2/BBB/BBB+

- Insurance financial strength ratings: A2/A/A+

- Global Deal

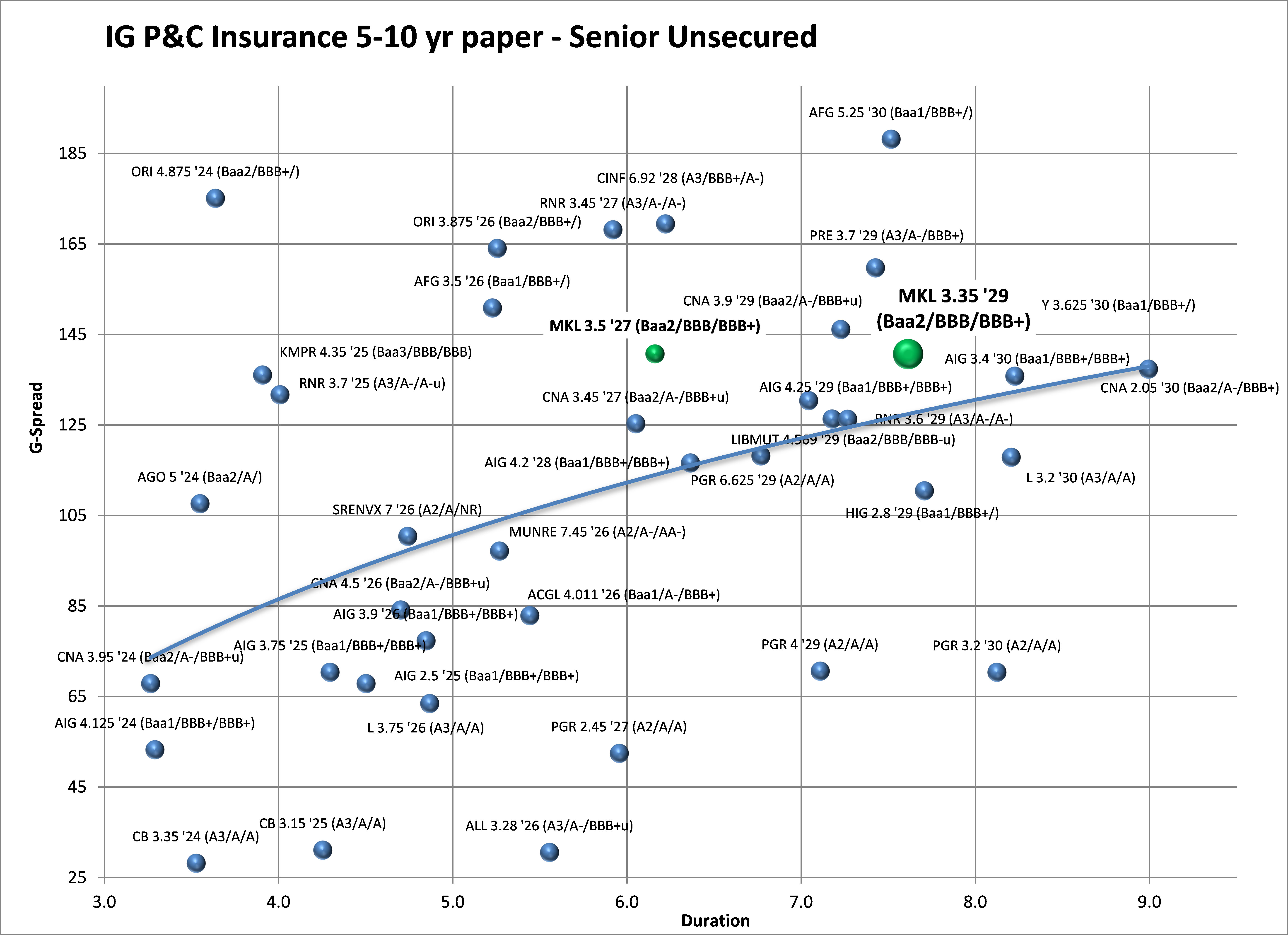

Exhibit 1. A/BBB P&C Insurance Curve – MKL ‘29s appear attractively valued at a spread pick to peers AIG ‘29s and LIBMUT ‘29s

Source: Amherst Pierpont Securities, Bloomberg/TRACE G-spread Indications

- Markel Corporation is a mid-sized P&C/Reinsurance company primarily underwriting specialty and excess & surplus lines of insurance. The breakdown of insurance versus reinsurance operations is in the mid-80% versus mid-teens range. The majority of operations are conducted in the US. MKL is most known for its vast portfolio of over 100 highly specialized niche markets, such as aviation and marine, small business, special events, summer camps, amusement parks, etc. While there are obvious concerns regarding the current atmosphere, we believe longer-term demand for coverage from these niche areas could benefit from new anxieties that arise out of the post-pandemic operating environment for small businesses and these unique lines of business. Like most P&C operators, MKL is subject to earnings volatility related to catastrophe losses and long-tail casualty exposures. More recently MKL has been diversifying into non-insurance, fee-based investment lines.

- MKL is extremely well-capitalized for its rating category. As of year-end 2019, the Company had Capital & Surplus of over $3.6 billion, with a risk-based capital ratio of 346% at the insurance operating company level. Total investments at the holding company level were $17.5 billion as of 2Q20 with $20.7 billion in policy reserves.

- MKL’s liquidity profile remains extraordinarily stable. As of 2Q20, the Company has over $4.8 billion in cash and near-cash items on its balance sheet, enough to fund the entire $3.6 billion in total company debt outstanding. Near-term maturities include $350 million in 2022 and $250 million in 2023, with the entirety of a $300 million revolving credit facility still available through 2024. The last trip to the capital debt markets was a perpetual preferred deal in May of this year, so they could seek to pre-fund their upcoming maturities with a term debt launch in the near-to-intermediate term.

- Mergers and acquisitions have been a source of risk in recent years as MKL pursued a growth strategy (particularly into non-insurance categories), but has done so without significantly impacting its credit profile and ambitions appear to be cooling down more recently. The Company has made some bolt-on acquisitions in recent quarters, including the $556 million purchase of Lansing Building Products that closed in early 2020, and the $204 million purchase of VSC Fire & Security that closed in late 2019. More consequential purchases in investment management included the 2018 all-cash purchase of Nephilia Holdings in 2018, which added $12 billion in assets under management (AUM), and CATCo Investment Management in 2015, which added $6 billion in AUM. Ratings were affirmed by Moody’s and Fitch at the time of the Nephilia purchase.

- MKL recorded a better-than-expected $65.75 in net income per share in 2Q20, versus $36.01 in the prior year period. Performance helped offset the net loss of $100.60 in 1Q20, or roughly $1.4 billion. MKL reported +12% top-line growth in the first half of the year with gross premiums written of $3.7 billion vs $3.3 billion in the prior year. Combined Ratio (all-in operating costs) rose above 100% in the first half of 2020, largely reflective of the $325 million underwriting loss booked in 1Q20. A $293 million loss was ascribed directly to COVID-19 related exposures. Combined Ratio was down to an exceptional 88% in 2Q20 from 118% in 1Q20 (or 94% excluding the COVID-19 exposures).