Uncategorized

Making sense of servicer behavior across private MBS

admin | June 5, 2020

This document is intended for institutional investors and is not subject to all of the independence and disclosure standards applicable to debt research reports prepared for retail investors. This material does not constitute research.

An analysis of major servicers and shelves across all sectors of mortgage credit shows that not only can treatment of loans in forbearance differ materially from servicer to servicer, but that the same servicer may treat loans in forbearance differently across different shelves. And these differences will not only impact the optics of the amount of loans in forbearance but cash flow to different trusts as well.

May remittance reports have helped illuminate how different servicers are treating loans in forbearance in private MBS, and while there are discrepancies, certain trends are beginning to emerge. For example, Shellpoint appears to performing capitalization modifications where missed payments are deferred to the maturity of the loan more consistently than other servicers across all types of post-crisis issuance. And in legacy space, Ocwen is performing far more capitalization modifications than other servicers.

Modifying borrowers rather than marking them as delinquent likely creates a number of issues for investors in private trusts. First, capitalization modifications will understate the amount of borrowers in forbearance if investors are simply looking at delinquency rates to measure forbearance. Secondly, to the extent that these modifications occur and the servicer can mark the borrower as current, they do not have to make principal and interest advances on those loans which they may otherwise have to if the loan was delinquent, creating potential cash flow shortfalls on loans in forbearance. Finally, to the extent that payment forbearance is capitalized and deferred to maturity and not accruing interest, it generates a realized loss in most post-crisis private MBS structures that can be subsequently recovered if and when the borrower pays back the capitalized amount. Investors in lower-rated classes of post-crisis deals would likely take exception to this treatment to the extent that the servicer is making a spot judgement that the borrower will be unable to recoup that missed payment any time before the maturity of the loan. A determination that may be premature if the borrower is able to re-perform and recoup those payments or be put on a payment plan to recoup them that would not result in a loss to bondholders.

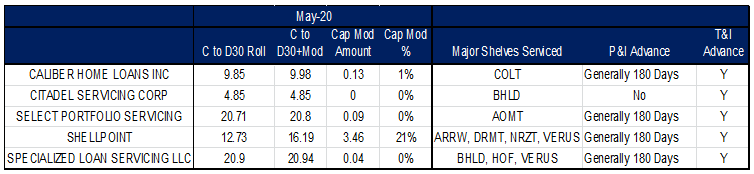

Breaking down the non-QM sector

Delinquency rates in the non-QM sector surged in the May remittance cycle, reflecting April status. The amount of loans transitioning from current to 30 days past due after accounting for capitalization modifications increased from just over 3% in April to nearly 16% in May. Looking across five major non-QM servicers, the incidence of capitalization modifications was relatively modest and by and large exclusive to Shellpoint. More than 20% of loans in forbearance serviced by Shellpoint experienced cap modifications in May. (Exhibit 1)

Exhibit 1: Stacking up NQM servicer performance in May

Source: Amherst Insight Labs, Amherst Pierpont Securities

A servicer’s incentive to capitalize missed payments rather than mark the borrower as delinquent is in all likelihood primarily borne of their obligation to advance on delinquent loans. In terms of broad advancing policies on delinquent loans, most non-QM servicers are required to advance principal and interest for a period of 180 days, but this is not always the case. Per Bunker Hill prospectus language, Citadel is not required to advance principal and interest. Servicers that are not required to advance principal and interest would have limited motivation to mark the loan as current and capitalize the missed payments.

Shellpoint’s capitalization mods are localized pretty much exclusively to the NRZT NQM shelf. While they appear to be reporting loans in forbearance as delinquent across ARRW, DRMT and VERUS shelves, this is not the case with the NRZT shelf. Roll rates on Shellpoint serviced loans totaled just 82 bp in May, while capitalization mods accounted for 12.64% of loans that were current in the April remittance. Servicers may have different motivations to mark borrowers as delinquent rather than capitalize missed payments. In the COLT documents, a deferral is defined as a current period realized loss. Given the alignment between servicer and sponsor in COLT transactions, it seems unlikely that Caliber will capitalize missed payments while borrowers are in forbearance as it will result in a current period realized loss to first-loss risk retention classes held by the sponsor. According to AOMT documents, SPS may defer both principal and interest and has to advance principal and interest for 180 days. However, since a large portion of SPS servicing book is in seasoned RPLs where no P&I advancing is required, the servicer may have more liquidity available to make advances on NQM loans in forbearance.

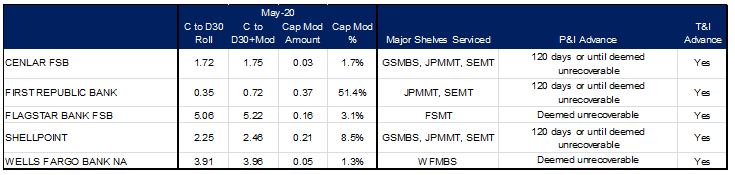

Breaking down the prime 2.0 sector

Similar to non-QM deals, larger prime 2.0 shelves define a payment deferral as a realized loss and an increased incidence of these modifications could have a material impact, especially to relatively thin subordinate classes. Cap modifications across major prime servicers were very modest in May, ranging from 3 bp to 37 bp. These modifications were mainly localized to loans serviced by First Republic Bank and Shellpoint. First Republic capitalized roughly half of the loans that went into forbearance in the May remittance while Shellpoint capitalized just under 10%. (Exhibit 2)

Exhibit 2: Stacking up prime 2.0 servicer performance in May

Note: Shelves analyzed exclusive to FSMT, GSMBS, JPMMT, SEMT, WFMBS – No performance data available for Chase FSB or Chase Mortgage. Source: Amherst Insight Labs, Amherst Pierpont Securities

Loans that were modified by First Republic were localized to JPMMT shelf with no incidence of modification in SEMT shelf. This is likely a function of P&I advances being capped at 120 days on SEMT shelf versus having to advance until advances are deemed unrecoverable in JPMMT. It seems plausible that to the extent the servicer’s advance liability is capped in the SEMT shelf there may be a lower amount of modifications in the SEMT shelf versus other large prime jumbo issuers. That being said, Shellpoint performed cap mods on all three major prime jumbo shelves they service. The most pronounced was in the GSMBS shelf where roll rates were just 5 bp but roughly 30 bp of previously current loans were modified and payments deferred. The JPMMT shelf saw 15 bp of cap mods while the SEMT shelf had 20 bp of cap mods in May.

One additional consideration in prime jumbo space is the presence of variable servicing fee structures. Last fall, deals with variable servicing structures experienced interest shortfalls as the amount of servicing compensation was insufficient to cover the amount of accrued interest due to bondholders as a result of elevated intra-month prepayments. Both Flagstar and Chase employ a variable servicing strip, so while cap mods to date have been small, an increase in forbearance coupled with relatively small servicing compensation on performing loans may create incentives for servicers who employ these structures to do more cap modifications.

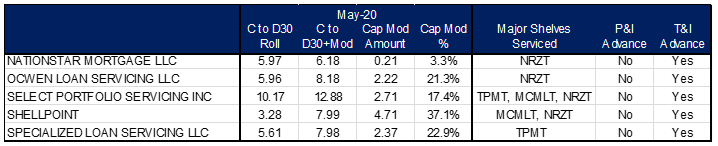

Breaking down the RPL sector

Seasoned RPL structures diverge from most post crisis issuance in that they by and large do not require servicers to advance principal and interest on delinquent loans. Given this, there may be a higher incidence of capitalizations as loans in forbearance would interest shortfall irrespective of any cap mods. May remittance data is largely supportive of this concept as most major RPL servicers modified upwards of 20% of loans in forbearance last month. (Exhibit 3)

Exhibit 3: Stacking up RPL servicer performance in May

Source: Amherst Insight Labs, Amherst Pierpont Securities

Capitalization modifications were particularly prevalent in Shellpoint serviced loans in NRZT RPL trusts. Roll rates in May were just 3.7% while cap mods represented an additional 9.25% of previously current balances across NRZT deals. The incidence of cap mods was even more prevalent on loans in forbearance across the MCMLT shelf where cap mods accounted for 11.43% of previously current balances while only 3.89% rolled to 30 days DQ. SPS services the overwhelming majority of the TPMT shelf. It appears the servicer performed a limited amount of cap mods on this shelf as the difference between roll rates and roll rates plus mods on the shelf was negligible (12.45% vs 12.62%) in May. Similar to legacy MBS, Ocwen is capitalizing loans in forbearance in NRZT RPL deals. After adjusting for capitalization mods, loans in forbearance increased by 28% from 5.86% to 8.17%. One potentially interesting wrinkle that may be occurring in seasoned RPLs is it appears that servicers may be recapturing previously made T&I advances on loans in forbearance. For example, MCMLT 2018-4 saw all bonds at the BBB level and below experience interest shortfalls this month as T&I advances were potentially recouped at the top of the waterfall.

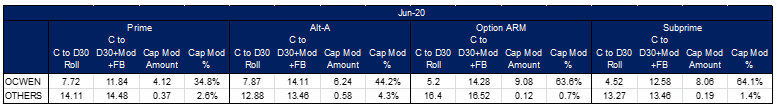

Breaking down the legacy sector

Last week’s detailed analysis of the legacy sector showed that Ocwen was an outlier relative to all other servicers with regards to a much larger incidence of capitalization modifications than other legacy servicers. While most prevalent in subprime and option ARM profiles, Ocwen is employing capitalization mods across prime and Alt-A credits as well. (Exhibit 4)

Exhibit 4: Stacking up Ocwen versus other servicers in legacy

Source: Amherst Insight Labs, Amherst Pierpont Securities

Additionally, to get the full picture of loans in forbearance on Deutsche Bank trustee deals simply looking at delinquency rates plus capitalization modifications does not suffice. In the case of those trusts, Ocwen is neither marking the loans as delinquent nor capitalizing the deferred payments while loans are in forbearance. In these trusts, they are continuing to advance on missed payments and but oddly marking the loans as current. To get the full scope of forbearance of loans in these trusts, loans reported as in forbearance on the Ocwen Real Portal are added to delinquencies and cap modifications. After adding loans that are reported as in forbearance to delinquencies and modifications, forbearance rates across all legacy credits that Ocwen services appear to fall in-line with broader legacy forbearance trends.